The reverse-radical and W-shaped recoveries

You guys are my guinea pigs today. I have a 4PM shoot for the Real Vision Daily Briefing and realized that I haven’t organized a theme in my head for it. So I am going to use today’s newsletter to put pen to paper. And in the interest of full transparency, I will be riffing off of this piece by Axios’ Felix Salmon. I love Axios. They do good work. While I’m at it, let me put in a good word for David Rosenberg, whose video with me went up on Real Vision today (link here). He’s definitely in my head as I write today.

The framing

So, the frame is straight up Felix Salmon today. Here’s what he says:

It’s not a U, it’s not an L, and it’s definitely not an I. America’s economic recovery from the coronavirus shutdown has already started. In economists’ shorthand, that means it’s a V (a sharp rebound), a W (a nasty double-dip), or, most likely, something in between.

[…]

The consensus among economists is now that we’ll see a “reverse radical” recovery. Think of a backwards square-root sign, where there’s a sharp drop, a relatively small bounce back, and then a long period of subpar growth.

It sucks to be with the consensus but I think that’s the reasonable best case at this point. My base case, unfortunately, has moved away from the reverse radical toward a ‘W’. And I will tell you why below.

First though, let me remind you that I am thinking of the May figures as confirming a recovery. For example, when I see durable goods prints up 15.8% MoM like I saw this morning, and ahead of consensus estimates for 10.9%, I am thinking about how the NBER defines recession and how it defined this recession beginning.

For example, in the case of the February 2020 peak in economic activity, the committee concluded that the drop in activity had been so great and so widely diffused throughout the economy that the downturn should be classified as a recession even if it proved to be quite brief.

That’s not how they described recessions in March, if you consult the Wayback Machine. But they did have this to say:

During a recession, a significant decline in economic activity spreads across the economy and can last from a few months to more than a year. Similarly, during an expansion, economic activity rises substantially, spreads across the economy, and usually lasts for several years.

In both recessions and expansions, brief reversals in economic activity may occur-a recession may include a short period of expansion followed by further decline; an expansion may include a short period of contraction followed by further growth. The Committee applies its judgment based on the above definitions of recessions and expansions and has no fixed rule to determine whether a contraction is only a short interruption of an expansion, or an expansion is only a short interruption of a contraction.

My takeaway: If the downtick was so violent as to force the dating committee to call a recession, the recent uptick in economic figures in the US is violent enough that they could call the recession’s end after only three months.

It doesn’t really matter, of course. But, in framing this, I am going to be writing as if the first (and potentially only) recession ended last month. And that matters, because all of the action in risk assets is in support of that thesis, just as it was in March 2009. The question is whether this is a double dip or bear market rally, something akin to the bottoming process of 1980-1982. Let’s discuss that below.

The Credit Writedowns Archives

You know I like to look at the archives to see what I was saying a couple of months ago (and learn from my mistakes). This morning I was looking for the term ‘second wave’ to see how I positioned it. That’s because I was thinking about things that would turn the consensus reverse-radical outcome into a W-outcome where I am. And the second wave of viral infections is a big part of that.

Before I tell you what I found, let me tell you what I believe separates the reverse-radical recession – let’s call it an ‘RR’ recession for short – from the W-recession (aka the double dip).

- A high spike in second wave infections

- A policy error in monetary or fiscal stimulus

- A spike in defaults, bankruptcies and/or unemployment

- A falloff in spending due to precautionary savings after an initial period of pent-up demand

- A reduction in capital investment demand

- A contraction in output due to a reduction in inventories

That list is approximately in the order of my assumed significance for each variable, with the second wave leading the pack, which is why I did the archive search. Here are the results:

The first mention is Apr 6: Looking forward on coronavirus, the economy and markets: “A worst-case scenario is where the relaxation of the lockdown is premature and you get re-infection and a second wave that is equivalent or bigger than the first. A base case, hopefully, is a second re-infection wave that is worse than China’s but better than the initial wave. And the third best case scenario is a China outcome, where the second wave is almost minuscule compared to the first.”

Takeaway: I think of this as my framing the RR recession as a base case and a W recession as a worst case. Though I feared a premature lockdown release and spike in a second wave, I wasn’t ready to say that was the base case.

