I have three threads I want to say a few words on: jobless claims, the jobs report and recent market volatility. I think the macro theme that connects them is about a reversion to the mean’ in real economy versus financial economy performance. And I will start by framing it that way.

Is this a recovery?

Back in 2009, I was relatively early in calling the economic turn. The markets bottomed with the economy in early 2009 despite an ugly bankruptcy and unemployment cycle that lasted months after the official end of recession. In the beginning phase of that recovery, there were a lot of doubts about whether we were in a recovery. And if we were, there were doubts about its durability.

I think we’re at a similar point now.

The way I am looking at the numbers is as a sharp downturn, called aggressively early in the US by the NBER as a February 2020 economic peak. This was followed by the largest and sharpest decline in output in US history. We are now in the midst of the largest and sharpest advance in output in US history and everyone is questioning its magnitude and sustainability.

I see this as a recovery in the same way the downturn was a recession, simply because the magnitude of the increase in output is so large. And to the degree the recovery peters out or rolls over into recession, this would be a new recession with vastly different dynamics than the short, sharp recession earlier this year.

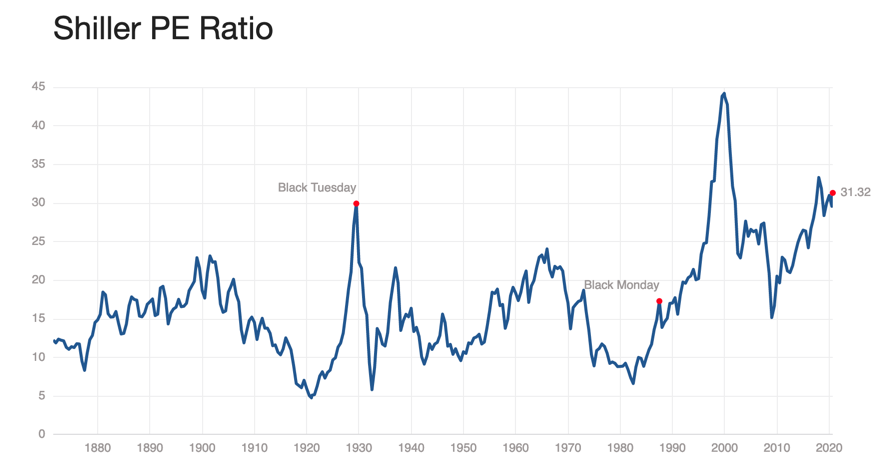

Meanwhile, shares have exploded higher as if we were in a sustained recovery. The price action is vastly different than it was in 2009. The move up in shares is much more ferocious, just as the tumble through March was much more rapid. Moreover, to the degree we are in a sustained recovery, shares would be starting an up move from an unprecedentedly rich valuation base.

Source: Multpl.com

My gut tells me you can’t have a durable economic and market cycle when valuations are starting from these elevated levels. So I expect more downside. And given the parabolic nature of the recent tick up in share prices, I expect the down move to be violent. Shares simply don’t vault up parabolically and then move down slowly. They cascade down.

What that means regarding the real economy, I can’t say. The data are still inconclusive. But that’s how I am looking at the situation from the most macro level.

Jobs data

Having laid out that macro frame, let me say that the jobs report today was really good. We hit targets for non-farm payrolls. We exceeded targets for the unemployment rate falling. The labor force participation rate increased. And average hourly earnings were up as well. The headline numbers and the details showed real progress. My worry is that this was the rearview mirror.

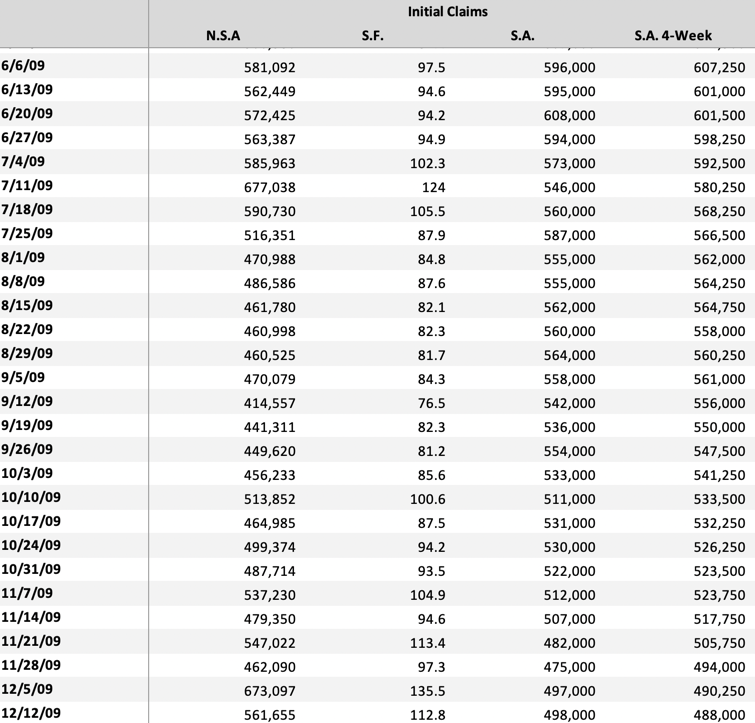

If you look at jobless claims, you have to be a bit worried. In 2009, initial jobless claims were coming down from the 600,000 level as the recovery took hold.

