By Edward Hugh

Spain’s political leaders are in cheerful, almost jubilant, mood at the moment. Economy minister Luis de Guindos, speaking in Davos, declared the tide had turned, and forecast that the Spanish economy would return to growth in the second half of 2013.

“The perception of the Spanish economy has improved and will continue to do so over the coming weeks and months,” he told his audience at the World Economic Forum. In similar vein, he told Spanish journalists in Moscow last weekend that Spain’s economy no longer being a key theme at G20 meetings was another welcoming sign of the times.

As ever, Spain’s economy sage is hedging his bets – earth shattering the growth will not be, but grow the economy will, this is his mantra. Put another way, the bottom in Spain’s economic collapse has now been passed. From here on in the road may be winding, but it will be up. Perhaps, he suggested, the economy will be stationary in the third quarter, and then we will see growth, albeit ever so slight, in the fourth one. And quite possibly he is right. The core of the issue is not whether the country could see one, or even two, quarters of positive performance, but whether any faltering recovery will be sustained out into the future, through 2014 and beyond. It is here that all the old doubts really emerge.

The brunt of the argument which says the country is now about to see a resurgence rests on the idea that Spain’s government have now enacted sufficient reforms to enable the economy to return to a strong growth path. Optimists claim they will, which the skeptics like myself are not convinced at all.

Certainly Mr de Guindos can point to occasions where he has carried the argument. Back in October last year, when he told an audience at the London School of Economics that Spain didn’t need a bailout they simply laughed. Four months later it is looking increasingly unlikely that the country will seek additional EU aid in the short term. “Spain doesn’t need any sort of bailout,” he told Bloomberg TV recently, and this time no one laughed.

Perhaps the key point here hangs on your interpretation of the word “need”. If paying around 5% on your 10 year bonds is considered to be an acceptable cost for financing your country’s debt – Germany, for example is paying around 1.7% – then there is no need to apply to the EU and trigger ECB bond buying via the Outright Monetary Transactions program. If, on the other hand, you think the country could well benefit from lower funding costs, and the kind of pressure for reform which would be exerted from the outside though a Memorandum of Understanding, then clearly a bailout is needed.

Personally I take the latter view, since personally I think the country still has a long way to go in terms of reforms and since it is clear that introducing more measures that bite would be massively unpopular (and especially in the context of all the recent corruption scandals), the shelter provided by a troika driven program would make implementing them a lot easier.

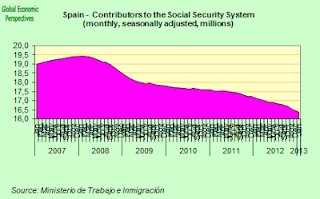

Pension reform is a case in point. With the country’s elderly dependency ratio rising rapidly, and the number of people paying contributions into the pension fund going down by the month, the whole system is badly out of balance and urgently needs some deep structural reform. According to estimates provided by EU economics commissioner Olli Rehn at the last Euro Group finance ministers meeting, shortfalls in the pension system added more than 1% to the fiscal deficit in 2012. And without major changes in the system this problem will only get worse. Yet Spain’s political leaders are apparently incapable of addressing this problem in public.

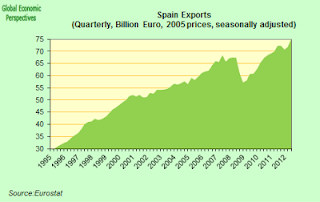

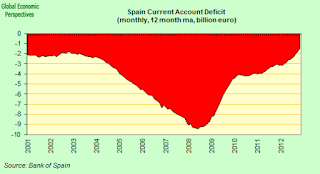

Another example is the urgent need to restore additional export competitiveness to the economy. Despite all the claims that the recent labor market reforms need time to work it is already evident that what has been done is far too little far too late. Exports have improved considerably, and the current account balance is moving into surplus. Yet despite this sterling performance the economy still contracted by 0.7% in the last three months of last year, and this during a period when the government was running at least a 7% annual fiscal deficit.

