At the beginning of 2015, I began to push an investment thesis for fixed income that has had a lot of upside, but that I believe has finally played out. I want to discuss why that thesis mattered, why it’s dead and what will replace it.

Secular Stagnation

So let’s frame this through the lens of secular stagnation. I’m talking about the ‘convergence to zero’ trade, of course. And that trade is an outgrowth of lowflation and stagnant growth in advanced economies. Here’s how I put it in January 2015 when I first introduced the thesis.

As low nominal GDP growth takes hold, we should expect short-term interest rates to remain low and for the yield curve to flatten. There are three main reasons this is so. First, low nominal growth rates imply low inflation or deflation. Second, to the degree market volatility produces risk-off sentiment, the bid for safe assets will further suppress yields. And third and most importantly, the natural rate of interest on a zero-day fiat currency liability is zero. I expect that the safe asset class in lowflation currency areas will be dominated by these trends, causing yields to stay low or even shrink. This convergence to zero makes the highest yielding safe assets attractive and thus favours New Zealand and Australia, as well as the the US, UK and Canada to some degree.

We can add Norway into the mix here. But, they are a special case because of oil. It’s mostly been an English-speaking advanced economy trade, in large part because of persistent current account deficits run across the Anglo-Saxon advanced economies (see here, here, here, here and here).

These countries, running current account deficits and absorbing global savings, had higher growth rates. And so, they were the last countries to cut base rates to zero. The United States notably even tried to get off the zero lower-bound, only to be forced into retreat in 2019.

But, secular stagnation and disinflation were the prevailing economic force after the Great Financial Crisis due to a number of forces like private debt, excess capacity and aging populations. No amount of debt-fuelled growth was going to change that. So the gravitational pull toward zero was inexorable. Japan got there way ahead of everyone else because of it’s bubble, market collapse and demographic challenge. Europe came racing behind after the sovereign debt crisis. And that left the Anglo-Saxon economies, which have now succumbed due to the coronavirus.

As an investor, I saw this as an opportunity though. You could ride the wave as curves flattened and the convergence toward zero played out.

Flat as a pancake

And now it has done. There’s no juice left to squeeze. The Australian 10-year offers the most upside at 94.1 basis points. But that market is small. The UK is already down to 29.9 basis points. And eventually I believe that’s where the others are headed as well. But, again, is 64 basis points of flattening in Australia or 39 basis points in the US going to get you outsized returns? No. You have to go elsewhere for returns.

That’s a problem. Here’s why. Ben Inker of asset manager GMO explains:

When I was a student studying finance, I was taught that government bonds served two basic functions in investment portfolios. They were there to generate income and provide a hedge in the event of a depression-like event.1 For the first 20 years or so of my career, they did exactly that. While other fixed income instruments may have provided even more income, government bonds gave higher income than equities and generated strong capital gains at those times when economically risky assets fell. For the last 10 years or so, the issue of their income became iffier. In the U.S., the income from a 10-Year Treasury Note spent the last decade bouncing around levels similar to dividend yields from equities, and in most of the rest of the developed world government bond yields fell well below equity dividend yields. The falling levels of income caused us to question what had become an implicit article of faith for many investors – that a balanced portfolio could generate 5% returns over inflation in the long run. But while the income side of the equation for bonds was clearly not what it once was, until very recently we have continued to assume that bonds could accomplish their other important task, providing capital gains in the event of an economic disaster. This winter, U.S. Treasuries once again did their hedging job admirably, providing substantial positive returns when riskier assets fell in the early stages of the Covid-19 crisis. But that success has come at a cost. At today’s yields, U.S. Treasuries not only fail to provide a useful amount of yield to investors but also have likely lost their ability to hedge in the event of further economic trouble.

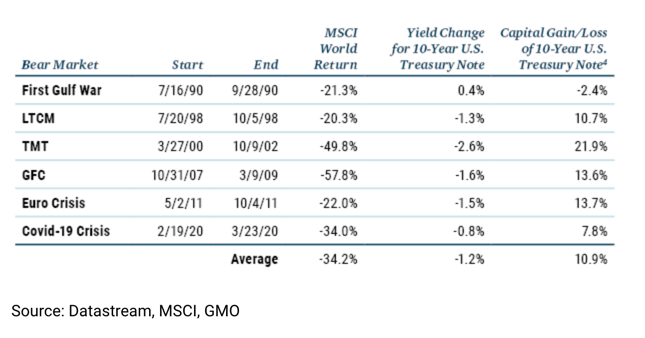

Inker shows us the chart where fixed income helped investors weather the storm in 5 of the last six major drawdowns. The average return was 10.9% while equities melted down by 34.2%. That’s nice in a 60/40 equity/bond portfolio.

