More on inflation, the mutant wave in Canada, the stall in rates and the new normal

This post is a bit of a catch all on what’s happening right now because there is no dominant theme consuming markets. After the spike higher in rates, we have seen the first real consolidation wave. And so the trends that drove market action like value over growth have ended or even partially reversed.

I see this as an opportunity to take a breath and think about what we face on the viral front, the economic front and the market front in that order. And I lead with the virus because, while it is no longer all-consuming, it is still the dominant variable in altering medium- and longer-term economic and geopolitical paths right now.

Let’s start in Canada.

The mutant wave is here

For the first time that I can remember since this pandemic began, Canada has a higher rate of COVID-19 infection than the US. When I read the Canadian news and see Canadian Twitter, the conversation veers between hatred spewed toward the Justin Trudeau ‘cult’ and invectives toward US journalists like Jake Tapper, who recently called out the vaccine rollout failure in Canada on CNN.

I’m not interested in keeping score or assessing who is to blame. I’m more interested in what the situation tells us about the virus and how we can expect it to evolve. For me, it is confirmation of what I’ve been telling you for weeks, that the footrace between the virus and viral mutations was critically important in terms of re-opening the economy in the middle of this year. Countries with delayed vaccine rollouts had the greatest risks of a delayed re-opening, and, therefore, the greatest risk of longer-term economic damage.

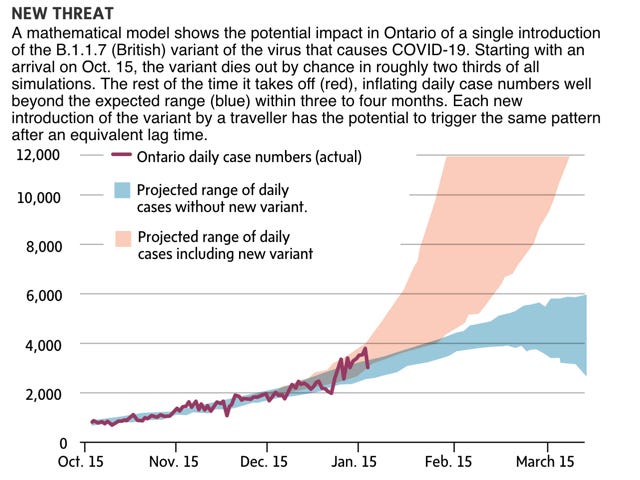

Remember, this has been coming for a long time. I first wrote about the mutant wave based on information from Canada on January 13. And you could see there were stark outcome differentials due to the infectiousness of the B117 variant in particular.

So we have had time to prepare, both in terms of non-pharmaceutical interventions and in terms of vaccine rollouts. In fact, I actually thought the B117 wave would hit North America much sooner. So we have had a lot more runway than I anticipated. And in Canada, the response has failed. The result is lockdowns, remote learning for children and a delayed full re-opening.

My takeaway from the Canadian situation then is that forewarned is not forearmed if people or governments don’t take the warning onboard. After a year of living through a pandemic, it’s hard to prepare for another lockdown without wanting to scream. And so, at this point, many more stark non-pharmaceutical interventions will likely fail. That’s my takeaway.

The grey swan: more mutations

To me, this is mostly a tunnel-lengthening problem, meaning Canada and the EU will eventually get on track and re-open fully after vaccination. There will simply be a bit of a delay. And while that delay might cause some permanent damage through business failure or long-term unemployment, it is not something that alters outcomes economy-wide.

If we want to think of known unknowns of greater importance, we have to go to Brazil and India, where there is a massive wave of infection going on, likely because of more infectious viral strains and likely creating more infectious strains at the same time. Let’s go back to the epidemiological tail risk I wrote about on February 1.

The most plausible outcome is that we have a foot race between vaccination and mutated viral spread. The goal is to vaccinate as many people worldwide as possible to make viral spread less deadly so that we can leave this state of siege we have been under since March. Maybe we will need a booster shot to deal with the new mutations. And the new normal won’t be like the old normal. We might even still wear masks in many public places for years to come. But, after the mass vaccination, in this scenario, we can return to offices, schools, airports and vacation destinations without being overly concerned about infection and death.

There are other outcomes though. And for the time being, let’s consider these outlier scenarios, what financial professionals like to call tail risks because they reside in the extreme left-hand end of a distribution of outcome probabilities…The question: The coronavirus is mutating. Will our vaccines keep up?

[…]

Even if these new strains remain highly susceptible to the vaccines we already have, their emergence suggests that SARS-Cov-2 has the ability to mutate enough that it could, over time, evade a vaccine.

That means several things. First, the virus is never going away. Even if it could be eliminated from the human population, it can infect other mammals, mutate in them and then jump back to humans.

Second, the more people infected, the more opportunity the virus has to mutate in a direction that creates problems. So, it is in the self-interest of wealthy countries to get vaccines distributed worldwide to limit those opportunities.

Third, covid-19 will become much like influenza, requiring year-round, worldwide, surveillance of new strains and regular updating and administration of vaccines. We may not need a new vaccine every year, but we will need new vaccines, nonetheless.

I would move the mooted outcome here from tail risk to base case – meaning that, from what I read, epidemiologists are now of the view that “SARS-Cov-2 has the ability to mutate enough that it could, over time, evade a vaccine.”

What that means is that this virus will become endemic. It won’t go away. And the only question is whether it becomes less deadly in becoming endemic as a virus’ killing the host is a surefire way to snuff itself out.

Economic outcomes

So, as we look toward the re-opening, what we should be thinking about is the new normal in a world in which SARS-Cov-2 is an endemic viral problem.

