Watch for a re-emergence of the convergence to zero play

Understanding curve flattening

Long-time readers know that I have talked for a number of years about a longer-term global convergence to zero play that I see shaping up. It first emerged during the mid-cycle slowdown in 2015 and 2016 as yield curves began to flatten. Looking through my archives, I note that I first made this call in January 2015 in a note titled “The convergence of safe asset yields toward zero favours Anglo-Saxon bonds“.

The gist here is that the global economy is chronically suffering from a lack of consumption demand growth. This is a secular trend that is tied to the impotence of monetary policy in a world in which monetary policy is still the only game in town. It is also tied to inequality. It owes to the fact that globalization and monetary dominance have combined to shift income and wealth gains away from the developed economies’ middle classes who no longer have appreciating house prices as a fallback to continue consumption growth in the face of stalled wage gains.

The result is stagnating domestic demand growth all across the developed economies, resulting in lower central bank policy rates and a flattening of yield curves as the outlook for any eventual rate hikes gets pushed out. The Anglo-Saxon economies were the last to succumb to this outcome because, amongst developed economies, they are the economies with the largest net current account deficits, and, therefore, the highest growth rates and highest base policy rates.

Re-acceleration and then deceleration

Now, when the global economy re-accelerated after the last mid-cycle slowdown, the convergence to zero trade temporarily went away. While the European Central Bank and the other major western European central banks were never able to get off zero, the ECB did stop quantitative easing with an outlook to eventually normalizing. The Bank of Canada raised rates. And the US Federal Reserve raised them even more, shrinking its balance sheet at the same time.

But, starting sometime in 2018, a renewed global economic slowing began. And the convergence to zero trade started to make more sense again. I mentioned it explicitly again for the first time in June. See “The convergence to zero trade is back“. But, this time, because of the Fed’s rate hikes, the Fed was the base rate king instead of Australia and New Zealand, which were cutting due to their leverage to slowing commodities and Chinese growth. The biggest play in converging to zero, then, is on the Treasury curve.

To give you an example of what this looks like, notice Jim Bianco’s recent research showing that the US has had the highest policy rate among developed economies for 13 months on the trot. He says this is the longest streak for 65 years, and also the first time since December 1982 that the US has had the highest policy rate.

The curve flattening and inversion we saw in the middle of this year is testament to the pressure on US base rates due to the global economic slowing. But it also owes to the pressure via the foreign exchange channel for long rates to come down and convergence with the rest of the world.

The tactical play vs. the medium-term trend

This flattening move is played out for now. And the tactical play today is for a steepening of the curve again, either because the data flow has gotten better, because the Fed is likely to cut enough to prevent a major recession going forward, or because people are starting to think the trade war will force Trump to cave in his battle with the Chinese.

This is only a tactical position though. Over the medium-term, there are headwinds.

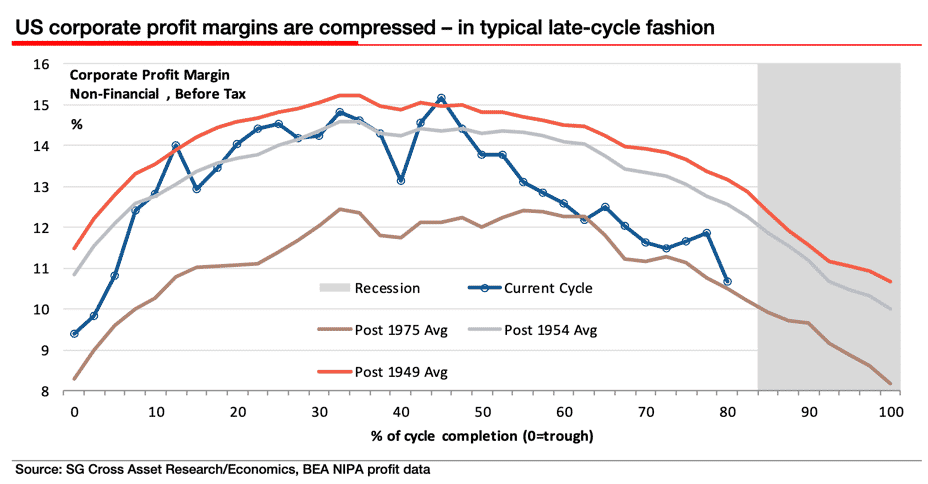

- First, there’s the profit cycle, I thought Vincent Catalano’s interview with Richard Bernstein that aired on Real Vision on Wednesday was interesting on this because Bernstein was looking at GAAP earnings and seeing those numbers roll over. What were big gains in 2018 peaked in Q4 2018 according to Bernstein, meaning 2019 gains will be meagre. And he sees a profit deceleration on the cards for 2020. Interview here.

- Then, I saw today’s note from Albert Edwards. And he notes the exact same thing, saying “The latest revisions to US whole economy profits (aka NIPA, National Income and Product Account profits) were sufficiently large to suggest that the end of this record economic cycle is now much closer than previously thought. The key corporate profit series featured in the press release (economic profits from current production) saw almost 10% slashed from the previous perky 2019 Q1 estimate.”

- Finally, I spoke to Mark Orsley Of Prism FP on Tuesday. And his view is that we are seeing the services ISM and PMI data converge down toward the manufacturing data. And he thinks this can last a few more months still given that US leading economic indicators are still heading down.

So, I think the convergence to zero play will be back on in short order. In the end, with the ECB cutting and adding QE today, the US dollar is under pressure. And that might be the critical factor forcing the Fed’s hand more than domestic concerns.

My view

Longer term, it’s the impotence of monetary policy that is the key factor here. While the ECB is going more negative with rate policy, this is a tax on banks. It will not boost growth.

But Central banks have two other policy tools up their sleeve. One is yield curve control, whereby the central bank explicitly targets a longer-term point on the yield curve, controlling not just the policy rate but longer rates as well. The Bank of Japan is doing this. And we will have to see if it is effective. I suspect it won’t be because curve flattening is destructive to bank balance sheets.

The last policy tool is average inflation rate targeting, which effectively says that the central bank will let the economy run hot in the future in order to allow an average inflation to reach target after months of below target inflation. So, if the average inflation level over a 6 month time frame were 1.5% , then the average over the subsequent 6 months could be 2.5% before the 12-month average reached a 2% target that would force the central bank to tighten. I don’t think this is going to work either because it’s implicitly just a curve flattening exercise. And the central bank has no control over inflation. Its targets are meaningless.

My view: until the prevailing policy paradigm shifts away from monetary policy toward fiscal or coordinated consolidated balance sheet dynamics, you can forget about sustained growth re-acceleration. That will put the convergence to zero play into the mix over and over again, until we hit the zero lower bound in the US. And then we’ll have to see what happens next.

Comments are closed.