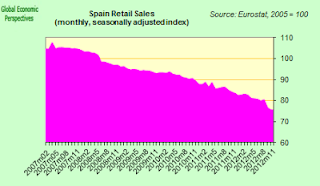

Private domestic demand is weak, and weakening. Retail sales, for example, are on a continuing downward course. As salaries fall while prices continue to rise it would be wishful thinking to imagine this dynamic is going to change, especially as consumption patterns are altered by the population ageing process.

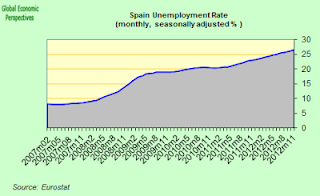

High unemployment (currently just over 26% of the workforce is unemployed) and heavy household indebtedness only add to domestic weaknesses, and it is clear that this will continue to be the case for years to come. No one seriously imagines an unemployment rate under 20% come 2020, and household and corporate deleveraging still have a long way to go.

On the other hand whatever deficit target relaxation the EU Commission gives Spain in 2013, fiscal accounts do eventually have to be brought into balance, so we can expect government spending to remain on a downward trend. The conclusion we are forced to draw is that all we have left are exports, if we want to see Mr. de Guindos’s hopes fulfilled and the economy return to sustainable growth that is.

So to cut through the jargon, and the war of statistics and counter statistics, I want to propose a definition – a country suffering from deteriorating demographics (rapid population ageing) and a private debt overhang is sufficiently internationally competitive when its exports grow quickly enough to fuel headline GDP growth sufficient to generate new employment on a sustainable basis.

This is patently not Spain’s case, and it won’t be in the coming years, so more needs to be done. Much more.

The employment generating caveat is important, since it is only by starting to generate new employment again that the Spanish economy could enter a positive dynamic, bringing to an end the surge in non-performing loans in the banking system, initiating a recovery in the housing market, and giving some sort of stability to consumer demand.

Thus, despite the fact that the country’s current account balance is steadily moving into the black, this doesn’t necessarily mean that growth is just around the corner. I recently carried out a studyof another economy in the process of adjustment, the Hungarian one, where the current account is now regularly positive, but the economy continually falls back into recession. As I point out in that study:

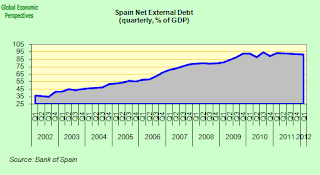

Surely there are lessons from the Hungarian case for the future outlook on the southern periphery of the Euro Area. Improving goods trade balances are steadily pushing current account balances in countries like Portugal, Spain and Greece back into the black. But far from being like Japan and having a large stock of external net savings these countries are more like Hungary with a large net external investment position (again hovering near 100% of GDP in all cases) and consequently a large external debt. What this means is that they are totally unprepared to receive the full impact of the kind of population ageing we have seen in Japan, an impact which is surely now under a decade away.

The Hungarian lesson is that exports can do well, very well, and the current account can correct, but the economy can still languish permanently on the verge of recession unable to generate sufficient growth to break out into a sustainable growth dynamic.

Spain, like Hungary, has a very high negative net external investment position – around 90% of GDP – which means the country is extremely ill-prepared for the full impact of an elderly population.

Financial Economy – Real Economy Split

What is beyond doubt is that conditions in the financial economy have improved greatly. The government has opened a market for its debt, the banks have a solid capital base for 2013 and are able to access European wholesale funding markets – even if this is still at a considerable price in terms of interest paid. This is why Mr. de Guindos thinks the need for a bailout is receding.

But of course conditions in the real economy continue to deteriorate. Most estimates for 2013 are for a larger contraction than that estimated by the government (something which has become habitual), and many observers continue to expect the negative growth trend to continue in 2014. Unemployment was already over 26% as 2012 drew to a close, which makes 27.5% next December a virtual certainty and a number over 28% entering 2014 horrifyingly possible.

