The Mid-2019 Macroeconomy

In the US, we are officially in the longest expansion of all time. And, as yet, there are no definitive indicators I can see that it will end in short order. So I remain hopeful, if cautious about the potential for the US economy to avoid recession over the coming 18 months through the end of 2020. Below, let me give you a general sense of what I’m seeing and where I think we are headed over the medium term.

Expectations

Let’s look at this from a global perspective. And I want to focus on expectations. That’s because a lot of what we read regarding the economy is forward-looking, questioning whether an existing trend can continue.

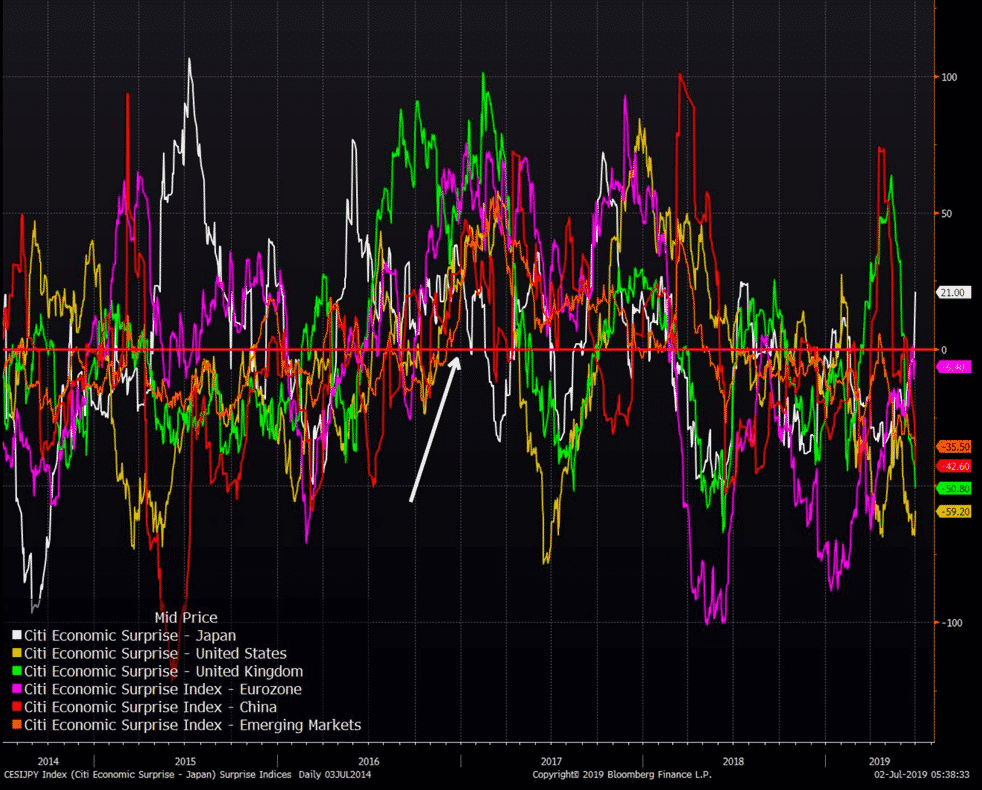

Over the past few months that data trend has been down, with PMI numbers falling, GDP growth rates falling, and bond yields falling with them. The worry is that this trend takes us into recession. For example, look at this chart of the Citi Economic Surprise indices that Joe Weisenthal drew up this morning.

The lines are all over the place. But if you look closely at where they end up, all of them are below zero except Japan. What that’s telling you is that the macro data have consistently underperformed expectations across the globe, except in Japan. And so, if this trend of underperformance continues, eventually we could have a recession.

Here’s how Joe puts it:

the lines oscillate because they’re naturally mean-reverting. As data deteriorates, analysts start slashing estimates, and then they go too far, and the data starts to exceed expectations again, and so on. I highlighted with an arrow a period in late 2016 where you could see that every line was above zero, meaning every region in the world was seeing economic data that bested forecasts. Fast forward to now, and it’s basically the opposite. Virtually every line is below zero, with the exception of Japan. Of course, the lines will eventually bounce, but the question is whether it’s a result of economic data improving, or economists realizing they’re being overly optimistic and thereby slashing forecasts.

This is where we are. We are waiting to see whether the divide between data and expectations gets closed by data improving relative to expectations or expectations deteriorating to meet the data.

Manufacturing vs Services

Now, a lot of this is driven by a slowing of manufacturing and trade flows. This is going to hit trade-dependent economies the most. For example, on Sunday the Caixin Manufacturing PMI came out for China showing a worse than expected 49.4% print versus the previous 50.2% print and expectations of 50.0%. Anything below 50% is considered recessionary.

