Three Market Narratives

After the last week off, let’s see if we can get back into the flow here. And my apologies for ghosting you. I was overcommitted last week against a backdrop where there was less to say.

In the interim, though, I have seen three market narratives develop as we move toward a full economic re-opening. Broadly-speaking, they are the following:

- Inflation vs disinflation

- End of cycle vs beginning of cycle

- Institutions vs retail

I will outline all three briefly

The reverse radical recovery and bonds

Before I get into the narratives, let me update you on my thesis regarding the move higher in yields that I outlined on Friday, a week ago. Here’s what I wrote then:

We are now set to consolidate above the 1.50% resistance levels that represent the next move up in the stair step climb of rates for the US 10-year. If we close above that level today and next Friday, consider the next level of resistance much higher i.e. 1.75% or 2.00%. And Fed Chairman Powell confirmed what I’ve been telling you about this; the Fed is reactive, not proactive. It won’t put in a Fed Put until something breaks.

We confirmed a second Friday close above 1.50% on the US 10-year this past Friday. And so, that puts us into a new trading range above 1.50%. In fact, just like the move up from resistance around 1.1425%, we broke resistance and ended up at least ten basis points higher, where we are presently trading. I think we go higher still until the Fed is forced into action. And while I appreciate Larry McDonald’s view that the Fed will be proactive this time, I don’t expect action from the Fed until we get some sort of market turmoil. For them, it’s about watching paint dry until the market tells them something in the house has caught fire.

Inflation vs. deflation

But remember, despite the stimulus in the pipeline and the coming large GDP prints, we are still in a reverse radical recovery. That means that ordinary wage earners will not feel the full breadth of recovery. Once the stimulus runs out, stagnation and disinflation are bound to become themes again. And to the degree we haven’t already had a crash up and crash down in yields, you should eventually expect bonds to rally on the back of receding inflation expectations. At heart, I am still in the David Rosenberg camp that sees any uptick in inflation as temporary.

And that’s the first narrative, isn’t it. What’s driving markets right now is inflation. And one lens to look at it is through the vector I gave you last summer with growth stocks as a long duration play. In a world of low nominal GDP growth, you pay a premium for growth and yield as yields fall to zero and the curve flattens. But, when nominal GDP growth increases, it can rise because of real growth, inflation or both. And I look at the real growth part as good and the inflation part as mostly bad.

What’s happening now is what I intimated in August:

It’s not necessarily a down market per se. You could see a rotation out of growth into value due to a reflation-associated rise in inflation expectations and rates. That means bear steepening in bond markets and increasing nominal and real GDP growth plus increased earnings growth due to GDP and operating leverage.

So think of the FAANGS stagnating since then, and the Dow and S&P 500 outperforming the NASDAQ this year, with everything having advanced. That’s simply a rotation, a benign outcome from a modest rise in yields.

On the other hand,

the worst case outcome is pernicious because it can have an impact even if it is short in duration. A spike in expected inflation and a steepening of the yield curve can trigger a mad rush for the exits that swings us from 2nd and third standard deviation long positioning to 2nd and third standard deviation short positions in a heartbeat. That would have knock-on effects regarding liquidity and financial conditions, potentially triggering real economy impacts and Fed intervention.

So, you don’t have to believe the inflation is permanent to see increasing inflation expectations as destabilizing. All you need is just enough of a steepening in the curve to get instability. We aren’t there yet. But we can get there. The recent 10% selloff in the NASDAQ was a foreshadowing of how a wider and deeper selloff could work.

That’s how I am thinking about the first narrative.

The end of cycle?

At the same time, I am very cognizant that valuations are already universally stretched by almost all valuation metrics. Sure, we could go up from here, but doing so may simply be more multiple expansion, a blowoff top in the rise in shares.

And so, you have to ask yourself where we are in the cycle. What I mean by that is that seven- or ten-year return profiles are markedly different depending on how stretched valuations are, given that the market is mostly mean-reverting. Put another way, when we have a rough patch economically, stocks generally take a breather. And that affords people a better entry point from which to benefit over the subsequent seven- or ten-year longer-term time horizon. When multiples are high and valuations are stretched, you have to rely on further deviations from the mean and more ‘greater fool’ outcomes to get the same kinds of returns. We are in the latter ‘stretched’ scenario more than the former.

We did see a 30% drawdown in March 2020. But the snapback was so abrupt and so breathtakingly over the top that we are back to extreme valuation levels. We have simply never begun a bull market from this P/E level. Never. I am not saying it can’t happen. But the odds are against outsized returns from long-only passive-investing style positions.