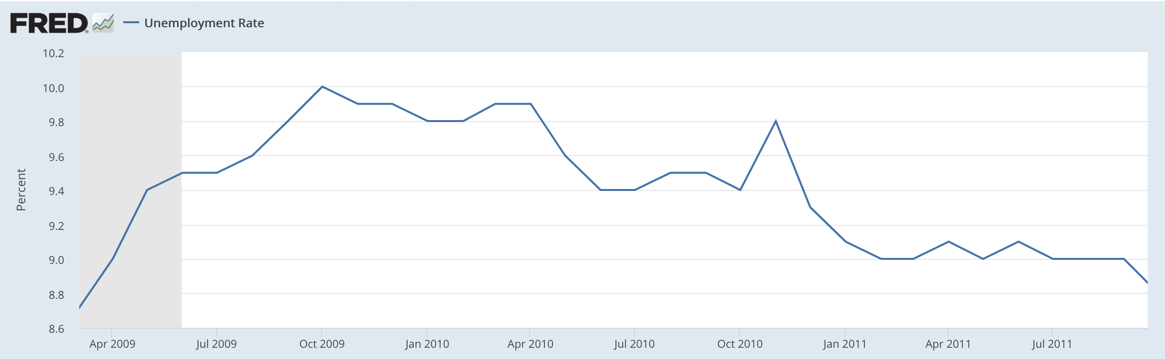

And this was consistent with a rising unemployment rate.

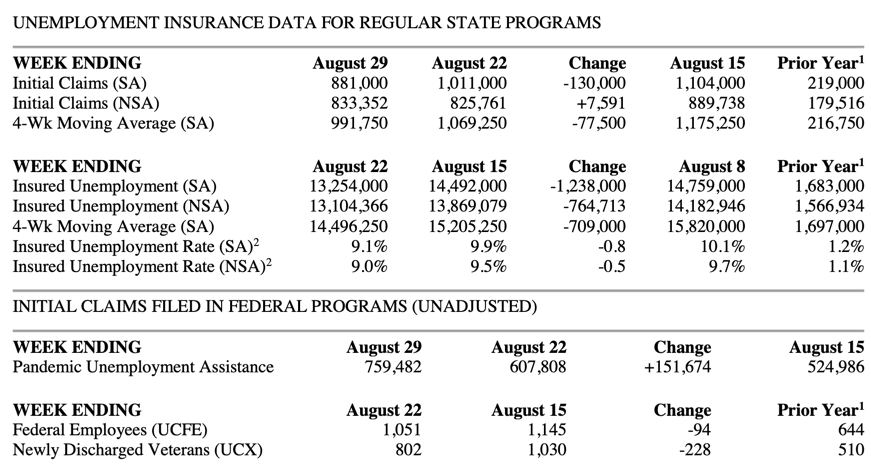

Today, we have initial jobless claims at a weekly 800,000 level. And it’s not yet clear when they will fall from that level since they have been there for a few weeks.

Why should we expect unemployment to fall, if so many people are losing their jobs? Once we work through any temporary layoffs, I would expect the unemployment rate to rise, just as it did in 2009. And in 2009, we brushed the 10% unemployment level and remained above 9% through April 2010 before the unemployment finally began to fall in earnest. Then, it spiked up to near 10% again in late 2010 before falling for good. That’s 18 months of touch and go on the jobs front – in a recession that was less severe than today’s.

Why would stocks be up so briskly from historically elevated valuations? Something doesn’t look right. Either this time is different in terms of a rapid improvement in the real economy, especially the labor market or share prices have gotten way ahead of themselves.

The Meltdown

The turmoil in equity markets right now has this quandary as the macro backdrop. I look at the recent drop in share prices as driven overwhelmingly by technical factors. It’s not a fundamentally-driven selloff. After all, this morning we got great jobs data and the market sold off anyway.

I believe the market is simply overextended. And so, shares are repricing. They are doing so with more vigour because of the dealer community short gamma position amplifying the move. And higher realized volatility will only exacerbate this as investors with volatility control strategies will de-risk by reducing leverage.

Charlie McElligott wrote this morning that “again reiterating that next week, we will still likely see a VERY large acute BUY flow in the short term“. And so, he expects at least one nice pop in the next week. None of this has anything to do with market and economic fundamentals.

My view

So, let’s see how this plays out. Personally, I expect realized volatility to remain elevated. And that is going to lead to some de-risking, putting downward pressure on shares. But to the degree the real economy can maintain momentum, we don’t have to have a major drawdown.

The risk is that economic momentum fades, both in the US and globally. And, the jobs numbers aside, I see recent data prints as decidedly lacklustre. All of the diffusion PMI indices have been either below consensus or underwhelming, with numbers in the mid-50s. After a monster downtick in growth and PMIs in the 20s and teens, you expect to see sustained upticks into the 60s and 70s if we are in a V-shaped recovery. We haven’t seen that. And so you know this recovery isn’t V-shaped.

My expectation, then, is for markets to bitterly accept that shares have been priced for a V-shaped recovery scenario that won’t happen. And we will get a major sell-off as a result. I’m looking for this to play out by the election in the US, adding fuel to the fire of an already volatile political situation.

Caveat Emptor

Comments are closed.