Let’s look at upside potential instead of downside risk today. And then let’s put it in the context of the three yield curve outcomes I have posited.

The virus

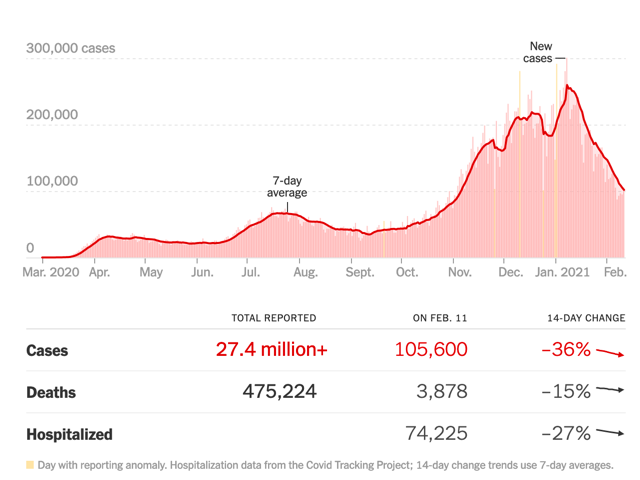

I’ll start with the thing that everything else seems dependent on these days, COVID-19. It’s remarkable how quickly numbers are receding. And while I still expect a fourth US wave from the infectious mutant strains, why shouldn’t we think about scenarios where we win the vaccine footrace against them?

Two weeks ago, case counts were down -33%, hospitalizations -17% and deaths only -2%. And I wrote: “Think of the lagged moves as case counts to hospitalization to death. So the fact that case numbers are declining more rapidly than hospitalization, which is declining more rapidly than deaths tells you that the direction is down. Cases are the leading indicator, with hospitalization following and deaths lagging.”

So, here we are two weeks later with hospitalization down from a peak over 130,000 to 101,003 when I wrote that to 74,225 now. And average daily deaths due to COVID-19 are down -15%. That’s a big falloff. And it’s telling you that the coast is clear for now.

The only thing stopping us now are the mutant viral strains. For example, Brazilian Health Minister Eduardo Pazuello says “a coronavirus variant identified in the Brazilian Amazon may be three times more contagious”. But, he also says that “early analysis suggests vaccines are still effective against it, the country’s health minister said on Thursday, without providing evidence for the claims.”

To me, the data point to viral strains as likely to take off in a big way in the US and worldwide. But, in the US, there is also an upside possibility where we vaccinate enough people quickly enough to prevent a fourth wave. And so, that’s where I am coming from in this post.

Jobs

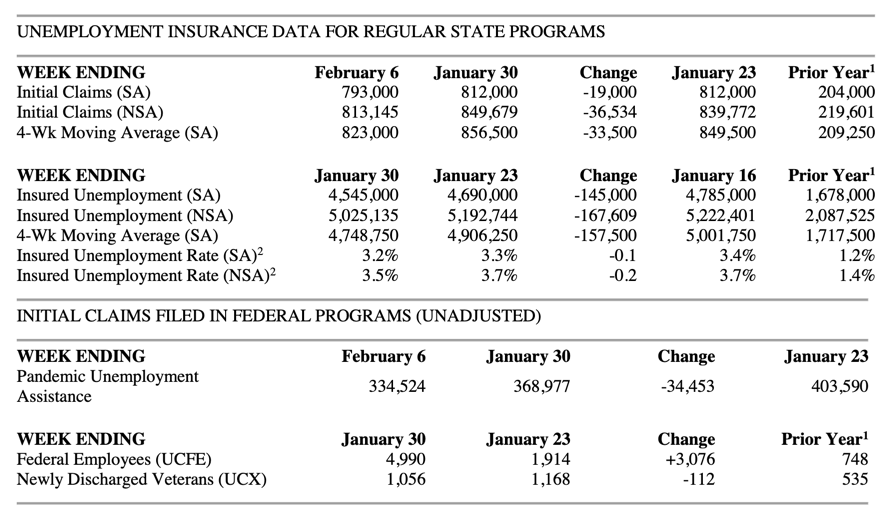

Yesterday’s jobless claims data confirm the link between shutdowns and job losses.

