Hope and Risk

I know you want me to talk about how angry Trump supporters stormed the Capitol yesterday just five miles from where I live. But actually, let’s leave that as a tangential topic and use today to marry the first two posts of 2021 that I wrote earlier in the week.

The first post was the hopeful one, where I told you I was a glass half full kind of guy these days. The second one, though, was one where I voiced concerns over the economic trajectory, adding the ‘Caveat Emptor’ warning label at the end. This is where I bring the two together.

Hope and reflation

How many times have you hear people talk about markets looking through the near term data to the post-vaccine nirvana? I’ve heard it scores of time and I’ve talked it about this plenty myself.

At a fundamental level, this ‘look through’ mantra is hopeful. It’s telling you that the economic pain from the pandemic is time-limited, and that when the pandemic is over, we will be just fine economically. The basic concept here is that while near-term economic prospects and earnings growth will take a hit, higher asset prices can still be justified by discounted cash flow models with robust medium- and long-term earnings prospects.

That’s the market context for yesterday’s chaos. Unless what happened yesterday is a signal of a fundamental break from the past, it has no long-term economic significance. And even if it has political significance, it may still have no economic or earnings significance. That’s the reality. And so, remarkably in some respects, hope continues unabated.

Reflation is the key word defining this hopeful outcome. If you look at market action, it all speaks to reflation — dollar down, equities up, bond yields up, oil prices up, gold up, Bitcoin up.

Just before I wrote this, a friend who I didn’t know cared about Bitcoin texted a group of us, telling us “meanwhile, Bitcoin broke $40k. As if nothing is going on.” What he’s giving voice to is the concept that the current political events are monumental – in a negative way, and that this will have a negative impact on asset prices. Yet, the opposite is happening. Equity markets keep going up. And Bitcoin is going up even faster. What gives?

My explanation: irrespective of whether you think this is a liquidity-driven rally or one anticipating massive fiscal stimulus or one that is forward-looking to a post-vaccine world, the reality is that it’s signalling a reflation trade. It’s all one trade. It’s saying that monetary and fiscal stimulus will be enough to ride out the storm. And when that storm is over, financial conditions will be easy for months and years to come, supporting low yields, higher growth, higher earnings, higher valuations, and lower bond yield spreads.

Risk and disinflation

Here’s the problem(s). First, equities are priced for lowflation and low yields. We’re sitting at 1.08% on the US 10-year. And already, that’s becoming alarming. My friend Albert Edwards over at Soc Gen reckons 1.50% on the 10-year, only 42 basis points away, is too much for this market to handle.

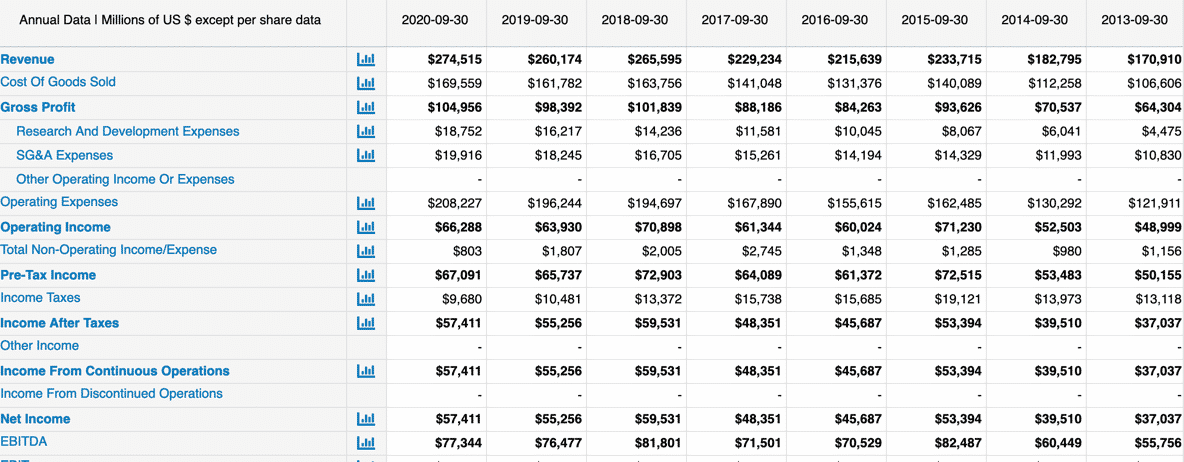

Why? Take a look at Apple (AAPL) for a sec. It’s up 3% today to $130 a share, putting its market cap at $2.2 trillion. That’s 40 times earnings, folks. And you’d be paying 40 times earnings for a company that has basically barely grown earnings in 5 years. The only reason earnings per share is up is because Apple bought back shares.

