Scalability and the K-shaped recovery

I was reading something this morning about Fed Governor Lael Brainard recommending monetary and fiscal support to stop a K-shaped outcome where the less well-off lose and the most well-off win.

“This strong support from monetary policy – if combined with additional targeted fiscal support – can turn a K-shaped recovery into a broad-based and inclusive recovery that delivers better outcomes overall,” Brainard said.

That’s a contentious debate now, whether monetary stimulus works to prevent income and wealth inequality or to entrench it. I tend to believe the latter. But I reckon this is why Brainard focussed on the two-pronged stimulus attack as best.

Why is there a K?

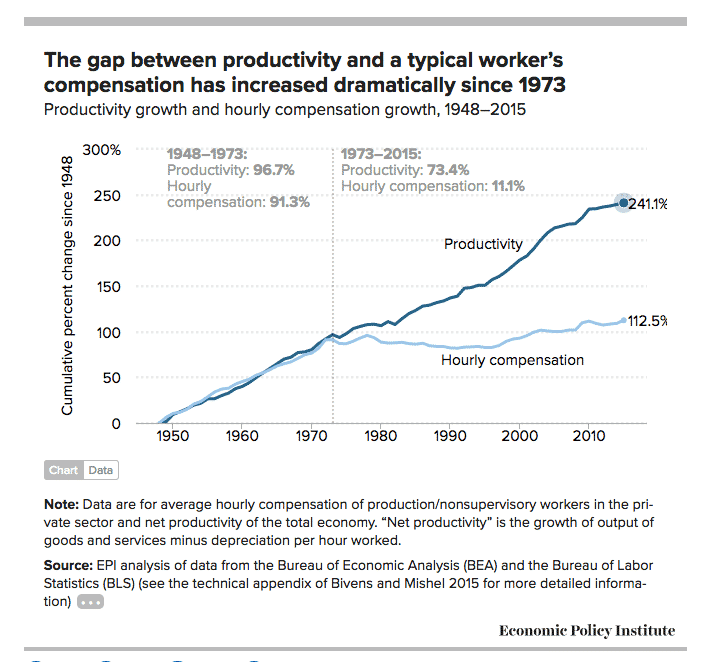

Her comments got me to thinking more deeply about this concept of a K-shaped recovery and why inequality is increasing in this recovery – and why it has been increasing for decades. My immediate thought went back to this chart I posted as I discussed Baumol’s disease in 2017, where US hourly compensation has stagnated despite a rise in productivity.

To me, this chart is a quintessential hallmark of inequality, where most workers are not compensated for the gains in productivity. Any profits that accrue from those gains go to the so-called 1% (and maybe the 10% as well).

There are a lot of postulated reasons for this increase in inequality. The end of the Bretton Woods currency regime, the loss of labor union strength and globalization come to mind. Jonathan Tepper did a good job in making the case for industrial concentration too in his book with Denise Hearn, “The Myth of Capitalism“.

But while inequality has increased dramatically in the US, it is not the only place where we have seen this phenomenon. Inequality is rising everywhere in the developed world. And we also see it in many emerging markets like India and China. So, there are clearly trends that cut across countries, from the most developed like Switzerland or the US, to those with burgeoning middle classes like India and China.

With that as context, I’d like to focus on scalability.

Scalability as the K-shaped bogeyman

I wrote a tweetstorm on this yesterday. So I have been thinking about this a lot recently. Here’s my macro view.

In business, economies of scale and scope are known concepts whose benefits companies have striven to attain for decades. The concept is that larger businesses can have fatter profit margins by increasing productivity through the cost savings of getting big. This is an advantage that Walmart has had and that Amazon has too.

But, as software has become increasingly important in business models to gain these advantages, the technology itself has become the ‘economy’. That economy is called scalability. And what I think is most important about the idea of scalability is that it means using technology to increase revenue without a concomitant increase in costs.

I saw the benefits (and drawbacks) of scalability first hand in the Internet bubble when I worked at Yahoo. As the company got bigger, the fact that it was a software company whose revenue depended in large part on automation, machine learning, and algorithms, meant that the increase in revenue required much lower increases in costs. Most of the revenue ‘fell to the bottom line’. The term ‘operating leverage’ was often used to describe this phenomenon. Of course ‘leverage’ works both ways. So when the bubble burst, Yahoo’s profits imploded, as the costs remained relatively fixed relative to the revenue loss.

But scalable business models are ubiquitous now because of the advantages they confer to shareholders as the companies grow. Growth in earnings per share can far outweigh revenue growth if you have a scalable business model. And so, scalability has become almost a fixation around the world, as companies compete for shareholder attention and strive to make profits.

The problem is that scalable business models concentrate wealth. After all, the whole concept is to grow by reducing the need for human intervention so as to require fewer (higher paid) workers so that profits are much larger for those that own the company.

Not everyone is going to be a software engineer either. And so, more and more of the ‘value’ we now derive from the goods and services we consume is created by fewer and fewer people – which creates a problem of how to employ those that have lost out in that model. Where do they get their income to survive? Bagging groceries, delivering packages to remote white-collar workers and doing gig work is not enough.

Now, some people say this is an ‘intertemporal’ problem – meaning that we the ‘invisible hand’ of capitalism will eventually sort this out. It did when people moved from the farm to the cities and when the car replaced the horse and buggy and when switchboards were manned by machines instead of people. Time and again, people have found new and better employment as the ‘invisible hand’ worked its creative destruction magic. They say that the problem now is just that innovation and technological change is so rapid compared to the past that we can’t keep up. We just need to be patient.

I am not convinced that the ‘invisible hand’ will move fast enough to fix things. And in the meantime, many, many people, displaced by machines, ‘scalability’, automation and economies of scale will look for solutions in political extremism. We need a solution here… and fast.

My view

In the 19th century and early 20th century, many people also had a farm. The standard of living was lower, yes. But, at a minimum, you had some control over where you received shelter and food rather than depending on a third party to be gainfully employed. For most people now, our ability to buy food, shelter and clothing is entirely dependent on third-party employment. So scalability is a threat to our survival.

I think this is why people are looking for solutions like Universal Basic Income or the Job Guarantee. I also think this is why politically-speaking socialism has gained adherents, particularly among Millennials and Gen Z. And of course, nationalism is also appealing in this kind of environment.

The longer the pandemic continues and the more social and economic disruption and isolation it causes, the greater these trends will become. What can we do about that? At a minimum, we have to make sure the social safety net is robust. And we have to ensure people feel public health protocols are robust too to prevent a reasonable fear of contracting coronavirus and dying.

Right now, in the US, neither of these policy measures is on display. And to me, that suggests the K-shaped recovery will continue for some time. Let’s hope I’m wrong.

Comments are closed.