Looking past slowing global growth

This morning, Reuters confirmed my view that the European Central Bank will look through weak euro area data, with an eye to normalization. And I believe the Fed will do as well. The Bank of England and the Bank of Japan will soon join them in normalizing. None of this threatens a recession until the latter half of 2019. Let me update you below on my thinking about how to read the situation.

Understanding the macro backdrop for normalization

Here’s what I was saying in December about how the year would shape up:

The stage is now set. We are well into the business cycle, with the real economy doing as well as it has done for the last decade, but also with financial assets at frothy levels. Against this backdrop, there is a dangerous releveraging driven by household debt and house prices.

The UBS Housing Bubble Index shows a number of cities with house prices at significant risk of a future correction pic.twitter.com/3dzXUDfPMU

— Edward Harrison (@edwardnh) 20 November 2017

If central banks try and lean against these asset markets with interest rate hikes instead of through macroprudential means by “loan-to-value caps (on the borrower side) or credit growth caps (on the lender side) are designed to force borrowers and lenders to internalise the impact of large credit expansions on the probability of a systemic crisis” as the BIS suggests, you could see a financial crisis.

My baseline assumption now is for continued growth in the US, with the headline rate of unemployment dipping well into the 3% range in 2018, drawing a more aggressive response from the Fed than currently anticipated. After three rate hikes by mid-2018, the US yield curve should be near completely flat. And it’s at that point that the rubber hits the road. If the Fed continues to hike into those pre-conditions, I believe it will do so in an environment of slowing economic and credit growth with potentially large negative downsides for 2019 and beyond.

The four questions to ask about this economic cycle

I still think all of that is true. We need to look at four separate questions.

- What is the real economy backdrop? I said it was good in December. It is still good today despite some slowing.

- How does the financial economy look? I thought it looked frothy in December. And I still believe that today. But there are incipient signs of stress in the financial economy as policy normalization builds. Let me talk to these later.

- What will the central banks do? The biggest question is not what they say they will do. Instead the question is what they actually do given the incoming data. What’s their reaction function?

- How does fiscal policy impact the growth trajectory? I see fiscal policy being a real boon to growth in the US. Now the Federal Reserve will offset that. But it does provide a cushion that makes recession in the US less likely. Elsewhere, fiscal policy is also less restrictive too.

I will cover each of these four topics below and come out with an overall assessment.

The real economy is slowing, but not precipitously

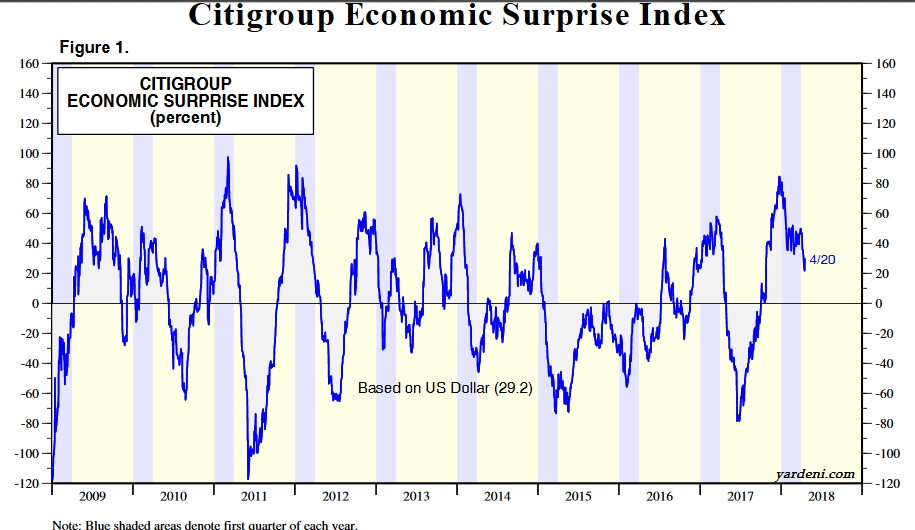

I don’t see the end of this business cycle on the horizon. The data have been weak. And I pointed to Citigroup’s Economic Surprise Index (CESI) in Europe last week. But the data have surprised to the downside globally. Here’s the chart from Ed Yardeni.

Source: Yardeni.com

Notice that the series is mean-reverting. And we have seen the CESI turn negative multiple times without a recession during this economic cycle. The one cautionary note I would add is that the numbers have a long way to go down. In Europe, they are already deeply negative and expected to mean revert. In the US, that’s not the case.

