News flow as European shares outperform the US

Happy Wednesday. From what I can discern, the macro outlook is largely unchanged today. So, I thought I’d take a stab at presenting the news flow that most grabs my attention to put it in context for you.

The framing here is that we reached an inflection point in mid-June where the re-opening rally was well-advanced and markets were looking for greater certainty about the path forward. Since that time, we have had a lot of negative news flow concerning the pandemic, with the United States a large part of that news. And so, the biggest questions now are around how this news flow will play out in economic and market terms.

I am keeping my mind open. Even as the credit cycle deteriorates, it isn’t clear whether we are in a bear market rally or in the beginnings of a cyclical recovery. On the one hand, we have had a sharp recovery in both economic data and shares – just as there was in June 2009. On the other hand, there is a lot of uncertainty around whether that recovery is durable – just as there was in November 2008. So, that’s the framing to keep in mind as I present the news flow below.

Best quarter in thirty three years

The quarter that just ended was the best for US shares since 1998, with the S&P 500 ending the quarter up 20%. The Nasdaq jumped 31% for its best finish since 1999. And the Dow Jones Industrial Average was the laggard at just +18%. But it was the Dow’s best quarter since 1987.

Now, you could read this as a positive i.e. this is what the beginning of a new bull market looks like. And the market internals are looking good on a technical basis. That’s what trader Dave Floyd told me yesterday on the Real Vision Daily Briefing (link here). He said the S&P500 had broken out of a trading range between 3020 and 3050 into a new range between 3050 and 3080, with the index testing a breakout above the 3100 level near the close.

That suggests further upside momentum, especially to the degree data continue to beat expectations as the US housing data did yesterday. We have a jobs number coming out tomorrow that gives us a snapshot of the US jobs picture through that mid-June inflection timeframe. And if that number beats, we could see another pop to the upside.

At the same time, that ‘Dow 1987 beat’ is ominous because 1987 ended the year down 23.4% in Q4 due to a crash in October. And while that October crash didn’t spell recession, the market is rich now, meaning it is vulnerable to a sharp correction.

European outperformance

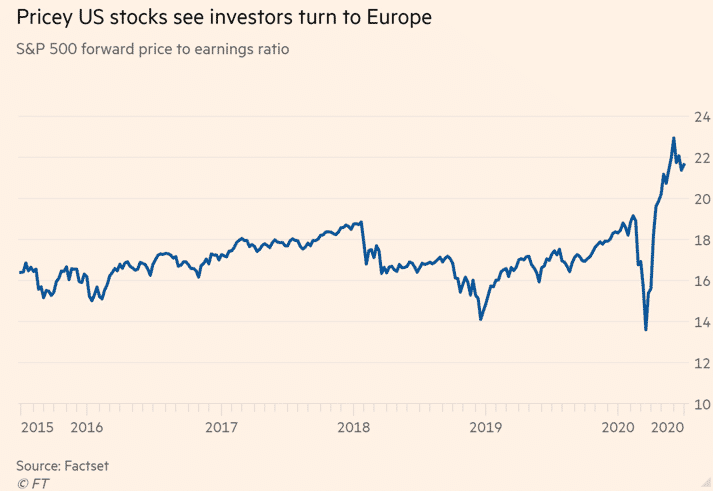

Source: FT

Look at the chart above. It’s from an FT article highlighting the fact that the European markets are now outperforming the US. The S&P500 ended June with a 1.8% rise, while the Euro Stoxx 600 index rose 3%.

To me, this is very much inline with the European viral containment thesis I first posited in late April. While the US has done well to date on the back of re-opening, I saw a risk that the US would open too early, causing viral infections to rise and dampening economic performance. As I put it then, “we should expect the US to either risk a second wave of infections or be forced to wait another few weeks before rules start relaxing.”

The US did not wait. And, as expected, a second spike is running out of control. The numbers are at record levels. And top US disease expert Anthony Fauci thinks this wave could double to 100,000 cases per day. even as the US is bumping up against the upper limits of its testing capacities.

