Where are we on growth and macro policy right now?

I think it’s a good time to outline where we are in this business cycle right now because a number of factors are coming together to present a larger picture in the US both in terms of growth and the policy response to that growth.

The Fed

I want to start with the view I expressed in my last post, that the Federal Reserve is attempting to remain as tight as they can without crashing the economy.

Quantitative tightening and the problems in the repo market best illustrate that stance. Zoltan Poszar does a really good job of outlining how quantitative tightening has been behind the repo mess. And he notes that despite the Fed’s move to so-called QE lite, the problem has not gone away. The takeaway here has to be that the Fed has wanted to be as tight as they could be. And in so tightening, they have unintentionally created stresses in the plumbing of our financial system.

Moreover, while the Fed is working to alleviate the stresses in the repo market, they are still maintaining the overall stance of tightening where they can and loosening only under duress. That’s why I told you the last jobs report was a big deal – because it moved the narrative from one of potential recession forcing the Fed to cut to one of the Fed standing pat and investors having a fear of missing out on a monster bull rally.

The data

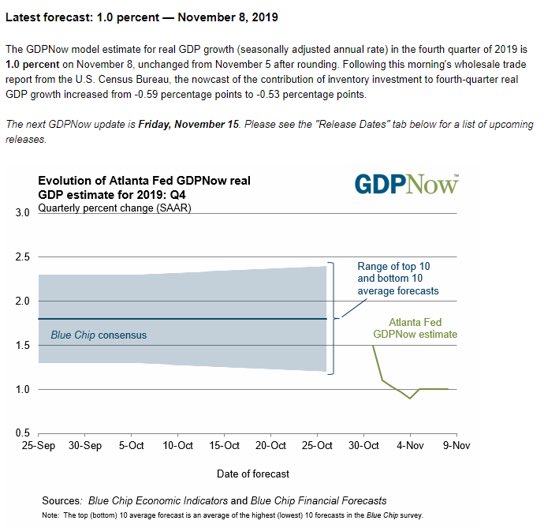

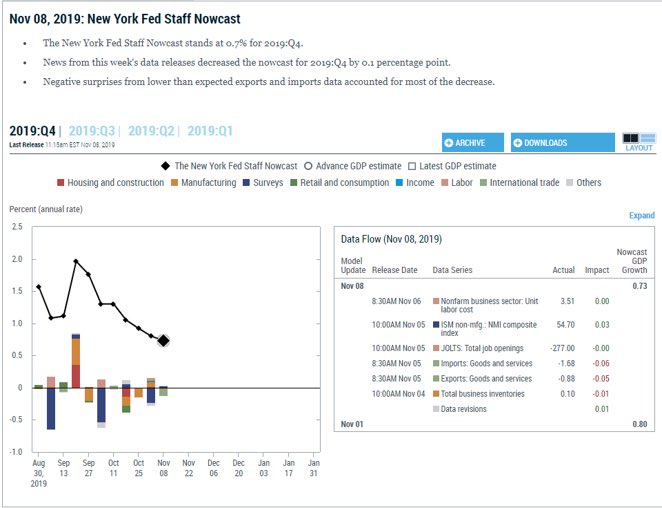

But, the numbers are still weak. Look at the nowcasts issued by the Atlanta Fed and the NY Fed.

The Atlanta Fed says Q4 is tracking at 1.0% annualized growth and the NY Fed says 0.7% growth. That’s stall speed, folks. It doesn’t take a lot to get you below zero here.

Moreover, as Tim Duy puts it, “even the Fed’s own research shows rates are too high“. Basically, the Fed should be cutting now. But, because it has been uncomfortable with a role of providing mid-cycle easing to keep the economy on track, it is trying to ‘normalize’, cognizant that the downside risk is recession. So far, the Fed has managed that risk well. But will its luck run out? I think yes, which is why recession in 2020 is still my base case.

The problem

I want to flag something that I see as a problem in this context. Say downside risks do materialize and the Fed is caught out, causing us to lapse into recession. The unemployment rate is incredibly low. Household interest costs are also low. We could have a shallow garden-variety recession and consumers could be off to the races again soon afterwards.

But, these passages from a NY Times article from yesterday worry me:

SoftBank’s Vision Fund is an emblem of a broader phenomenon known as “overcapitalization” — essentially, too much cash. Venture funds inundated start-ups with more than $207 billion last year, or almost twice the amount invested globally during the dot-com peak in 2000, according to CB Insights, a firm that tracks private companies.

Flush with the cash, entrepreneurs operated with scant oversight and little regard for profit. All the while, SoftBank and other investors have valued these start-ups at inflated levels, leading to an overheated system filled with unsound businesses. When the companies try to cash out by going public, some have run into hurdles.

[…]

The model of using contractors, which has defined the last decade of start-up investing, has created work opportunities. But among people who are most dependent on these companies, unrest is growing.

[…]

When some of the start-ups cut costs, often prodded by SoftBank, they reduced payments to workers. Many contractors said they wanted to stop working with the start-ups, but couldn’t because of upfront investments they had to pay off.

This is a global phenomenon. But I want to concentrate on the US here.

Now, remember, these are labor arbitrage schemes. These companies are employing people as contractors because it allows them to shift the burdens of healthcare, retirement and vacation onto workers. And yet, these companies are still unprofitable. What happens in a downturn? It will be carnage.

Because these venture-funded companies are so massive, in a downturn, we will likely get a flood of contractors who see their pay savaged or disappear altogether. So, in a recession, this ends badly for many workers. I would argue that the unemployment rate is ‘artificially’ low because of this increase in contract labor schemes – in that many more workers will become unemployed as these companies terminate their contracted labor arrangements en masse. That’s the downside of easy to hire; It also means easy to fire.

Moreover, on a macro level, it’s important that these labor arb schemes shift lots of burdens onto workers that companies normally pay because it normalizes the risk shift and allows companies in traditional arrangements with their workers to lower the bar and offer less. It’s a race to the bottom. And that’s why wage rates haven’t accelerated.

Last thoughts

Am I being Debbie Downer here? I don’t think so. For example, in the UK, many people are turning to food banks. And that’s happening in a non-recessionary environment. What happens in a real recession? It’s something we have to consider.

But, on the numbers, I still maintain that nothing says recession. The numbers still point toward lower growth, with the Q4 nowcasts showing a marked deceleration if those numbers hold.

At the same time, the policy backdrop is ‘toxic’, for lack of a better word. I have already mentioned the Fed’s tightening bias. But, another government shutdown is looming in the background while Presidential impeachment hearings are going on. A government shutdown could take the economy over the edge.

Meanwhile, the Washington Post is reporting that Trump aides are discussing ways to cut the middle class tax rate to 15%. Do you think that’s going to happen in a polarized political environment? I don’t. In fact, I see fiscal policy playing no stimulative role here.

And finally, trade policy is counting on the phase one deal between the US and China actually happening. What if it doesn’t and tariffs go up? There is a risk there despite Trump’s need for detente ahead of the election.

In sum, while the numbers still show the economy expanding for the foreseeable future, there are big risks ahead and little policy space with which to counter them. 2020 is going to be a momentous year on both the economic and political fronts.

Comments are closed.