At the end of April, I wrote a bullish piece centered on an economic snapback after the re-opening, in large part because of pervasive bearish sentiment. I called it “Negative sentiment, the oil price collapse and re-opening business“. After over a month of the market going up and up, I think it’s time to re-evaluate. And after reflection, this post is going to be almost a mirror image of that April post. More fleshed out thoughts follow below.

What I was saying before the re-opening

Writing in such volatile times is tricky because it’s easy to get caught up in the moment. And since sentiment changes so abruptly, momentum can shift extremely quickly. We have seen this in the time between the March 22nd lows just before the Fed intervened and today, as sentiment has shifted from extremely bearish to almost V-shaped recovery bullish.

Economic uncertainty is driving all of the volatility, because none of us knows what’s likely to happen. This is true now more than ever. And so, I am looking at both near-term outcomes and a range of potential longer-term outcomes that emanate from those, recalibrating along the way.

In terms of predicting what’s happening right now, in late April, this is what I was saying:

Yesterday’s post was relatively upbeat. I was talking about a European lockdown relaxation that allowed the economies in some countries to return to a somewhat normal post-lockdown environment by mid-June. This would be faster than anticipated by economists. But, it doesn’t mean a V-shaped recovery per se. It still means a U- or an L-shaped recovery…

I stand by yesterday’s analysis, of course. But, a strange thing happened last night when I presented it on-air at Real Vision. It got more downvotes than usual and negative commentary…

…I think it goes to negative sentiment and confirmation bias. I remember a similar sentiment bias in May 2009 after I signalled the recession was over. That caused me to write a whole Ingmar Bergman-themed post about it called “Through a glass darkly: the economy and confirmation bias in the econoblogosphere“.

I am not going to go that far here, mostly because we are deep into an almost Depression with an uncertain outlook. But I did want to flag it as an issue because I was taken aback at how fervently viewers at Real Vision believe in a very dark vision of the immediate future. Is this just an outgrowth of self-selection – doom and gloomers looking for their daily dollop of negativity to confirm their own views? Or is it representative of sentiment right now? And if so, what does that say about near-term economic and market outcomes?

Looking back now, I think my near-term optimism has been vindicated, both by economic data and by market sentiment. And that allows me to answer the last question from the April post: near-term economic surprises are bullish, because people, biased by recent negative sentiment, get caught out. And that pushes sentiment (too) aggressively in the other direction, as people then start extrapolating Nirvana instead of doom and gloom forward. The truth is almost always somewhere in between.

The same is true on oil prices. For example, in that post I wrote:

There is clearly a glut of supply. And it points to the massive global drawdown in demand. Storage-wise, there’s talk of tanker rates going up to $2 million per day. That’s crazy levels. Last week, I quoted a $180,000 figure. In February, the rates were $30-40,000.

Is this just speculative though? The $2 million level certainly is. But, it reflects the anxiety now permeating the energy sector due to the loss of demand. And it mirrors the negative sentiment I talked about at the outset of this post.

Oil has rallied significantly, with Brent trading over $40 a barrel this morning and WTI down from near $40 as well. Again, that speaks to short covering as data surprises turn sentiment bullish.

I will admit that where I got it wrong is in believing an ill-prepared US wouldn’t benefit from the re-opening as much as Europe. The US has benefitted even more, both economically and in equity market returns, despite some signs that viral contagion has accelerated in certain post-lockdown US states.

What comes next?

I think a lot of this move is played out now. The sense I get is that, while sentiment is not as extremely bullish today as it was bearish on March 23, it is close to as bullish today as it was bearish on April 27 when I wrote the ‘negative sentiment’ post. And that’s bad for shares.

Let me give you an example from Morgan Stanley, using their fixed income call:

Morgan Stanley strategists added a bet on a steeper Treasury yield curve, seeing the potential for a “regime shift” in the wake of a rapidly improving U.S. economy.

“In the blink of an eye, that seems about how quickly the economic narrative has tilted in favor of a V-shaped recovery versus a slow and prolonged one,” Guneet Dhingra, head of U.S. interest-rates strategy in New York, wrote in a June 5 note. History suggests that, after a period when 30-year yields led longer-dated rates higher, it’s time for 10-year rates to become the key driver, he wrote.