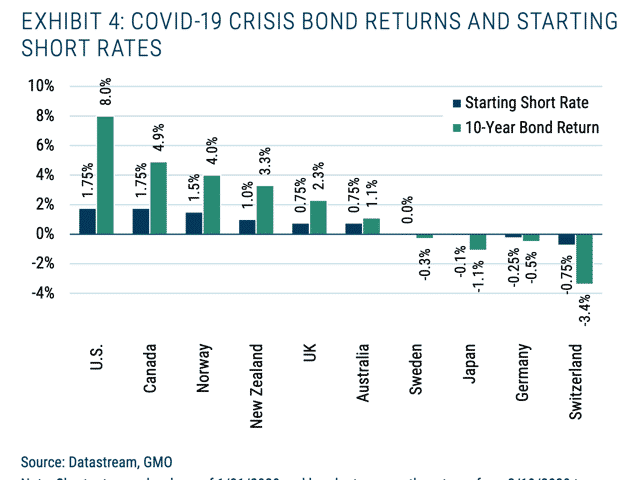

In the next equity drawdown, bonds will do nothing for you. When you flee to that liquid safe haven, you may find liquidity. You won’t find a lot of return. In fact, that’s what we saw from those bonds already converged to zero when Covid hit. Only the Anglo-Saxon bonds and Norway cushioned your losses. And the cushion was weak, because yields were already so low.

The result: any future equity drawdown will hit you that much harder.

Unprepared

Now, the good thing for investors after the March drawdown was the gangbusters rally in equities. We are back at or near record highs in the US after the best August in over 3 decades. But I am worried the foundation of that rally is shaky, and that retail investors are not prepared for a relapse in which their bond portfolio does not help them.

Mohamed El-Erian gets at this in a recent piece in the FT.

Over the past few weeks, the fear of missing out on an unceasing equity rally has increasingly been expressed through call options — contracts that give the right to buy at a fixed point in future — rather than straight equity longs. That limits the amount at risk and gives users the ability to capture rallies. It has been supplemented by more downside “tail protection” aimed at safeguarding portfolios from sharp drops. With that, the Vix volatility index has decoupled from equity indices, adding to signals that a large market correction, should one materialise, would encourage more professional selling that could overwhelm the buy-the-dip retail investor.

Translation: professional investors are increasingly looking to mitigate tail risk while chasing upside returns. Retail investors aren’t doing that. So if we hit an air pocket, not only will retail investors be caught flat-footed, they will be surprised by the magnitude of the selloff as action in the derivatives market will make things even worse.

Will retail investors remain in a ‘buy and hold’ crouch as they did in March? Should they? Let’s wait and see if we get a selloff. But there are some mitigation strategies one needs to keep in mind.

Risk Mitigation

First, even in scenarios where there is no selloff, the fact that there is no income left in government bond-heavy fixed income portfolios means that a 60-40 portfolio is not going to give you a good return. The 40% of your portfolio committed to fixed income won’t return much income at all, either as coupon payments or in capital gains. That forces you out the risk curve.

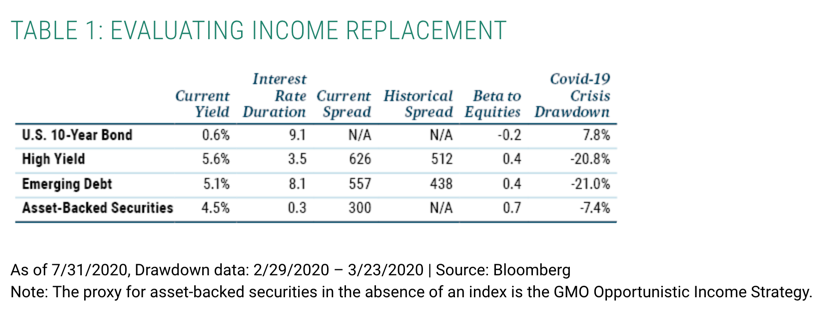

GMO has come up with a number of alternative fixed income government security replacement holdings. But they all come with the downside of lower liquidity, lower credit rating, lower duration and greater risk.

