Dreams of a Second Half Recovery

As I write this, Washington is fixated on the congressional testimony of Robert Mueller. My attention is elsewhere though. For me, it’s the economy that matters.

Over the past two weeks, we have had a “recession watch” on Real Vision, where I act as both editor and interviewer. The thesis is that we are at a crossroads both in the economy and in investor sentiment regarding the resilience of the US and global economy. And so, we brought in a variety of guests to discuss where this is headed.

Real Vision tends to have a bearish bias though. So, I feel as if too many of the guests were of that ilk. But, interestingly, despite recession being my base case by the end of 2020, I found the few bulls’ arguments more compelling. So, I’m writing this post to tell you why, but also why I still remain cautious about the medium term.

Germany is the example

If I could choose an economy that best displays what is happening in the global economy and where the downside risks are right now, it would be Germany. In the post-Greek crisis up phase of synchronized growth in the global economy, Germany led the way. But as the global economy has decelerated, Germany has been at the forefront of that deceleration. And ALL of this has been driven by manufacturing.

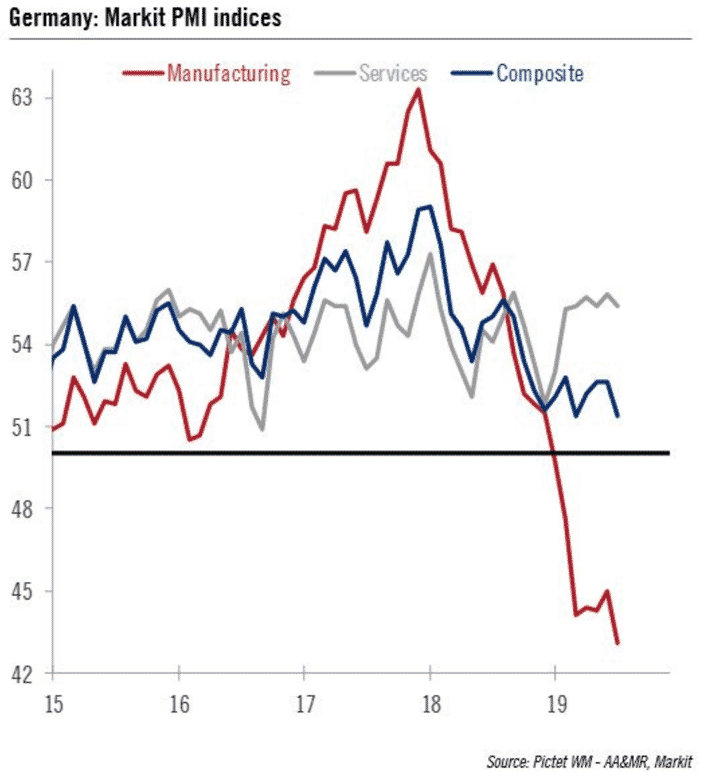

Here’s a chart of the PMI data released this morning by Markit.

There are a couple of things to take in regarding the chart above. First is the sheer magnitude of the decline in manufacturing relative to the preceding period. It is massive. Germany’s flash manufacturing PMI came in at 43.1 in July. That’s down from 45.0 in June and worse than the 45.2 expected. Moreover, it’s also the lowest level since July 2012. To make matters worse, the outlook isn’t much better as new orders fell at the fastest pace in a decade. All of this was driven by weakness in trade with China and in Germany’s automotive sector.

I would also highlight the dichotomy between the big moves in the manufacturing PMI and the stable services PMI and the consequently relatively stable composite PMI figure. So while, manufacturing soared to near the end of 2017 and plummeted, the services PMI shows a more range-bound path, with the numbers showing strength of late. Without the recent strength in the service sector, Germany’s composite PMI would be below 50 and the German economy would be in recession.

That’s the example for the rest of the world. This entire downtick in global growth is driven by manufacturing. And the bigger the manufacturing sector is as a percentage of output and growth, the more vulnerable an economy is. Countries like Singapore are hurting even more than Germany because of the dependence on manufacturing, and particularly on manufacturing that involves China.

The upshot of this is that an economy can avoid recession to the degree the services sector remans insulated from the problems the manufacturing sector is having, especially since services make up a much larger proportion of industrialized developed economies.

