Initial claims and the fiscal cliff update

Quick post here on jobless claims

I want to lead with what I wrote yesterday:

In terms of real-time data, initial jobless claims are where the rubber hits the road. They are declining but elevated. A steady-state post-recessionary economy is associated with maybe 400,000 initial claims, about half today’s levels. If we don’t get down to that level quickly, expect expectations on consumption, capital investment and GDP growth to crumble for Q3 and especially Q4. If the downward trend in claims stops and reverses, the economic implications would be even worse. I wouldn’t rule out a negative print for Q4 GDP.

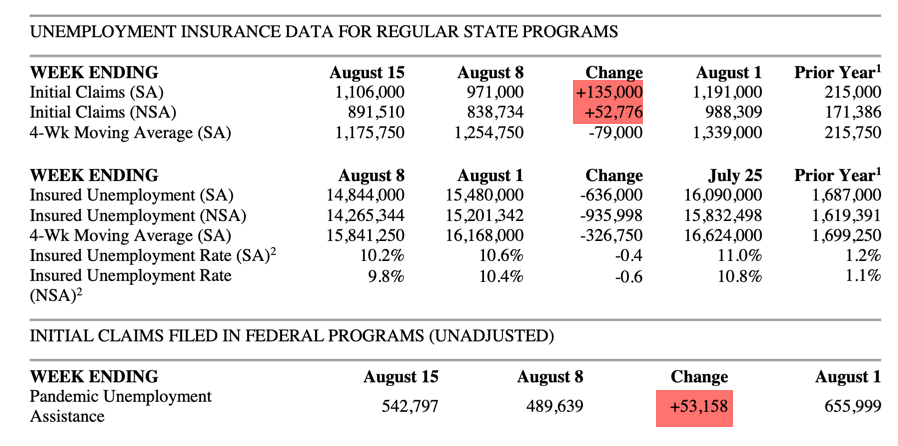

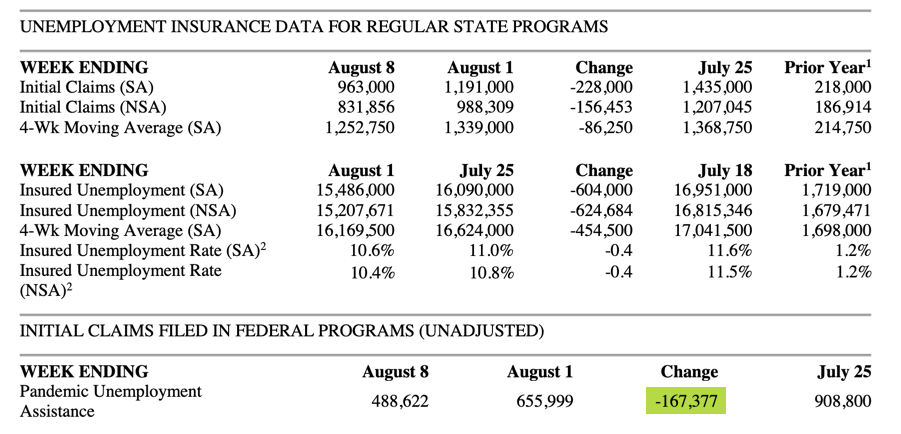

This morning, the unemployment insurance claims data came out. And the numbers were higher than the 925,000 seasonally-adjusted claims expected. Both the seasonally-adjusted number and the raw number I have been tracking for the data trend increased.