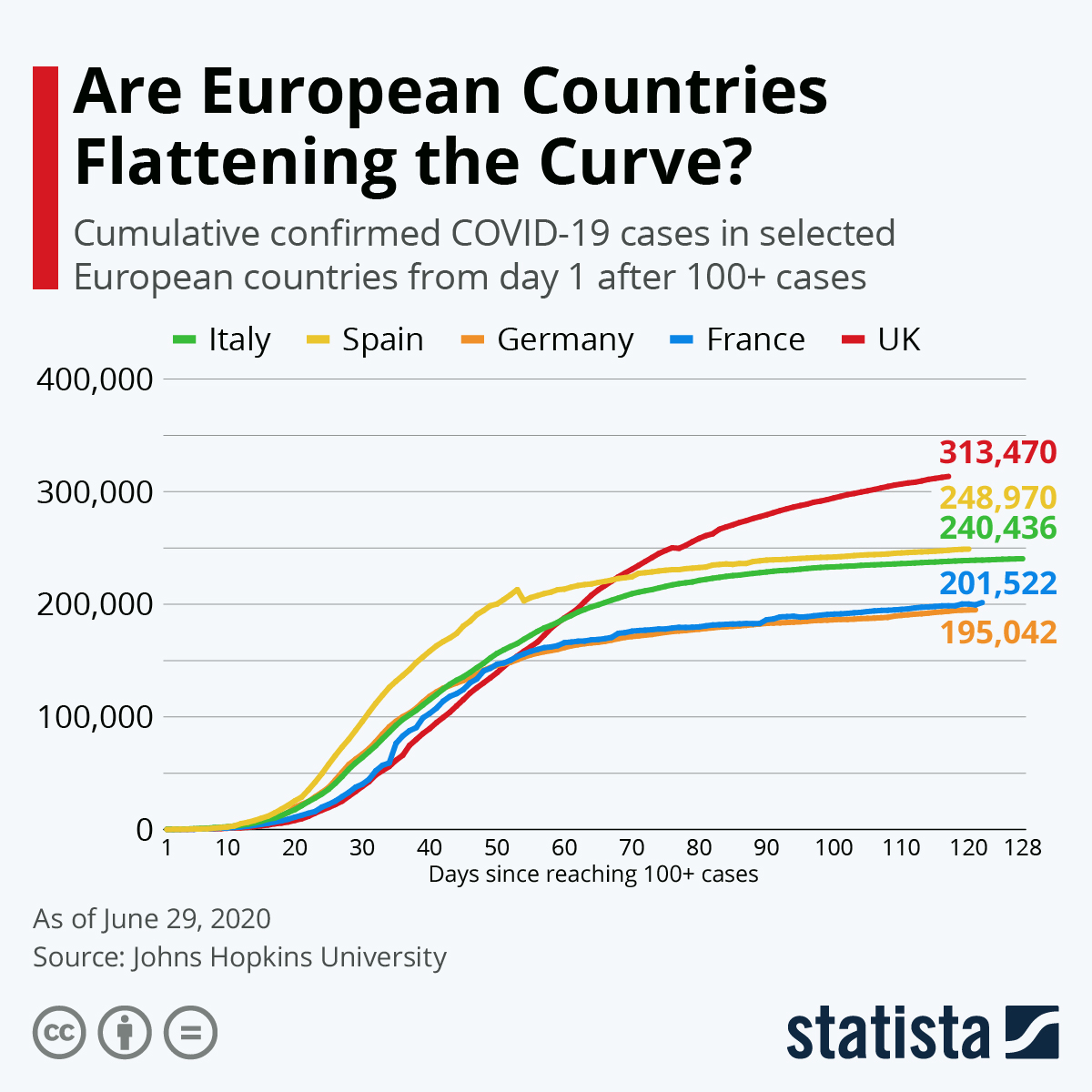

By contrast, in Europe, where we saw a worrying but localized spike due to a meat processing outbreak in Gütersloh, Germany, infection levels have quieted down again. Even in the UK, control measures have flattened the viral curve.

