Markets were down today, sending the US market to its worst loss since June. Given that I have been writing about downside market risk, I thought I would make a few comments.

First, let me say that one bad day isn’t a big deal. In fact, because the rally in shares was so overextended, a pullback and consolidation could be viewed as healthy. Only time will tell if today’s market action has legs.

But beyond that, I do think there are two big takeaways, one from each of the downside risk posts I wrote this week.

Nowhere to hide

The first takeaway comes from the post on “Portfolio implications as the convergence to zero trade ends“. This is the part to remember:

In the next equity drawdown, bonds will do nothing for you. When you flee to that liquid safe haven, you may find liquidity. You won’t find a lot of return. In fact, that’s what we saw from those bonds already converged to zero when Covid hit. Only the Anglo-Saxon bonds and Norway cushioned your losses. And the cushion was weak, because yields were already so low.

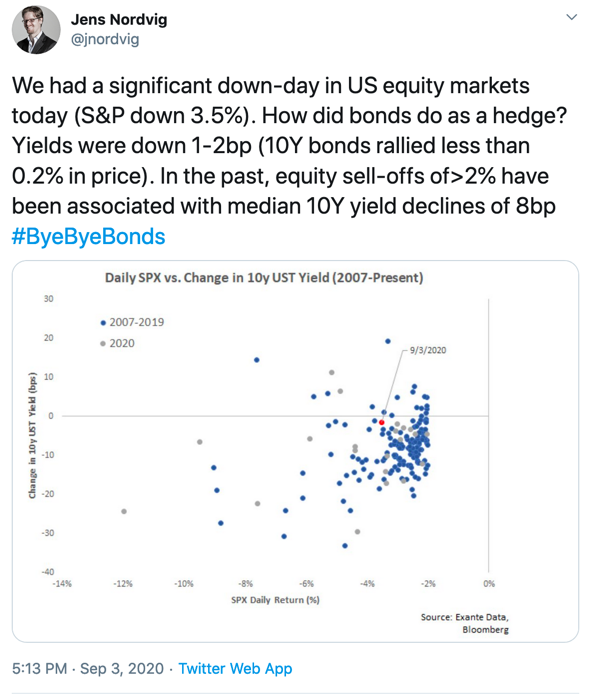

Today, Jens Nordvig noted that’s exactly what happened as the Nasdaq declined by 5%.

Yields are so low now that, when equities melt down, you aren’t going to get any relief from your government bond portfolio. Yields barely moved today.

Drawdowns could be violent

The second takeaway goes to the point I was making on Wednesday. The melt-up had gone too far. The Nasdaq started the week 30% above its 200-day moving average. That’s incredibly overextended.

And much of it was driven by action in the options market. A lot of the melt-up was, therefore, driven by dealers forced to buy shares they were effectively short due to filling single-name call orders in large cap tech stocks. That makes the market vulnerable.

Market makers were massively short gamma coming into today. And as Nomura’s Charlie McElligott noted this morning, before market open:

The Eq Vol complex is acting “broken” and indicative that “something’s gotta give,” in-light of the aforementioned “(vol market) tail wagging the (equities market) dog” dynamic we discussed last note—which sits at the core of this recent and mechanical “negative convexity” / “short gamma” -driven grab into market upside—it all adds-up to feel like a recipe for tears, i.e. “real” potential for a Nasdaq / SPX -6% to -8% single day in the next 1m-2m timeframe in my eyes as it all then turns the other way to the downside

Remember, the meltdown came on the back of almost no news – nothing. It was an air pocket precipitated by absolutely nothing. That tells you the market was overextended – and that we have to question support levels, as a result.

My View

Timing-wise, I got this right. But, this was really just a mini-selloff. Downside risk remains though. All of the factors that drove the phantom selloff are still with us. It is going to be an interesting few weeks in markets. Expect volatility to remain elevated. Caveat Emptor

Comments are closed.