Compare Germany to the US

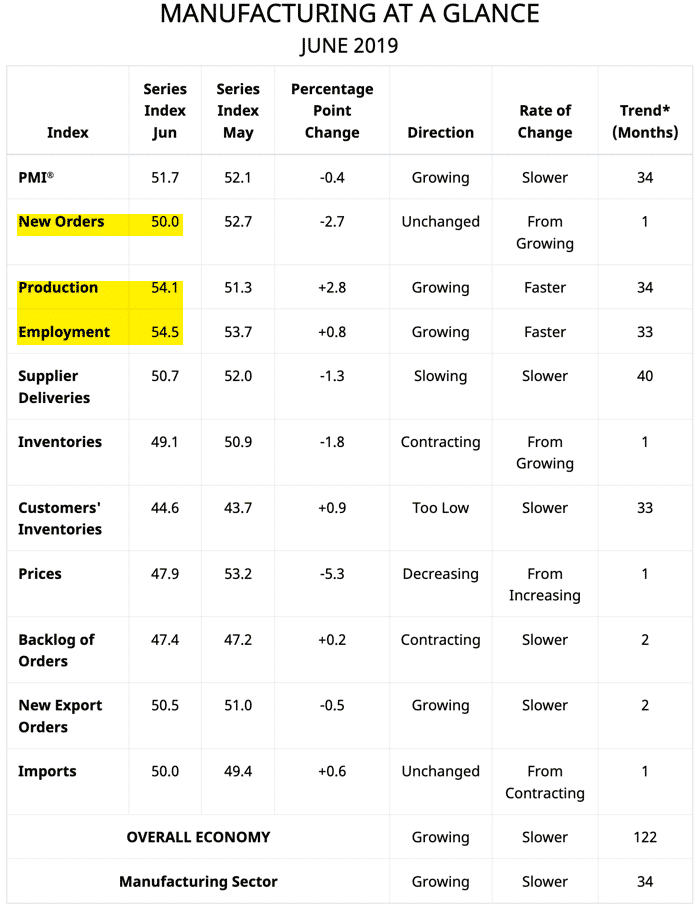

If you contrast Germany to the US, a couple more things become clear. First, Germany hit the manufacturing wall before the US. Here’s a chart of manufacturing from when Markit’s last US PMIs came out in late June.

Notice that the downturn in US manufacturing is the spring of 2018 versus the fall of 2017 for Germany. Both of these dates moderately precede the trade war. And that tells you that this is a normal cyclical phenomenon that has been exacerbated by the US-China trade conflict. That is to say, the trade war is not the cause of the slump in global manufacturing. It is an accelerant.

One of the recession watch guests we had on Real Vision, ECRI’s Lakshman Achuthan, said something interesting in that context. His firm monitors US business cycles and the data he’s seen shows three distinct cyclical ebbs and flows of this business cycle within the expansion. What that means is that we have already had three mid-cycle slowdowns in the US without a recession. And although this cycle is very long, there is no rule that we can’t have a fourth. There hasn’t ever been four. The most is three. But that doesn’t mean there can’t be a fourth. Achuthan even says this directly.

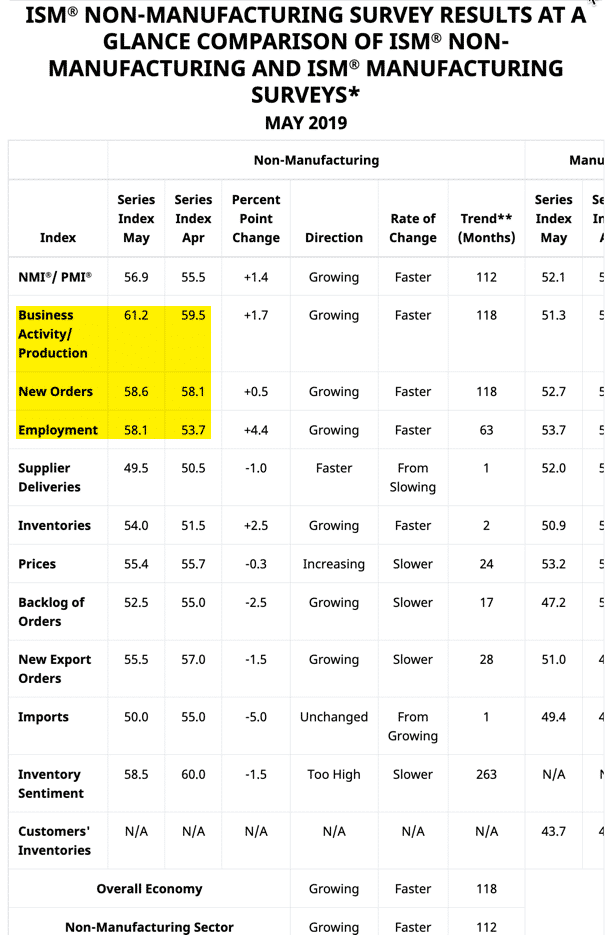

And, of course, the US is more insulated than Germany here. Trade and manufacturing are a lower percentage of GDP. The domestic service sector is basically all that counts. And if you recall, I recently highlighted the fact that the US services sector is humming along quite nicely. The subindices highlighted tell the story.

