This is going to be a relatively short post (I hope). My aim is just to bring together all of the thinking from my recent posts into one shorter narrative. And I’m hoping I can do that successfully here. So, here goes

Pre-lockdown economy

When 2020 started, despite a brief yield curve inversion in the US in 2019, signaling a potential recession ahead, the Federal Reserve had done just enough to prevent that outcome. An easing of financial conditions led to a re-acceleration of US growth in early 2020 just as the coronavirus was hitting China with full force.

That re-acceleration came to an abrupt end in February as the Chinese economy reeled from a stringent lockdown designed to halt the coronavirus. China’s actions disrupted supply chains and upended business confidence, causing the US and European economies to slow as China’s economy contracted.

We had never seen such a wide-scale and draconian response to a pandemic before. So the situation was uniquely severe for China and the ripple out into the rest of the world was more severe than it would have been had China simply taken the test, distancing and isolate measures now in place across the world. But I believe that downdraft was manageable for the West. With the right policy response mix, recession was not an inevitability.

The European and American lockdowns

But, at some point early in 2020, it became clear that the situation in China was a precursor of what was to come elsewhere. And while Asian countries were relatively prepared for the COVID-19 pandemic, particularly because of the SARS and avian flu dress rehearsals, the West was completely unprepared. Mask-wearing and social distancing protocols are completely foreign in Europe and the Americas. So, before the COVID-19 outbreak, Asian tourists wearing masks in cities like New York or London had been treated as curious and overly cautious.

As a result, when the coronavirus case counts mushroomed first in Europe, and later in North America, panic was perhaps a sensible reaction. And I wrote at the time that the quarantine and lockdown approach was all but inevitable if policy makers wanted to retain the trust of their electorates in the West.

Given the economic impact this lockdown approach has had, this draconian approach is increasingly being questioned. But, hindsight is 20/20. Look at the Swedish approach and the high death toll they have sustained. That approach too – with its aim of creating a longer-term manageable social and economic environment – is being questioned. No one was going to have the right answers. It is the thinking that goes into creating protocols that matters – and the ability to change tack as the situation warrants, with enough communication between government and electorate and enough trust of government to implement effective policy.

Nevertheless, the lockdowns have been catastrophic for the global economy, creating what I would call contingent liabilities for governments in the form of reduced taxes, transfer payments to households and bailouts for business. This is the rightful role of government, by the way – to mitigate unforeseen and catastrophic downside risks from natural and financial disasters, to step into the breech when the private sector is prostrate and cannot defend itself financially (or militarily, were it to come to that).

Post-lockdown outcomes

Knowing that the lockdowns would be catastrophic, they had to be both purposeful and limited. That means the goal of a lockdown is to mitigate adverse health outcomes like health care system overload and death as well as to buy time for greater preparedness, while recognizing the financial hit.

This is where the thinking that goes into creating protocols and the ability to change tack and instill trust in the electorate matters. Lockdowns are by definition temporary because they strangle sustainable economic and social well-being. The state steps into the breech in that time period to right the wrongs created by mother nature or financial actors and to create a response mechanism that will mitigate any further disruptions to economic and social well-being. So, by definition, a lockdown is supposed to be a time of preparation for a sustainable post-lockdown future. And to the degree those plans are proved wrong by events, preparedness means having the ability to adjust on the fly without catastrophic breaks to economic and social outcomes.

In my estimation, much of Asia was already prepared ahead of the pandemic and, therefore, didn’t need a lockdown. Japan is one example here. The result is that I expect less economic downside risk to employment there and to their economy.

Other countries that locked down like New Zealand made preparations that appear well-considered at this point. And this is true both in terms of mitigating adverse health care outcomes as well as in having a flexible system in place that the state can maintain ad infinitum regardless of how the viral pandemic develops. That’s because New Zealand’s four-level alert level system gives the country the ability to ramp up or lessen restrictions based on available data on the threat of viral contagion. So, I would expect New Zealand to fare relatively well economically going forward.

