European vaccination, Manchin, and Republican infrastructure spell European outperformance

I am going to try and fit a few topics together into a cohesive narrative around a pivot to Europe amid an ongoing stimulus campaign on both sides of the Atlantic. The broad outline is one where both fiscal and monetary policy are accommodative in North America and Europe but where the delay in vaccination in Europe moves the ‘action’ from a markets perspective eastward. And then the questions over the medium term go to the durability of the broader policy shift and the underlying dynamism of the respective economies.

The US rally

Let’s start in the US, where the rally in shares has been extreme. And I think the right question now is how well the medium-term future economic and earnings backdrop is represented in that spike.

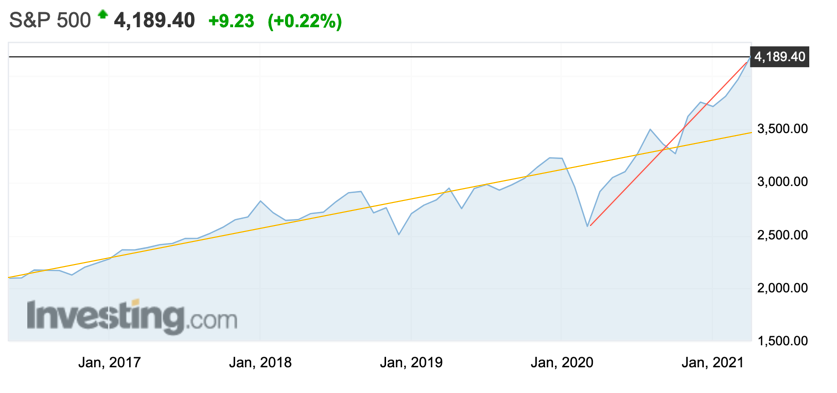

If you look at the longer term trend of the S&P500 as denoted by the yellow line below, the recent trend off the March 2020 lows, denoted by the red line, is much more sharply upward.

That’s telling you that we have seen a clear acceleration in market price movement to the upside. And that makes the market vulnerable to a pullback unless medium-term economic and earnings data are robust enough to maintain the (extreme) bullish sentiment. That’s a clear risk. And Wall Street analysts are talking about it now:

Some of Wall Street’s biggest names are predicting a pause in a rally that has taken the S&P 500 to fresh records this year, leaving investors trying to determine whether to lock in some of the breathtaking gains or stay the course.

Among the most recent has been Goldman Sachs, whose analysts on Wednesday said an expected second-quarter peak in U.S. growth could be tied to weaker stock returns. Morgan Stanley earlier this week warned stocks would soon face headwinds. Deutsche Bank this month called for a pullback of as much as 10% in the S&P 500 as growth decelerates, and BofA Global Research backed a year-end target for the index about 8% below current levels.

A comparatively long period without a serious drop in stocks has also made some investors uneasy. The S&P 500 has declined at least 5% every 177 calendar days, according to Sam Stovall, chief investment strategist at CFRA. The latest market advance has lasted 211 days without such a drop.

The big question, then, is whether the move has been so extreme that you want to re-weight now. There are several things to consider. One is where to re-weight. Another is the policy backdrop. Let me talk about both of those from a narrow perspective of monetary and fiscal policy in the US and Europe and the re-opening in the US and Europe as well.

Will the Dems get enough for the midterms?

In terms of US fiscal policy there are three broad considerations driving outcomes: the macro policy shift, partisan politics, and the 2022 midterm US elections.