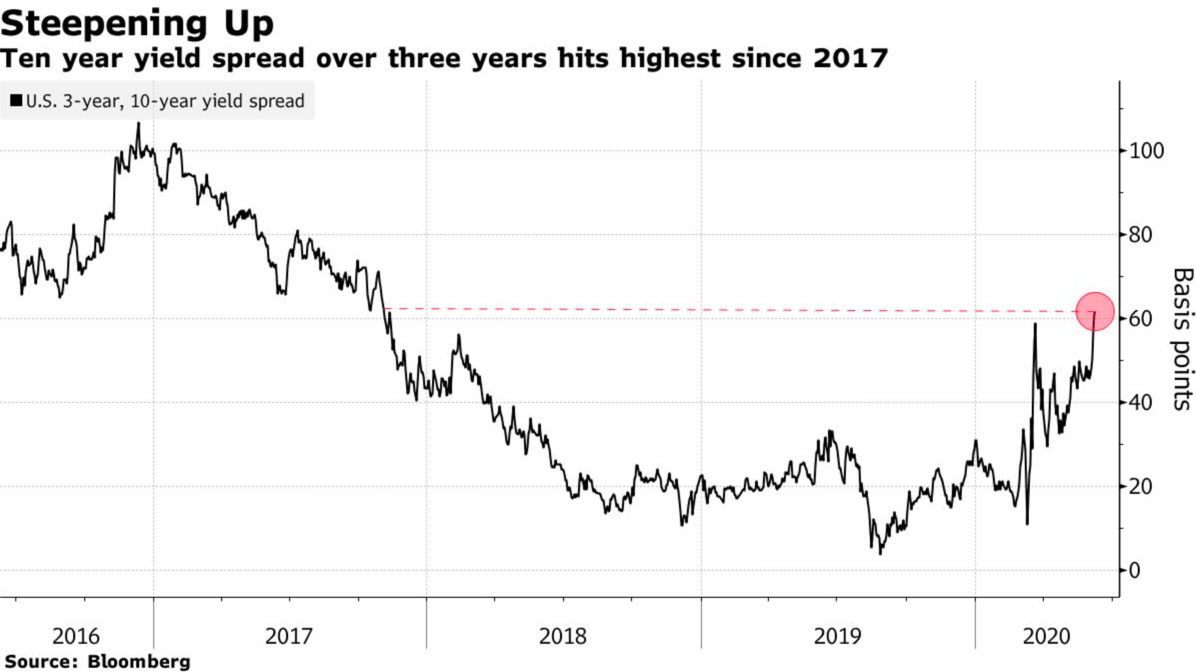

The bank added a bet on the spread between three-year and 10-year yields widening to their existing so-called steepener trade call — a wager on five-year, 30-year spreads. That’s after the unexpected surge in U.S. payrolls in May.

On Thursday, I was saying “Right now, the yield curve is near the steepest it’s been since May 2017 from 5 to 30 years.” And here Morgan Stanley is telling you to expect the curve to steepen even more because of a V-shaped recovery. That’s pretty darn bullish. To me, that’s off to the races bullish on the economic recovery. And it’s a view with considerable downside risk given the range of potential economic outcomes.

My view is quite different from Morgan Stanley’s. And I summed it up in the comments section on the April 27th Real Vision Daily Briefing, saying:

In short: Over the next several weeks, (Northern) Europe (and New Zealand) will look better than expected and better than the US. Remember,for example, that the eurozone PMI just printed 13, where 50 means recession. The basing effect from that low level will have a positive impact on sentiment. But, over the longer-term, consumption habits will have changed and precautionary savings will increase. There’s no V-shaped recovery coming. This pandemic will have severe long-term economic consequences.

That’s still my view for Europe. And with the US having opened up too, this outlook is true for the US as well.

For me, that means that what comes next is a sort of N-like economic trajectory, with the snapback proceeding apace as the re-opening unfolds. But, at some point, we will hit a snapback ceiling, with unemployment still high and monetary and fiscal policy stimulus diminishing. That’s when I believe expectations will reset.

My View

I was talking to Hedgeye’s Darius Dale about this just an hour ago. The video will be released on Real Vision on Thursday. But Darius’ view is very similar to mine.

He talked about credit card and auto loan forbearance ending in June in the US, enhanced unemployment insurance ending at the end of July, and mortgage forbearance ending a few months later. He also spoke of deficit hawks in Congress taking center stage and thwarting more deficit spending in the US. He sees the economy hitting a fiscal wall in the third quarter as a result of these and other measures of fiscal support ending. And that will mean sequential GDP growth numbers will roll over.

At the same time, with the re-opening, the free pass companies get on guidance because of a lack of visibility will end. By Q3 reporting in October, we are going to see investors demand forward guidance from companies, if not before. And I believe that guidance will mostly be down. Darius told me he believes 2021 S&P500 earnings estimates are way too high. And these will get whacked in due course. I agree.

These risks will be playing out against a backdrop of excessively bullish market sentiment. Call it recency bias, but this V-shaped recovery stuff is back in fashion again. I believe investors will be disappointed.

None of this pre-supposes a second or third wave of viral infections. I’m not talking about the viral ravages that Latin America is taking on right now either. I am simply talking about the medium-term outlook in a world in which social distancing will still be very much a consideration for the foreseeable future.

So, I think it’s time to fade this re-opening rally and wait to assess how the credit cycle and the inventory cycle play out in the wake of the lockdown. Time stamp: June 8, 2020.

Comments are closed.