Europe, to a lesser degree, is well-prepared. The localized outbreaks in Germany right now make the dangers plain. Germany, a country smack dab in the middle of Europe and which has a federal and decentralised system of government within a larger European Union and Schengen area of border control, is subject to several different layers of pandemic protocols. The country has to coordinate Länder-level response protocols with both the country-wide ones and the Schengen area and EU-wide protocols on the coronavirus. Any discrepancies can lead to localized outbreaks that metastasize into larger uncontrolled spreads. The remote small island nation of New Zealand doesn’t have that problem.

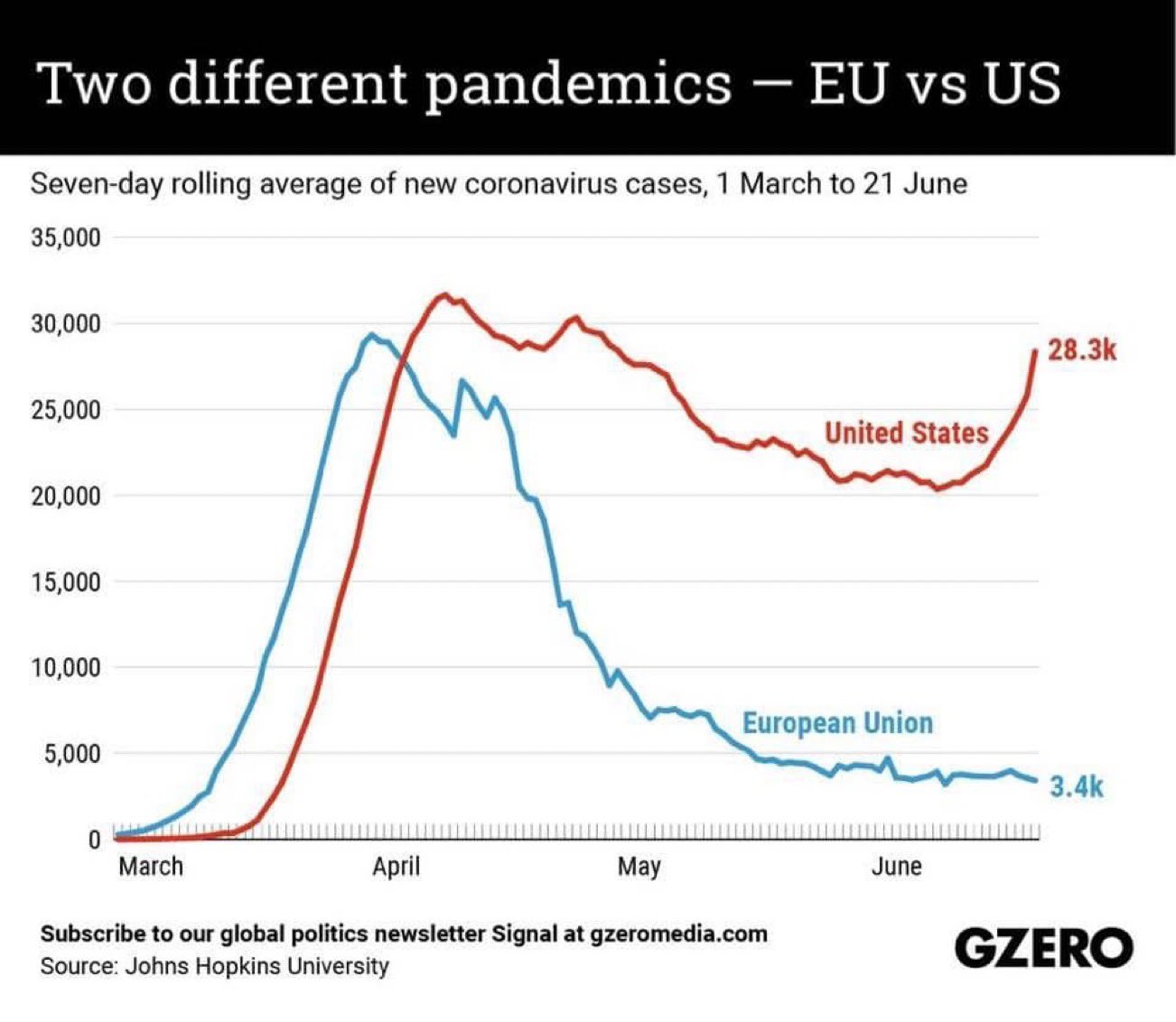

But, the Europeans are doing well. Here’s a chart showing you the difference to the United States.

