The Fed will end up playing chicken with bond markets

Hearing what Boston Fed President Eric Rosengren makes of the US economy, you get the feeling that the Fed may not be ready to roll over completely. And with the yield curve inverted between the 3-month and 10-year yields, we are at a crucial time regarding the importance of Fed policy action. So I want to lay out some of the possibilities here.

The Rosengren View: Bullish on the US

Rosengren is a voting member of the FOMC. So though his view may not hold for the rest of the FOMC, his forecast does represent at least one potential outcome. Here’s how Bloomberg describes what he told them on Friday:

Federal Reserve Bank of Boston President Eric Rosengren still thinks the central bank’s next move for interest rates is more likely to be a hike than a cut. He just won’t be surprised if that turns out wrong.

In a March 22 interview Rosengren said he’s “more optimistic” over the outlook for economic growth and inflation than most of his colleagues on the central bank’s policy-setting Federal Open Market Committee. If that turns out to be right, he said, “it is possible the next move would be up.”

“I’m also quite willing to accept that if the economy weakens and the global economy weakens more than I’m anticipating — and the recent data could be consistent with that, then the next move could be down,” he said.

[…]

Rosengren’s outlook would appear to place him among the six officials projecting at least one increase this year. The majority of policy makers said no move is likely.

I would call this the pre-December consensus. The viewpoint Rosengren is expressing says that the US is doing so well that the Fed could actually hike rates in 2019. Rosengren might say that residual seasonality is causing the temporary downshift in GDP growth, but that growth will climb as the year progresses. And while low inflation and turmoil in China and Europe are potential headwinds, they won’t be enough to sidetrack a robust US economy. That’s what this view would say.

The Bond Market View: Recession is Coming

If you look at the Treasury curve and fed funds futures, we see quite a divergence from the Rosengren view.

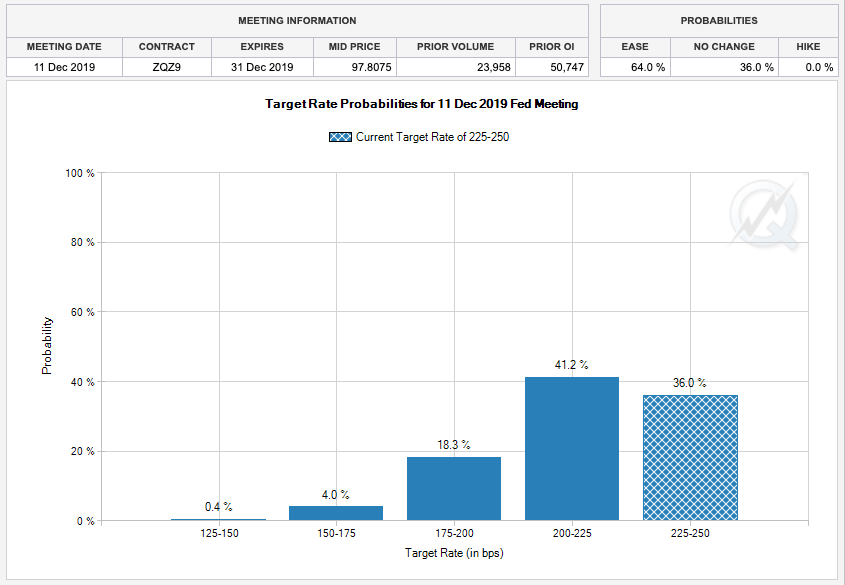

Source: CME

Fed funds futures are saying there’s a 64% probability of a cut in rates by the Dec 11th FOMC meeting. And if you look at the yield curve its shape is telling you the same thing.

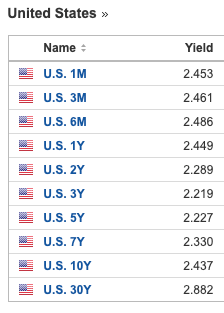

Source: Investing.com

The curve slopes up through the 6-month Treasury. Then it is perfectly inverted out to 3 years, before reclaiming its normal upward slope. The curve shows a maximum inversion between 6-months and 3 years of 27 basis points. And the timing and depth of that inversion suggests a cut before year end and continued cutting over the medium-term due to a recession. After the 3-year time frame, in 2022, the recession will be over and the yield curve reverts to a normal look.

So, the bond market is saying quite emphatically that it now expects recession. I was talking to some macro colleagues with trading backgrounds. And they expressed the problem as having emanated from abroad i.e. China, emerging markets and Europe. I am more partial to Rosengren’s formulation, that Europe and China impinge on the US but that the US growth is fundamentally driven by domestic concerns. So I read the yield curve inversion as reflecting US specific problems.

My concern with the US is all about the credit cycle. The curve inversion has a certain degree of reflexivity to it in that it is primarily a marker of worries around economic and credit distress. But the inversion also prevents banks, which borrow short and lend long, from getting as much net interest margin. And, in that way it restricts credit. So, in front-running a fed rate cut, the market is adding to the tightening of financial conditions that makes such a cut more likely.

The Fed: Let’s Play Chicken

How long can the Fed hold out against the market? Powell and his team have already caved by presenting a very dovish forecast at the March meeting last week. But, apparently, that’s not enough for the markets now. They want to see rate cuts. And while Rosengren is out of step, holding on to the pre-December Fed view, I have heard only faint noises from Fed officials about cutting in 2019. Chicago’s Evans, for example, downplayed recession risks in his most recent comments about the economy. And so, while CNBC focused on his comments that the Fed could let inflation rise to 2.5% before it hiked, the real message is that he is not prepared to cut.

Policy symmetry around the Fed’s 2% inflation bogey is not an issue since the Fed has been raising rates before inflation even reached 2%. It has acted as if 2% was a ceiling, not a target. So, in effect, the Fed has moved from a hawkish, tightening bias to neutral, as demonstrated by Evans’ comments on inflation. But, in some senses, it really isn’t dovish yet. Fed officials still believe they can keep rates on hold and ride this one out even though the bond market – for the first time in a decade – is telling them they need to cut.

The Fed is playing chicken with the bond market. Who blinks first depends on how the data come out. There is still plenty of bullish risk-on sentiment out there. The Lyft IPO pricing tells you that. Here’s a company with $900 million in losses in 2018, the largest ever for an IPO in history, coming to market. And people are so afraid of missing out that its IPO price range is now skewing higher. It could come out of the gate valued at $25 billion. That’s two-thirds more than the last private round that valued the company at $15 million last year. So the Fed could be right to wait and see.

On the other hand, a lot of the economic data have been weak, not because of residual seasonality, but rather because of change of change data shows a material deceleration. This is especially true for jobless claims.

I don’t have a strong view yet where this is going because there hasn’t been the credit distress that presages recession to make me feel recession is around the corner. So I am taking a wait and see approach too. Nevertheless, given risk asset valuations – equity and high yield principally – a recession is likely to induce a triple whammy from a decline in earnings, a decline in earnings multiples, and a cessation of stock buybacks furthering the decline in earnings per share. 40 to 50% downside risk is a reasonable worst case outcome.

So, the recession outcome is not something to be dismissed easily. It’s no longer an outlier. It is a reasonable worst case. And, right now, it looks like the Fed is willing to wait it out, hoping it has done enough to prevent a recession. But for me the depth of the inversion in the middle of the curve is beyond worrying. It demands a more aggressive response. We aren’t going to get it..at least not unless things get worse.

Comments are closed.