GMO doesn’t mention municipal debt. But that is a whole separate can of worms you should wrap your head around via a recent Barron’s deep-dive here.

The point is that all of these alternatives are inferior to government bonds. And re-weighting your fixed income mix accordingly will make the bond portion of your portfolio riskier – and therefore subject to losses during equity meltdowns, rather than having fixed income act as a hedge.

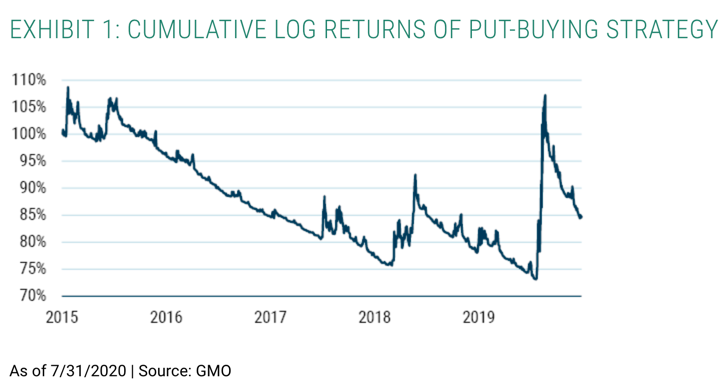

So, in the event of a risk event, you need to put on tail risk hedges. In the same GMO piece, GMO’s Matt Kadnar explained that this comes with downsides because of negative carry and the need for continual hedge adjustment, something retail investors won’t be able to do.

for depression protection, investors must turn to tail hedges that bring with them the very likely prospect of negative expected returns over a number of years before the potential payoff. For some investors, this may be a reasonable trade-off. However, there are reasonable caveats to consider before embracing this approach.

Investing in tail hedge strategies requires substantial discipline. Properly structured tail hedges pay off in the scariest of times – either extreme economic duress or some period of extreme geopolitical uncertainty. Like any good rebalancing strategy, investors should be moving out of strongly performing tail hedges and into beaten-down risk assets. This requires selling those tail hedges at the point of maximum uncertainty, which is difficult to do to say the least. Having a firm plan in place before the extreme event occurs is critical to using tail hedges to maximum effectiveness. To illustrate, we constructed a simple put-buying strategy1 and plotted its returns over a 5-year period (see Exhibit 1). It is evident that this form of insurance had some significant benefits in the spring of this year. Of course, enduring a drawdown of more than 25% of the original capital before receiving the payoff would have been unnerving. And failing to rebalance in the spring would have caused a substantial loss over the succeeding several months.

Here are the back-tested returns.

My view

With the convergence to zero trade just about toast, the government bond portion of your fixed income portfolio is not going to offer you any appreciable return here in terms of coupon or capital gains. You must re-weight to other asset classes to get a return. And that carries risk.

The sense I get is that retail investors don’t understand this. They do not realize that the next equity meltdown will be a bloodbath for their equity portfolios with no compensation from their bond portfolios. And to the degree their bond portfolio has become mostly non-government security focused, they risk a loss in bonds as well as stocks.

So, the portfolio implications of the end of the convergence to zero trade are large. Alternative but less liquid asset classes like precious metals, cryptocurrency or private assets might offer some diversification. GMO devotes considerable time to addressing some of these asset classes. But, retail investors are geared to buy and hold for a reason; they don’t have the investing acumen to navigate more active portfolio management. So they turn to passive vehicles with the lowest possible management fees.

In some ways, I wish the portfolio losses in March had been more enduring. Maybe then, investors would be more aware of downside risk. For now, we just have to wait and see when the next equity drawdown comes and how powerful it will be.

If my gut is right, the next drawdown will be large. And retail investors will hold on for dear life through at least 40% losses. But, at some point, for those in retirement or nearly there will be forced to cut their losses. And that will add to the selling pressure.

Comments are closed.