Initial claims and the fiscal cliff

I am a bit time-constrained today. So I want to make this a relatively brief post. I am going to focus narrowly on initial claims for unemployment insurance in the US and on the political struggle to aid the 30 million people unemployed due to the Covid-19 pandemic.

Initial claims were good

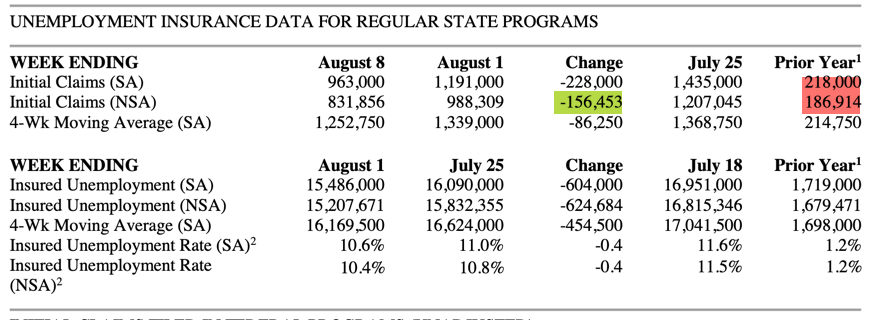

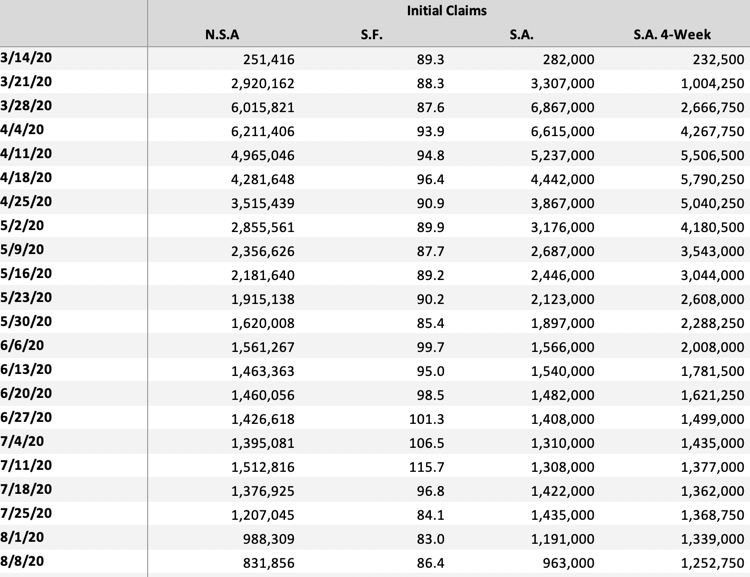

I have been focused on the unadjusted initial claims trend because of what I see as a somewhat distortionary impact that seasonal adjustments have had on claims during the heavy seasonal adjustment period we are in right now. The unadjusted numbers track relatively well with the reported numbers, but there have also been some relatively large differences over the past several weeks.

I am not going to talk about continuing claims because nothing in the data set speaks to me about economic trends.

Last week’s data show claims continuing to fall as expected, with the only week since the re-opening bucking that trend happening in the week ended July 11. Notice the numbers highlighted in red showing how low claims were last year relative to where they are now. And notice the figure in green highlighting how sharply initial claims are falling on a week to week basis.

Overall, we now have a downtrend of 18 weeks.

The way I would characterize the initial claims data set is as one showing still elevated levels, but also within a well-established downtrend. Ceteris paribus, we should expect this trend to continue. But, unfortunately, the fiscal cliff is going to upset this.

The fiscal cliff

Here’s the latest on political wrangling between Democrats and Republicans over fiscal support via the Washington Post:

The two parties are not in the same ballpark on the overall cost of the bill, which Democrats have said cannot be less than $2 trillion. Republicans, including Mnuchin, have said $2 trillion is too high.

The Senate has nominally been in session this week, after Majority Leader Mitch McConnell (R-Ky.) delayed a planned August recess in hopes of voting on a coronavirus relief bill. But there are few senators in the Capitol, and no negotiations or votes have been taking place. The House is out of session.

The Senate appears likely to recess on Thursday for the remainder of the month. It looks increasingly possible that there will be no new deal on coronavirus legislation until September, when an Oct. 1 government shutdown deadline will force legislative action of some kind.

Asked Wednesday if it was possible that there would be no deal until that deadline approached, Pelosi said, “I hope not, no. People will die.”

This elicits one observation and three questions.

Observation: there is likely to be weeks now when almost no fiscal support is coming to the US economy. Not only is the Federal government withdrawing fiscal support, but state and local governments are guaranteed to add to the pain:

Moody’s Analytics estimates that without additional federal aid, state and local budget shortfalls will total roughly $500 billion over the next two fiscal years. That would shave more than 3 percentage points off U.S. gross domestic product.

President Trump is looking at the state and local government through a political lens rather than an economic one. On Monday, he tweeted that the states and municipalities “only wanted BAILOUT MONEY for Democrat run states and cities that are failing badly.” So, he’s fine not giving them the money.

Economically, in conjunction with the withdrawal of federal pandemic relief, that’s going to be a big problem.

My questions

Three questions will play out over the near-term economically.

- How quickly does the lack of federal support force local and state governments into service cuts and layoffs?

- How quickly does the lack of federal government pandemic relief filter through into lost consumption? I think increased initial jobless claims will tell us.

- Is the October 1 government shutdown deadline meaningful in a political sense?

In my view, we are essentially facing a worst-case scenario policy-wise. Much of this is driven by the polls for November, where President Trump trails badly. He needs to close such a tremendous gap that he is forced to take a ‘political barbell’ strategy.

On one side of the ledger he and his allies have to do ‘whatever it takes’ to suppress votes for the Democrats and increase turnout for Republicans. Given Trump’s penchant for pushing the envelope, ‘whatever it takes’ could come in manifold and unexpected forms. I won’t speculate on what those might be. They are not likely to increase faith in US governance and the legitimacy of the election process.

On the other side of the ledger, Trump must reckon with his eventual loss were he not able to close the gap. And, as a result, taking a scorched earth tack would make sense. The goal is to force the Democrats to compromise for fear of taking blame for an economic meltdown. ‘Burn it down’ and ‘make no compromises’ would be the way to frame that side of the barbell. We are already seeing that regarding the fiscal cliff.

For me, what has sent off alarm bells is the mention of a October 1st government shutdown deadline in the Wall Street Journal piece linked above. And that led me to the third policy question overhanging the economy. It’s not clear to me Trump has any impetus to budge before October 1. And, to the degree he is still behind in polling by that date, the ‘burn it down’ approach would still make sense – meaning a total government shutdown is not inconceivable.

I hate to write this. But, as I have been saying, the political environment in the US is toxic. The result is that we cannot rule out any worst case scenarios politically or economically.

Three deadlines matter then. The October 1st shutdown one, the November election one and the January inauguration one. Leading up to each of those deadlines, expect political brinkmanship to play out in unprecedented ways. And watch for a reversal in the downtrend in jobless claims for signs of the economic impact in real time.

Comments are closed.