A lot of the downside we have seen in US Treasury bond yields owes to the weakness in the CESI. Think of the 10-year rate as moving up or down in concert with positive and negative macro surprises. And that explains a lot of the recent yield curve flattening we have seen. The short end is anchored by near-term fed fund rate increase expectations while the long end is reacting to negative incoming macro data.

Expect this dynamic to continue through mid-year, with the curve flattening to 25 basis points. If the 2-year moves up to 2.75% on the back of Fed guidance, that would leave the 10-year largely unchanged. That’s my baseline for now.

In terms of actual macro data, Q1 will be weak in the US. The Atlanta Fed is tracking it at 2.0%. And that’s bang inline with the forecast for Friday’s release. Friday will be a big day for data. We get the Personal consumption expenditures, employment cost index, Michigan Consumer Sentiment. as well as the GDP numbers. So expect some market volatility.

I think a lot of Q1 is residual seasonality and expect Q2 to be better.

It’s EM and Europe data that have been weak

The place to worry is elsewhere. With G-10 policy normalization on the horizon, that’s negative for emerging markets. And the data there have already been weak.

Since governments and companies there often borrow in developed economy currencies like the US dollar and the euro, their costs of funding will increase. Moreover, hot money flows could create liquidity problems that negatively impact capital investment.

I know Jeremy Grantham has been talking about rotating into emerging market assets because of their relative value. I question whether that will work over the short-to-medium-term. Trade tension will exacerbate the vulnerability.

The data in Europe have been weak as well. The threat from diminished trade flows makes Europe especially vulnerable given the eurozone’s move from a balanced current account position to a net surplus zone.

But I expect mean reversion, meaning more upside data in Europe. We should worry only if Q2 and the beginning of Q3 look weak too. That gives us at least three months to look at incoming data. And what happens in that timeframe will be crucial for the ECB in deciding whether to end quantitative easing this year. I expect they will.

The financial economy is where we have to worry

On Wednesday, I moderated a panel at the 2018 Hyman Minsky Conference held by the Levy Economics Institute. And while I was there, I got to talk to veteran economic advisor Frank Veneroso about his data on debt and asset prices. His view: the macro data we see on US corporate leverage wildly understates the problem.

So the situation is one where asset price valuation indicators are above historical means. And we have a synchronized monetary tightening happening against a backdrop of elevated corporate leverage. That’s a recipe for crisis — not just yet, but down the line.

His data are not public, so I won’t speak to the exact figures. But the overall gist is that the household deleveraging in the US has been completely swamped by a simultaneous bigger corporate leveraging. And that leverage has gone to buying back shares, boosting earnings (artificially). When the economy turns down, financial stress will engender a corporate deleveraging and precipitate a financial crisis.

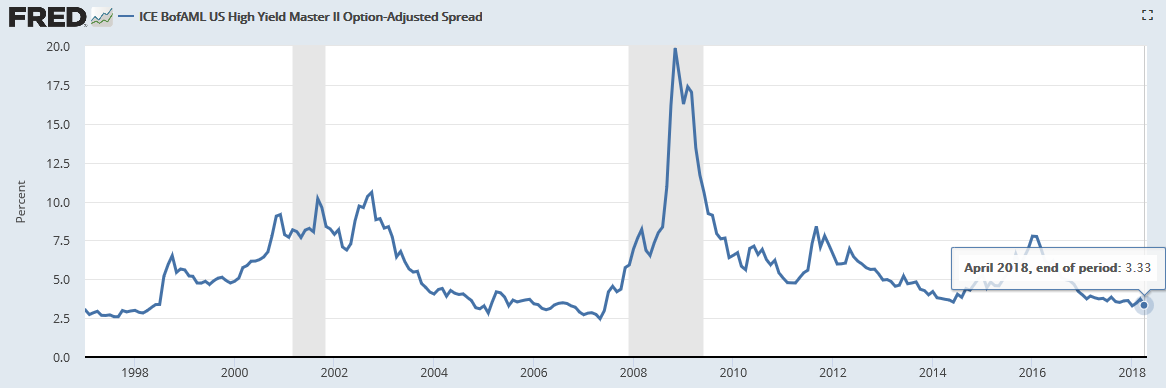

Now, this is not a near-term prediction. Most financial conditions indicators show clear sailing. High-yield debt spreads are at their tightest levels, for example.

