Growth vs Levels – Eurozone Edition

This post originally appeared at Alpha.Sources.

It is a well known dictum in the context of economic analysis that you have to distinguish between stocks and flows and how focus on one in stead of the other lead to misguided analysis. It is the same with growth and levels with the former defined as the growth from one period to another in a given economic variable and the latter signifying a broader perspective of the level of economic activity relative to a past or average level. One example which springs immediately to my mind was the exuberant media coverage in Denmark of the recent record high annual increase in domestic car sales in the last months of 2009 and January 2010. Surely these had to signify that recovery, at last, had hit the shores of my home country. Alas, looking at the data reveal that those months of 2008 and 2009 respectively were exactly the pinnacle of the contraction and thus the increase observed at the end of 2009 and in the beginning of 2010 was all down to the so-called base effect.

Such low or high base effects are treacherous companions for the economic analyst since they may serve to bias the analysis either in the direction of excessive pessimism or optimism. In general, any good economic analyst should be able to discern what the underlying trend is beyond any base effects. However, the I should emphasize the treacherous aspect here since it is also well known that short to medium term growth trends as a result of low/high base effects may be significant drivers of tactital decisions not to speak of outright policy movements in the context of inflation and the effect of headline price fluctuations. In this, the real savvy economic analyst is able to master the effects and trends of both short term growth movements (and their tactical repercussions) as well as the underlying level and trend of activity relative to the past.

Allow me a demonstration on this in the context of Eurozone industrial production activity;

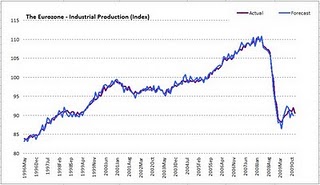

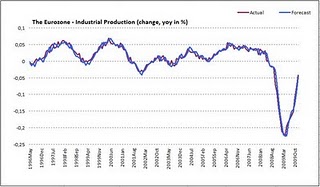

The two graphs above show the actual trend in Eurozone industrial production both in levels and in growth overlaid with an in sample forecast by the Alpha.Sources proprietary forecasting model [1]. So far the model has been used to generate three out of sample forecasts (October 09 to December 09) and the results indicate a slight, but noticeable, pessimistic bias. Consequently, the model has overestimated the annual decline in the IP index with an average of 17% in these three months.

But this is just technical drivel.

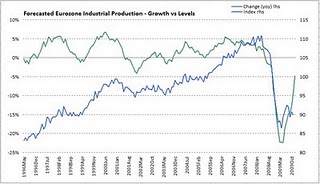

What is real important is to note the distinction between the level and growth better illustrated in the following chart;

In this way, the annual growth rate appears to be mean reverting which would imply a sharp surge in relative growth to compensate for the slump in annual growth around autumn 2008 and into 2009. However, looking at the level index and the implied forecasts generated by the model it appears that the industrial production (and thus in some sense economic activity) may have taken a lasting hit. Consequently, the relative level of activity observed in the second half of 2009 has fallen back to levels not observed since 1998 even if the index, in changes, has gravitated sharply higher moving into 2010.

In fact, and even if we assume that the index moves sideways from here the first half of 2010 is likely to see a continuing sharp surge into positive growth rates. My back of the envelope calculations suggest that a continuous monthly growth rate of 2-3% throughout the first half of 2009 are very likely since this would materialize as the index moved sideways. In fact, even if the index fell slightly from its level in H01-2009 it is likely that we well see positive growth rates y-o-y even if it would hardly constitute evidence of anything but the fact that the recovery is still a long way off.

What does it Mean?

Well, I will end the economics lesson here and simply note that both perspectives are important. This is especially the case at the moment where investors and economists alike are busy pondering whether there will be a double-dip recession or whether policy driven liquidity will push our economies towards a new bubble. Ironically, the real challenge here is to realize that these two outcomes may prevail at the same time.

In terms of the level of growth and activity the massive debt overhang in all real economic sectors mean that growth will be significantly impaired not least because long run inflation, in my honest opinion, will languish close to the deflation mark. This is especially the case in economies who need to correct external imbalances in the context of a fixed currency union.

However, there are also risks in the other direction.

No where is this more prevalent than in the Eurozone where the ECB is struggling with the obvious need to maintain rates fixed at the bottom to avoid a collapse in Southern Europe while frothy house markets in France (and lately Finland and others) look set to move higher. In fact, in a global perspective analysts closer to the situation than me have lately identified Canada and Australia as obvious places where ultra loose global fiscal and monetary policy risk fuelling asset bubbles.

Personally, I tend to focus my gaze on the level effect and thus the underlying growth dynamics but as divergence grows the other part of the equation becomes crucial to latch on too, not least in relation to international capital flows. This current dual aspect of the distinction between growth and levels makes for a treacherous but also fascinating companion, on the professional level, for the economic analyst.

—

[1] – Sounds fancy no :) … the model is quite simple and uses a VAR setup with the lagged change in the manufacturing order index as the only real economic variable on the right hand side to explain the annual change in the IP index.

Comments are closed.