Source: Statista

We still have to be concerned about a second wave in Europe, especially as they have just relaxed border controls. But, the EU is only admitting travellers from outside the Schengen area where viral contagion is under control. A number of countries, including the UK and Ireland are not on the list for travel within the Schengen control-free travel area. The US is also excluded for obvious reasons.

My expectation is that Europe will continue to re-open toward a Swedish-style outcome. And this, in conjunction with policy stimulus, will aid a sustained recovery from the pandemic shutdown.

The United States’ second spike is trouble

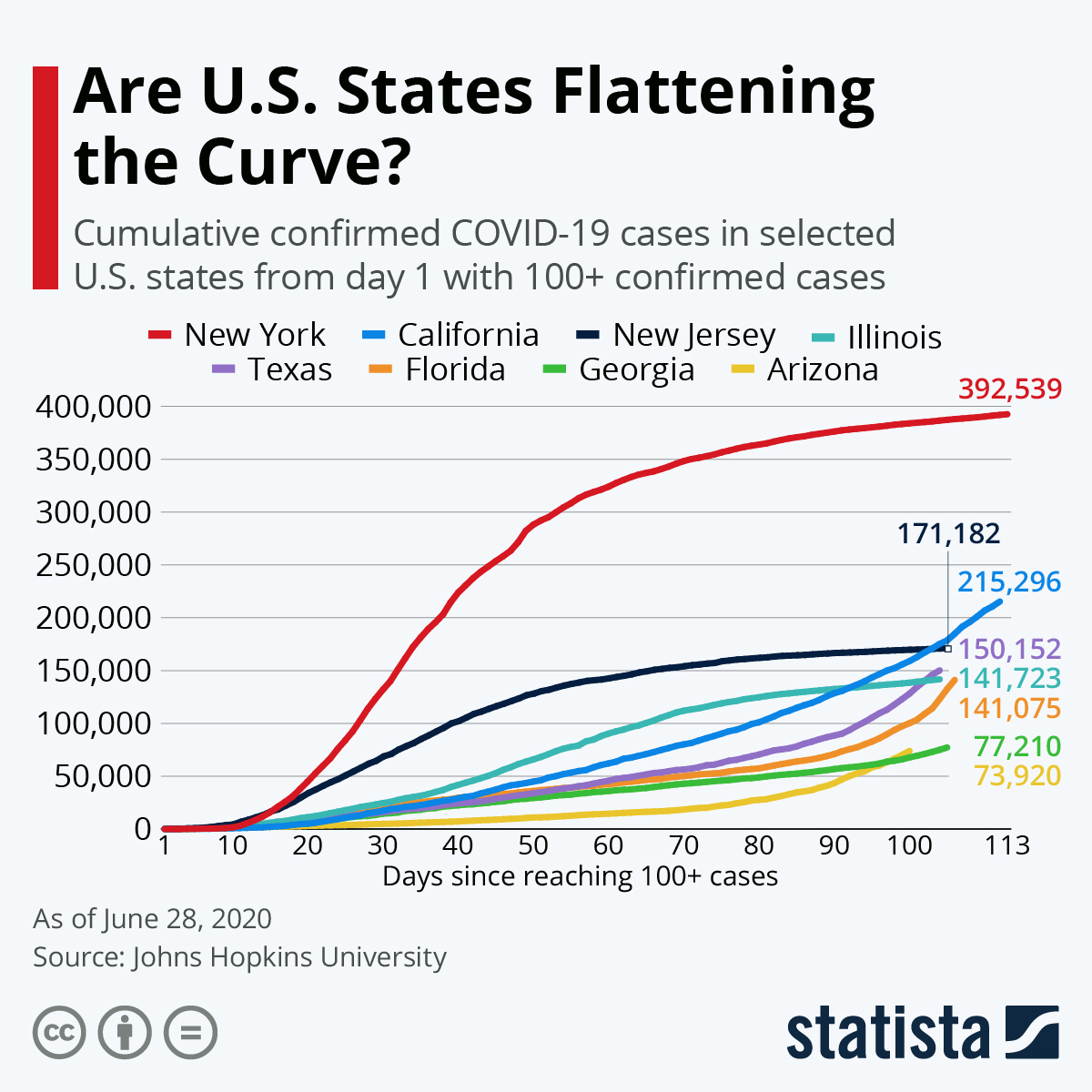

When you look at the United States, there are three stories to tell. If you look at the curve flattening story, many states in the Northeast like New York that were hit early are seeing the curve flatten. But states that re-opened without getting hit by a lot of viral infection in March or April are now seeing the curve steepen.