The outcome we hope for is a new normal slightly altered from the old normal – where the virus is endemic because it is less deadly and yearly or semi-yearly booster shots similar to flu shots allow us to deal with the virus.

On the other hand, the reasonable worst case scenario I posited in early February is this:

So, let’s say John Barry is right about the outcomes, that the virus is never going away. What does that mean economically? In one potential future, we could have a new normal largely similar to the old normal because of vaccines. And then we would learn to live with the increased mortality from coronavirus mutant strains.

But, in another potential future, that risk of increased mortality would be enough to alter behaviors, in effect bankrupting large swathes of the economy impacted by that change. This is the economic tail risk. I call it a tail risk because we’ve seen time and again how resilient the US and global economies have been in the face of calamity. Yes, we’ve had a difficult stretch ever since the Great Financial Crisis. But it has yet to be anything like the Great Depression. And I would say that is in large part due to the overwhelming policy response designed to prevent that outcome. I expect these measures to continue. And while they won’t be pretty and they won’t be perfect, if they continue, they will prevent a Great Depression.

At a minimum, what we are talking about is a world in which mask-wearing because much more the norm, where social distancing becomes much more the norm. The question is how much more normal because that’s where those sectors of the economy most leveraged to social closeness become severely impacted. I see four outcomes:

- Government pays the cost of transition to the new normal by underwriting the majority of the business costs of non-pharmaceutical interventions and new social distancing conventions.

- Businesses bear the cost of NPIs and pass on those costs to consumers.

- Consumers change behavior enough to bankrupt large swathes of industries where contact with unknown ‘foreigners’ are part and parcel of the experience. I’m talking about airlines, cruises, hotels, sporting events.

- Regulation of socially close activities increases dramatically through the ubiquitous administration of vaccine passports.

This is the future that is coming. It will be a combination of these four outcomes. Prepare for it

The Inflation Bogeyman

The one economic outcome that requires our thinking is inflation. Today, we had some figures come out on consumer price inflation in the US. And they showed that the CPI increased more than expected to 2.6% y-o-y (see Twitter thread here).

I look at this as part noise and part harbinger. The noise part has to do with the deflationary impact of last year’s lockdowns distorting the figures and the numbers being largely in line with expectations. The harbinger part has to do with a likely increase in costs from supply chain problems and other costs now embedded in the system.

It’s this ’embedded in the system’ part that requires our attention. If we think of inflation as coming in varieties due to two variables, it helps to understand what’s happening.

Variable number one is the persistence of the price level change. It’s one thing for a price change to occur once over a discrete time period. It’s quite another if it continues to occur. In the 1970s, we saw cost-push inflation that was embedded because wages and costs rose together, feeding off each other as purchasing power was eroded. We haven’t seen that dynamic in ages. So, the supply chain snafus could just be a one-time price level step-up. And that’s bad but not terrible.

The other kind of inflation is related to productivity gains and technological advancement. It’s actually more about deflation, where the cost of goods and services decreases because of productivity gains and technological advancement. Computers costing less is an example. That’s a good thing. But if prices are going down because people’s demand is going down as people hoard cash for a rainy day, that leads to a debt deflation and can be pernicious in causing a chain of bankruptcies.

When I look at what’s facing us now, I see a step-up in the price level from both supply chain adjustments and non-pharmaceutical interventions coming. But I think that step-up is time limited. On the other hand, because ordinary wage earners have not benefitted from productivity gains over the past four decades, there is a risk that this step-up causes a loss of demand that leads to so-called secular stagnation at best or debt-deflation at worst, if and when large government deficits stop sending massive net financial assets into the private sector.

To put this in more readable terms, I would say, the government is tiding us over by sending us money right now. But when they stop doing that the increase in costs may be too much to bear for ordinary people unless they make more money. And if it is too much to bear, the whole pent-up demand story will fade.

My view

So, let me end this post with how markets respond. When I think of the pandemic, I divide it into four phases.

- Phase 1 was the liquidity crisis that precipitated a collapse of over 30% in share prices from January and February 2020. And this was arrested by massive central bank intervention in March 2020.

- Phase 2 was the repricing up of risk assets under the new post-intervention regime in an uncertain world where we didn’t know how long the virus would be with us. This lasted until November 2020.

- At that point, vaccines caused a wholesale recognition that the pandemic would cease in due course and an absolute and relative re-pricing ensued. Everything went up but cyclical and value-oriented assets went up the most as they had suffered the most due to pre-vaccine economic uncertainty. That phase lasted until February 2021.

- Starting in the New Year, the combination of vaccines and government stimulus caused investors to rethink the path of future policy rates, creating a massive upward move in longer-term interest rates globally. For US Treasuries in resulted in the worst quarter since 1980. And by February it turned ‘growth’ assets from under-performers to outright losers. This was a very short phase of the cycle, because growth – as represented by the Nasdaq – double bottomed on March 5th and 8th and has been going up ever since.

Meanwhile, the US 10-year first broke through 1.50% on March 5 and has failed to confirm the next trading range above 1.50% ever since. There has been no successful push above 1.75%. We are now locked into a trading range between 1.50% and 1.75%. And that gives support to growth because it gives confidence that the rate scare may have been short-lived.

I think this phase potentially lasts through the end of the spring. The last deflationary comp for US CPI is going to come in June. And I think we get a free pass on inflation until then. It’s at that point, when we can measure inflation in comparison to post-lockdown 2020 and when the majority of US citizens will be vaccinated, that we will get a sense of the inflationary impacts and the demand dynamics of the new normal.

The crucial test for markets comes this summer because that’s when we will be at the end of the pandemic tunnel in the US. And then we will begin to see what the new normal looks like in terms of the virus, virus mutations, inflation and consumer behavior.

Comments are closed.