Some brief thoughts on the second coronavirus spike and financial markets

With financial markets seemingly untethered from the real economy, it’s not clear what impact differential viral outcomes will have on risk assets. Because of central bank intervention and the potential of that intervention to put a floor under assets – ostensibly for liquidity’s sake – it’s difficult to know if and when the path of financial markets and the real economy will converge.

But, it’s been my view for a while that the US would underperform on viral containment. (And while I question the thesis given Fed intervention,) I have also written that I think US markets will eventually underperform as a result. So, after Friday’s piece about the Fed’s severely adverse scenario, I think it makes sense just to frame what we know about Covid-19 and the various strategies being employed to contain it. I’ll try to be brief today.

Asymptomatic and pre-symptomatic spread

An article I just read in the Irish Times on the scientific debate about asymptomatic and pre-symptomatic spread of the novel coronavirus is fascinating. The gist is that, as the disease spread early on, scientists had an intense argument over how to think about the potential spread of Covid-19 by those without clear symptoms. Those who downplayed this factor won out in terms of policy responses. And the result was a greater spread of the disease from asymptomatic and pre-symptomatic carriers, and, thus, greater hospitalization and loss of life.

Here’s how the Irish Times put it:

Dr Camilla Rothe was about to leave for dinner when the government laboratory called with the surprising test result. Positive. It was January 27th. She had just discovered Germany’s first case of the new coronavirus.

…The visitor had seemed perfectly healthy during her stay in Germany. No coughing or sneezing, no signs of fatigue or fever during two days of long meetings.

She told colleagues that she had started feeling ill after the flight back to China. Days later, she tested positive for the coronavirus.

Scientists at the time believed that only people with symptoms could spread the coronavirus. They assumed it acted like its genetic cousin, Sars. “People who know much more about coronaviruses than I do were absolutely sure,” recalled Rothe, an infectious disease specialist at Munich University Hospital.

This was a mistake. And for me, it underscores the importance that testing, contact tracing and mask wearing has had in limiting viral contagion.

Question: would we have had a pandemic if people in many Western countries wore masks the way many in Asia already do? Question number two: would we have had a pandemic, if countries got on the testing and contact tracing bandwagon early, the way Singapore and Australia did? To be fair, the answer to these questions is unknowable, because it’s an alternate reality that never happened. But, asking them does frame the public policy debate.

The United States’ policy response failure

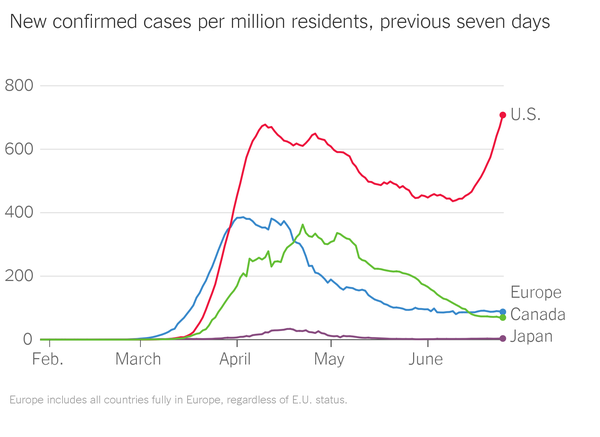

Take a look at this chart.

Source: Johns Hopkins University, The New York Times

I think this chart represents failure. It represents a failure in the West to understand the importance of testing, contact tracing and mask wearing early on, as the Irish Times article outlines. But, it also represents the public policy failure in the US even after the first wave of viral contagion hit the West.

The reason the US curve looks different than the others is because the US public policy response has been different. It is been uncoordinated and contradictory on mask wearing. It has been ambivalent about the need for social distancing. And it has been politicized, with political partisans choosing public policy positions merely to be ‘onside’ rather than to save lives. The result is a public health catastrophe.

With a large second spike of Covid-19 infections hitting the US, the question now is three-fold:

- Will the spike lead to an overwhelming of hospitals and a large increase in deaths too?

- Will the spike change public policy in the US?

- Will the spike lead to adverse economic and market outcomes?

Here’s my stab at answering these questions.

Healthcare outcomes in the US

Here are three articles I tweeted over the weekend that get to what we can expect to happen in the US.

Scientists just beginning to understand the many health problems caused by COVID-19 https://t.co/AeZzj9vzMg

— Edward Harrison (@edwardnh) June 28, 2020

Why Changing COVID-19 Demographics in the US Make Death Trends Harder to Understand | The COVID Tracking Project https://t.co/udmOdHKvJP

— Edward Harrison (@edwardnh) June 27, 2020

Deaths in nursing homes and other long-term care facilities now represent at least 43% of coronavirus deaths in the U.S.https://t.co/TZbNmkfvMm

— The New York Times (@nytimes) June 27, 2020

First is the fact that we still don’t understand the virus. The most important quote for me from the first article is this one right at the beginning: “Scientists are only starting to grasp the vast array of health problems caused by the novel coronavirus, some of which may have lingering effects on patients and health systems for years to come.”