Source: Statista

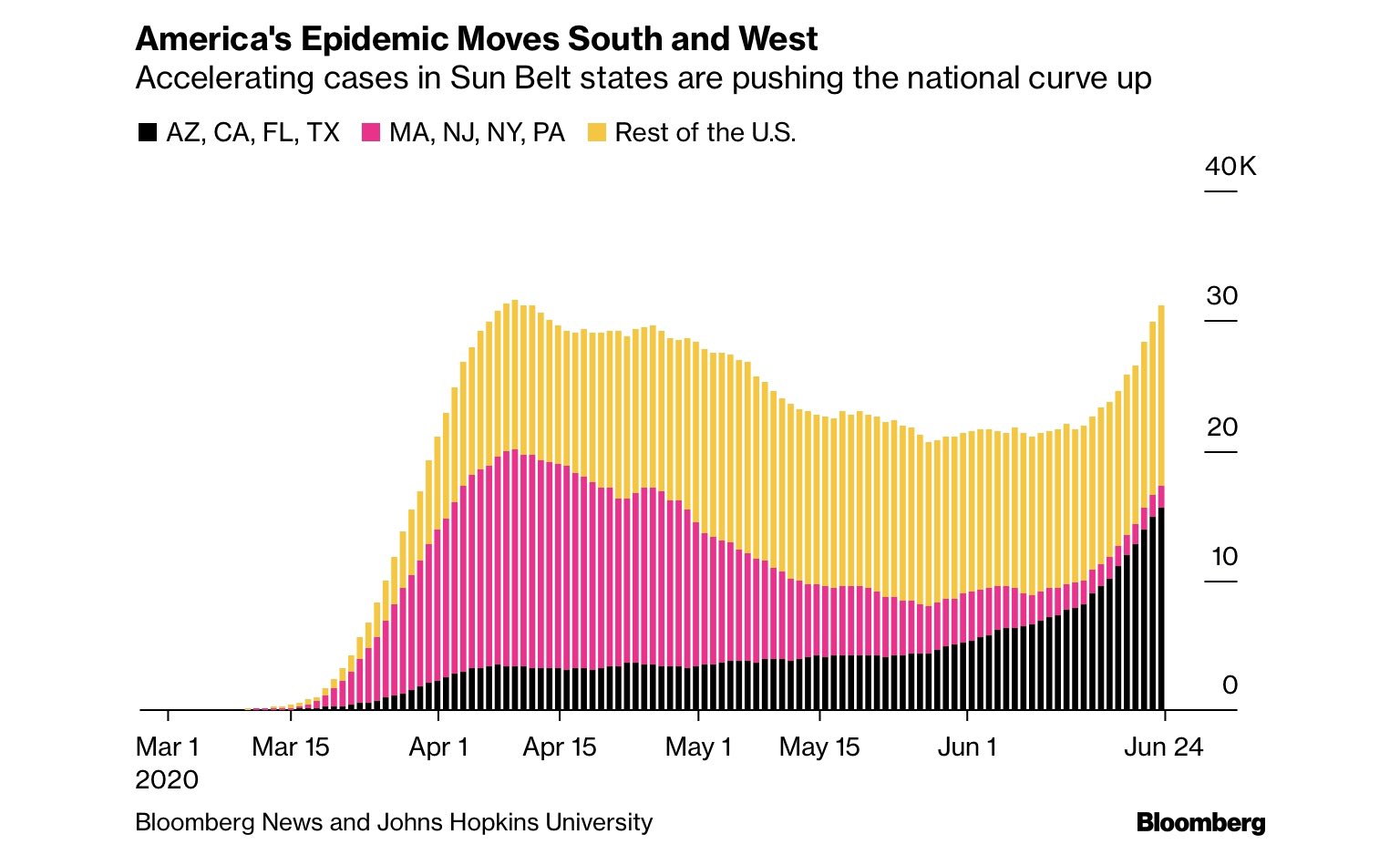

Because some of the states where the mushrooming case counts are large, like Texas, California, Arizona and Florida, overall daily infections are going to new highs overall.