I mentioned the second wave a few more times in April in a similar vein. But this next post from May 4 has a chart that frightens me. First, here’s the second wave quote:

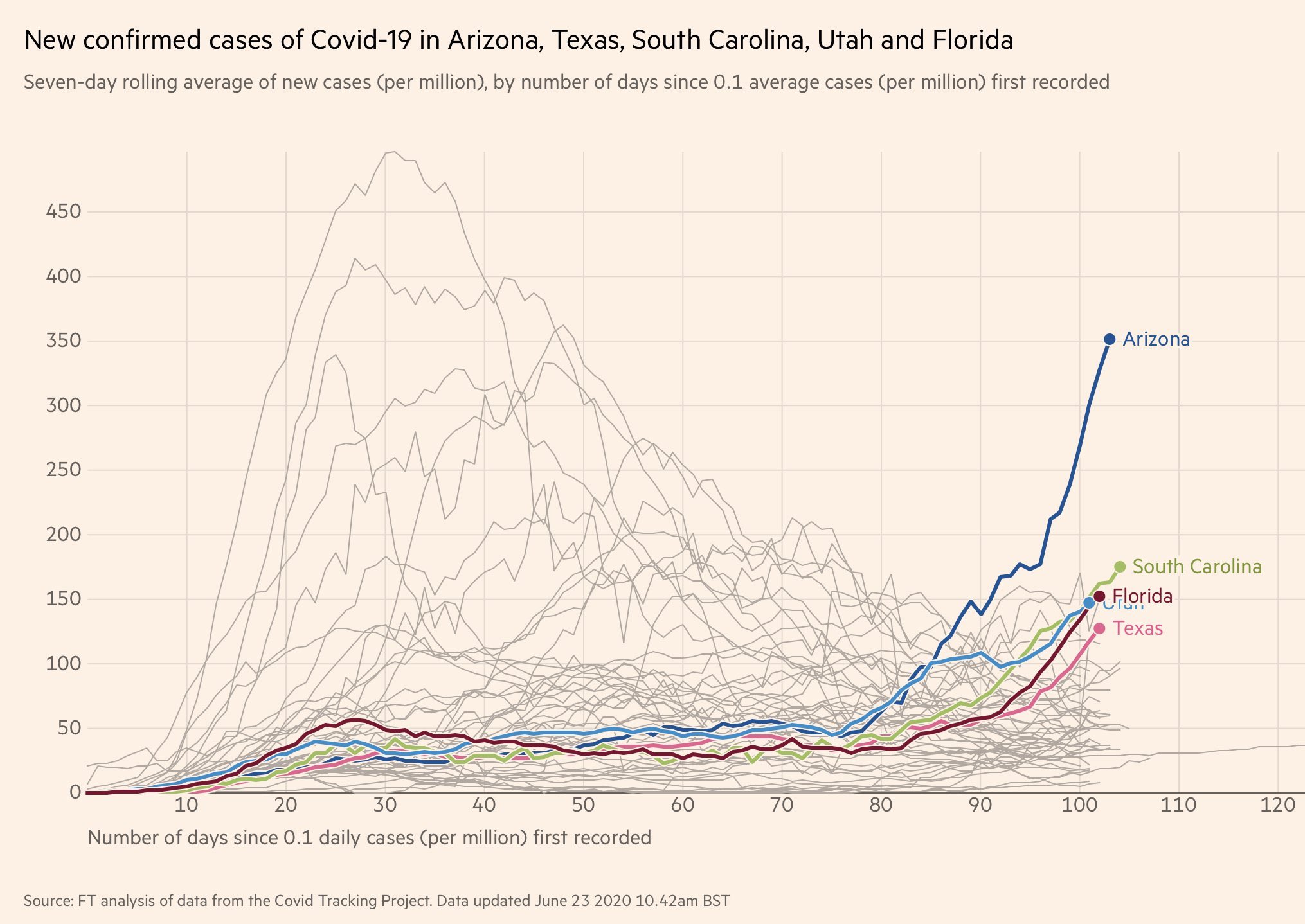

The US is a testing laggard. And it was a lockdown laggard too. From everything I know about controlling the Covid-19 outbreak, the chances of a second wave in the US are high relative to countries like Germany, Denmark or New Zealand. People know that. And that informs behavior.