Source: GZero

Case counts in the US are now ten times higher in the US than they are in Europe, despite the fact that Europe has ramped up testing even more than the US. That tells you the EU is doing better than the US in containing viral infection. I expect the EU economy to outperform as a result.

Inherent in that statement is my assumption that increased viral infection rates lead to increased downside risk for negative economic outcomes. And although I have cited one study on pandemics that has shown this link, it may not necessarily be the case going forward.

The US post-lockdown outcomes

The United States presents the best test case for this linkage. That’s because right now we see several states with mushrooming case loads of coronavirus infections.

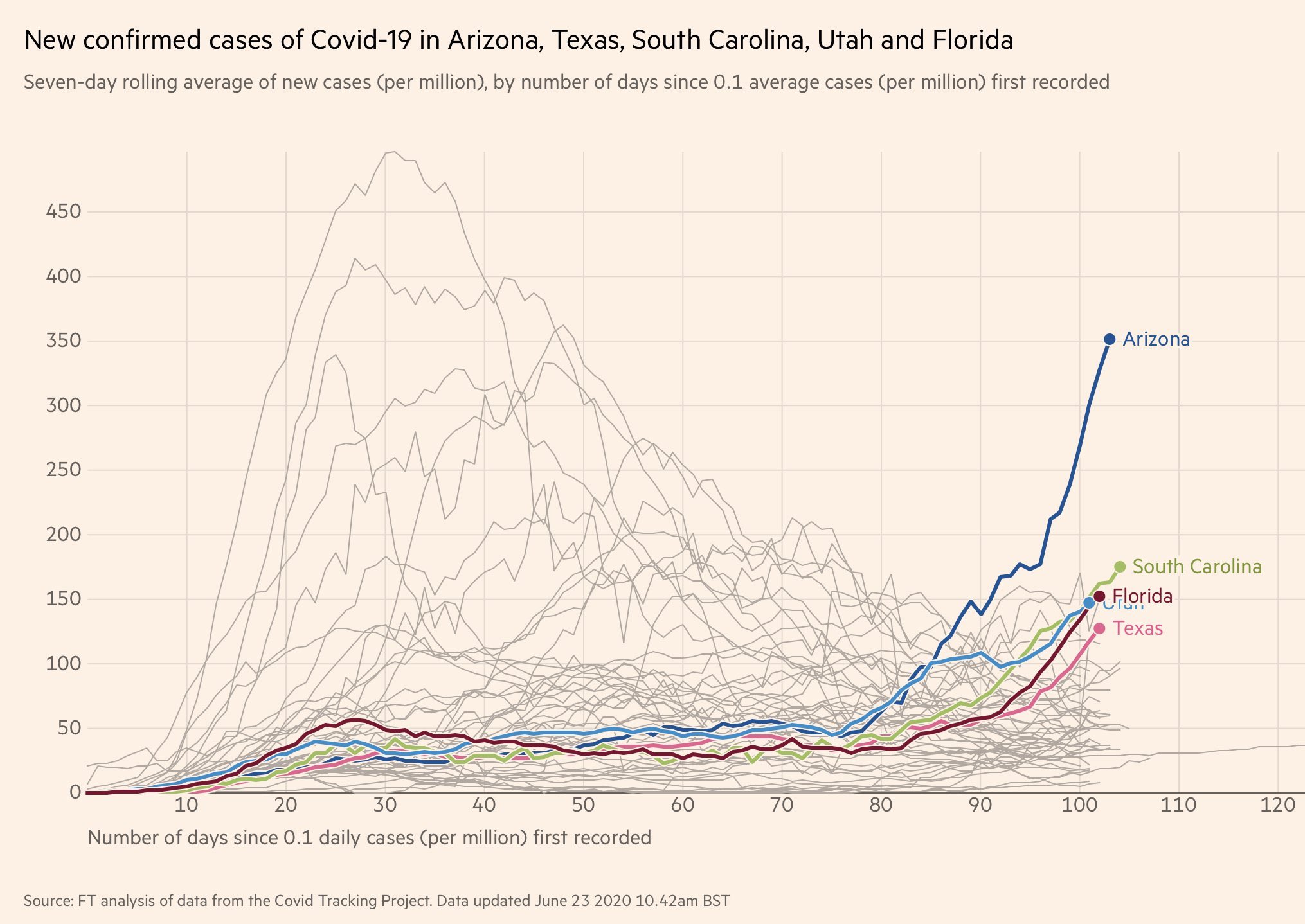

Here is a state by state chart from the Financial Times highlighting five states.

Source: FT

You can see the early spike in case loads in states like New York and New Jersey. But because we had an economy-wide lockdown as a result, a differentiated outcome did not occur. I expect to see a differentiated outcome now though, in large part because the US will not have a uniform protocol to the Covid-19 pandemic. Instead, I expect places overrun by sick hospital patients like Arizona and Texas will end up locking down a lot more than places like New York and New Jersey that have taken a more cautious re-opening approach. And to the degree they don’t lock down, consumers will flee en masse anyway. The result will be catastrophic for the economies of Arizona and Texas relative to other US states that have encouraged continued social distancing protocols.

Overall then, I expect the US to do worse than Europe economically as a result of a likely increased spread of coronavirus. And I also expect it to hit shares and high-yield bonds as companies hit the wall from reduced economic activity. Again, the assumption here is that increased infection rates lead to adverse economic outcomes. And one hint that this is true comes from the US slowdown in February.

The National Bureau of Economic Research dated the recession from February, not March when lockdowns began. Why? Cautious US consumer behavior pre-dated the lockdowns. The lockdowns were a response to fear. The lockdowns (in both North America and Europe) were the inevitable result of a fearful people who understood their countries were totally unprepared for a pandemic and had changed their behavior. So, the economy began to slide even before the lockdowns were in place.