Source: St. Louis Fed

The canaries in the coal mine

But there are incipient signs of credit stress. I mentioned the subprime auto sector on Wednesday. The sectors I watch are subprime auto, commercial real estate, retail, student loans, leveraged loans and high yield.

On an individual debtor level, I would also add Tesla as a canary in the coalmine. I am thinking of Tesla today as one analogue to the Amazon of two decades ago. See my thoughts on that here. But the upshot of that comparison is that it’s now “Show me the money” time for Tesla. This year is make or break. If they can’t meet targets in the Fed’s rate hike environment, bad things will happen. And that will spook markets far and wide. Something to watch

One other incident that has alarmed me is the retailer Bonton. It’s a store that I like and have used when shopping in Pennsylvania. Back in February, I mentioned that it had declared bankruptcy as a non-systemic event. But now it appears Bonton is headed for liquidation. That’s a really bad sign for the retail apocalypse, a true canary in the coalmine because the sector is large. When credit cycle stress begins, expect other retailers to follow Bonton’s model and liquidate instead of following a credit workout. This will be a catalyst for more downside in both the real economy and in the credit space.

The Fed is looking through all of this

So that’s the background as the Fed decides whether to hike 3 or 4 times in 2018. Two hikes is an outcome that is almost fully off the table. The only question now is whether we get three or four and how many we get in 2019.

I’ve spilled a lot of ink on this. So I am going to leave it short. But the overarching theme is that the Fed has a tightening bias. And that basically means that negative data will not forestall rate increases unless really negative. On the other hand, positive data will accelerate the timetable.

In this context, it’s interesting that Fed officials have started to talk about the yield curve. I have heard Evans from Chicago, Williams in San Francisco and Bullard in St. Louis all making comments. Their message seems to be that they aren’t dismissing flattening. Instead they are telling us to focus on the fact that the US economy is doing well. They will stay on their present path, then, unless and until the yield curve is close to inversion. And then we’ll have to take a look-see.

From a credit market perspective, that means no relief for marginal debtors. The noose is going to tighten. For interest income, that’s bullish. And that will add some impulse to GDP growth as I believe banks will begin to pass through the hikes to savers. But that’s going to take away the need to reach for yield. Again, marginal debtors beware.

At some point in 2019, we will see the signs that more Bontons are about to happen. But, by that time, the die will be cast. The Fed’s policy in late 2018 will be the make or break because that’s when I believe we will flirt with inversion.

Fiscal policy tailwinds

Fiscal policy will be adding a safety net of sorts, while all this is happening. In fact, many Fed officials have said that fiscal policy is the biggest economic tailwind of all.

One way to look at this is as the Fed offsetting loose fiscal policy with monetary policy. Another way to look at it is as the safety net of fiscal stimulus allowing the Fed to ‘reload’ for the next downturn.

If you look at monetary policy offset to US fiscal stimulus, it’s not a good look. And that’s because financial conditions are easy and asset prices are high. If we were talking about offset soon after the S&P bottomed at 666, that would be a great story. Instead, we are at risk of Minsky financial instability dynamics playing out with monetary policy offset being applied this late in the cycle.

If you look at the ‘reload’ narrative, it is also problematic. The Fed has typically needed a full 6 percentage points of policy relief in cutting cycles since 1982. Even if we get to a federal funds rate of 3% before recession hits, we’re only talking about half of the ‘ammo’ to prevent hedge and speculative borrowers from turning into Ponzi borrowers.

In the meantime, policy normalization will occur in Europe and Japan as well. Fiscal policy provides less relief in Europe where the German model of tight fiscal policy is balanced by current account surpluses. This leaves Europe especially vulnerable to any hiccup in trade flows or to a generalized economic slowdown. When the economy turns down, the politics — particularly in Italy — will be volatile. I will have a lot more to say about this going forward.

Smooth sailing for now

But I want to wrap up saying that we have plenty of time before a recession or financial crisis hits. I don’t see the recent global growth figures as indicative of a slowing to recession.

My worries are about financial fragility caused by high asset prices and corporate releveraging. If the move to normalization proceeds slowly and regulators use macroprudential tools to tamp down on potential crisis trigger spots, we could see a beautiful normalization globally.

And even though the Fed has downplayed the yield curve, I will continue to use it as a guide to how well the Fed is handling this process. Negative credit dynamics will take over in 2019 if the Fed doesn’t heed any warnings from the yield curve in 2018.

Comments are closed.