But there is a third group of other states where the overall composite levels are relatively high but not increasing. This includes early-hit states like Maryland and Virginia that have things relatively controlled and states like Michigan that are still seeing numbers escalate.

See the graphic below.

Source: Bloomberg

My overall take is that this is trouble because it means rollbacks of the re-opening or even renewed localized shutdowns. As I have said many times, the initial lockdown had such a horrific impact on the economy, we are unlikely to see something like it again, unless things are dire. But, we are already seeing rollbacks. And if the worst case Fauci numbers come to pass, we will see localized shutdowns too.

The economic outcome

As I wrote the above the ADP private payrolls numbers came in at 2,369,000 jobs added, below consensus estimates of +3 million jobs added in June. And although ADP and the government numbers are often uncorrelated, I see a big risk that we get a big negative surprise tomorrow to the jobs numbers, which would leave the V-shaped recovery crowd scratching their heads.

It could be that the ADP numbers are actually a more recent look at the payroll data than the government figures though, meaning the government figures will reflect the bullish re-opening rally before case counts started to rise and the rollback began.

Irrespective, the news flow suggests that by early August the negative data flow will pick up. For example, the Washington Post has found that workers are getting laid off for a second time, as the virus’s surge puts reopenings on hold. People who were already near the brink after the lockdown were looking at the re-opening as an economic savior. But, the rollback of re-opening in the Sun Belt means unemployment and economic deprivation for many. And that will be very negative for the economy.

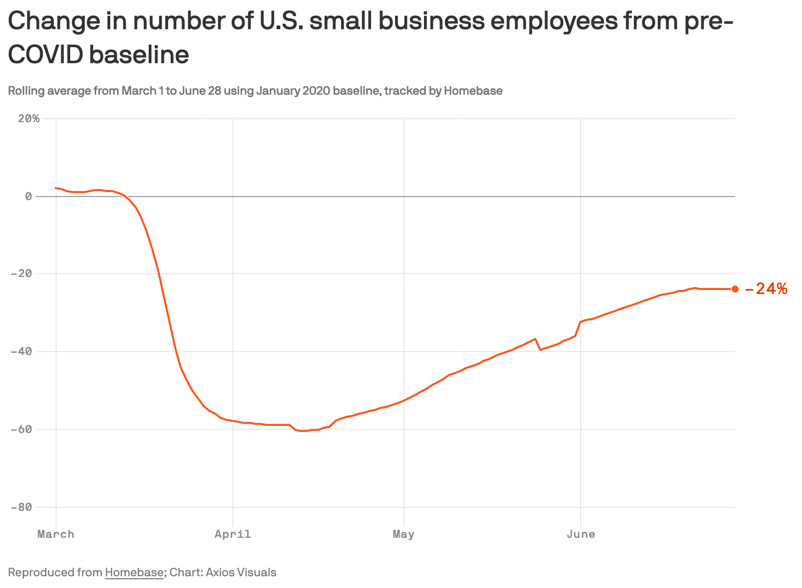

Axios reported this morning that “private data the White House closely monitors has been pointing to an economic recovery that’s plateauing — and that could bolster the case for more stimulus this summer.”

Source: Axios

But, at the same time, I have serious doubt that stimulus is coming. Axios also reported this morning that there is a big divide over the next stimulus. And with the November election breathing down our necks, David Rosenberg’s thinking that Nancy Pelosi will play hardball about stimulus priorities makes sense. He told me last week that there is zero incentive for the Congressional Democrats to water down their legislative priorities to meet Trump, since he is likely to be the one who will be blamed for the viral spike and faltering economy. The potential for a policy error is large.

