Apropos of Everything (Part 2) – Disengaging the World from the Dollar

By Lee Quaintance & Paul Brodsky, QB Asset Management

The following is the second in a series of posts by QB Partners. The first post is available for review here.

In section 1 we tried to lend perspective to the current global monetary system, its weaknesses and predisposition to fail, whom it benefits and harms, and the natural incentives of various participants to push it towards demise. Though obvious to us and many of you, this state of affairs has not been widely addressed by global leaders responsible for steering public economic policies. And though there have been some overtures towards public acknowledgement made by prominent people, such talk has no doubt been seen by active Western policy makers as inconvenient and maybe even irresponsible discourse. Officially, a "strong dollar policy" remains in effect.

Pressure to change the system first came from leaders of small economies without a historical say, irritants like Hugo Chavez and Mahmoud Ahmadinejad, and was then perpetuated by leaders of emerging powerful economies with more economic clout, like Hu Jintao and Vladimir Putin. More recently we have seen occasional moments of acquiescence from representatives of the status quo, like Nicolas Sarkozy and World Bank President Robert Zoellick. Just this week, Chinese authorities have been re-asserting that the Renminbi should take its place at the center of global trade, and the Hong Kong Monetary Authority announced it is actively considering new rules that would pave its way. There seems to be an undeniable growing acknowledgment that the current global monetary regime does not fit the current global economy.

Still, consensus valuation metrics in established financial markets remain firmly anchored in the notion that currency values are defined against each other – not vis-a-vis the items they must purchase such as food, fuel, finished goods and services, labor, production and assets.

Some with ability and willingness to invest independently have migrated towards expressions that anticipate change. High profile investors including John Paulson, Paul Singer, George Soros, Paul Tudor Jones, David Einhorn, Ray Dalio and others seem to have concluded in varying degrees that the future for the US dollar looks very different from its past. (As far as we know, only Soros has taken a stand that the dollar cannot satisfy the future needs of the global economy.)

As investors, we see a widening gap separating the already well-established march towards a new monetary system and an "official ignorance" among active Western policy makers (and genuine ignorance among most investors) that this change is occurring. Among those that dare to think ahead, there have been three solutions discussed:

- Replacing the US dollar with an existing currency that would then be the world’s reserve currency

- Using multiple reserve currencies

- Converting all existing currencies to a new common global currency managed by an impartial authority.

We think none of these options will come to pass. The global monetary system will remain firmly US dollar- based…up until the time the system crashes and a hard money system is officially adopted. Section 2 addresses the whispered alternatives and why we feel they will not be adopted.

A Review of the Fundamental Story

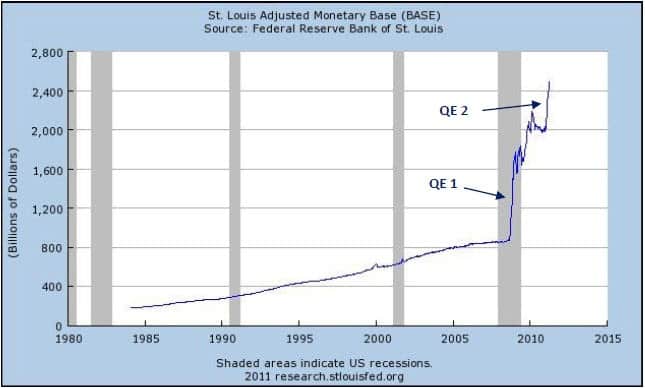

In 2008, following what most call "the bursting of the credit bubble" (better termed "the natural and necessary contraction of the debt-to-money ratio" or, more commonly, "de-leveraging"), the Fed manufactured money from thin air in an unprecedented amount. Base money (MO) was created by the Fed and credited to bank reserve accounts in an attempt to offset natural credit contraction. This first round of quantitative easing ("QE1") was pure inflation. As the graph below illustrates, the US Monetary Base (bank reserves held at the Fed and currency in circulation) grew 130% virtually overnight:

As we have discussed before, TARP, TALF and the other programs that comprised QE1 were not directly stimulative to the broad economy because they did not exhaust debt. QE1 was mostly stimulative for its recipient organizations, and this now seems very obvious by their subsequent performance. As we wrote at the time, there was very little chance that a banking system multiplier effect would prove widely stimulative. Bank assets (loans) would have to continue to be carried on balance sheets at levels that had very little cushion for sudden delinquencies and defaults, and at levels that would not allow for widespread value reconciliation. The US banking system remained far too levered after QE1. Banking system capital reserve ratios remained far too low.

