The Three Stages of Recession

I participate in a weekday markets briefing at Real Vision these days. I love these. They’re timely, spontaneous and fun. It’s something we started there because markets have been so volatile and fast-moving in the wake of the coronavirus pandemic.

I wasn’t on the Friday show. But it was a great back and forth between the host Ash Bennington and Real Vision’s CEO Raoul Pal (clip here). Raoul said something, laid out something, that I think is a good framework for thinking about this downturn, and, perhaps, recessions in general. And so, I want to use it as a way of framing where we are in this business cycle and what it could mean regarding the economy and risk assets going forward.

The framework

Raoul broke down into three buckets how he sees this cyclical downturn evolving. Bucket number one is what he called the liquidation phase. Bucket number two is the hope phase. And bucket number three is what I will call the ‘real economy’ phase.

In the first liquidation phase, firms or banks hit the wall as funding dries up. Think of it in Minskian terms as firms operating using Ponzi finance getting caught out. These companies are cash flow negative and need to roll over debts to stay in operation. They run into a snag because of a deterioration in financial conditions and face insolvency as a result. But, at some point, it becomes a generalized liquidity event engulfing not just Ponzi but also hedge investors where prospective income flows cover interest and principle.

That was the phase we saw up until the Fed stepped in on March 23rd. In the liquidation phase, a slew of investors need to liquidate any- and every asset that has value in order to meet near-term financial obligations or they face insolvency. In the Great Financial Crisis, it was investment banks and commercial banks that faced the music. In this crisis, it was asset managers and shadow banks. In both cases, the Fed was forced to step in aggressively because it justifiably feared a financial crisis. And its actions ended a financial panic.

The second phase is where the initial success of policy makers’ actions are visible for all to see. Hope replaces fear and asset markets rally. I was just trolling through the Credit Writedowns archives to get a sense of how this played out in 2008 and found a post from November 2008, “An amazing market rally. What’s next?” that encapsulates how that sense of optimism sparks relief rallies in risk assets.

But eventually, the third phase enters the picture, the real economy phase. And that’s when people finally get to see how well policy makers have done in arresting the economic decline. Usually, this means another or several more legs down in risk assets as reality sets in. Mercifully, in 2009, this period ended by March, with the S&P hitting its infamous 666 low.

Where are we now?

I think we are late in the second phase of that cycle. The initial liquidation decline was breathtaking in its speed.

Think about it: the Great Financial Crisis began in February 2007 with the credit writedowns of HSBC’s US subsidiary Household Financial, because of its subprime portfolio. It took four months to accelerate with the Bear Stearns hedge fund losses in June and the August BNP Paribas fund freeze. It was another year before Fannie and Freddie collapsed. And only in October 2008 did we get the sweeping government intervention we all remember. I have the whole credit crisis timeline saved for posterity.

That’s a 20-month process from Household International writedowns to wholesale government security blanket. This go round it was perhaps two months from the Jan 15th from the first known case of coronavirus in the US to the Fed intervention on 23 March. And, remember, the first known coronavirus death in the US wasn’t until 29 Feb, less than a month before the Fed’s pulling out all the stops.

So, we shot through the liquidation phase in record time. We are just beginning the fourth week of the hope phase. And, I think we are seeing signs that we are starting to enter the real economy phase. Why? Markets rallied on terrible news over the last several weeks, including the record 16.7 million jobless claims.

But, now the market tone is different. It is softer. And I think we are less likely to see rallies on hopes of a V-shaped recovery. Instead, it will be worry about how quickly we can bounce back. And this corporate earnings season will be helpful in giving equity markets some hard data to set expectations with.

What am I reading now?

Here are four articles I find interesting in that context:

- Muni-Bond Market Reviving After Fed Moves to Ease Cash Crunch

- Coronavirus Pandemic Fuels Rapid Increase in Missed Mortgage Payments

- Goldman Sees Advanced Economies Shrinking 35% Amid Pandemic

- Coronavirus: is investment management the weak link?

The first article tells me that the Fed’s liquidity provisions are working. We are seeing double the normal issuance in the muni market as issuers rush to take advantage of better market conditions.

The second article tells me that the real economy impacts are beginning to seep into all types of markets, in this case the residential mortgage-backed securities market. The Federal Reserve is under pressure now to bail out mortgage servicers with the kind of emergency lending facility other industries have received.