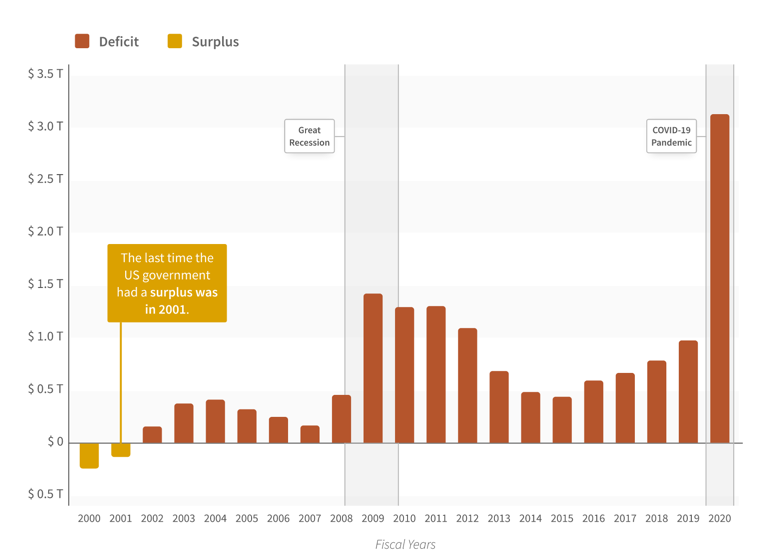

On the first, it is clear, we are seeing developed economies move toward a more robust fiscal response to economic downturns. The fiscal deficits we are seeing now are an order of magnitude higher than anything we saw after the Great Financial Crisis under the Obama Administration.

Source: USASpending.gov

Even in Germany, often seen as the epicentre of fiscal conservatism, we are seeing the biggest deficit spending since reunification 30 years ago.

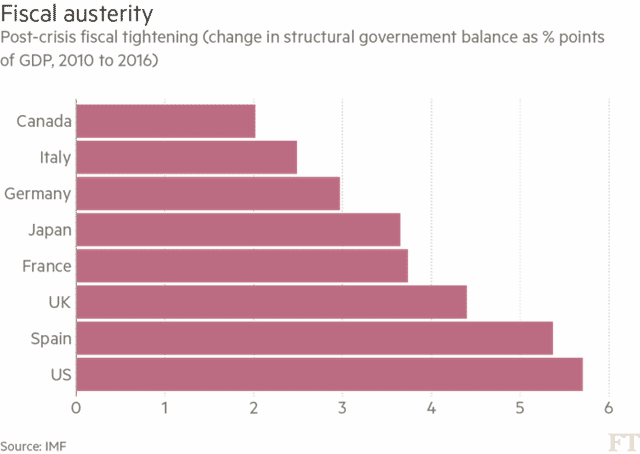

But, look at how quickly deficit spending receded after the GFC. The reduction in the structural budget deficit was 6% of GDP from 2010-2016. That’s massive. And it’s the largest of several large advanced economies.

Source: International Monetary Fund, The Financial Times

The question now, after such a big run-up in deficit spending, is whether the willingness to close the output gap and head toward full employment via deficit spending is any greater now than a decade ago. We could just as easily see a move toward fiscal consolidation once the coast seems clear, just as we did a decade ago. Germany has already made noises about this within the EU regarding Spain.

I think the Biden Administration is more dovish here than the Obama Administration and the Powell Fed is more dovish than the Bernanke Fed too. But you have to understand partisan politics to know whether the Dems can keep the stimulus going through 2022, the next big political test.

Joe Manchin and Kyrsten Sinema

The two people who matter most here are the most conservative US Democratic senators because the Democrats have a Vice Presidential tie-break in the Senate to pass legislation only if they get all Democratic Senators onside, including Manchin and Sinema. And both of these two have shown they have reservations about unending deficit spending.

For example, Politico is running an article highlighting the fact that Manchin is praising the Republicans’ infrastructure plan, which is much less aggressive than the one Biden is touting.

West Virginian Sens. Joe Manchin (D) and Shelley Moore Capito (R) on Sunday both voiced their support for Republicans’ nearly $600 billion infrastructure counteroffer to Biden’s $2.2 trillion plan.

Republicans last week unveiled the proposal, which is about a quarter the size of Biden’s plan, and several Democrats have spoken out against it.

