More on the US Treasury yield curve inversion and widening bond spreads

The equities relief rally

Yesterday was a relief rally in stocks due to the China-US trade truce deal at the Buenos Aires G-20 meeting over the weekend. But this truce is not that significant economically. As I indicated yesterday, though, this deal was very amorphous, very squishy. The quid pro quo terms that China has agreed to aren’t very specific. And there are conflicting messages about timing. This freeze is bullish (for equities) but not dramatically so. But, it is bearish for rates. And that’s where I want to focus.

The yield curve inversion and Powell’s neutral rate comments

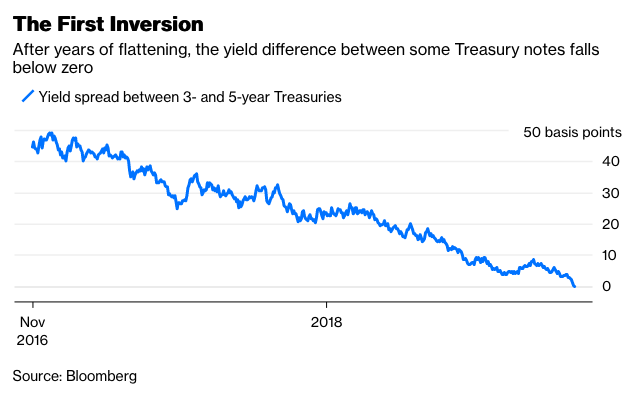

I’ve already written this up for gold investor members, so I am not going to go into huge detail here. But yesterday, the US Treasury yield curve inverted between 2- and 5-year rates. Right now, the 2-year is trading at 2.82%. While the 5-year is trading at 2.81%. So, the curve remains inverted. Bloomberg has a good chart of how the similar inversion of 3- to 5-year rates has come about.

Also note that the spread between 2- and 10-year Treasuries is at just 14 basis points now. We are getting dangerously close to inversion there as well.

The key here is the Fed because Fed officials have given mixed signals about how much they care if the curve inverts. We are going to hear testimony from Fed Chairman Jay Powell and it will be interesting to see if he says anything about the neutral rate. I maintained last week – contrary to most analyses – that the Fed had not actually changed messaging. It did alter tone and stress as a hedge against data weakness in case it needs to downshift on tightening. So, it’s important to see if Powell addresses this.

Yesterday, the Wall Street Journal’s Nick Timiraos wrote a piece that makes the same point I was making last week. So, let me quote it:

Markets soared last week after Federal Reserve Chairman Jerome Powell signaled fresh flexibility in how the central bank sets interest rates in an economy facing uncertain crosscurrents over the next year.

But Mr. Powell didn’t say policy makers’ economic outlook had changed, which would justify a downshift in the central bank’s policy path…

Markets rallied last week because many investors believed Mr. Powell had signaled such a shift, though the full context of Mr. Powell’s remarks didn’t explicitly reveal one.

He observed that the Fed’s benchmark short-term rate, in a range between 2% and 2.25%, was “just below” the range of neutral-rate projections submitted by 15 Fed officials at their September policy meeting, which varied from 2.5% to 3.5%.

Some commentators abbreviated Mr. Powell’s statement to make it sound like he believed rates were just below neutral. Mr. Powell hasn’t said where he thinks neutral lies or what should happen to rates once they get there.

Now that the curve has inverted, this becomes a much bigger issue.

Look at Randal Quarles

If you want to know what Fed officials were really thinking in the lead up to the inversion, look at Federal Reserve vice chairman Randal Quarles. Here’s how Reuters described his views yesterday:

After a week in which markets have swung in their interpretation of where the Fed is heading, Quarles appeared to anchor the Fed’s ongoing move towards slow but steady interest rate increases.

“We should be data dependent but not reacting to every wavering of the needle across the dial…We have described in all the communications tools a path that is pretty clear,” Quarles said. “We are following a strategy and taking account of data over time as it comes in and in response to significant changes in direction.”

I know the headline on last week’s article by my friend Pedro da Costa talks about a “looming policy shift“. But, the correct way to interpret the Quarles statement – and it reinforces what I’ve been saying – is that the Fed continues to support their existing policy guidance. And while they are more cautious today than a month or two ago and remain data dependent, it will take “significant changes in direction” to get the Fed off that guidance.

So, Quarles is saying that, just because we have a few market hiccups or a slightly lower GDP growth rate, it won’t mean deviating from the existing policy path. You need to see a consistent and large directional move. And we haven’t had that as yet. Moreover, I don’t think we will get it until the holiday shopping season is over, because US consumers will spend more for this year’s holiday. Maybe we will get it early in 2019. But we’ll get at least two rate hikes before then.

All of this has created the inversion. The bond market is telling us the present policy path risks a slowdown that will cause the Fed to eventually pause and reverse course.

What about other bond yields?

What should be alarming is how this happening against a backdrop of rising spreads. Even though oil prices have had a couple of good days, they are a major factor. Energy companies represent 15% of the Bloomberg Barclays U.S. corporate high-yield index. And there is a lot of debate about the low ‘break-even’ prices that junk-rated shale oil producers have been touting.

For one, break-evens generally exclude such key costs as land, overhead and even at times transportation. Companies also frequently tout the low break-even price point of a portion of their holdings, without citing the higher price for crude needed to profitably exploit the rest, or adjusting for the inflated cost for drilling contractors and other services that come with rising oil prices.

Independent financial research firm CreditSights says five oil companies will go from cash-flow positive to cash-flow negative in 2019 if oil prices stay around $50 a barrel rather than $65 a barrel, as it had assumed previously. And as I’ve been telling you, this means credit stress.

So, from early in October through the end of last week, the spread over Treasuries for the average junk-rated bond increased to 418 basis points from 303. It was worse for energy bonds. The average spread there jumped to 561 basis points from 352. And remember, this is because US WTI crude prices fell 33%, even dipping below $50 last week.

My view

So, we are in a relatively strong near-term economic environment in the US. The numbers have been strong enough for the Fed to maintain existing guidance for four more rate hikes through the end of 2019. And given the data I have seen, we should expect the holiday shopping season to confirm continued near-term economic resilience.

With the Fed only moving away from its guidance if data weaken or strengthen significantly, we are likely in a holding pattern for a few months. And that means the Fed is likely to maintain policy action and policy guidance through March. Thus, we will probably get two more Fed Funds rate increases before the Fed has a chance to change any guidance.

And since policy acts with a lag, this means by mid-year 2019, we will have a number of rate hikes whose impact will be working their way through the financial system. I expect the curve inversion to worsen as a result and eventually take the 2-10 year spread into inverted territory. We are only 14 basis points away from that outcome now.

Comments are closed.