Trying something different: on the economic re-acceleration thesis and other topics

I apologize for missing Monday and yesterday. I am actually on Holiday right now. And though it seems strange to work on Holiday, I have always written through my vacations. I reckon I will be off tomorrow. But, who knows. I have my laptop with me for this brief beach week. But, in contrast to Monday and Tuesday, I did want to forewarn you today.

So, I want to try something new here and write about the news of the day in sort of a morning briefing format. The difference is that I am going to have a go at it with my own opinion and analysis, rather than the straight up reporting you get from the likes of the Telegraph or the Washington Post or the FT. The goal is to align what I am writing with what you see in the media, but with my analysis overlaid to give you more context.

My hope is that this is an easy but good read for thinking about the issues of the day. Please let me know if you like this format because I might do it more often.

Chinese re-acceleration

Here’s my thesis here: the global economy has become dominated by the US-China barbell. And to the degree either or both of those economies slows, the rest of the world will be dragged in tow. And that’s because while Europe could provide a counterweight, its export dependency makes it less deterministic in terms of the directionality of global growth. The giant domestic economies of the US and China make them less trade-dependent, and, therefore, more important to global growth.

In that context, this blurb from today’s briefing in the Guardian is interesting:

Asian share markets have swung higher after Chinese data easily beat expectations. First-quarter economic growth hit 6.4% while industrial output surged 8.5% in March from a year earlier, beating forecasts of 5.9%. Retail sales rose 8.7%. Investors reacted immediately by buying the Australian dollar, closely tied to China’s fortunes. The Aussie pushed up 0.3% to a two-month top at $0.7206. The Nikkei added 0.5% to reach its highest in almost five months, while E-Mini futures for the S&P 500 rose 0.2%. MSCI’s broadest index of Asia-Pacific shares outside Japan gained 0.2% to near its highest since July.

My take here is that China is re-accelerating. And this has nothing to do with the US-China trade spat. It is a Chinese domestic economy re-acceleration. And that means the continued slowdown in growth that many like the IMF are predicting has to be viewed with scepticism. We could be in the midst of a Chinese re-acceleration that takes the global economy out of the doldrums into a renewed appreciation for animal spirits.

US re-acceleration?

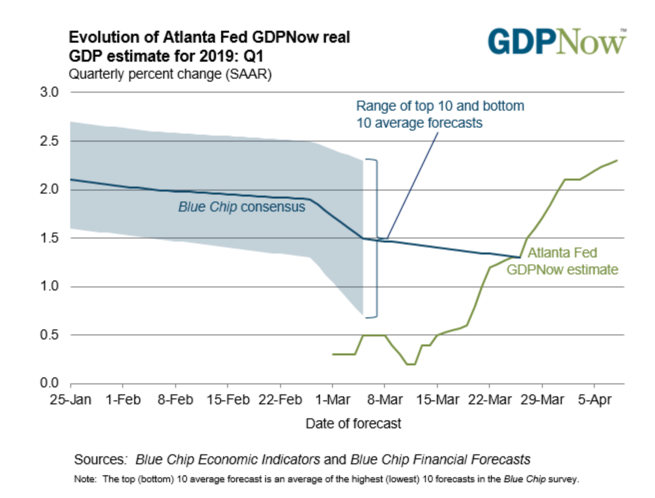

But on that same theme of re-acceleration, the data are less clear in the US. I still like to look at the Atlanta Fed’s GDPNow model for a sense of consensus views on growth. And it shows the consensus plummeting to 1.3% in Q1 while the Atlanta Fed nowcast is accelerating to 2.3%. That’s a complete flip flop from the beginning of the quarter.

That flip flop suggests to me the potential for upside surprises. And it also points at a potential growth re-acceleration. We get another crack at the data today with the trade data. I don’t expect that dataset to change the nowcast a ton though.

At the same time, US manufacturing data remain weak. The Federal Reserve reported industrial production declining 0.1% in March from February, against expectations for a 0.2% rise. While the number is up 2.8% year-over-year, the recent data have been uneven. Also note that capacity utilization, fell 0.2% to 78.8%. This was also below expectations for 79.2%.

My take: the US manufacturing sector remains weaker than the much larger services sector, where things have stabilized and could be re-accelerating as in China. That will prevent a 2019 recession in the US and lead to upside surprises that underpin risk assets.

British Depression

On a different note, the FT’s morning briefing noted that the UK teeters on the verge of a Brexit breakdown. And this isn’t economic or political but psychological. I recommend the piece highly. Basically, Brexit has sucked all the air out of the room. And all other issues in the UK have been shunted to the side. The result is an increase in anxiety and depression, for remainers and leavers alike, as well as for EU citizens trapped in the limbo.

I think the whole fiasco has been quite destructive. And it makes me ask how it could have been avoided. Certainly, Theresa May’s stewardship as Prime Minister has been shambolic. But, given the narrow 52-48% Brexit vote outcome, wasn’t Brexit always going to be a divisive process? I would say yes. But, my view here is that May’s lack of compromising instinct, poor interpersonal skills and desire to hold her party together caused her to take risks in seeking a solution without building consensus around that outcome. So I blame her.

The right thing to have done would have been to build consensus where she could right from the start. And to the degree she couldn’t, put the choices back to voters again (and again, if necessary) in order to force an outcome one way or another. If this is what taking back control looks like, the Britain is in deep trouble.

My take here is that there are going to be no more Brexit extensions. Either the UK gets this right by October or it faces a calamitous break with the EU. And UK leaders will have no one to blame but themselves if voters feel the outcome was poor – because the EU has already granted two extensions. And patience has run out with Brexit in the rest of Europe.

On a side note, I found this from the Guardian interesting:

Jeremy Corbyn has said Brexit negotiations with the government are stalling because influential Tories want to “turn this country into a deregulated, low-tax society which will do a deal with Trump”. Corbyn suggested it would be better to let parliament decide via binding indicative votes.

One, Corbyn wants out to be able to re-nationalize stuff and do a bunch of other stuff that the neo-liberal rulebook in Brussels says is contrary to EU rules. He doesn’t want out so that the UK can become an extreme “deregulated, low-tax” refuge off of EU shores. So, his talks with May are going to fail. There is no doubt about that. But two, it suggests that Theresa May still doesn’t have a clue about what to do. She’s like a deer in the headlights. And her stalling again and again limits outcomes. It’s hard to be optimistic.

Conclusion

There is a ton of other stuff I want to address. But I am going to leave it there. I think that making these daily posts too long makes them unreadable. But, again, I welcome your feedback on both style and content. Let me know if there are some topics I am not covering that you want to hear more about. Having just written this piece, I feel refreshed and eager to write more.

Thanks for reading.

Comments are closed.