Despite perception Powell was dovish, the yield curve remains super-inverted

I mentioned earlier today that Federal Reserve Chairman Jerome Powell had a joint discussion with former Chair Janet Yellen and former Chairman Ben Bernanke at the American Economic Association and Allied Social Science Association 2019 Annual Meeting, in Atlanta, Georgia. Markets took their commentary to be dovish. And this added some major upside to the equity market rally today. The bad news, however, is that if you look closely, the US Treasury curve remains inverted. And that’s a warning sign for monetary policy that may have to be reversed as soon as this year.

The curve inversion

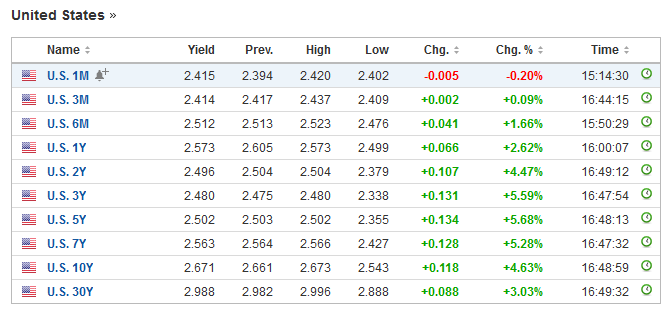

Let’s look at the full curve instead of just the 2-10 year spread that most people focus on.

Source: Investing.com

Here’s the inversion:The six month yield is higher than the 2-year, 3-year and 5-year. The 1-year yield is higher than the 2-year, the 3-year, and the 5-year too. But it’s also higher than the 7-year. And the 2-year is also higher than the 3-year.

If you look at the maximum negative differential as you go out the term structure, it’s 9 basis points from 1 to 3 years. That’s less than it was just a day or two ago. But that is still an inversion in the middle of the curve. Moreover, the fact that you have an inversion all the way from 6 months to 7 years makes me call this a ‘super inversion’. And by that I mean a significant enough inversion in the curve to warrant a pause by the Fed.

The Fed

But it’s not clear this is what will happen. I think Powell, Bernanke and Yellen made all the right noises about policy at their joint appearance. Yellen even mentioned how global economic and financial conditions caused the Fed to stand pat from December 2015 to December 2016 when the December 2015 summary of economic projections had penciled in four rate hikes for 2016. But the Fed’s guidance is still fundamentally hawkish considering it is telling us it wants to raise rates twice more even though the middle of the yield curve remains inverted.

I also saw Cleveland Fed President Loretta Meester. And she sounded pretty dovish to me too. She made it seem like the Fed was ready to stand pat for the time being. But, again, she did not walk away from the guidance of two more rate hikes in 2019. That makes me think the Fed is on hold through March, still with a possible first 2019 hike before we reach the halfway mark of the year. If the economy holds up decently well in the coming months, I expect this view to be validated.

Trump is a risk to the economy

Meanwhile, Donald Trump represents an increasing risk to both the US and global economy. The tariff issue was a defining part of the negative Manufacturing ISM released earlier in the week. But, more ominously, Trump is talking about keeping the government shutdown in place indefinitely and even declaring a state of emergency due to his not being able to get the wall.

It’s not clear why Trump is doing this. But, his instincts are for unilateral or autocratic action despite ostensibly being limited by other branches of government like Congress, the judiciary and the Fed. My suspicion is that Trump feels ‘cornered’ because of the Democratic takeover of the House of Representatives. And so, he is looking for a way to deflect and regain the narrative from the Democratic House by figuratively going to the wall for his Wall, pun intended!

How and when will there be pushback against Trump and from which branch of government? We saw the Fed rebuke him today. So we now know that Powell would not resign if Trump asked for his resignation. trump would have to fire Powell. And even then, the rest of the Fed would back the exact course of policy the Fed is already on. Getting rid of Powell won’t change Fed policy. But it could create a crisis

Mitt Romney’s pushback against Trump seems to have been rhetorical. When pushed by Jake Tapper on CNN yesterday, Romney didn’t have anything substantive to say about disagreements he had with Trump on policy. He specifically said he would have voted for the Wall if he could. So, Romney was merely making remarks about Trump’s tone, not his policies. That’s not real pushback.

Finally, there’s the judiciary. I believe we will see some critical decisions about Presidential power getting decided this year because Trump will push the envelope on these issues.

Summation

The Atlanta sit-down for the Fed chairs did a lot of good for the Fed. It made the Fed seem reasonable about heeding changes in financial and economic conditions, both domestically and abroad. And the Fed chairs specifically mentioned several instances in which the Fed has heeded changing conditions as proof that they are data-driven stewards of monetary policy, not set on a predefined course.

Nevertheless, to the degree the macro news is good, this is bad for risk markets but bullish for Treasuries. Because the Fed’s forward guidance is basically hawkish, any good news means a greater likelihood of rate hikes. And given the yield curve is inverted from 6 months out to seven years, that’s not a good thing.

Comments are closed.