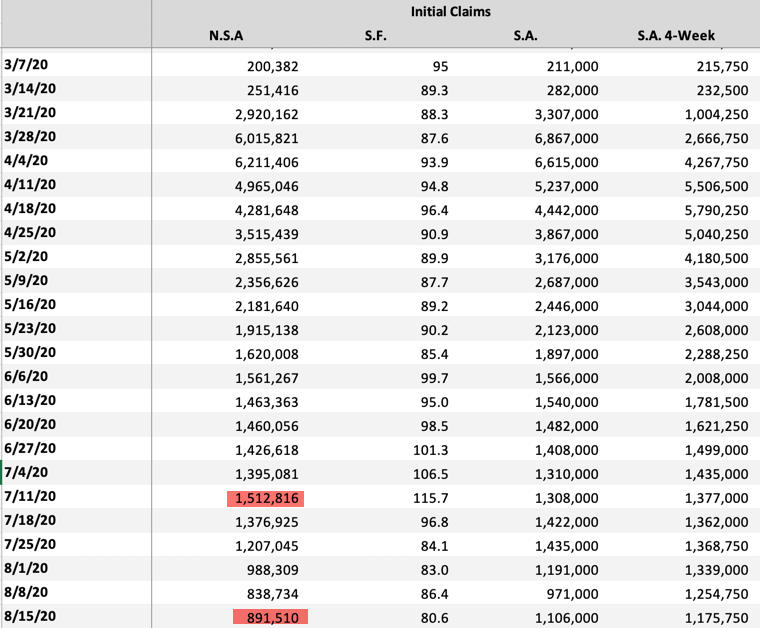

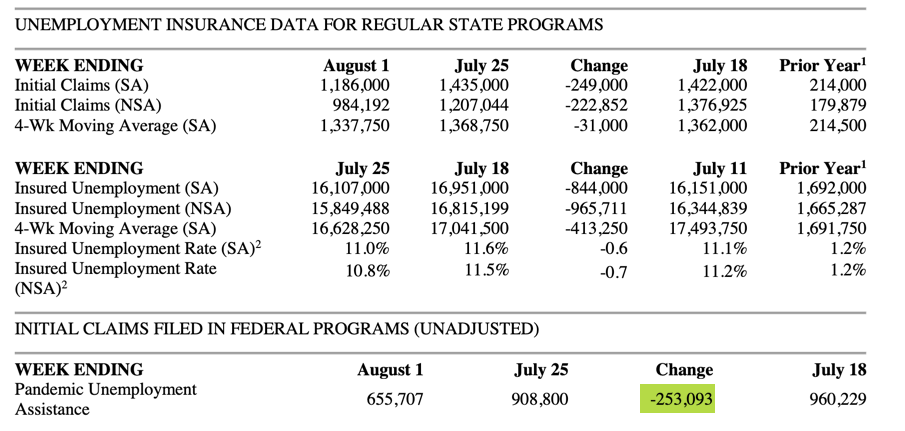

I highlighted in red that all three real time ‘flow numbers’ increased last week. And while this is just one week’s data, it is worrying that we are seeing raw initial claims both near 900,000 and increasing some 20 weeks into the pandemic data set. It was only the second time since early April we have seen a week-to-week increase. We need to watch this next week to see if this was just a blip.

Something I have not tracked closely is the number of people filing for Pandemic Unemployment Assistance as this is a new data series and I am not familiar with it. Second, we hit a cliff where the assistance was cut off at the end on July.

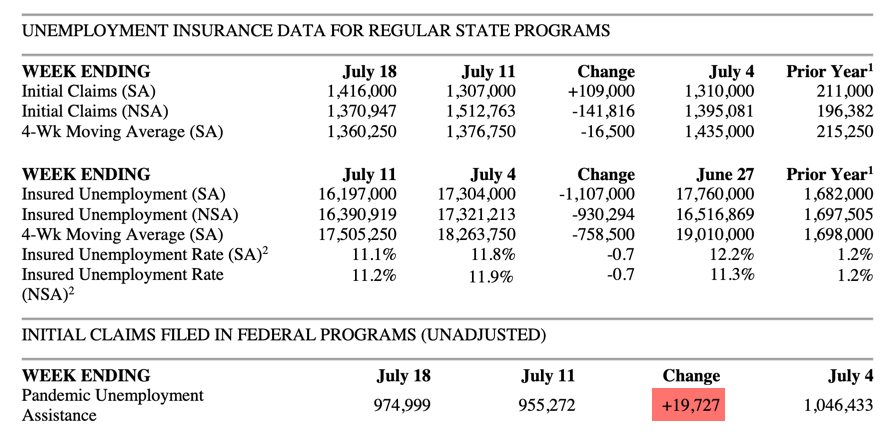

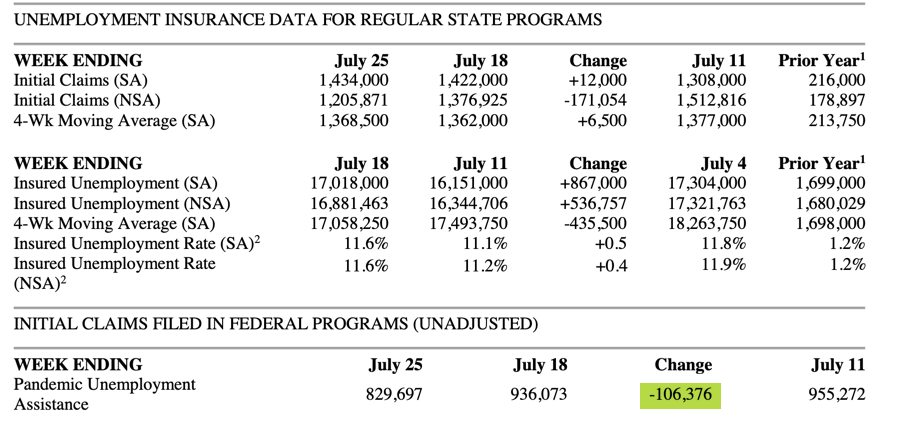

Yet, somehow the numbers increased last week. I looked back over the past several week and this is definitely an anomaly. See the news release screenshots below.

Again, this is just one week’s data. So, we can’t read to much into it. But if the uptick continues for a couple of weeks, I think we will have a trend of significance. And it will tell us to expect economic slowing.

Comments are closed.