How an unchanged financial system and credit stresses will prove problematic in the next year

Happy Tuesday! In the US, the summer holiday season is officially over today. And so, markets here are fully re-engaged. That usually means a reassessment of the economic, political, and investing landscape. And that has sometimes led to volatility. Below are some of the things on my mind as this Fall begins.

1 – Martin Wolf on the unchanged financial system

Let’s start off this week with a review of the excellent Martin Wolf piece in the Financial Times about what policy makers have achieved since the financial crisis. What Martin says is that the goal of policy was rescue: “stabilise the financial system and restore demand.” There was no aim at making fundamental changes to the macroeconomic architecture.

And indeed, there have been no changes. There has been a little regulatory tweaking here and a bit of adjustment to capital requirements there. But, on the whole, we are using the exact same financial architecture we did before the financial crisis.

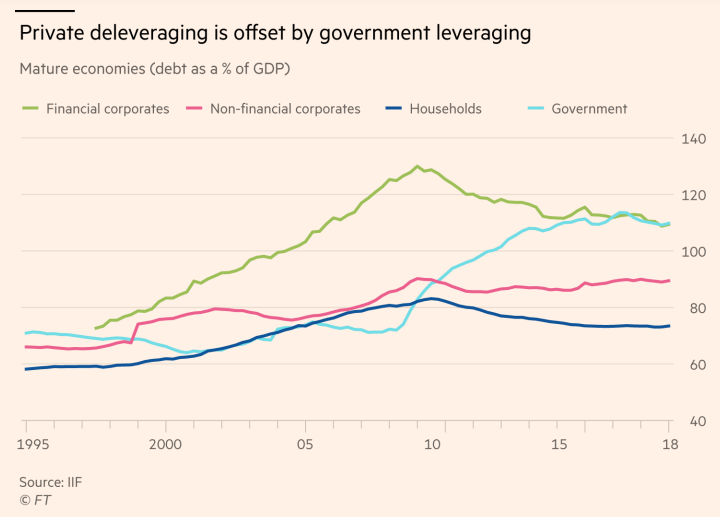

The result is that – after socializing the losses of financial corporates through government deficits in the acute phase of crisis – monetary policy has been the only game in town. Ultra-low interest rates has allowed a releveraging among non-financial businesses to offset household deleveraging. And so, in terms of aggregate debt percentages for developed economies, we are largely where we started.

Deeper dive: In developed economies, the Achilles heel seems to be business debt and leverage rather than household debt. – though this varies from country to country. Households in the bubble countries – Ireland, Spain the US and the UK – have seen a massive deleveraging.

But households in Sweden, Canada and Australia are still particularly vulnerable to a fall in house prices.

The big difference now, though, is that debt in the emerging markets is much higher. And a large swathe of that debt has been borrowed at low rates using the currencies of mature economies.

Now, during the financial crisis, we saw the devastation that borrowing in Swiss Francs or Euros had on the households of Eastern Europe, where many mortgages were taken out in foreign currency. This time, however, the problem is more widespread and it’s corporates and governments on the hook.

That’s why we are seeing a crisis form in the emerging markets as developed economy central banks normalize rates.

None of this goes to Martin Wolf’s main point though – which is on economic and political vulnerabilities in the developed economies. So I suggest you give his column a read.

2 – Inequality and immigration are big unresolved issues in the developed world

When I look at mature economies, across the board I see a rise in xenophobia. Now, in my last daily post a few days ago, I wrote about ‘Zeitgeist’ phenomena. And the word I wanted to focus on was ‘normalization’. That’s because, as I put it, “the Zeitgeist exists because certain things get normalized, accepted and gain currency. Some previously normal things become cool. And some previously shunned behaviors and norms become ‘normalized’.”

In today’s world in developed economies, xenophobia has been normalized. So when people ask why, I tend to discount country-specific explanations and look for commonalities across the developed world. And invariably I come back to the lack of change after the financial crisis.

The narrative Martin Wolf tells of so little changed since the financial crash makes sense to me – not just in the aggregate figures, but in how I believe ordinary people in the developed world see things. Look at it this way: for most people, we had a cataclysmic event that turned their worlds upside down. A lot of people lost their homes, their jobs, their dignity. This was an economic earthquake – and one caused by human agents. Yet no one has paid the price for it. No one went to jail at the biggest financial institutions. And they’re back to earning billions of dollars a quarter. And the captains of industry are doing better than ever.

Meanwhile, on an inflation-adjusted basis, the average wage earner are barely getting by. From her perspective, it’s not that nothing has changed. We’ve gone through a catastrophe the brunt of which wage earners bore. And there’s been no payoff. So in many cases, people feel worse off.