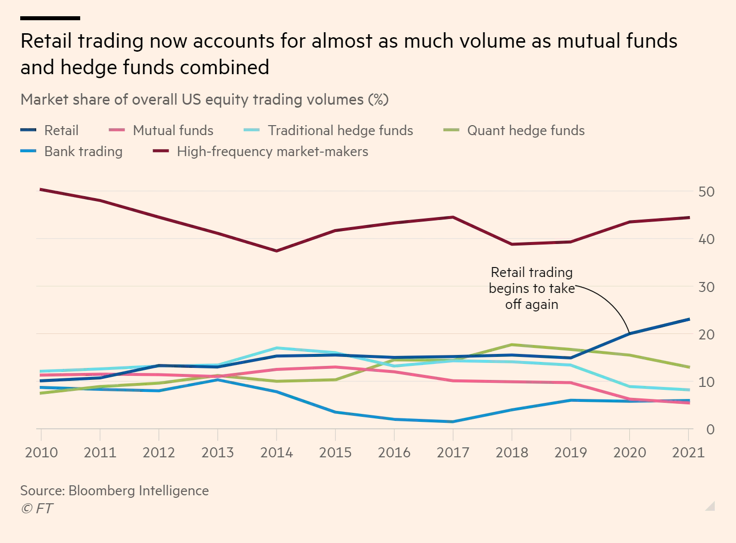

So, when I think of cycles, I think of the 1980-82 double dip period as a potential parallel, where another shoe has yet to drop. At the same time I think of some of the signposts of late cycle excess like the proliferation of SPACS and IPOs. There’s also the fact that Charles Schwab has seen new brokerage accounts triple last month. Then, there’s the upsurge in stock and stock option buying by retail accounts, another classic late cycle signpost. Look at this chart from the FT and you can see the surge.

I believe it was David Rosenberg who wrote today about the Internet bubble parallel. He wrote that if “you’re tracing out this relative outperformance between the Dow and Nasdaq in recent weeks, it is the same gap we experienced two decades ago, as the latter peaked and the former followed suit with a lag”.

That means it may not be that the rotation is simply yield driven as I put it in the first narrative bucket above. Instead, it’s a sign of faltering market leadership and exhaustion of this bull market.

Institutions vs retail

And so as we grapple with whether the previous bull market that began in 2009 has simply had a momentary blip with Covid like the 1987 crash blip before a 1990 recession, let’s think about the balance of power in the markets.

On the one hand, there is this democratization of finance, which is exciting. And I think institutional investors’ informational advantage over retail traders will continue to shrink in this digital age. But, these things don’t go up in a straight line. If you remember, the Internet bubble saw a wave of online brokerage firms moving into the limelight. It was a similar period of finance democracy. But we still saw a 90% drawdown in the NASDAQ. That’s a level of selling new investors cannot be prepared for.

So, I tend to believe the increasing importance of retail investors is a bad omen. It makes valuation less important and momentum more important. It is what caused a surge in the shares of bankrupt companies like Hertz last summer. It is also what caused a surge in the FAANGs right before they started trading sideways. And it is also what has caused the explosion in gains from meme stocks like AMC and Gamestop. None of these events had any relation to ‘fundamentals’. It was all driven by retail momentum and the attendant trading algorithms capitalizing on that momentum.

All we need in this environment is enough momentum – driven by yield curve steepening or real economy underperformance – to last long enough to drive momentum from 2nd and third standard deviation upside to second and third standard deviation levels of ‘oversoldness’.

Larry McDonald tells me the slow institutional money is already rotating out of Large Cap tech and into value. And so, we now have a tension. Does this rotation continue? If it does, how long can it continue before it leads to actual market price declines given the relative importance of large cap growth to the overall market? Let’s see.

My View

So those are the market narratives I see people lining up to take bets on. I lean toward an inflation followed by a disinflation narrative on the first score. I see this period now more as an end of cycle one than a fresh beginning to a multi-year upcycle.

And I see the market’s propensity to follow retail investors’ momentum as worrisome despite the so-called levelling of the playing field increased retail participation means. Having more unsophisticated investors in the markets doesn’t necessarily mean those investors benefit. It could mean that the are left holding the bag when momentum shifts. Let’s hope I am wrong just as I am hoping I will eventually be proved wrong about another wave of the coronavirus due to mutations. But, on both counts, we may not know the outcome until Spring of 2022. We still have quite a ways to go before the coast is clear.

Comments are closed.