Italy’s quagmire and lingering impacts of post-lockdown social distancing

Morning thoughts

Let’s hit on several themes today that I’ve covered in the past which are advancing.

The overall context here is that we have escaped a first wave of dreadful information flow, with policy makers doing their utmost to take worst-case scenarios off the table. Now, we are preparing for a second wave of information flow regarding how many people get sick, how long lockdowns last, what the economic and market impacts will be, how big the second infection wave is, and, most grimly, how many people die.

You can’t talk about this crisis without first thinking of the human tragedy and suffering. It is great. And the lingering psychological impact will be with all of for the rest of our lives. In terms of my own life, I am just hoping and praying I get through this with good health, and that my friends and family do too.

I haven’t left the house once except to go for bike rides in at least a week. That’s because I have had the luxury of being able to work from home. Others don’t have that luxury, especially people who work with their hands, or in unskilled or semi-skilled positions.

Outside of healthcare workers and essential employees, lower-skilled workers – who don’t use computers for work – are the most vulnerable everywhere around the world. Every time you leave your house is an opportunity for you to get infected or to unknowingly infect others. And, in a worst case, you can die, like the Detroit bus driver who, rightly, feared for his life.

Policy responses

It’s all very sobering. As is the recognition that no amount of aggressive government policy response can prevent a recession, job losses and bankruptcies. The right approach can mitigate downside risk, taking worst case scenarios off the table. But government cannot eliminate all adverse economic outcomes.

The European Union is uniquely challenged here amongst the wealthy countries of the world because of the euro. The common currency presents a unique challenge because it eliminates one degree of freedom governments need to take worst case outcomes off the table. The reminder of this came overnight when around the clock stimulus talks amongst EU finance ministers ended in failure.

In an emergency teleconference that lasted more than 16 hours, finance chiefs couldn’t reconcile their contrasting visions for the steps needed to help European economies recover, as countries in the continent’s hardest-hit south were pitted against hawkish northern states over sharing the costs of the looming recession.

Faced with what could be the deepest recession on record, the acrimony highlights how Europe is mired in the same old divisions that almost tore it apart during the sovereign debt crisis almost a decade ago. A new call is scheduled for Thursday, though it’s unclear what could push countries to move from their red lines, not least because a massive intervention by the European Central Bank has taken off some of the market pressure to strike a compromise.

My view is that the Germans and the Dutch in particular will compromise when the potential for redenomination and eurozone breakup is real, not before. When Greece was on the verge of being ejected from the eurozone, the Germans and their allies took a hard line because Greece was not a large economy. Italy and Spain, which want a more aggressive and mutualised policy response, are too large to ignore. But, the Italians and Spanish will not get what they want until the threat of redenomination enters the picture.

In the meantime, Italian bonds have sold off, with the spread to German bunds widening by 29 basis points for 10-year paper. In a best case scenario where these arguments are papered over, what is the long-term outcome for Italian growth and fiscal options?

The Italian problem

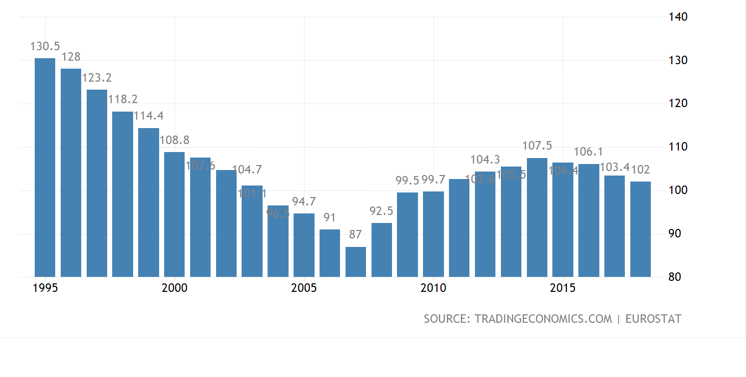

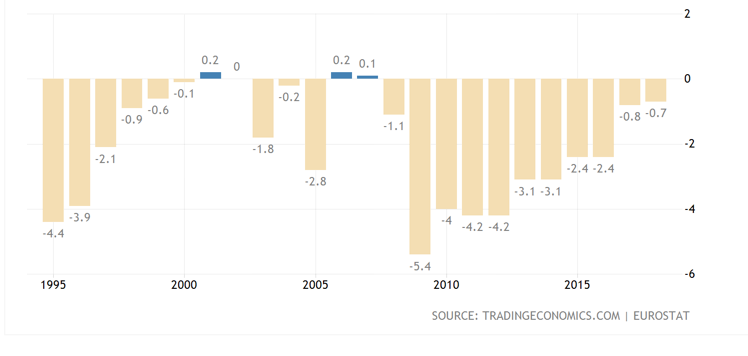

I am not worried about Spain here. It’s Italy that has the issue. The Italian problem is a pre-euro debt pile that cannot be shrunk relative to GDP because of a lack of growth. The Belgians were in the same boat as the Italians pre-euro and have had a poor track record on deficits.