Going forward, I expect the same outcome – meaning there will be a chill of economic activity in Florida, Texas, Arizona and other states like them that have opened up too early and with inadequate health measures in place.

My View

So, we are going to see a differentiated outcome here.

Globally, growth plummeted more than expected because lockdowns were a (necessarily) draconian response to the Covid-19 pandemic in Europe and North America, powerhouses of global GDP. We will never see such a sharp reversal in the economy unless there is a complete lockdown of economic life in regions so economically important. And I don’t expect there to be.

Going forward, what I expect to see is continued struggles in dealing with the pandemic. And some countries will deal with those struggles better than others. All of Africa, India, Latin America and the United States will struggle. And the result will be health care system overload, a pullback in spending, more draconian state intervention to prevent viral contagion, and economic contraction.

For the United States, then, that means a W-shaped economic outcome, where the first economic drawdown is more severe than the second (or third). We are in the midst of the first upswing. But, by September and October, I expect we will see data that confirms a second growth deceleration, if not outright contraction.

The result will be felt acutely in risk assets because they are overvalued. Shares in mature technology companies like Apple, Google and Microsoft should not be trading at multiples to earnings in excess of 25-30, as they now do. These companies, which dominate American market capitalization-weighted indices like the S&P 500, will see their multiples contract. And because of their market weight, it will have a pernicious impact on the indices. Moreover, retail investors using passive strategies will feel this pain very acutely – and the millennials piling into the highest fliers, even more so.

The outcomes for high yield will be similar, in my view. Why? Because the investment grade bond bid from the Federal Reserve has compressed yields across the credit spectrum. But, I do not anticipate the Federal Reserve will buy either individual high yield names or equity ETFs – though they could do. My expectation is that, once the cycle turns down again, high yield companies will feel financial distress and defaults will rise. Credit spreads will rise too, creating more financial distress, increasing defaults further.

This is what I believe lies ahead. And I expect to see these outcomes by September or October. That’s my view at present. But, if the situation changes though, I will update my view.

Not as short as I wanted, but hopefully clear and well-written

Comments are closed.