So despite all the positive “talking up” that Spain’s economy is receiving from well-wishers at the international level, the disconnect between the financial economy and the real one has now become markedly pronounced, and the clearest evidence for this is that what are now, at least for the time being, well capitalized banks are still unable to provide systematic credit to the deteriorating private sector.

And if the private sector doesn’t improve, then the banking system will surely need more capital further along down the line. Even the relaxation of deficit targets comes at a price – next year (2014) government debt will almost certainly slip through that psychological 100% of GDP level, and still be heading upwards. Meaning that at some point a sovereign debt restructuring in Spain certainly can’t be ruled out.

Perhaps the worst of all assumptions that policymakers seem to be making is the one that “economies always recover”, an assumption which seems to be based on some sort of quasi-religious version of the “hidden hand” theory. Indeed, all that is necessary to makes this a less than universal generalization is one counter example, and unfortunately the real world is populated by several of them. Argentina in the 20th century would be one, the country started out among the richest globally, and look how it ended the century. Twentieth century Japan would be another, and once you start to look you can surely find more (try Ukraine, or Hungary). So recovery isn’t automatic, and something has to happen for recovery to occur. That something isn’t present in Spain at the moment, and indeed the danger is that as conditions deteriorate the contraction becomes self-perpetuating.

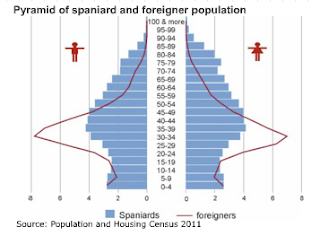

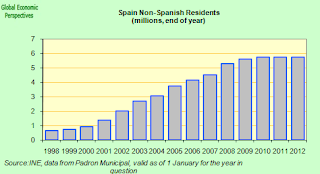

One of the less well commented features of Spain’s boom during the early years of this century is the way the arrival of economic migrants fueled a significant part of GDP growth. The country’s population grew by more than 6 million (from 40 to 46 million) in the first eight years of the century, raising employment levels in both the formal and the informal economies.

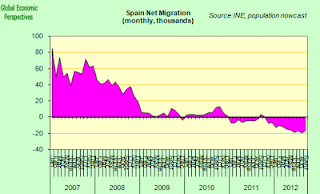

Migrants are still arriving, but the balance has now turned negative. According to data from the National Statistics Office, as of last September the net outflow was around 20,000 a month and accelerating. That is to say a quarter of a million a year, or a million every four years. And the final numbers will almost certainly be much larger.

So a country which already doesn’t have enough people working to pay for its pension system, now faces having less and less as time goes by, while the number of pensioners looking to claim will only grow and grow. In part that is the end result of sitting back and watching a 1.3 child per woman fertility rate for over 30 years.

But to this grave underlying problem is now being added a new and potentially more deadly one. Those leaving are not only migrants who came earlier. Increasingly young educated Spanish people are upping and leaving, and unlike in earlier periods many who go now will never return. Not only is there a massive human capital loss involved here, trend GDP growth is evidently being reduced as the workforce steadily shrinks, while all those unsellable surplus-to-requirement houses become even less sellable. And so we may go on in what has all the hallmarks of a non too virtuous circle. So next time Luis de Guindos proudly proclaims that economic conditions are improving, he might care to consider stopping for a moment to reflect on the possibility, nay the almost certain reality, that Spain’s economic contraction now feeds on itself.

The country is no longer waiting, as the New York Times’ Landon Thomas so aptly put it, for Mr Rajoy. Indeed, Mr Rajoy himself has now turned his famous indecision into a virtue. “Sometimes the best decision is not to take any decision, and that itself is a decision,” he told enthusiastic supporters in his Partido Popular parliamentary group last week. Or as one PP supporter put it to me last week, it now looks like Mariano Rajoy took a very intelligent decision last autumn, saying he would ask for a bond buying programme if the country needed it and doing nothing. Only time will tell if this was such a good decision as it seems. In the meantime far from waiting for Mr Rajoy, many young Spaniards are now only waiting to see who will be the last to leave so they can ask them to turn the lights out.

