Covid-19 waves, EM canaries, and large cap tech optionality

As the new week begins, I have three subjects I am focused on. The first is the coronavirus, where the mutant-inspired infection wave I have expected is forming. The second is emerging markets, where the increase in the US dollar is starting to have an effect on policy rates and currencies. And the third is the stagnation of large cap technology companies as interest rates rise.

Let’s start with Covid-19.

The vaccination-mutant footrace

My assumption late last year, after we heard that more infectious variants of the Covid-19 virus were proliferating, was that it was only a matter of time before these variants displaced others and led to infection waves. But I also believed that the fact that several vaccines were already in production would mean the impact would be blunted. And so I said, it’s basically a footrace between the vaccines and the mutant strains of coronavirus determining whether the waves of virus are economy-altering.

After several weeks, I think we can say this framing looks to be the right one. And it is leading to increased infection with disparate outcomes globally, depending upon how effective governments have been in administering vaccines as well as in controlling the virus. For example, countries in Asia where viral control has been good have yet to be hit hard by this wave despite a slow vaccination rollout. By contrast, Central and Western Europe, which have had several waves due to less effective social distancing and containment protocols, are seeing a massive rise in cases due to the more infectious mutant strains. And Brazil, where the P-1 variant is raging, it is an absolute disaster because there is a very slow vaccine rollout and ineffective social distancing and containment protocols.

The United States and the United Kingdom, despite weak social distancing and containment protocols, are faring better because of their vaccine rollouts. In the UK, more than half of all adults have been vaccinated, many with the contentious Astra Zeneca vaccine whose usage many countries in the EU have halted. In the US, two-thirds of people over 65 have been vaccinated already. And as these are the people most likely to be hospitalized, it has kept healthcare system overload at bay.

I think the debacle surrounding the Oxford/Astra Zeneca vaccine in the EU is instructive here. Just today, data from trials in the US, where the vaccine has yet to be approved showed 78% effectiveness and no safety issues. A month ago, a Scottish study showed “the Pfizer and AstraZeneca vaccines were found to reduce the risk of hospitalisation by up to 85% and 94% respectively.” And the World Health Organization has said these benefits outweigh any risks.

I consider the Astra Zeneca rollout a litmus test for the EU given reports of illness and deaths there, potentially related to the vaccine. It will test the EU’s sense of cohesion and set the tone for when deficits and government financing become a contentious issue after the pandemic is over.

Where are we with the next virus wave?

The question in the here and now though is whether the viral waves from the more infectious viral variants will cause serious illness, healthcare system overload, and economic strain. Let’s take the US, where most over-65s have been vaccinated as an example. In Miami Beach, a curfew has been enacted through April 12 because so many young people are coming there and flouting social distance protocols that government officials there are concerned about another virus wave, despite the progress on vaccination.

In Europe, a third wave is already underway. It’s dominating the headlines in the German newspapers I read. The Süddeutsche Zeitung’s top story right as you open the site has this blaring headline right now: “vaccination against the Third Wave”.

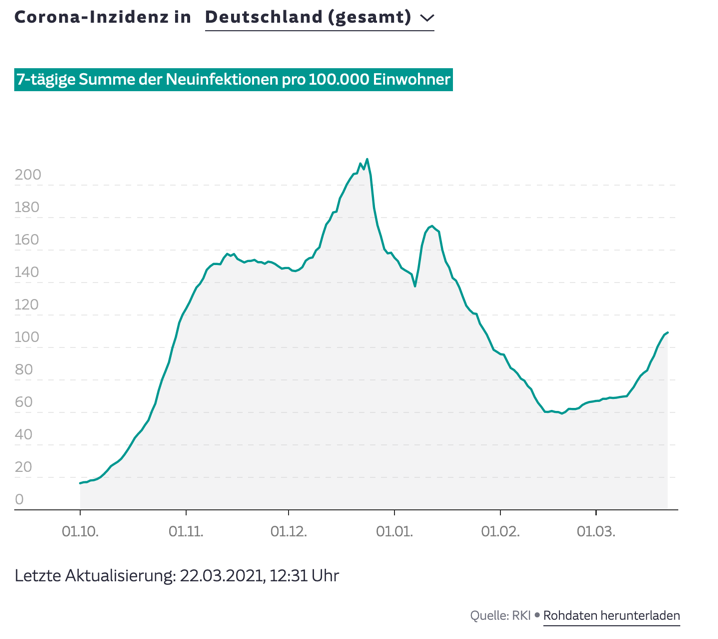

And that makes sense if you look at how quickly infection rates are escalating despite lockdown protocols.

We are rising to infection rates that will soon correspond to the last wave. And hospitalization and deaths will follow with a lag because of the lack of vaccination.

Put starkly, the EU is facing a healthcare crisis and that means its economy will lag as lockdowns are needed given the lack of vaccination. The only question now is whether the protocols in Asia will withstand the mutant infection rates and whether the US, the UK and other countries that are vaccinating quickly, are doing so quickly enough to prevent waves there too. Of course, this could have economic and market implications if the delay in economic normalization is long enough.

Emerging market turmoil

At the center of all this lies Brazil. That’s because of its lack of vaccination, the rise of the P-1 Covid-19 variant and the rise in the US dollar due to US outperformance. All of these factors are bearing down on the country simultaneously, pointing to Emerging Markets as a potential locus of instability due to the rise in global interest rates.