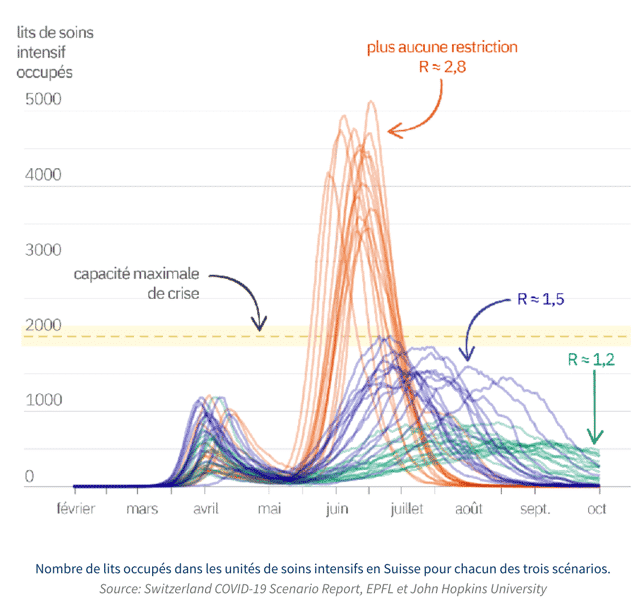

Takeaway: I think of this as my realizing that a premature lockdown was likely and that, thus a larger second wave was likely – meaning a W-shaped recession was becoming more likely for the US. But how large would the second wave be? Look at this chart from that post.

Source: Le Figaro

At the time I asked “How realistic is this though?” And I still am flummoxed bu how large the second wave simulations are. That’s when I moved to the RR recovery as a baseline, what I was then calling An L-shaped recovery:

The conclusion I come to is that we are not headed for a V-shaped recovery or even a U-shaped one. The best case outcome is an L-shaped or W-shaped recovery.

So, by the time I wrote that the coronavirus pandemic is worsening on Monday, you should have seen the RR-recovery as a best case. The W-shape with the second downturn better than the first is the new baseline I made plain yesterday.

A brief discussion of the path variables

As I said just after the framing, I see six major variables here, with the virus itself the biggest variable. If we have a big second or third wave, A deeper W-recession is guaranteed. I am assuming now that the orange second wave paths on the chart from Le Figaro are not baseline, that they’re much worse than baseline. But, that kind of chart gets you to a deep W-recession. Even the purple likely gets you there. It’s the green charts that are my mental baseline now. And that’s still a W-recession.

Moreover, if we see government pull away just enough stimulus while this second wave is in effect, that would exacerbate downside risk. I can’t gauge how likely an outcome that is. But I see fiscal policy as both more important and more at risk than monetary policy, which at this point is mostly creating an asset bubble.

