Market setup

The S&P500 futures index are limit up as I write this. What a turnaround this is from yesterday. It shows you that volatility will rule the day until we get certainty on the economic and market issues behind the coronavirus epidemic. Meanwhile, Donald Trump is talking stimulus, as are many other politicians. And so, we will get some relief from the litany of negativity that has pervaded markets over the past several days. Analysis below

Yesterday was the biggest market slide since the Great Financial Crisis, with market circuit breakers going into effect at the open and stocks trading to near session lows at the close. And the volatility wasn’t just in stocks, as I highlighted in yesterday’s piece. Clearly, asset market price action was driven by pure panic – a wholesale flight to safety.

Now, the panic has subsided – at least temporarily. Immediately after the close futures indices were up and the positive tone has carried over into Asia and Europe, ending with US equity futures limit up now. This reprieve will, hopefully, give markets a time to take stock and think about the long term.

Framing the situation

I like the three-pronged framing I borrowed from Joe Weisenthal yesterday. We are facing a triple threat from the immediate economic impact of the coronavirus, knock-on economic impacts and the real economy fallout from a financial panic. What markets must do is assess what asset prices best reflect the likely economic outcomes of this triple threat and the policy support used to counteract it.

Markets are not good at doing this kind of thing. There is a lot of uncertainty around the magnitude and duration of the economic threats facing the global economy right now. And the knee-jerk reaction is panic, a wholesale flight to safety. Only after markets have shored up their positions from potential downside losses does a real fleshed out re-assessment follow. And when more bad news hits, we get another wave of selling and a relief rally, with this cycle repeating until the economy collapses or markets are convinced that the policy support will prevent the worst case outcome.

That’s why early and well-designed policy intervention is key. Before the Federal Reserve was created in 1913, major depressions were preceded by panics – the Panic of 1837, the Panic of 1857, the Panic of 1873, the Panic of 1893 and the Panic of 1907. And while the Fed failed to stem the tide in 1929, leading to the Great Depression, the US escaped major panics until the Panic of 2008. That’s what the Great Financial Crisis really was – a market panic.

The policy support

So, now we get the policy support statements. In the US, Trump has proposed small business loans and guaranteed time off to workers most affected by the pandemic. He has also proposed a payroll tax cut, something some Democrats touted in the aftermath of the Great Financial Crisis. And that has the markets relieved. Will it be enough though?

I am hopeful but sceptical. I wouldn’t call myself cautiously optimistic anymore. After all, I still see recession as a base case and I still believe Trump is inclined to half measures so as to not admit there’s anything wrong. But, this is a positive step. Let’s see what the substance is behind the proposal and whether he can get it enacted.

As I’ve been saying, the US was well-positioned to withstand an economic shock before the crisis. And that’s good. So we’ll have to wait and see how long this shock continues and how great it is. The effects will have to be pervasive and long-lasting – through at least the late summer – to think we are in a recession.

And that distinction is important for asset markets because a recession scenario is one where stocks fall 40% or more, while a mid-cycle slowdown is one where stocks fall 20%.

Finally, in terms of policy support, as we saw with the Panic of 2008, panics that lead to financial crises can actually cause recessions or deepen and lengthen a slowdown. So, when the next wave of panic selling happens because more bad news makes recession seem more probable, the policy response has to be up to the challenge.

The virus and the economy

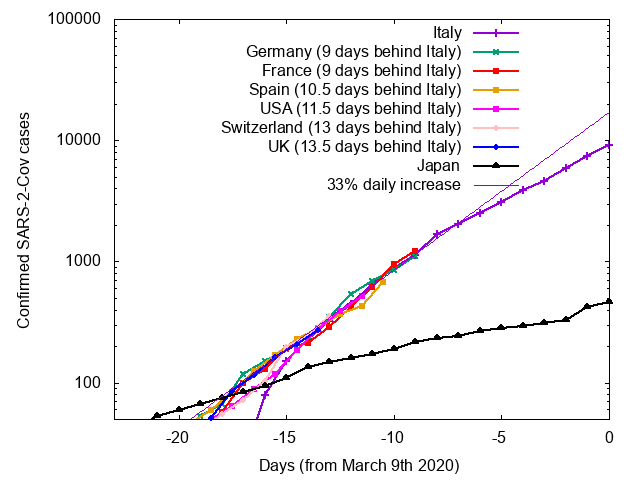

Take a look at this graphic.

Source: Mark Handley

It shows a log-scale chart for a number of Western countries and Japan and the rate of daily increase for the number of people infected by the coronavirus. The infection count in all of these countries is increasing at approximately the same rate 33% daily, with the outbreak severity in Italy furthest along. So, the clear inference is that Italy is the base case for where all of these countries are heading outside of Japan.