Belgian government debt to GDP

Belgian deficits

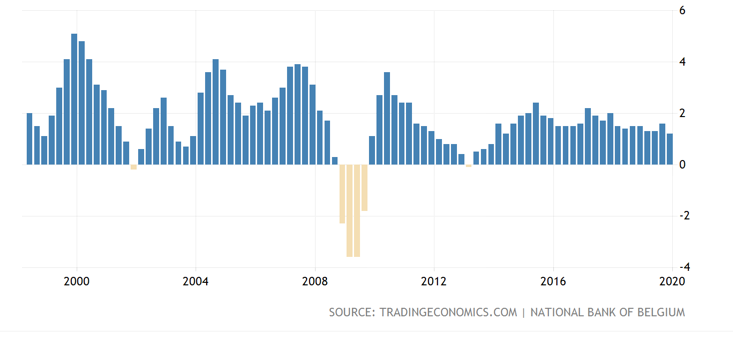

But the Belgians had growth.

But the Belgians had growth.

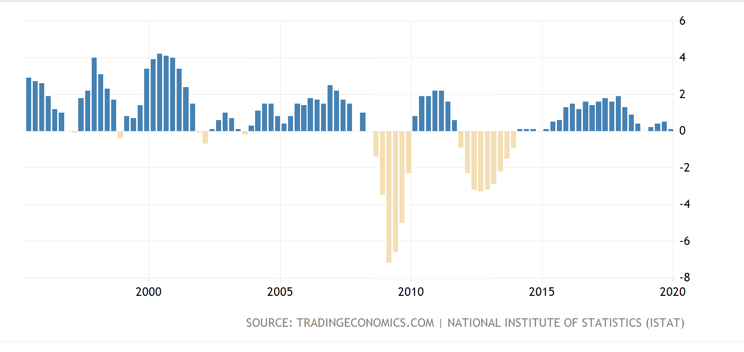

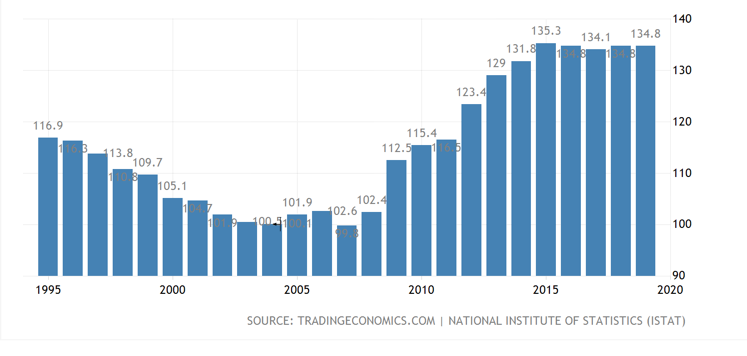

The Italians have had growth too.

But it has been lower and deep recessions have wiped it out. That’s increased the government debt burden.

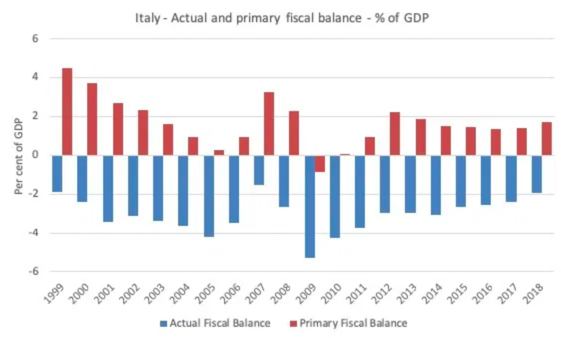

Because of the debt burden, the Italians already run a primary surplus to meet EU budget rules.

Source: Bill Mitchell

The Italians have in fact been more fiscally responsible on primary surpluses than the Germans, who were in contravention of the stability and growth pact repeatedly in the run-up to the European sovereign debt crisis.

How do you solve this problem? Do you have Italy default? Do you issue Eurobonds? Does the ECB backstop Italy without regard for its public finances? Does Italy magically increase productivity when it has the oldest population in Europe?

The euro makes all this a problem. Without the euro, Italy would run deficits, the currency would have adjusted down, and growth and employment would have been higher as terms of trade and government stimulus bolstered the economy. Higher inflation would have been the trade-off. The euro has been a disaster for Italy and redenomination risk is, therefore, real.