Who’s to blame for that? When you have politicians like Donald Trump pointing the finger at an ‘invasion’ of foreigners, it makes for a compelling target. Now, in the US, a lot of people are saying Trump voters are racists. But let me ask you this: is their alleged racism due to their moral depravity or is stoked by the political forces into a ‘Zeitgeist’? Using analogies, were the Hutus and Tutsis in Rwanda and the citizens of the former Yugoslavia crazed lunatics who just started killing each other? Or were their latent prejudices exploited and stoked?

I think what we’re seeing in the developed world is a natural outgrowth of the inaction of policy makers on the key issues of inequality and globalization. After the seismic economic turbulence of a financial crisis, going back to the status quo simply doesn’t work. That’s why – despite seeming economic growth and low unemployment – populists everywhere can point the finger at targets to blame.

And this will only get worse in an economic downturn.

Bonus: For a good example of how all of this works in practice, look at the FT’s piece on Gothenburg, Sweden. With elections coming up in Sweden, the piece is very timely.

3 – Will EM ricochet back onto DM?

I have been out in front of this emerging markets crisis, claiming two months ago Turkey was a potential canary in the coalmine. Unfortunately, we are indeed seeing a significant amount of contagion. When Turkey falls out of bed, there’s no reason for it to have any impact on South Africa or Brazil. Those countries are not inextricably linked. And when Argentina announces several new austerity measures like closing ministries and grain export taxes, this has nothing to do with Turkey or India. Yet, when these measures were announced, we saw pressure on EM currencies across the board.

The weakness here is the debt – and specifically foreign currency debt. The question here is the wherewithal. Can we create a firewall between the countries already in trouble – Argentina and Turkey – and the rest of the emerging markets universe? Or will the foreign currency debts throughout EM make significant contagion inevitable, creating a domino effect?

I think developed economy monetary policy plays a central role here because it is driving the liquidity preferences of mature economy investors. And these investors are leaving EM because their central banks are tightening policy and raising rates. That exacerbates the problem.

Watch to see not just how central bankers in the US and Europe talk about their role in this crisis, but what they do and how their policy evolves.

Why this matters: The big question, though, is whether what happens in EM will cause trouble for the developed economies. Riskier asset classes in the US are doing well in terms of default ratios and bond spreads. But we are seeing warnings.

Moody’s recently withdrew credit ratings for inaugural bond offering, even though investor demand had caused the issue to be upsized 40%. Back in May, Goldman warned that the riskiest junk bonds, rated CCC or lower were ‘mispriced’ the most since 2007. In May, Fitch downgraded $2.5 billion of Illinois bonds backed by sales taxes five notches, rating them almost like general obligation bonds of the state.

So, spreads may be declining, defaults may be low, and investor appetite for even risky personal loans may be increasing. But underneath, the warnings are mounting. What has happened in emerging markets will eventually spread to the riskiest segments of the developed markets, especially if the Fed and other central banks continue to raise rates.

4 – What is the yield curve telling us?

I don’t think the yield curve is saying a ton right now. The flattening of the yield curve is really mostly a sign that monetary policy is becoming less accommodative. But we know that already. Where the rubber hits the road is inversion. And we’re not there yet.

What we need to ask – in the context of warning signs for risky assets – is whether the yield curve is putting out definitive stop signals for policy makers. For example?

- how likely is it that the yield curve can steepen from here while the Fed raises rates 2 more times in 2018 and several times beyond that date?

- If the yield curve doesn’t steepen, but flattens further, what is the likelihood that it inverts?

- If the yield curve inverts, what is the likelihood of a recession if the Fed immediately pauses and remains on pause until further notice?

- If the curve inverts and the Fed continues to hike, what is the likelihood of a recession?

When you hear Fed officials talking about the yield curve, these are the questions going through their head. They want to ‘normalize’ rates, but not if doing so triggers so much credit stress that it creates a recession. Their goal is to move rates higher and forestall inflation without damaging the real economy. And they are asking themselves this series of questions as they continue to raise rates.

My sense here is that the Fed will raise rates two more times in 2018 and look to continue to raise rates in 2019. With headline unemployment below 4% and the US economy’s quarterly growth running above 4%, they are saying to themselves: “if we can’t hike now, then when?”

Why this matters: By the time this year ends, I expect the curve to be nearly flat from 2 to 10 years. I don’t expect a huge uptick at the long end. And so most of the Fed’s tightening will be felt at the short end, causing the curve to flatten. In December, I believe they will be met head on with the question as to whether they should raise rates and cause the curve to invert. And, likely, they will pull the trigger.

Credit stresses in riskier segments of the market will mount in 2019. And the Fed may become significantly less hawkish by that time. But it will likely be too late by that time. That’s my current read. Let’s see what happens to change it.

Thanks for reading,

Edward

Comments are closed.