This post first appeared on my Roubini Global Economonitor Blog “Don’t Shoot The Messenger“.

+Y-o-Y.png)

Excellent if depressing article.

As he rightly points out there is massive emigration of Spain’s future in its young graduates leaving the country. This will only exaggerate the ageing demographics still further. Spain simply cannot afford any period of stagnation as it will simply drive more young out of the country to greener pastures. You only have to look around London to see that. They have been arriving in their thousands. In that respect the contraction will continue. If that were to happen for too long then ultimately default is the only way for Spain to end its spiralling contraction. As they leave they will make the ageing demographics worse.

Look at Ireland still contracting albeit much more slowly and the private debt burden has not cleared so they will need another bailout even as the poster boy for austerity. This is the fate that faces Spain. It might just take longer. The other factor that will be crucial is how suffers the losses when they do default? France has a lot in stake in Spain that would be at risk of a reset of its debts. That will push solvency problems deep into the core of the Eurozone.

Thanks, absolutely agree with the article. Population problem in Spain has been here since the late 90´s, and nobody focused on it, probably because of short term minded politicians, for them this wasn´t an issue at all. Now what? How can this economic meltdown be stopped? Probably it can´t.

Excellent article. I work as an English professor in the University of Rey Juan Carlos in Madrid and I can verify that the only sector of the Spanish economy that seems to be doing well is English study. This is for the simple reason that most students study English because they´re planning on leaving the country. Other departments – German, Chinese – have enrolled a lot of students as well and for the same reason. In a country with 2 million ¨ni-ni´s¨ (young people classified as not working or studying) it´s terrifying to think what will happen when the best and brightest have gone. I´d like to encourage my students to stay but I can´t think of a single reason why. And they´re not stupid. They realize that in a country with one of the lowest birthrates in the world, completely inept and corrupt politicians and an education system that has been decimated there simply is no future here.

“Migrants are still arriving…” you say somewhere in the article. Maybe we spaniards should be wondering as to why they are still arriving since there is no clear future in our country. Can we really afford that? Maybe our more and more spoilt and unaffordable welfare state has something to do with it.

I doubt that it is down to the cost of unemployment benefits. From what I know they are capped to two years, which with the length of this crisis means that many have simply exhausted their entitlement already. This is what has lowered the unemployment rate in the US. The impact will be to for people to move to find work outside the country and they may not return. If these people are younger they may marry and stay abroad. This reduction of the young tilt the demographic make up so that the population ages rapidly.

Totally agree, unfortunately, here in Spain there’s no future in a long, long, time. Me and my husband are not as young, but we’re leaving the country with our two daughters in a few months. The most sad is that we could be growing yet if our political leaders had intelligently invested our taxes instead of stole them.

how can you say self perpetuing contraction? I guess there are solutions to the problems and soon or late they will be solved. Spain had much worse problems after the civil war for expample, during a period of 10 years there was no enough food for everybody!!! so you can imagine which graphics we had. But it could become a modern industrialized country. without Marshall plan. I hate all those extreme and apocaliptic predictions. Pure sensationalism.

Yes, you’re right. Spain faced a far worse situation in the 40s, and the fact is that -by the early 60s- the economy was growing strongly and unemployment was close to zero. But there are important differences between now and then, as the country has changed a lot in 70 years. After the war, most people forgot about politics (anyway, a dangerous activity at the time…) and centered into personal improvement. The demographics were also far more favorable, with a younger population, not the present, aged one.

In my personal opinion, and in the course of 20-30 years, Spain’s real GDP will descend to the levels of the mid-50s and stabilize there. To find how to grow will be a big problem, since Spain has ‘lost his job’ to the ‘new economies’ of Eastern Europe and China, and it may take decades to find ‘a new job’ for the country, well-paid enough to return to the prosperity of the last years of the 20th century.