Is bank lending on the cusp of increasing in the US?

Asha Bangalore of Northern Trust writes:

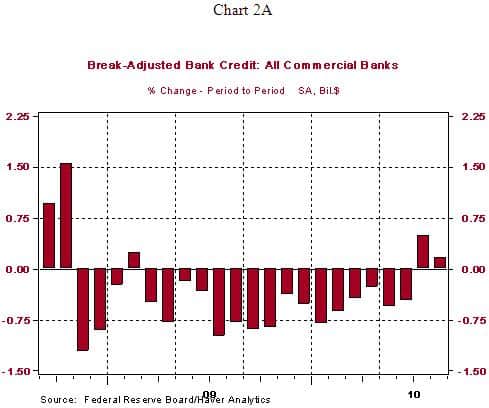

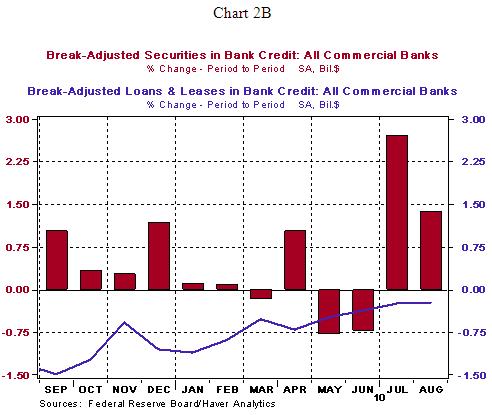

Recent data indicate bank credit has increased in July and August (chart 2A), while partial September data suggest another monthly gain. This is a positive and noteworthy development, but skeptics point out that bankers have been purchasing securities not extending loans (Chart 2B). True.

However, one has to dig deeper to differentiate between the disparate trends of the components of bank credit. As noted earlier, bank credit is made up of two major components – (a) securities and (b) loans and leases. These components do not move together as the economy recovers. In fact, as chart 3 indicates, purchases of securities and that of loans and leases trace distinctly different paths as the economy gathers momentum. More importantly, purchases of securities have posted gains early in the recovery phase after each recession since 1960 and their growth rate peaks well ahead of loans and leases (see chart 3). By contrast, loans and leases have picked up momentum at a later stage of all economic recoveries (see chart 3) compared with purchases of securities. Furthermore, loans and leases show an extended lag vis-à-vis an economic recovery if a banking crisis has accompanied a recession. After the 1991 economic recovery commenced in March 1991, purchases of securities shot up rapidly but loans and leases staged a comeback only in June 1993, a little over two years after the recession had officially ended. The 1990-91 recession involved a banking crisis of significantly smaller in dimension compared with the current recession. Fast forwarding to more recent developments, loans and leases (inflation adjusted) have contracted, on a year-to-year basis, every month since August 2009 but these declines are noticeably small in July and August. At the same time, purchases of securities show a decelerating trend in recent months.

There has been a lot of criticism of banks because they have been purchasing government debt with their money instead of lending it out to customers. It sounds like Bangalore is suggesting we may have turned a corner on bank lending. If so, that is supportive of continued recovery. The next few months will tell us if this is a sustained trend. See the full post at the link below.

Source: Bank Credit: Securities vs. Loans – Guidance about Lags from History, Asha Bangalore, Northern Trust

Comments are closed.