Source: Macrotrends

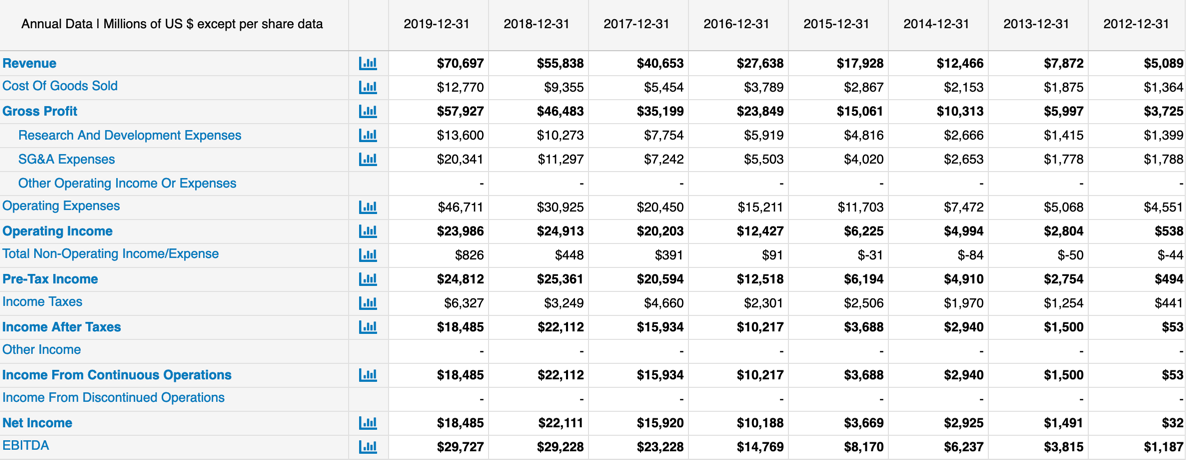

At least Facebook has been growing. Yes, earnings stalled last year and the company faces severe regulatory challenges going forward. Still, it has offered a lot more growth than Apple and it ‘only’ trades for 30 times earnings

What happens when rates go to 1.50% or 2%. You’d better see some serious concomitant economic and earnings growth. Otherwise, you have trouble. Effectively reflation is about real economic growth, not nominal growth. Inflation just eats away at purchasing power. It does nothing to make companies’ earnings worth more. So, by definition, the reflation trade is one of higher long term real economic growth. And I find the case for this wanting.

Moreover, when you look at the short-term that we need to look through. It’s pretty dire. Germany, a country that crushed the virus in the Spring just recorded a thousand deaths yesterday. And they’re in lockdown as countries right across Europe are. Even countries like South Korea and Japan are struggling with the virus.

When the B117 variant comes to the US en masse, we should expect lockdowns that will cause GDP growth to crater here. As I said in my last post, we can look through the data to a degree, yes. But, the ADP numbers yesterday showed large businesses lost jobs in December. That’s telling you market-listed companies are feeling pain. And that pain will increase in Q1.

My View

So I tend to look at this as a rally in shares with great risks – at least over the short- to medium-term. If the economic data decline or yields rise, there is an elevated likelihood of a large market correction. And while the Fed and other regulators might intervene, those using leverage to goose returns might be stopped out and need to liquidate at the worst possible time.

Market structure has changed in favour of passive so much now that you do have to wonder if buying the dip is actually inbred. By that I mean, yes you get massive air pockets that require central bank intervention. But after the downdraft exacerbated by leveraged speculators liquidating is over, the 401(k) flows that are impervious to fundamentals take centre stage again. We saw last year that this was enough, in conjunction with the Robinhood crowd, to buoy shares to new highs. Maybe this is the new normal.

It’s certainly something to ponder. It’s curious that we are on the verge of another downdraft in the global economy and asset markets are traded for reflation as if we were in the middle of an economic boom. It makes no sense to me — except for the outsized role played by passive investing. However you look at it, these are extraordinary times.

P.S. – Today’s claims data were heartening. But I see them as part of the rearview mirror now that B117 is staring us in the face. Stay safe

Comments are closed.