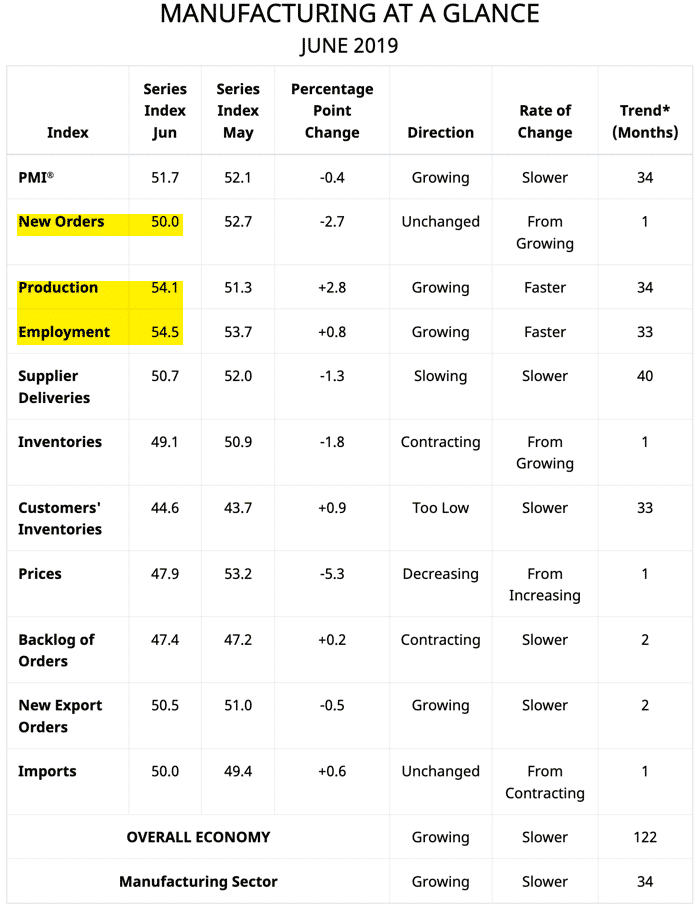

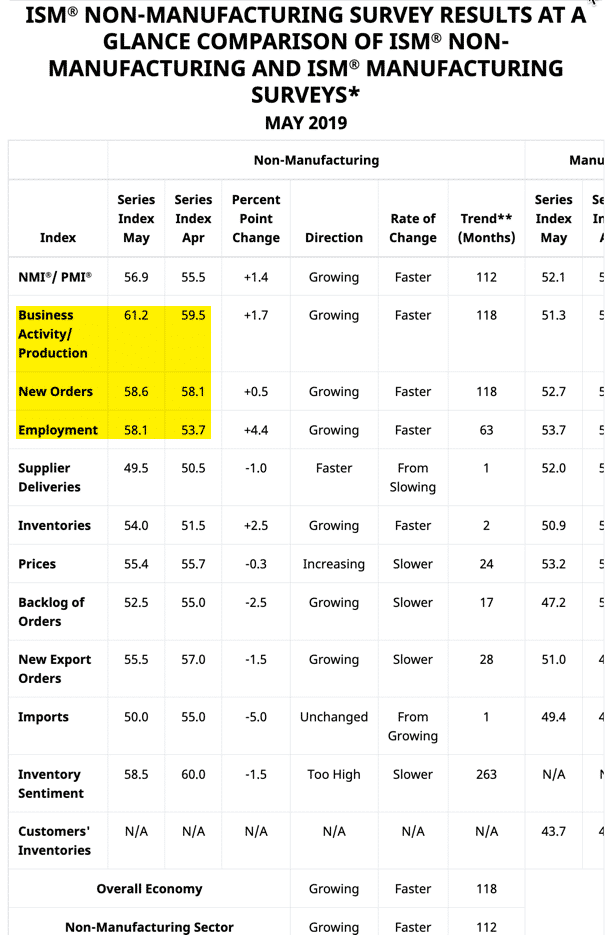

Nevertheless, unless the poor performance is mirrored in the service sector, economies can continue to grow, and we will continue to avoid recession. Let’s take the US, for example. Yesterday, we saw the manufacturing ISM survey at 51.7%, down from 52.1%. Again, that shows manufacturing is weak. And so we have to see what the Non Manufacturing ISM survey shows when it gets released next week. The May data released last month were relatively good with the index at 56.9%, up from 55.5%.

When we look at the subindices, we see more divergence, with manufacturing new orders moving in the opposite direction of employment and production.

On the other hand, the latest NMI survey showed business activity, new orders and employment all moving in the same direction — up.

If I had to pick one of the two surveys to pay more attention to, it would be the services side because that’s where the lion’s share of the US economy’s growth comes from. And the data there show things growing robustly.

Yields

So, when I look at low government bond yields, the caution I see is reflective more of expected future policy and inflation than a prediction of doom. For example, Italy’s government cut its 2019 deficit goal to 2.04% from 2.4%. That means it will likely avoid EU sanctions.

Italian 10-year bond yields fell to 1.94% on the news, reflecting decreased redenomination or default risk in an environment where the ECB will keep rates below zero. And the Italian 2-year notes are now yielding 0.034%, a refection of the lack of default risk for short-dated paper.

And even Greek 10-year yields, at 2.15%, have fallen to their lowest ever, going back to 2007. This is a reflection of low expected future policy rates and low future inflation.

This is exactly what’s happening in the US as well, where 10-year yields are hovering around 2%. For me, right now, the question is whether the bond market has overshot the Fed – meaning are the 75 basis points of cuts priced in by the market overly pessimistic? Now that the Fed has begun cutting, are they behind the curve or will the data bounce enough to forestall the cuts bond markets are anticipating?

I think these are fair questions to ask. And by asking them, we’re effectively saying there is no definitive indication that the US is in or headed for a recession. The jury is still out.

Conclusion

So, the data I am seeing shows economic deceleration globally. But, the deceleration is not so pronounced that I think recession is a foregone conclusion. Moreover, in the US, where I actually am on recession watch, last month, we saw a bounce in the services sector composite data read. And that suggests we are not in recession, and gives me hope that we will avoid recession as well.

So, I think we are still in this holding pattern, waiting for a discernible break in economic data in either direction. And for now, it looks like that’s where we will stay for the discernible future.

Comments are closed.