For example, today marks the first day of the fiscal year for 46 out of 50 US states. And while 11 states are holding out, hoping for some help from the Federal government, all indications are we will see massive state budget cuts due to revenue shortfalls. If the US federal government doesn’t come through, that would be a policy error, a major one.

Moreover, when we look at the states now being hit by the coronavirus, we have to remember, these are mostly so-called ‘red states’, ones controlled by Republicans who have been hostile to Obamacare, the Affordable Care Act (ACA). As the employment impact of re-opening rollbacks take form, a greater number of their residents will be left without healthcare coverage, just when they need it most.

As Bloomberg News put it:

The ACA, known as Obamacare, aimed to broaden coverage in two main ways. For households with low or moderate incomes, it offered subsidized private plans that could replace job-based coverage. The 2010 law also expanded Medicaid, a program that offers free health insurance for the poorest Americans, to include those slightly above the poverty level.

But 14 states –- including Texas and Florida, where coronavirus cases have been soaring –- opted out of the latter provision. In those places, it’s been especially easy to fall through cracks in the system.

Meanwhile, the Trump Administration is actively looking to have the Supreme Court invalidate the ACA, without a replacement in place. Again, to me, this smacks of a major policy error that will exacerbate any negative economic shock.

The market

In a world in which data matter, this data flow would mean bad things for US risk assets, especially as compared to Europe. And while Europe has begun to outperform, the US is still buoyed by fiscal and monetary stimulus.

The US Federal Reserve is even thinking of yield curve control as a means of boosting the economy. San Francisco Fed President Mary Daly’s comments are indicative of the sentiment here: “Targeting forward guidance and quantities on the balance sheet would be the policies I would want to use before we go to yield curve control.” Translation: the Fed must continue with forward guidance and quantitative easing alone unless the economy really turns down. At that point, yield curve control, i.e. pegging non-overnight Treasury rates, will be the next step to take.

And while Dallas Fed President Kaplan and Cleveland Fed President Mester are both concerned about this distorting price signals, Mester is on record saying, “I’m open to using it as a reinforcement to forward guidance, but I’d like to see more study of that.”

The bottom line here is that the Fed can and will do more, if they see it as warranted. So, we shouldn’t be under any illusion that asset prices will reflect any weakness in the real economy, at least over the near- to medium-term. The Fed will do whatever it can to bolster the economy. And since its actions are all financial asset- and interest rate-centric, the Fed’s accommodation will lift asset prices before the real economy.

My view

In the end, the facts that the re-opening rollback may not be baked into tomorrow’s jobs numbers and that the market tone is positive makes me think we could have room to run in the short-term. The rollback effect will come through in the data with a lag. And it’s not yet clear how significant the impact on the economy will be.

At the same time, in the August, September and October time frame, we will see fiscal policy, both at the state and municipal level and at the federal level come into play. I believe the potential for policy error is large, if only because states have to balance their books and are poised to cut, potentially without any federal budget offset. The divisive nature of US politics makes the states’ budgetary issues and other stimulus policy issues all contentious. Expect some of these measures to roll off in late summer and early Fall without a replacement.

One thing to watch is evictions. Landlords who are receiving no rent due to COVID-19 deferrals may soon have a chance to get their money. But likely, many tenants will not have enough. And if allowed, landlords will begin evictions. For me, that will be the first visual sign that this crisis has escalated and the safety net of stimulus has broken irreparably. Consumers and markets will react – and negatively – if this does come to pass.

Overall though, I remain cautiously optimistic that the second spike in US viral infections will not lead to a massive upturn in deaths. And so, my hope is that this spike’s economic impact is muted, transient, and mitigated by policy stimulus. The risk, on the other hand, is that the wave is large and that policy errors exacerbate its economic impact. And so, while a second dip should be a base case, a full on double dip recession cannot be ruled out. For me, V-shaped outcomes are off the table.

Comments are closed.