QE2, announced two years hence and also portrayed on the graph above, is currently raising the Monetary Base by another $600 billion (or more) and is also not directly economically stimulative. The Fed is manufacturing new money to purchase Treasury debt. The Fed is devaluing the dollar, and in turn forcing all other currencies to devalue in-kind, so it can continue to fund the US government revenue shortfall. The critical point here is that aggregate debt is still not being extinguished. Balance sheets are still not being de-levered.

The current market debate is about whether and when the Fed will endeavor upon QE3. Having the debate at all shows advancement in market thinking from no awareness of the consequences of QE1 and very little pushback for QE2. The markets are beginning to come to terms with the nexus of the fundamental problem facing the global economy – the relationship linking a growing money stock and declining real wealth. (We urge readers not to politicize this discussion. We are not taking sides and we are likely to surprise readers with what we think will ultimately occur and reset the global system.)

Against the backdrop of the Q3 debate, the only promise the Fed continues to make is that some day, when the time is right, it will sell bonds from its balance sheet and take the proceeds from the sale out of the system, thereby draining reserves. (St. Augustus, the Fed – Lord make it chaste but not yet.) With overnight interest rates close to 0% and the markets more aware of the impact of devaluing currency on assets, making this promise is the only Fed action remaining.

If the Fed were to ever drain reserves, (we are skeptical it ever will), such an operation would not necessarily de- leverage the system. It would shift debt from the Fed’s balance sheet to the markets’ and withdraw bank reserves, thereby reducing the money stock. But the Fed would likely only do this amid a strong credit environment, which implies it would actually help widen the credit-to-base money gap, in effect helping to lever the system even more.

The days of policy makers being able to manage a sustainable build-up of unreserved credit have come and gone. The debt-to-money gap cannot be closed by issuing more credit and the act of printing debt-money merely shifts obligations – it does not deleverage the system. Yet, the system must de-lever or else real output, employment and production will be pressured to fall. Letting aggregate credit deflate without offsetting monetary inflation would be too great a shock to the system and not politically tolerable. The only way out is to manufacture more money. Money printing equals inflation which equals currency devaluation, and there is no mechanical or serious political roadblock preventing it.

What about a Debt Jubilee?

For thousands of years, as part of Middle East tradition, it was accepted that there would periodically be a wholesale cancelling of debts and the restoration of land to the poor. This was known as a "debt jubilee", a practice consistent with ancient customs that valued religion and morality over contracts and the rule of law. Indeed the Old Testament addresses this very subject: "Land must not be sold in perpetuity, for the land belongs to Me and you are only strangers and guests. You will allow a right of redemption on all your landed property."[1]

Of course in modern times all debt is not tied to land. Nevertheless, would it be realistic to apply the concept of complete debt forgiveness across the full spectrum of encumbrances today? We doubt it. A debt jubilee would set a precedent that would make the barbarous relic seem downright high-tech. It would be tantamount to declaring that modern societies are structured around super-legal principles. Our sense is that if such a scheme were proposed, even during the most chaotic of times, the party who did so would be ignored by creditors and debtors alike (or, to keep the metaphor going, he would be smote and flogged). Let us dismiss this idea and move on.

[1] Leviticus 25:23-28

Official Devaluation Done Wrong

It would be mechanically easy to overcome the burden of repaying overwhelming public and private sector debt. Policy makers could close the vast Debt-to-Base Money gap as much as they choose and they could do so immediately with four simple steps:

- Treasury issues securities until the market finally begins choking on them.

- Policy makers announce even more egregiously large budget deficits to come.

- Treasury then issues a quadrillion dollars of short-term paper directly to the Fed.

- Treasury uses the proceeds from the sale to retire all outstanding term-debt in the market for pennies on the dollar.

The steps above should not be taken seriously and we give it zero chance of occurring. It would summarily destroy the real value of dollars and all outstanding dollar-denominated credit. It would de-stabilize the global economy and destroy confidence for a very long time. Its cynical approach would create mistrust among allies and trading partners. But mechanically it would work, which is why we mention it.

Replacing the US Dollar with an Existing Currency

Some in the West have worried that China, arguably the largest global economy in real terms, (using the metric of GDP deflated for necessary future Western monetary inflation), will insist that the Renminbi become the world’s reserve currency. We think this is not possible (and we think the Chinese know this too).

