A few comments on Helicopter Money

This post is going to just be a collection of thoughts I have on the subject of helicopter money based on conversations I have had with people for and against the idea. The latest proponent of it who has written is Adair Turner, Chairman of the Institute for New Economic Thinking. I recommend you read his piece.

I have two strains of thought competing for my attention on macro issues. The one strain is essentially pro-Austrian Business Cycle Theory in that it tells me that policy choices to stimulate the economy in hard times can lead to misallocation of resources and investment capital that has to rejiggered at some point down the line. This strain says that any policy of intervention can help redirect capital to projects and enterprises that are starved for capital but that the same policy will not be able to channel where that capital goes. And as a result, stimulus will have the unintended consequence of pumping up sectors of the economy that require large capital investments over long periods of time to ever be profitable.

The result then of the stimulus is an unbalanced economy. And we have seen this time and again. We saw it in TMT in the 1990s, in housing in the 2000s, and we see have seen it again this decade in energy and autos. The question, of course, is how the economy finds balance and whether this process destroys the benefits of the stimulus. Adherents of the Austrian School say that economic balance will eventually come but only at the expense of growth, and that the stimulus will have been wasted as a result.

The other strain of thought is essentially Post-Keynesian in that it tells me government has fewer legitimate hard constraints than our institutional arrangements would have us believe. As the Japanese efforts show, government can go on deficit spending for quite a while without risk of default. This was even true under Bretton Woods which came after the British ran up a huge government debt burden through two world wars and a Depression without default. And the British post-war growth record was enviable by today’s standards even so.

In a world of deficient demand for goods and services, we therefore know that, over the long term, the private sector will be saving, net of investment – and that automatically puts pressure on the government sector. Deficient demand means private surpluses. And that means government deficits and increased government debt, fueling mercantilist thinking about ways to avoid the private/public sector account tension. But, for every current account surplus like Germany’s or China’s, there has to be a current account deficit like the US’s or the UK’s.

So when I think about helicopter money, those two competing strains of thought are in the background. The Austrian strain is telling me that helicopter money has the potential to add stimulus that creates economic imbalance. Meanwhile, the post-Keynesian strain tells me that without stimulus, we will still have government deficits due to demand shortfalls – and this will drive policy into a nationalist direction.

The question therefore is about how to durably raise demand in such a way that people do not feel so burdened by debt during the next economic downturn that they force a severe deleveraging. I lead from the aggregate demand shortfall as the base constraint, meaning that when I read Bill Gross opining about Helicopter Money as a means for combatting technological displacement, I am thinking the demand shortfall already exists; technology is just an added potential constraint.

My assumptions here are twofold. First, the levels of private debt that we have now – which are multiples of the post World War 2 levels – are constraints to spending. They act as a check on spending because many economic agents in the private sector – individuals, households, and businesses – will find themselves in debt distress when the local or national economy turns down cyclically. Monetarily sovereign governments don’t have this hard constraint since they issue debt in a currency they create. And so what this means is that a each cyclical downturn, the private sector will in aggregate deleverage, increase savings in order to pay down debt or simply make debt service payments in a distressed situation. That means a durable demand shortfall and high government deficits and increased government debt.

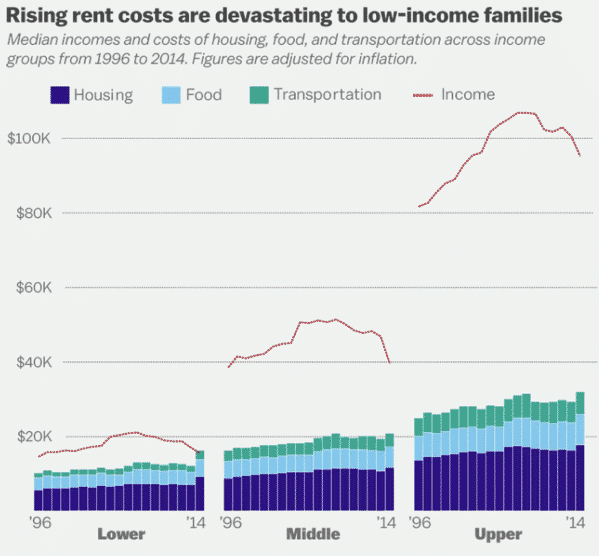

Second, the marginal propensity to spend of middle class to lower income agents is higher than the so-called 1%. The chart below from Vox best sums up why.

It shows the head room different income groups in the US have before their income is exceeded by their outlays. And to the degree these households save for retirement and other purposes, we should expect that the group with the higher income will be able to save a larger percentage of its income and spend relatively less. So when we have rising income inequality as we do now across the developed economies, it naturally means a redistribution of income to agents with a lower marginal propensity to spend. And this leads to slower growth.

Having said all of this, my sense is that the consolidated balance sheet approach, helicopter money and universal basic income won’t work to solve our problems. We have both stock and flow problems that have deep underlying causes and have been unchecked for decades. Stagnant median incomes and Income inequality have been rising for decades in developed economies. And private debt as a percentage of income or output has been multiplied many times over in countries like the US and Australia.

How is helicopter money or universal basic income going to change this? What will people’s reaction be to the perceived fairness of these schemes? Will people turn to populist candidates because of perceived policy failure? How long will it take for both stock and flow problems to diminish? And will politics intervene as nations turn inward before durable results are achieved? These are the questions I ask myself regarding helicopter money and also on basic income. I don’t think any of us have the definitive answers. But I do think these questions are the ones to be asking and that we will be asking them for a very long time to come.

Comments are closed.