I think of it like casualties of war. Many who died in the First World War would be alive today if they had had the medical expertise we now have. Some would have been maimed for life, but their lives would have been spared. Others would have made a full recovery.

The analogue in epidemiology is from the 1918 Influenza Epidemic. We have to remember that medical advances are vast and mean that people who would have died 100 years ago are saved. But that doesn’t necessarily mean they live without health problems in the future. We won’t know how this plays out for years to come.

So, we really shouldn’t take any succor from the fact that the second spike in viral infections in the US has skewed toward younger people. That’s what the second article is all about. My takeaway is that three factors are at play in the US. First, there is vastly more testing being done in the US now. Second, the elderly know they are at greater risk of death and are more cautious about contact with others. And third, younger people are less cautious or more exposed to contagion.

What should we expect to happen given the third article? It highlights that 43% of US novel coronavirus deaths are linked to elder care facilities. To put the question differently, if the patterns of the second spike that the second article highlights are in effect, what will that mean regarding hospitalization, healthcare system overload and death?

I would say that it’s too early to tell. But, in a best case scenario, we won’t see such a complete overload and so many deaths as we saw in the first spike of cases. In a worst case scenario, due to pre- and a-symptomatic viral transmission, the elderly won’t be protected and will be infected with a lag. In that worst case, death counts will rise with a greater lag simply because the elderly have put up a barrier to those getting infected. But, in that scenario, it won’t be enough to contain the spread.

Economic outcomes for the US

So, we know the US pandemic policy response has been a failure. We also know that, as a result, the US is unique amongst advanced economies in terms of the continued rates of infection and the recent re-opening contagion spike. But, given the range of potential healthcare outcomes, it’s hard to know what this means economically and for financial markets, especially with the Fed at play to act as buyer of (first and) last result for financial assets.

We have already seen hospitals in some US jurisdictions under stress. And that has precipitated a partial rollback of the re-opening. So, I believe we are guaranteed to see an increase in deaths and a decline in economic vigour in the US. The question is the magnitude.

On the healthcare front, because the skew of those infected and recent patients is younger, and because we have learned a thing or two since the first viral spike, we shouldn’t expect the second wave to be as bad as the first. However, it’s interesting that the 20-44 age cohort is the second most hospitalized group in Arizona now. The fact that they are requiring hospitalization shows us that this cohort is not immune from serious Covid-19 illness.

So, this will put a chill on social and consumer behavior, irrespective of what healthcare officials do. On the economic front, I, therefore, expect the economic decline to be greater than is priced in by economists. And the earnings expectations embedded in financial assets are therefore, too high.

My view

What happens to financial markets then?

We know the Federal Reserve has modeled some seriously adverse scenarios for financial assets. Forestalling these outcomes explains why it intervened in March with quantitative easing by providing a backstop to the Treasury market and then in April with credit easing by providing a backstop for investment grade credit markets. And markets have responded by moving higher.

But the Fed’s recent action to forbid share buybacks by banks and Fed Governor Lael Brainard’s plea to stop bank dividend disbursements tells you the Fed is worried. Clearly, they see downside to the economy going forward, likely in large part because of this second spike in Covid-19 contagion. And if that risk is so great, they are restricting bank’s use of capital, we should take it seriously. That was the subject of Friday’s post.

I think the downside risk here is that the second spike in cases leads to a less severe but still problematic downturn in the US economy. And while the downdraft won’t be as pronounced as when the entire advanced economies shut down, it will have an outsized impact simply because private sector balance sheets are already under stress.

The US, because of its poor policy responses, should see the greatest impact from this coming economic weakness. And in a world in which financial markets and the real economy mirror each other, that would mean US under-performance. But, of course, not only does the depth of US financial markets mitigate downside for US assets, the Fed’s willingness to buy more assets does as well.

The Fed could intervene in high yield and equity markets to prevent ostensible liquidity problems, just as it has done in Treasury, mortgage and investment grade credit markets. Will they? If they do, what impact will this have – and over what time frame? We don’t know.

But what we think know is that the real economy and financial markets cannot be divorced over the long term. While markets can sustain momentum over the short and medium term, despite what’s happening in the real economy, if there’s a major longer-term shift in economic fortunes, the ability for markets to resist that shift dissipates.

I believe the second viral spike in the US is a significant risk event for the markets. And so, by September and October, we will be in a position to know how significant.

Comments are closed.