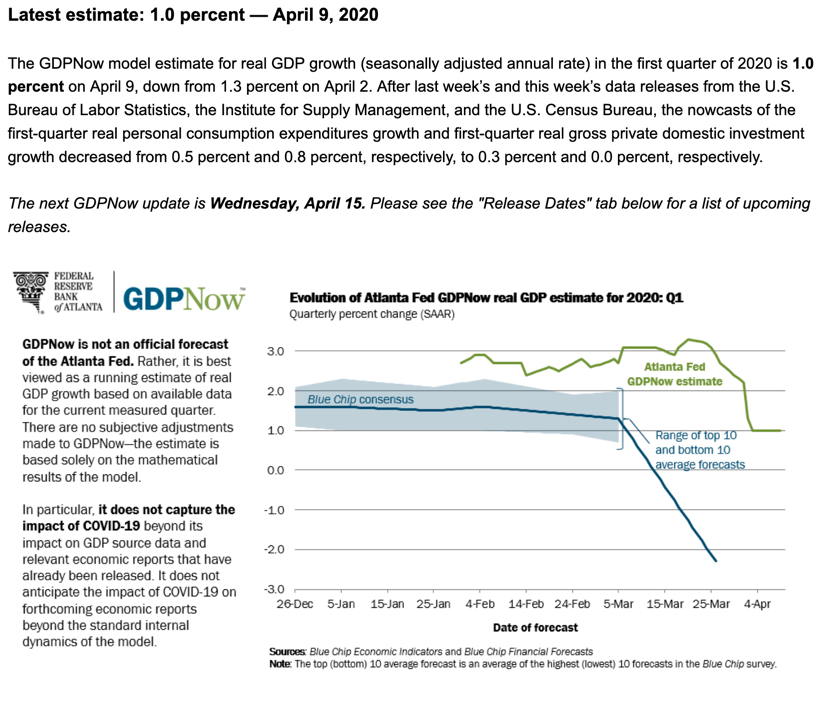

The third article is about how deep this recession could be. The numbers are so large that there is widescale scepticism that the reality will be as bad as the projections. I don’t have a strong view here. But when the numbers come out on 29 Apr, they will set a new baseline reality that either extends the hope phase or ushers in the real economy phase. Interestingly US Q1 2020 GDP is still tracking at +1.0% in the Atlanta Fed’s GDPNow nowcast.

The line in the sand

The fourth article is the most interesting one for me in terms of looking forward. First, it outlines why asset impairment at asset managers and shadow banks mater more this time than last. So, to the degree we think of financial sector distress creating tail risk, it may be less useful to look at commercial and investment banks.

Second, it also points to leveraged loans right up front, with a discussion about where distress is right now:

Even at the depths of the 2008 financial crisis, Cirque du Soleil’s acrobats kept twirling. While other companies tightened their belts or went under, the Canadian circus expanded its roster of flamboyant shows. But the coronavirus crisis proved a vault too far.

Last month, Cirque du Soleil was forced to cancel all shows and lay off 95 per cent of its employees. Two weeks ago, it missed a payment on its $900m of debts — sourced from the riskier leveraged loan market — and became the latest corporate victim of the virus. “The situation has been sudden and has put a very difficult strain on the company that we are actively working to manage,” Cirque du Soleil said.

This is important because the leveraged loan market doesn’t have a Fed backstop right now. And, it could become a locus of risk contagion as companies like Cirque du Soleil default.

Policy makers eventually draw lines in the sand that they are not willing to step over. That’s what Lehman Brothers’ failure was about. Will 2020 be any different? Maybe. But, right now the Fed has said it is only wading into high yield via fallen angel debt and high yield exchange traded funds. It is not buying individual junk names and its not backstopping the leveraged loan market at all. That’s where the risk lies then.

When the leveraged borrowers in these markets default, it’s going to create a wave of credit writedowns that I believe will cause distress, with the knock-on effect of seizing up funding markets for junk-rated companies. At that point, let’s see where we are in other asset classes and what kind of contagion this causes.

My view

I see the policy action to date as having been largely successfully in restoring liquidity to funding markets and in propping up risk assets as a result. And so, despite the dreadful economic data, shares have rallied. High yield has rallied too. But, we are fast approaching the time when beating expectations will matter. And so, we will have to see how deep and how long this recession turns out to be.

I anticipate at least another leg down, with the S&P 500 eventually testing its lows just under 2200. If the economic data are bad and the coronavirus news cycle about a second wave is bad, we will break through that level. And it’s not clear to me where support levels are from there. If the data are better than expected, this relief rally has legs. We are just hitting only about a 50% retracement of the down move. Let’s see where we go next.

And so, let’s end on that positive note for today.

Comments are closed.