My understanding is that the P-1 coronavirus variant that ransacked the Brazilian Amazonian city of Maunus has now spread everywhere in Brazil and is shutting down the healthcare system. ICU beds are all full and the lack of care means the virus is even creating serious healthcare difficulties for young people without co-morbidities. It’s the worst days in Brazil’s pandemic.

Meanwhile the Brazilian central bank is hiking policy interest rates as the Brazilian Real comes under assault due to the rise in global developed economy interest rates and the US dollar. A weakening economy, rising rates and a worsening pandemic is a toxic brew that could tip Brazil into an economic crisis. But Brazil is not the only country facing these problems. So, we should look at Brazil as the canary in the coalmine.

For example, there’s Turkey, which shares Brazil’s external balance problem. If you recall, back in 2014, it was the fragile five of Indonesia, Turkey, South Africa, Brazil and India that took it on the chin due to the taper tantrum and the rising US dollar after the Ben Bernanke Federal Reserve said it would taper its asset purchase program.

As the FT put it then: “What originally made the five so fragile was their combination of big current account deficits and low real interest rates.” So, Turkey followed Brazil and hiked rates this go round as the dollar started to climb. That got the central bank chief fired this past weekend. And the result is an absolute massacre of the Turkish lira. This means inflation and could also make Turkey, along with Brazil, another candidate for economic crisis.

These are the countries to watch as global interest rates rise.

My thinking on large cap tech and growth

Meanwhile in the US, the reflation rally continues apace. Although we could have a viral wave and I expect we will, the US is already so far down the vaccination route that I don’t expect healthcare conditions like Brazil’s let alone Europe’s. The question now is what that means for interest rates and sector rotations as we have seen a rise in interest rates and a rotation out of growth into value and cyclical stocks in anticipation of strong growth.

Going back to my framing of large cap tech stocks as a stealth long duration secular stagnation play because they grow when the economy doesn’t, this outcome is bad for the FAANGs in a relative value sense. I first started in on this thesis back in August. You can read the initial post here. I have linked to this a lot recently because it was good for thinking about what a rise in interest rates would mean. The rotation out of growth into value has tracked the framing in that post well.

But I wrote a second post on this in September that I was just re-reading. And I wanted to highlight a few issues from it now.

Here’s one. I would call it the regulatory hurdle:

I remember [GMO’s Ben Inker’s] saying that much of the price/earnings ratio differential between large-cap stocks and mid-cap stocks can be explained by the differential in growth. Essentially, we are living in a more winner-takes-all world. And the lion’s share of additional revenue growth accrues to the biggest and most dominant companies. Add in operating leverage and share buybacks and you see EPS growing much faster – and sustainably. It’s an oligopoly world in which large-cap stocks can grow earnings per share well in excess of small-cap and mid-cap stocks and above the rate of growth of the overall economy.

What happens if the FAANGs are subject to regulatory hurdles due to a belief/recognition that their market power is bad for innovation and growth? Then their earnings multiple declines. It’s as simple as that.

Here’s another on growth companies writ large:

…low interest rates reflect [economic] slowing, making the present value of distant cash flow streams more valuable.

….As in the Internet bubble days, fledgling companies give people upside via an out-of-the-money long-dated call option on their earnings. It’s akin to a lottery ticket, where the payoff is high. And if you invest in enough of these companies, one of those tickets is likely to score big as they did with Amazon, Google, Ebay and Facebook.

[…]

Inker agreed with the framing and focussed in the taped interview on the high implied volatility aspect of that optionality. He said that this volatility may not last, meaning that, as the company matures, the volatility will diminish and the option value will decrease. That’s going to hit share price. In the real world, that simply means that what seems like limitless possibilities in a company’s growth today will become much more limited five years down the line. And the share price will decline as a result. In the interview, Ben talked about Tesla as a perfect example of how this is likely to shake out.

Ark Investment’s Cathie Wood is saying just the opposite right now. She’s set a new price target of $3000 for Tesla. Her model says that, in a best case scenario, Tesla could reach $4,000 per share in 2025. And in a bear case, optionality has $1,500 as a price – meaning all reasonable scenarios in their optionality model show Tesla’s share price going up.

I disagree strongly. As Ben Inker and I laid out last year, as Tesla matures the optionality in Tesla will diminish. And that will hit the share price enough to dent its multiple. I see a range between $1,500 and $4,000 as laughably aggressive – reminiscent of Henry Blodget’s price targets for Amazon in the Internet bubble days. Cathie Wood’s previous high Tesla targets have been ‘validated’, just as Blodget’s were for Amazon. But, eventually there comes a reckoning via a reduction in growth, in optionality or both — with considerable downside risk.

My view

Right now, I am thinking most about whether the reflation trade causes a rotation out of large cap tech large enough to dent the Nasdaq and S&P 500 indices. The FAANGs are huge in these market cap-weighted indices. And if rates rise and cause rotation away from them, eventually it could spill over into index-wide declines. The price charts for the FAANGs are looking relatively weak, as shares have gone sideways since September except for Google.

I expect regulatory hurdles to add to those headwinds. And rather than help the FAANGS, any delay in the full re-opening may cause a reassessment of the optionality value of the FAANGs distant cash flows. Tesla is a different story, more akin to Amazon circa 1999. And the risk there is even higher.

That’s what’s top of mind for me now. The sector rotation story is first in mind and then come the mutant variant waves and EM turmoil. So whereas I have characterized the risks as mostly to the upside in the US, there are some developing global economic risks to the downside and some valuation downside risks to boot.

Comments are closed.