Shares are mixed in early trading today in the US after several days of positive performance. And while this might seem incongruous with the social unrest happening in the United States, there is no historical data supporting the notion that social unrest has a marked impact on equity markets.

The worry has to be the disconnect between the real economy and equity markets and the degree to which the recent rally is fueled by liquidity. As I am staycationing now (and need to hop on my bicycle soon), I want to touch on that only briefly below.

Pandemics, unrest and bull markets

In terms of where we are right now, here’s how I put on the Real Vision Daily Briefing on Tuesday (link here).

There actually is some precedent for markets moving down after a pandemic, as they did in 1957. But this move was neither sustained nor was it necessarily solely the outgrowth of the Asian flu pandemic.

At the same time, there is no historical precedent for protests or riots leading to sustained downturns in shares. For example, in 1968, the market ended the year up, despite the fact that the protests that year were of an order of magnitude worse than they have been today.

As I wrote Tuesday, Hong Kong is the closest precedent for when protests have had a strong economic and market impact. But, that’s a comparatively small economy. And the riots today are shorter in duration and less severe economically than the ones in 1968, when the market ended the year up. I don’t think we can assign too much weight to them in terms of the overall economic and market outlook. Markets can go up despite pandemics and social unrest.

The liquidity driven market and the re-opening

The concept that makes sense to me is that this is a liquidity driven market. So, let’s talk about what changes that. JPMorgan Chase is saying that money-market funds have gained $1.2 trillion in funds this year. While, according to Bank of America, fund managers overall are holding cash at levels rarely seen in history.

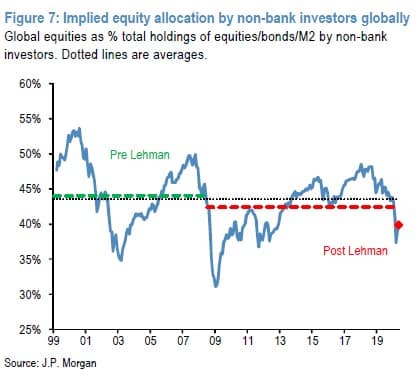

So, JPMorgan is saying that “Investors are still underweight equities” and the only real “signs of overextension are confined to momentum traders.” They have a great chart showing what they think are over and under allocations of equities in portfolios going back 20 years. To me, that speaks to liquidity continuing to support shares for the near term.

And, here’s the key: If you recall, I have been bullish on the re-opening as a catalyst for short and medium-term equity performance for over a month now. In late April, I initially flagged it with regard to Europe. And so, I anticipated that Europe would outperform. But the US re-opened more aggressively than I anticipated. And that’s meant the US has outperformed, with the focus in markets now on the short-term economic bounce the re-opening will provide.