The numbers are still extraordinarily high. But they are coming down again after the holiday season viral spike created economic shutdowns. And so, absent a fourth wave, I believe we are likely to see the reverse-radical shaped recovery continue, with unemployment rates falling and job gains mounting.

Blast from the past

What does this mean for booming asset markets? They seem to have fully priced in a reflation of the economy. And so, even though this is now a momentum-driven rally in shares, the economic upside outlook may not be galvanizing for yet more gains.

What’s interesting for me is the fact that high yield bond yields average less than 4% now.

The junk bond mkt rebranded to the ‘High Yield’ market because it offered .. er .. high yields. Today it offers 3.9%

HY defaults have averaged ~4% p/yr since 1980, and all you’re getting to underwrite that is 3.9%

who’s buying this stuff? is fiduciary not a thing anymore? pic.twitter.com/BFBRT97ZnF

— Dylan Grice (@dylangrice) February 12, 2021

This is very reminiscent of 2007 when Citibank CEO Chuck Prince infamously said “As long as the music is playing, you’ve got to get up and dance. We’re still dancing.” Apparently he was talking about the leveraged loan market, a market that is highly correlated to high yield.

This is what you should remember from a 2010 post-mortem:

The U.S. congressional panel investigating the origins of the worst U.S. financial crisis since the Great Depression pressed Prince about his comment, which has become emblematic of banks’ failure to come to grips with the gravity of the crisis.

Prince told the Financial Crisis Inquiry Commission on Thursday during questions after his testimony, “The quote itself related to the leveraged lending business, and I specifically asked the regulators if they would take action in regard to that.”

Prince said that at that time “private equity firms were driving very hard bargains with the banks, and at that point in time the banks individually had no credibility to stop participating in this lending business.”

Today’s bond market

I don’t see the reach for yield ending anytime soon. The Fed will remain accommodative. And so, real interest rates will remain negative. We are also going to see massive fiscal stimulus in the US. All of this speaks to economic support that will prevent the credit cycle from ending. And so yields can drop further still as yield-starved pension companies and insurance companies try to minimize their duration risk.

In today’s market, it’s the 10-year bond that’s interesting for me right now. We have broken out of a broader range from 0.50% to 1.00% and are now trading in the range above 1.00%. We have been testing resistance above 1.14%. We got to 1.19% intraday twice, only to pull back.

But yesterday, technical analyst Katie Stockton told me she’s looking at two consecutive Friday closes above the 1.1425% level as a confirmation of a rise to the top end of a new trading range to 1.50%. Last Friday, we closed above that level. And that means a close above that level today would confirm her signal.

A move higher in rates may just cause people to reassess their portfolio duration. If we see rates moving toward 1.50%, suddenly paying 40 times earnings for Apple doesn’t look so attractive. And so, a rebalancing may be in order.

My View

So, even in a bullish economic scenario, there are risks. For me, I go back to the three yield curve outcomes framework I laid out on 15 January. In the most bullish scenario, inflation is benign and the yield curve steepening stalls as we await progress on vaccination. Shares can continue higher in that scenario.

In another scenario, the yield curve flattens, signaling concern growth. That could potentially buoy the shares of companies that do well in a slow growth environment. But a low growth environment is not what we’re talking about here.

So that leaves the last scenario. It’s this last scenario we can worry about in a bullish economic environment. If the yield curve continues to steepen before the bullish post-vaccine economic outcome has crystallized, many growth stocks could sell off because their valuation is highly dependent on discounted cash flows.

I will be watching the 10-year today. If it closes above the 1.1425% level, I will take that as a sign that steepening will continue and that we need to hedge against that outcome.

Comments are closed.