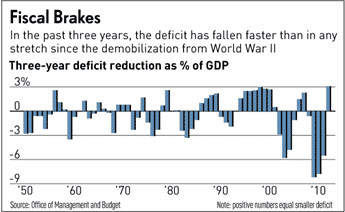

Chart of the day: US deficit reduction 2009-2012

This Great Graphic that shows that deficit reduction in the US over the past three years is largest in more than 60 years. I found it at the Investor’s Business Daily, which of course, is not known for its leftist leanings.

The US budget deficit has fallen 3.1% in the 2009-2012 period. Besides the demobilization after WWII, the other time the deficit was cut quicker was the tightening of fiscal policy in 1937 served to extend the Great Depression.

This has gone largely unrecognized and did not even come up during the most expensive presidential campaign in history. The sub-par growth in the US since the economy bottomed in 2009 is partly a function of balancing the needs of fiscal consolidation with the demands for growth.

This also puts the “fiscal cliff” in a different light. The “cliff” is of America’s own making. It is not being imposed by investors, as has been case for the peripheral countries in Europe. Capital is not striking against the US. But more, the fiscal cliff itself is not as much an economic problem as a sign of the dysfunctional political process. How it is avoided, mitigated or postponed, is itself a reflection of that same dysfunctional process.

There is a reason that it doesn’t come up because we are still pushing through 1 trillion a year negative and our debt doesn’t go parabolic until 2022-2050 when Mandatory payments explode. Also look what we have done to try to get the economy to grow just a sub 2%. Low taxes, low interest rates and trillion pushed into the system by the government and we are still negative. We are the first modern day country to have now three financial bubbles with in less than a 20 year span. This shows a economic problem where we need financial bubbles to pay the bills

The bubbles did mask the problem, but it also hid the fact that mainstream economics missed the real problems for so many years. The trade deficit was a serious problem for many years and because that was not dealt with it meant that the government had to run a deficit to balance the outflows from trade. The mandatory payments problem does not exist. There is always the option of raising taxes or pushing entitlements out by raising retirement age. Then at the very worst the Fed could simply print money again.

The fact that the Fed kept fuelling bubbles with ever lower interest rates showed that they failed to understand the problems then and now. WIth the artificially low rates we have now the debt may be manageable in terms of interest payments but the debt is still there. No return to normality can take place until these debts are significantly lower. There will be another massive financial crisis before long and this time the economy will implode, as interest rates cannot go any lower. The problems are that debts need to be written down, as fast as possible. This will constrain growth, but since the borrowing to sustain the economic model is seriously limited., growth will be limited.

There is interesting insight given above by Chandler but it of course the one half of a story. Thelogic of the market has altered fundementally but has not been priced.

Risk is off, de facto. It is only the stupid who do not hedge effectively since Scholes got his Nobel gong and finance becams a babana boat. Risk is off, for ever, but the premiums demanded in returns stand proud causing havoc.

Long term trading deficits will harm any economy, those ignoring this reality do nicely from trading margins but trade international trade does not an economy make, unless it breaks it first. Trading is not economucs but today the two stand weldec into the grotesque insanity that is short hedging. We love you Myron, honest we do. Never trust someone else with your money, ever. Especially if you have not, and never will, meet them.Alan Greenspan skidded to earth on that unregulated banana skin.