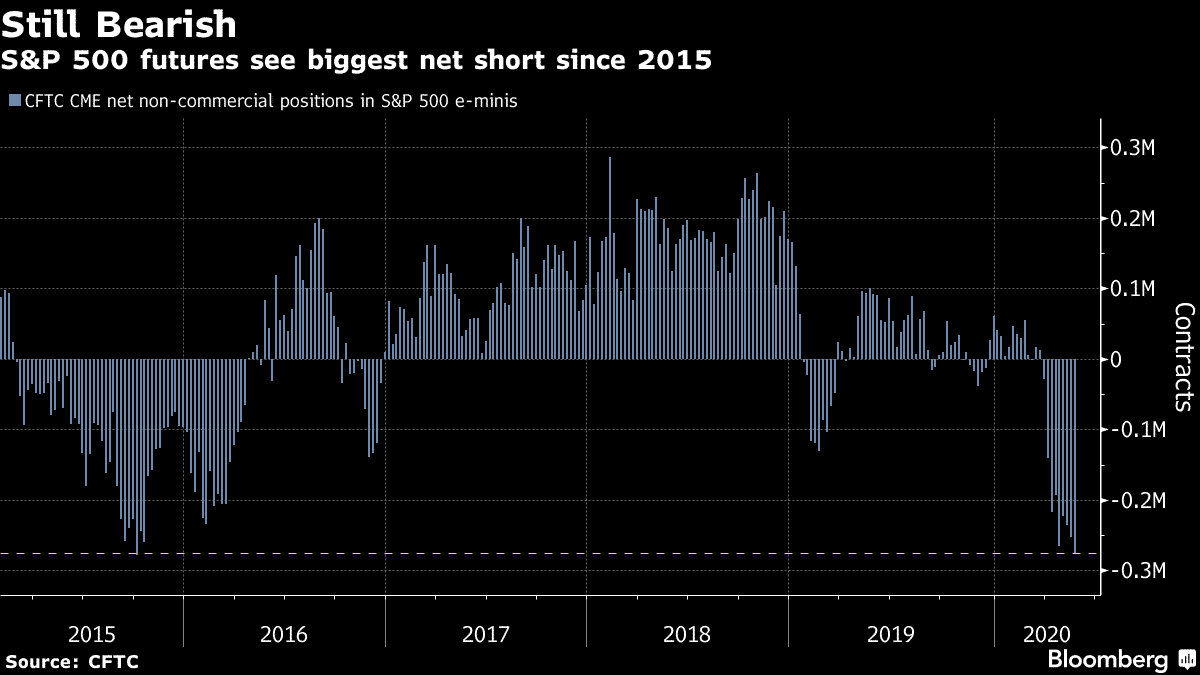

Moreover, the S&P500 has the biggest net short position since 2015 according to the CFTC.

That means when the market rallies on data surprises, shorts will need to cover. And that adds to the uplift we’ve seen as data has surprised to the upside recently.

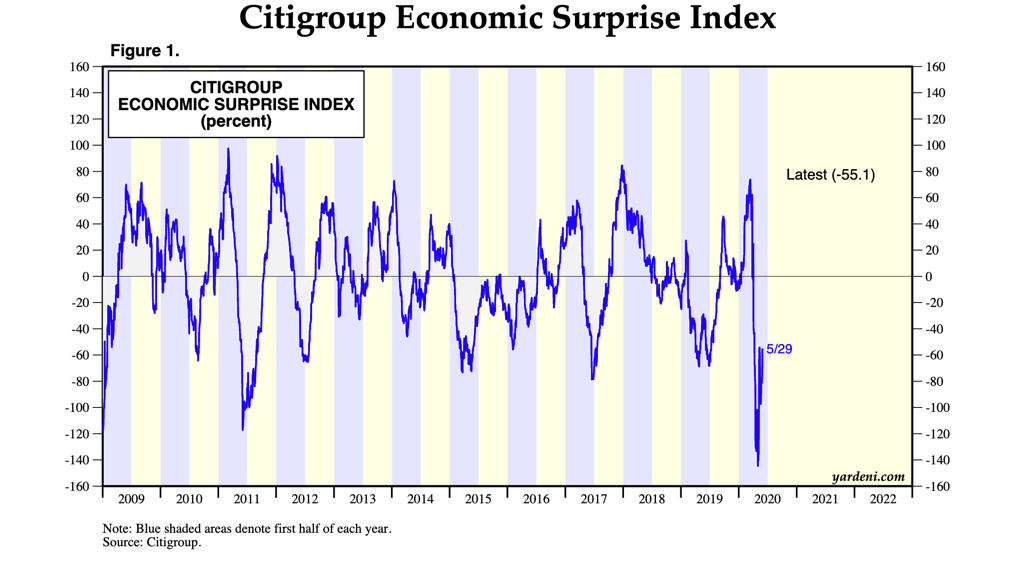

So, to the degree data continue to surprise to the upside, the bearishness of the market will help. Here’s the Citigroup Surprise Index showing the data now moving in the right direction on this front.

Source: Ed Yadeni

Fundamentals trumping liquidity

So when does that liquidity story turn into a fundamentals story? For me, this is key in thinking of the situation going forward.

Look at the equity market highs in mid-February. That was largely driven by a green shoots belief that the worst was over from the late summer to early Fall 2019 malaise that saw the yield curve invert. I was definitely in the camp that said the US was re-accelerating in early 2020 when the coronavirus hit. And it all fell apart at once when the market realized that the coronavirus was going to be a massive exogenous macro shock.

Since that time, though, on the back of central bank and fiscal support, we are almost back to record highs on the Nasdaq, we are down less than 10% off the S&P500 record highs and some 15% on the Russell 2000. That shows you the value of the Fed’s intervention. But, it also shows the growth over value narrative is still in place, which is a liquidity story because of narrow leadership.