Manufacturing is a different story in the US. Caterpillar, for example, came out today and guided toward the bottom of the range for 2019 earnings. They didn’t lower the range outright. They simply took the potential for upside off the table.

If you look at the raw data, they confirm what Caterpillar is saying: the U.S. manufacturing sector has weakened. But the weakness is not as pervasive as it is in Germany. I pointed this out a few weeks ago, with the chart below highlighting ISM’s manufacturing subindices.

What the yield curve is saying?

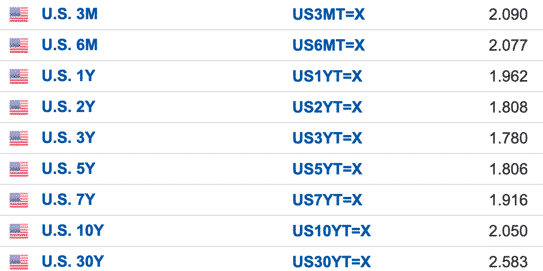

In the above context, then, what is the yield curve telling us? First of all, it’s not telling us a recession is coming. I’ve said this repeatedly. It’s an indicator regarding the collective positioning of Treasury market participants. It is telling us what buyers of Treasury bonds believe future Fed policy will be like.

Source: Investing.com

And from what I can discern, it is telling us the Fed will have to cut rates in the medium term, followed by a return to normalcy over the longer-term. That’s what the inversion from 3 months to 3 years says in the context of a very steep curve from 3 to 30 years.

That’s not a prediction of recession. It’s a recognition of enough weakness to force the Fed to cut rates aggressively. So, it’s a composite view that has the Fed cutting rates more than once later this month, but more aggressively in 2020 and 2021 as well. That would suggest the bond market sees economic and inflation weakness, not necessarily recession. The steepness beyond three years says that, after 2022, the cutting would end.

Three things here. First, notice that the spread between 2 and 10 year yields has never gone negative this cycle. Right now, the spread is almost 25 basis points. That’s pretty big. It’s a widening from levels in May and June, suggesting the bond market is less cautious about future economic deceleration. For me, it makes no sense to predict recession based on the bond market, when the most reliable inversion signal, the 2-10 spread has never once shown a recessionary indicator, not for a single second.

Second, let’s remember there is no credit stress yet. Glenn Reynolds of Credit Sights was on Real Vision recently talking about this. In past cycles, in 1989, 2000 and 2006, we saw significant stress in high yield markets leading the inversion. We haven’t seen that at all this cycle. In fact, Reynolds noted the lack of distress, the lack of defaults in high yield and leveraged loans and the low risk spreads in the space. This, high yield, is a space I know from having worked there. And to me, it seems obvious that you can’t have a recession without the economic problem revealing themselves in credit. By definition then, a recession and credit problems in high yield and leveraged lending are joined at the hip.

Third, last month, I interviewed Wall Street bull Stephen Auth, the CIO of Federated Investors Global Equities. He made an interesting point, as an equities guy, about the myth that the bond market is ‘smarter’ than the equity market. He says, in this cycle, the bond market repeatedly shows signs of getting it wrong, moving to cautious extremes, only to backpedal, where the equity markets have yet to crack. His intermediate target on the S&P500 is 3100, well above present levels.

My own view

I am preconditioned to look at the data and guide based on that. As I’ve said, nothing in the data says recession. I am heartened by the uptick in recent services ISM data too. But, there are way too many decelerations for me not to worry. On a sectoral basis, we see manufacturing, housing and autos now joined by technology and oil. And on the household front, we see employment and wage growth both topping out and decelerating.

Recessions are presaged by widespread deceleration across the broad palette of the economy. The numbers have to be down across a number of industries and areas of the economy. I don’t see the data showing that yet. But the deceleration is broader today than it has been at any other time during this expansion, including during the 2015-16 deceleration that was led by the oil sector.

So, my view is sanguine about the near-term but cautious regarding the medium-term. I don’t think we are in a recession or even near a recession in the US. That means we can still dream of a second half recovery. However, if the data weakness continues to fan out into other sectors of the economy and job and wage growth decelerate further, 2020 will be different.

In aggregate though, the economy hasn’t changed substantially in the past few weeks. That explains my silence. But, this post represents my present macro view as comprehensively as I think I can manage. That’s all I have for now. To be continued.

Comments are closed.