But Manchin told CNN’s Dana Bash on “State of the Union” that the Republican plan is “a good start. It really is, and I’m glad they did it.”

Manchin also said he supported the effort to work on “traditional infrastructure,” separately from other issues.

That’s trouble. It’s telling you there will be concessions, perhaps big concessions if we are to see this bill go through. And that means we will either see taxes go up or spending go down relative to what Biden wants before this is over. However you look at it, the deficits that Biden is able to run will be limited by Manchin, with Sinema likely to join in that effort.

What Biden wants to do is to have as much deficit spending as he can get away with because the larger the net transfer via deficits to the private sector is in 2021 and 2022, the more likely the economy is to remain robust until the mid-term Congressional election in November 2022. And the $1.9 trillion stimulus bill is not enough. Biden needs stimulus to keep the economy hot through the voting. At that means he needs more deficits via spending or tax relief.

You may not know this but most middle class people are already getting a massive tax cut because of Biden. Politico highlighted this fact in an article today:

New estimates by Congress’s official forecasters show Democrats’ tax cuts — included in their March stimulus package — will drive down tax rates on low- and middle-income people so much this year that those earning less than $75,000, on average, will owe nothing in federal income taxes.

Those making between $75,000 and $100,000 will pay a scant 1.8 percent average tax rate this year, the nonpartisan Joint Committee on Taxation predicts.

That will shift the relative burden to the wealthy, at least temporarily, with those earning more than $500,000 expected to pay more than two-thirds of all income taxes this year.

That’s a lot of deficit spending. But, Biden is trying to avoid huge deficits by taxing back some of the money with a shift to corporations and the wealthy via corporate taxes and capital gains taxes too. Here’s the capital gains tax proposal:

He plans to propose almost doubling the rate to 39.6% for those earning $1 million or more, according to people familiar with the proposal. Coupled with the existing surtax on investment income, that means federal tax rates for investors could be as high as 43.4%. This would fulfill Biden’s campaign pledge to subject capital gains to the top marginal income-tax rate, which, under his broader tax proposal, would rise to 39.6% from 37% for households with incomes of $400,000 or more.

In effect, Biden plans to make the highest marginal tax rates for long-term capital gains and for earned income the same, eliminating one area where the rich had been able to pay less tax on income than average wage earners. And he’s doing so by raising taxes rather than reducing them because, for political reasons, he wants to reduce the deficit from the new spending which he expects to buoy the economy at least through the end of 2022.

The politics

The politics are the biggest constraining element here. While the policy leeway is certainly greater now, there isn’t a blank check, first because the Republicans want to hobble the Democrats’ agenda and second because Democrats in Republican-leaning districts and states cannot be seen as too far left in their policy agenda or they will lose office. With the Democrats having only a tie-break in the Senate and a seven-seat majority in the House and Presidents usually losing seats in their first midterm election, Biden has to do everything possible to keep the US economy humming through 2022 while appeasing Manchin or Sinema.

I don’t think he’ll be able to raise capital gains taxes to 39.6%. That’s too steep an increase, even if it is only for gains over $1 million. It’s going from 20% to 39.6%, effectively doubling the highest marginal rate. Manchin cannot be seen voting for that.

Moreover, Manchin has already said that he wants to treat “traditional infrastructure” differently than other infrastructure issues. Does that mean rural broadband is not infrastructure? Maybe. I don’t know. But it certainly means that the $2.2 trillion infrastructure bill will be scaled way, way back because it won’t get passed without Manchin. And Manchin won’t vote for it.

I believe we will see an infrastructure bill that is more narrow and smaller than the $2.2 trillion proposal and bigger than the Republican $600 billion proposal pass. And we will see a capital gains tax rate more like 30% than 40%. And then, we will just have to wait and see if that’s enough to make the US economy robust enough to give Biden’s party a tailwind in 2022.