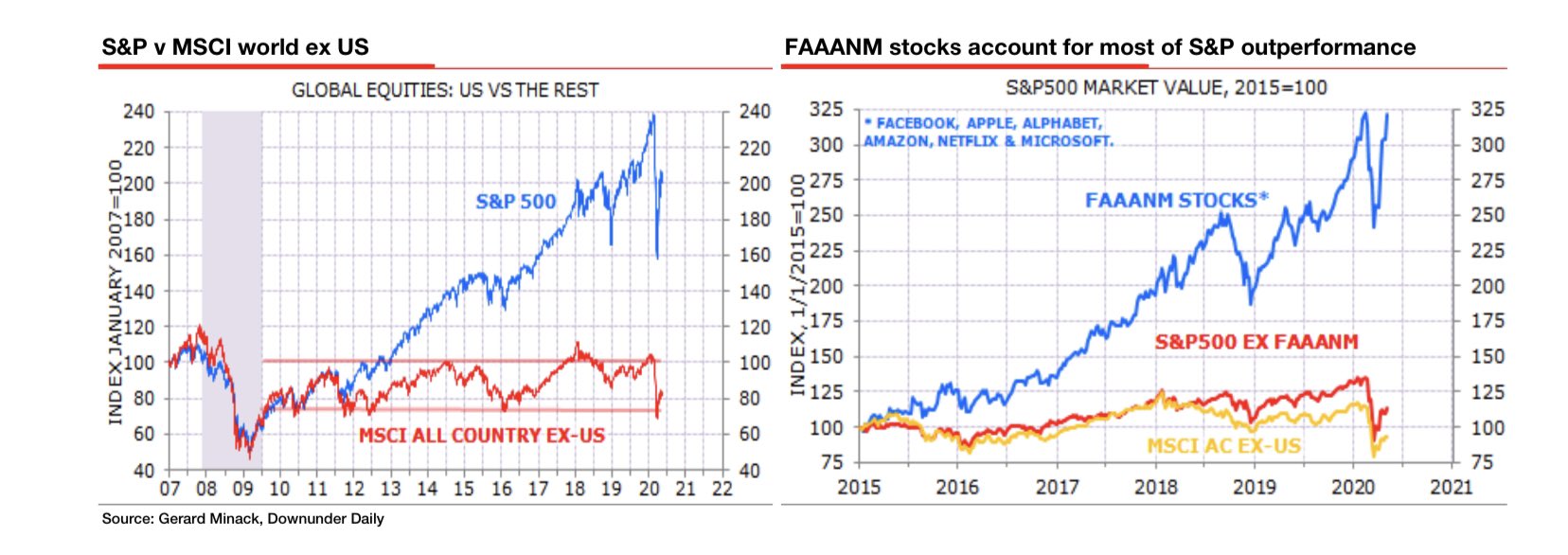

The excellent Albert Edwards published some great charts from Gerard Minack showing that the FAANG stocks (Facebook, Apple, Amazon, Netflix and Alphabet) + Microsoft is outperforming the rest of the S&P – the other 494 stocks – in much the same way that the S&P500 is outperforming the MSCE World Index.

My takeaway is that passive investment in a market cap weighted world is driving flows into the largest ‘growthiest’ stocks. And those shares are doing the best right now. That’s all about the liquidity. And we know that in prior down cycles, the prior cycle leaders were not the first out of the gate on a cyclical basis.

My View

All of that has the hallmarks of another leg down to me. Look at what bond markets are saying. Right now, the yield curve is near the steepest it’s been since May 2017 from 5 to 30 years. That’s a sign of bullishness. People are focused entirely on the near-term and the potential for economic green shoots. As I see it, the market is priced for short-term data flows right now due to massive uncertainty beyond 3 months.

We had a lockdown and re-opening – totally unique economic data periods in anyone’s lifetime. And so, it makes markets look through present data when it’s poor. For the S&P, We’re bumping against a 76.4% retracement level now.

But, when we hit September and October, the summer holiday season will be over. And minds will be focused on the future. By that time, we will have enough data to process what’s happened with the re-opening and start to make a long-term projection of where we’re headed economically.

My view is that we will see a spate of bankruptcies, deleveraging and a balance sheet recession in the private sector. Thus, I believe the market has overestimated the ability of companies’ earnings to weather this storm. And so, that means we have a reckoning by September and October. Let’s see how that prediction pans out.

Comments are closed.