Lifting of lockdowns

I hadn’t planned to talk so much about the euro. But it does lead nicely into my comments on what Italy needs now, growth. With no policy stimulus coming at the EU level quite yet, the Italians need the lockdown to end. The problem is that ending it now could cause a second large wave of infections and death.

So, I think looking at how to maneuver a lockdown relaxation makes sense. First, look at Wuhan that just yesterday left a full lockdown. Reuters is reporting that, even as Wuhan tries to reverse its lockdown, locally transmitted cases of coronavirus are popping up elsewhere in China.

But even as Wuhan came back to life, new imported cases in the far northern province of Heilongjiang surged to a daily high of 25, fuelled by an influx of infected travellers crossing the border from Russia.

On Wednesday, Suifenhe city announced restrictions on the movement of citizens similar to the measures Wuhan has endured.

People must stay in their residential compounds and only one person per family can leave once every three days to buy necessities, and must return on the same day, state-run CCTV reported.

“While the whole country is celebrating the unlocking of Wuhan, few noticed that Heilongjiang is under enormous pressure dealing with infections coming over the border,” one person wrote on the Weibo social media platform.

“Suifenhe is a small city without any high-level hospitals, how can it handle the huge influx of patients?”

For me, the obvious takeaway is that this is a months’ long fight. It’s not a two months and you’re done scenario. To the degree you have the wrong policy in place as a lockdown is lifted, we could see a second wave of infections and deaths that is worse than the first one. This is a real worst-case scenario. And, for Italy, it is important given their precarious situation in the eurozone.

New Zealand example

As yesterday, I want to point to New Zealand because of an article outlining some specifics on post-lockdown protocols. Let me quote important bits of the article. The link to the full piece is here.

Covid-19 researchers in New Zealand are optimistic that the level 4 restrictions could be lifted in at least some regions in a few weeks – but warn that New Zealanders should brace themselves to do things differently for up to 18 months.

The initial level 4 period is due to end on 23 April, although Prime Minister Jacinda Ardern has said the effects of the lockdown would not start to become clear until later this week – when enough time would have passed for anyone who was already infected to have shown symptoms.

[…]

Together with his fellow researchers at Te Pūnaha Matatini – a research cluster that studies complex systems – Shaun Hendy has been working on new modelling of Covid-19’s spread in New Zealand that can better predict short-term outcomes.

He is feeling optimistic.. Since 26 March – the first day of level 4 – daily cases have bounced around, going as high as 89 new cases and as low as 54, but are no longer showing the distinct upward trend from before the lockdown. Yesterday, for the first time, recoveries exceeded new cases – meaning the total number of current cases actually dipped.

[…]

He says R0 very much depends on everyone’s behaviour for the remaining lockdown period – the more strictly everyone adheres to the rules, the fewer new cases are created. “There’s a really optimistic scenario where we could go to level 3 and still eliminate,” he says. “If we’re as good as the Chinese you could think about coming off [the strictest level].”

Alternatively, there are scenarios the team has modelled where four weeks isn’t quite enough: “We might need to extend it for longer – it might turn into six or eight weeks.”

My takeaways were these:

- You cannot lift lockdown until enough time has passed to be reasonably sure that almost all people who are contagious are no longer contagious.

- Once people are out in public, they need to remain in a social distancing mode for months and months afterward.

- When cases do arise, individuals who test positive for Covid-19 and their families must immediately go into quarantine and a thorough check of their contacts must reveal who else needs to self-isolate to eliminate clusters that could become super spreaders.

- Constant and repeated testing must continue until a vaccine is developed, hopefully some 12 to 18 months down the line

If these steps aren’t followed, a ballooning of infections and deaths and a renewed lockdown is sure to follow. That’s my takeaway here.

The biggest complication is that many people with coronavirus are asymptomatic. Chief Swedish epidemiologist Anders Tegnell says as many as nine in ten people with the disease could be asymptomatic (link and video in Swedish). That’s why it is crucial to not just quarantine anyone who tests positive but to ascertain who they have been in contact with in order to test these people as well. And it shows you how important adequate testing is.

My take

I had prepared to talk about markets now beginning to show weakness suggestive of an end to the snapback rally. And I wanted to talk about the increase in rental payments misses versus mortgage defaults. But, this post is getting long in the tooth. So I am going to end it here.

My biggest takeaway though is that we have a long road ahead of us. Public and social behavior will be changed massively for months and potentially years to come. I think people will be maintain social distancing protocols over the next year and that will have lingering impacts on the travel and leisure industries in particular.

Will the most affected industries get bailouts or be nationalised? How deep will the impact be on paychecks and spending? We don’t know yet. But what I do believe is that the impact will last much longer than is priced into asset markets. And that presents downside risk to investors, with now ,after a historic snapback rally, being a particularly opportune moment to hedge against those risks.

Comments are closed.