A lot of people are still watching the flattening yield curve and distress in EM. And while I think both of these events are important, I am looking at a lot of other market signals, particularly US domestic credit markets. Here are some signals I looking at.

Look at housing

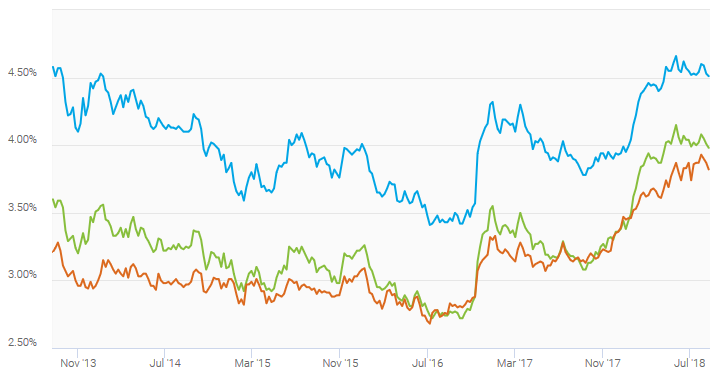

As you know, the way I am thinking about monetary policy is less about signals like the yield curve and more about acceleration and deceleration of credit. So as the Fed raises rates, I am looking for signs of stress that first appears in credit growth deceleration. One sector that matters is housing. Look at this chart on existing home sales.

Source: Trading Economics

There is a distinct deceleration in existing home sales growth. Right now, you could say home sales are largely flat. And if you look at data versus forecasts, the numbers have been weak, missing forecasts for the past three months in the middle of the summer selling season.

I haven’t seen any credible analyses as to why this is happening. I suspect, it’s a lagged response to the increase in 30-year mortgage rates, which have actually been coming down somewhat of late.

Source: Freddie Mac

But, notice that commercial real estate investors are piling back into the housing sector.

Amherst Holdings LLC is seeking to raise more than $1 billion to buy single-family rental homes as institutional investors show renewed interest in the young asset class, people with knowledge of the company’s plans said…

Other investors riding the wave include Pretium Partners LLC, which closed on a $1 billion fund, and Tricon Capital Group Inc., which announced a $750 million joint venture with the Teacher Retirement System of Texas and Singapore’s GIC Pte. Cerberus Capital Management is said to be raising more than $500 million to buy rentals.

I don’t see commercial real estate investment swamping the large market of existing home buyers. So they seem to be entering this market just as prices are cooling. So PE firms are paying peak prices and trying to use the rental income in order to satisfy yield hungry investors. The first CRS wave was successful in doing so. I don’t think this one will be. This is a big segment to watch as a canary in the coalmine regarding credit distress.

Leveraged loans and high yield could be in trouble

Another canary is the leveraged loan market. Consider its twin the high yield market as well. EM was the first high yielding market to crack, with both Argentina and Turkey hitting the skids. But none of this has affected US domestic credit markets. It’s really a case of hot money flows leaving EM for domestic markets so far.

But Moody’s is making some interesting comments on these markets, lowering recovery rates on leveraged loans from an average 77% historically to an expected 61% going forward.

And that’s on first liens. Moody’s expects second lean recovery rates to go down to 14%.

Here’s what they’re saying about high yield and leveraged loans:

They are making a case for the ‘subprime’ markets of nonfinancial business as the equivalent of residential subprime in the last business cycle. They are certainly of equivalent sizes.

Again, the selloff right now as the Fed raises rates is concentrated on EM. But we should expect the selloff to hit these markets as well in due course.

What the Fed is doing

One of the last comments I made regarding the Fed was buried in my note on Tesla before my holiday. But I think it sums up my thinking on where this is heading. So I will repeat it here”

What I have been saying since early March is that we are seeing a regime shift at the Fed. And while it isn’t clear to me we how exactly that shift will play out, what is clear is that it means the Fed has more of a tightening bias. And that means it is more likely to tighten in the face of uncertainty about macro signals from the economy.

The first group of risk assets to feel the impact was the emerging markets space. Look at what Fed chair Powell said in May. That was a clear risk-off marker for EM. And we have seen two nations – Argentina and Turkey – get battered in the aftermath of those remarks.

But the Fed’s tightening bias has risk-off implications for other risk assets as well. Boston Fed President Eric Rosengren told us this back in March…

That’s Fedspeak for “don’t assume there is a Fed put unless markets really get hammered. We’re going to err on the side of tightening unless and until the macro signals definitively tell us to halt or there’s an accident.”

The questions then are threefold:

- When will that accident happen?

- What sectors of the market will be involved in that accident?

- Will the Fed have enough firepower and can the Fed shift gears quickly enough after the accident to prevent a recession and financial crisis?

The third question is the most important. And I would suggest the answer there is no. But that’s getting ahead of the data. Right now, the US economy looks good. None of the emerging market distress is leaking into US domestic credit markets yet.

The concern has to be the future, particularly nonfinancial business leverage and the housing market given the amount of commercial real estate money tied up in that market. The cracks are beginning to show in housing. But only regarding existing home sales, not defaults or prices. I am less concerned about households this go round. But they will suffer if distress appears in the nonfinancial business sector.

Comments are closed.