First, the world’s reserve currency must have substantial global assets denominated in it. Yuan-denominated stocks, bonds, property holdings and foreign reserves would have to be liquid so that global investors could exchange perceived value. Available Chinese capital markets and property are tiny in a global context (as currently valued), and it seems highly unlikely that they will soon gain sufficient sponsorship from wealth holders in more mature economies. Second, China’s domestic social order remains an authoritarian regime that does not promote liberal commercial exchange, and China does not have an established judiciary that gives counterparties confidence they can settle disputes fairly. China is obviously aware of these issues and by all accounts unwilling to change its social order sufficiently to placate Western liberal democracies.

Further, China has shown an unwillingness to "play ball" with economic policy makers in developed economies. When adversity has stricken its Western trade partners, Chinese policy makers have consistently executed exchange rate and monetary policies that benefit its domestic goals but continued to pressure its importing customers. The concept of a global reserve currency is a social construct with which China is unwilling to abide.

So although its economy may be one of the strongest in the world, China’s political, social and financial infrastructures are too immature and inward-looking to establish enough confidence among global trade partners to allow the Renminbi to become the global reserve currency.

We also think proposals from China and Russia for regional reserve currencies should be seen as public posturing and summarily dismissed. Given China’s or Russia’s immature or dubious credit histories, small capital markets and curious records of jurisprudence, it would take at least a generation before global perceptions change to where genuine confidence among wealth holders in those neighborhoods would prevail.

The Euro, Yen and other already established major global currencies may have many of the components necessary to be a stand-alone reserve currency; however recent events show extreme, even life threatening vulnerabilities. Most are suffering for the same reasons the US dollar is suffering – they are debt-money representing vastly over- leveraged economies. As we are seeing today, there is no real challenge to the US dollar among other major currencies for global hegemony. The US dollar is the tallest little-person in the room, and so we think talk of another baseless currency replacing the dollar is unrealistic.

Multiple Reserve Currencies

Some have argued that although the dollar will remain the strongest currency, other currencies will rise in stature, leading to a global monetary system with multiple reserve currencies. We do not see this as a possibility either. In a global monetary system in which all currencies are debt-based, maintaining confidence in a currency’s underlying support system is the primary driver of global sponsorship. As the notion of confidence is not tangible, all debt money must ultimately default to the confidence given the strongest currency – the one perceived as the safest into which all others can be exchanged if need be.

A multiple reserve currency regime comprised of debt-based currencies would also provide no benchmark off which to calculate real value, other than prices expressed in the strongest currency. If the strongest currency were to remain the US dollar, then nothing would change from current conditions. Labeling the Euro, Yen and Renminbi as "reserve currencies" would be meaningless. Each would tacitly continue to be priced off the dollar, as would all global assets.

Further, the sponsors of "lesser reserve currencies" would no doubt continue to try to weaken or strengthen their currencies through intervention and interest rate management. Net exporters (i.e. China, Japan) would be partial to a weaker currency in optimizing global trade and, as we discussed in section 1, maintaining a relatively strong currency as the US has mostly done since 1971 is unsustainable without subsidizing consumption through an unsustainable leverage build up. Again, this describes the world today – a USD-based system.

Most damning to the notion of multiple reserve currencies would be that such a system would have an obvious omission. China no doubt knows that the issues that make the Renminbi unworthy of being the reserve currency also make it unworthy of being a reserve currency. So if the US dollar is generally perceived to be far and away the safest and most liquid baseless media of exchange, (a perception with which we would agree), then any attempt at a global regime with multiple reserve currencies could not include the Renminbi – and thus would be scotched.

We do not see room for more than one true reserve currency, or incentive for any other currency board to want to oversee tertiary media posing as a reserve currency. Simply, markets demand one benchmark monetary unit off which all other currencies, goods, services and assets may be ultimately valued.

That ends part 2. In part three, the discussion will continue covering special drawing rights, a semi-hard currency, or a basket of hard currencies as potential reserve currency replacements for the US dollar amongst other topics.

Given the writer knows how to access data from the FRED why isn’t this chart used that shows the so called printed money is being held as excess reserves.

https://research.stlouisfed.org/fred2/series/EXCRESNS

Given the writer knows how to access data from the FRED why isn’t this chart used that shows the so called printed money is being held as excess reserves.

https://research.stlouisfed.org/fred2/series/EXCRESNS