The Fed

That’s the fiscal picture affecting the medium-term outlook in the US. It’s accommodative but not as accommodative as it has been. And against a massive uptick in shares, it may not be enough to sustain momentum in the market.

At the same time, I also think the Fed is going to be under considerable pressure to dial back accommodation. There is nowhere near a consensus that employment now takes precedence over inflation as a policy goal. And so, the concept that the Fed could keep things super-easy until we are close to full employment despite rising asset price inflation and the threat of consumer price inflation is contentious.

You can already see the chatter about tightening. The Wall Street Journal previewed the FOMC meeting this week saying:

“Before the central bank begins to scale back support for the economy, it must first decide how to communicate the idea to markets”

That tells you where we are. The Fed may not change its messaging this week. But it will be under increasing pressure to do so as the year progresses. And so, at the margin you can add less accommodation on the monetary policy front to the lower levels on the fiscal front. That means the US consumer better not drop the baton when it’s handed off as the US economy re-opens fully.

Europe

So, that has me thinking about Europe. I saw the Market Ear talking about this earlier today as a market theme. They write that EU vaccinations are “gaining momentum and mobility is following. The pace of vaccination is picking up smartly. After having vaccinated only 8% of its population through mid-March, the Euro area vaccination rate moved above 20% this week and is on track to reach 50% by midyear.”

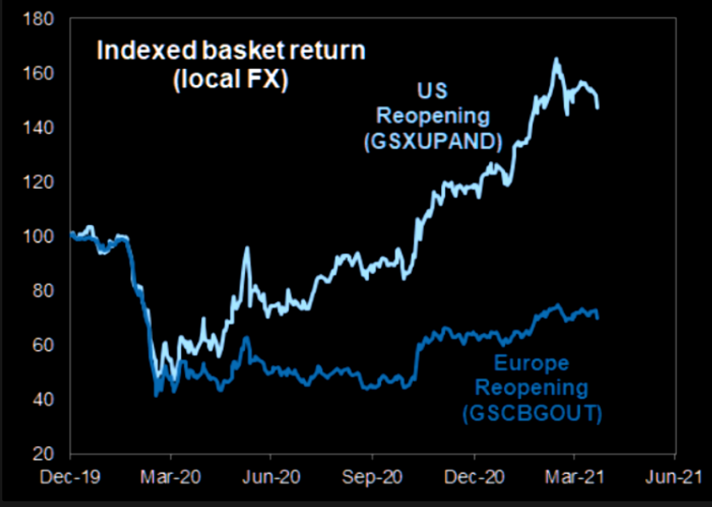

And Goldman Sachs is saying that growth has accelerated meaningfully in the countries where coronavirus restrictions have eased, including the UK, South Korea, Japan, and parts of the EU. Yet when you look at the market uptick there is a clear disparity. Here’s Goldman’s chart.

The caveat, of course, is that the US continues to outperform economically. And the fiscal consolidation rumblings out of Germany speak to downside risk in Europe being greater. But isn’t that already priced in? I think so. I think the odds of the US outperforming Europe as Europe reopens from midyear are lower than at any time since the lockdowns and 2nd wave in the US last year. And the relative gap this time is much larger, meaning the downside performance risk in the US is greater.

Last thoughts

Overall, I am bullish about the medium-term economic outlook. I do have longer-term concerns. But I think the re-opening and the deficit and monetary policy backdrop everywhere is very supportive of growth. And since we haven’t even reached a full re-opening yet, there is room for this to run as the baton gets passed to consumers. The risk of fiscal consolidation and monetary tightening isn’t great enough to derail the real economy by a long shot. That’s something for late 2022 or 2023 or later.

The problem is the run-up in shares in the US. It’s been absolutely over the top – to the point where you see people regularly touting meme stocks and meme cryptocurrencies. That’s clear signs of speculative excess. And that alone makes the US vulnerable. Europe, which has had much less upside, therefore, has much less downside risk. And it looks to be the better bet at this time.

Comments are closed.