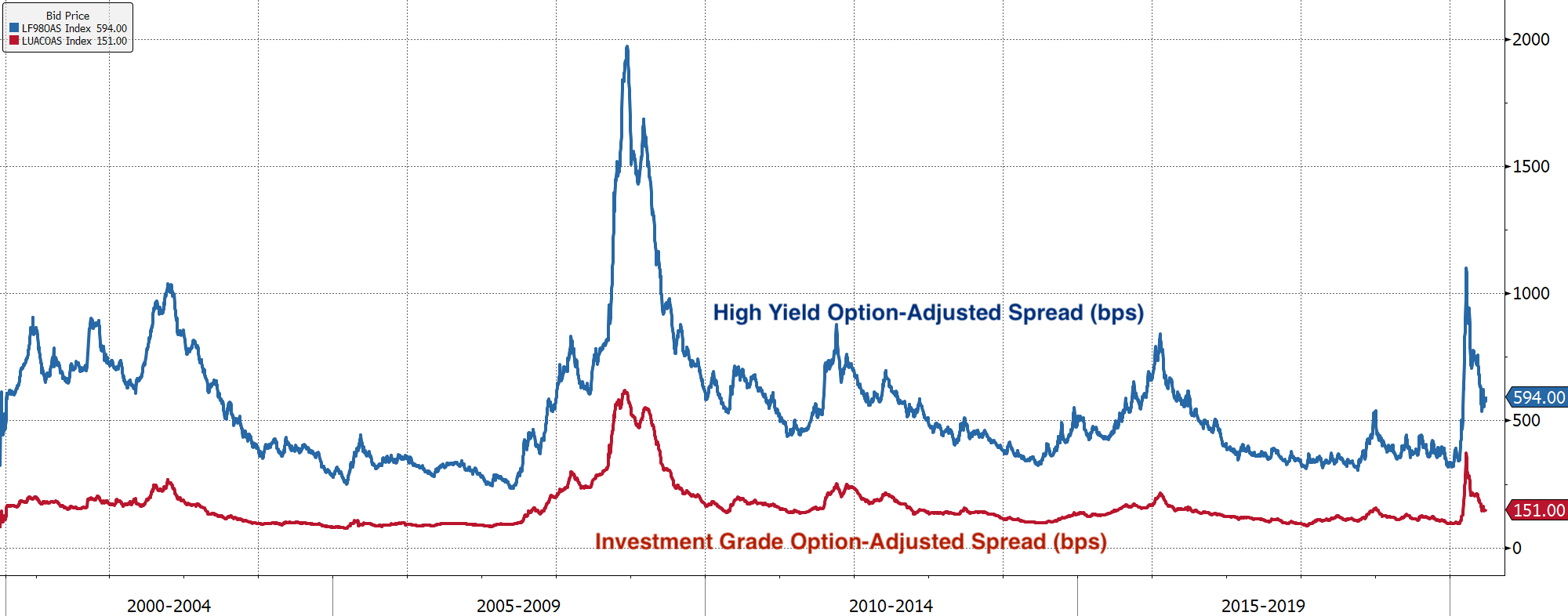

As we are now still in the midst of a credit cycle, it’s hard to know where we are in the business cycle. For example, defaults spiked in the last cycle and continued well after the March 2009 recovery turn. But, default rates were lower than anticipated. Maybe the same could happen this go round. Banks could be willing to zombify the economy by evergreening loans, rolling over loans rather than triggering a bankruptcy. What I do know is that high yield bond spreads are now lower than they were at several stress points over the last fifteen years.

Source: Bloomberg

David Rosenberg told me Tuesday, the levels now are approximately half what they were at the panic peak in March. If defaults spike, those spreads are going to gap right back out. And, in my view, that could be a trigger for a liquidity crisis in high-yield-land, triggering yet more defaults. To the degree we see a ‘policy error’ from the Fed, it would be here. What the right thing to do is, I don’t know. But, it’s worth considering the downside risk for high yield.

The last three variables are garden-variety recession triggers: consumption shortfalls, inventory purges and capital investment recessions. I put them at the back of the line in terms of triggers because they are more basic. The first three triggers are things I believe could lead to systemic risks and a financial crisis.

My View

Thank you for being my guinea pigs in writing this. It’s been very helpful for me in getting a sense of where we are right now. The thing I am thinking most about is the Le Figaro chart because it is at odds with what I have seen so far out of the US and anywhere else.

I would be surprised if we went back to or over the levels we saw in New York and New Jersey early in the crisis. I would need to see evidence supporting that thesis. So I am not yet at the point where I think the second leg of a W-shaped recession would be severe, especially given potential policy stimulus.

My greatest concern is duration because the three D’s of depression are depth, diffusion and duration. We have the first two locked up. It’s the ‘duration of the depth’ that I am concerned about. My worry is that we have double digit unemployment for a long time, say 2 to 3 years. That’s a depression in my book. And there are still reasonable scenarios that get us there. Nothing the US has done to date gives me any security that those scenarios are off the table – quite the opposite.

This second wave of coronavirus transmissions in the US is truly heartbreaking. For me, it’s personal as my good school friend who died in March is having a belated funeral on Saturday. And I can’t get there. I can’t attend. No closure. It hurts…horribly.

I want this pandemic to be over as much as anyone. But, there are responsible reactions to those emotions – and there are irresponsible ones.

Thanks for reading.

Comments are closed.