What would that mean if the chart is correct?

I think it means that the lockdown and quarantine approach of Italy will move to a swathe of Western countries in due course. As I have been saying all along, it’s simply not politically possible to risk the lives of citizens by refusing to take control measures. So, we are going to see the social distancing and lockdown measures in Italy in many more countries.

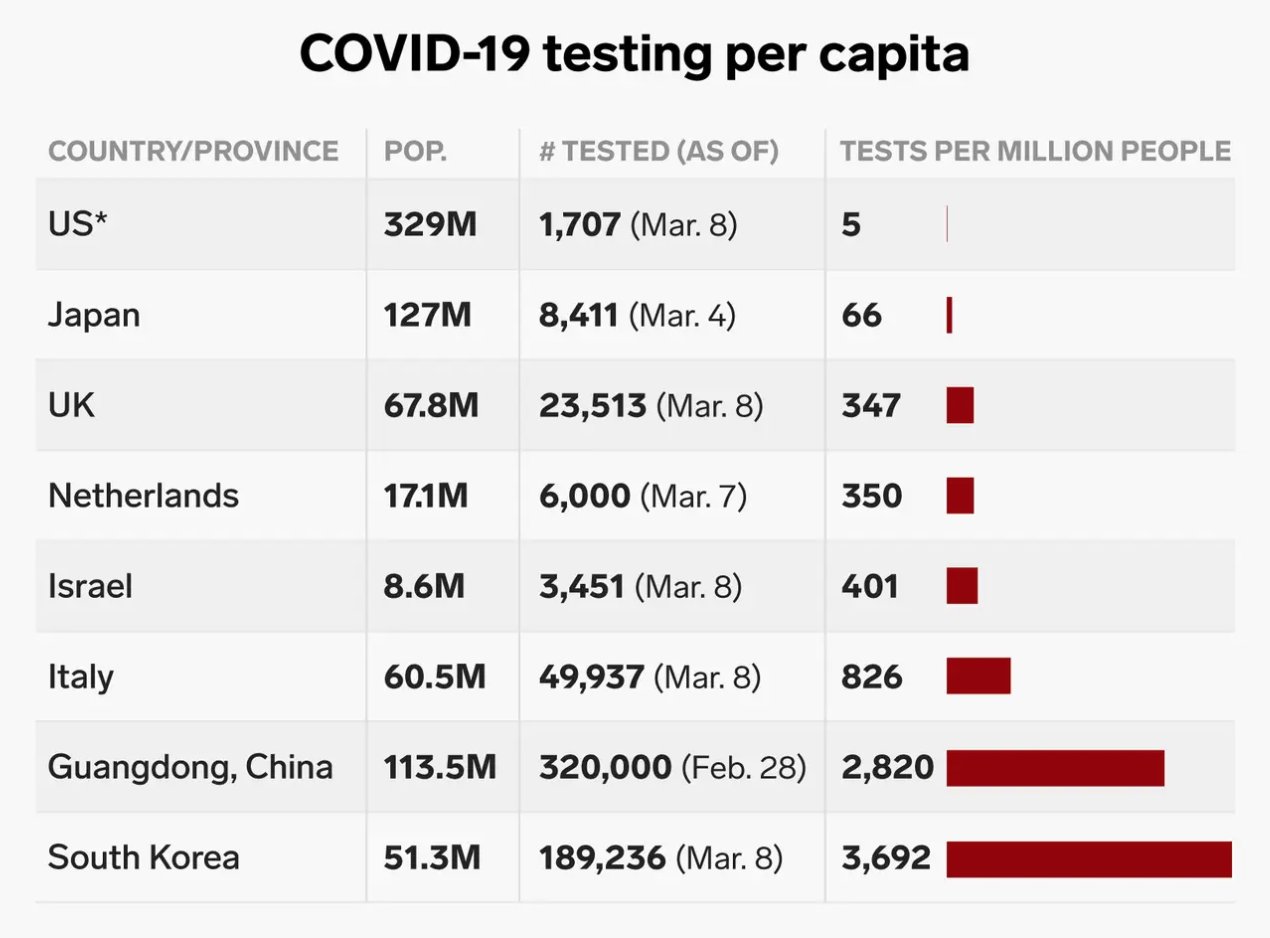

The US is an outlier here. But, not in a good way. The coronavirus control measures taken at the national level have been very weak. And testing has been slow. See the chart below for a comparison.

Source: Business Insider

The base case for outcomes here then is Iran. And the situation in Iran is horrific. I think the US needs to be prepared for a serious epidemic. And the economic impact will be equally severe as a result. I hope I am wrong.

That’s it for today. Let’s enjoy the positive tone in markets while it lasts.

Comments are closed.