Judging the state of the economy amid the coronavirus pandemic

My anecdote on where we are

This morning, before I left the house to take my son to school he said, “they should just close schools today. Why wait?” And so, as I took my son to school for the last time before it shuts due to the coronavirus epidemic, I had pangs of doubt. I immediately called my wife and asked her whether we should just keep him home today. She said no. He has a test he can’t miss and they will likely hand out packets for distance learning over the coming two weeks to students. I relented but I wasn’t left reassured.

I reckon a lot of people are feeling this way right now. And, for me, it’s a testament to the state of affairs here in the United States right now. On my way home from dropping my son off, I listened to an NPR segment about the coronavirus. And the way they framed the problem for New York was something I had never considered. But it made a lot of sense. Here’s what they said:

NY Governor Mario Cuomo is angry at the Trump Administration because the federal government’s botched rollout of testing means many fewer New Yorkers have been tested than he would like. Looking at current figures, I ascertained that 2314 New Yorkers have had coronavirus testing to date. And that’s not enough by an order of magnitude.

Here’s the part I never considered:

“Testing is not about figuring out how many people have the disease. We are already way behind on testing,” said Cuomo. “The testing is about finding what percentage of those infected are hospitalized so we can determine the capacity we need in our hospital system.”

What’s more, state and local officials can’t know where new clusters of outbreak are. You can’t know where localized transmission clusters are if you don’t do testing. And you can’t take extra measures in those locales if you don’t know where those locales are.

So, local and state officials are essentially flying blind without testing. And that means there are likely clusters of community spread happening right now without anyone’s knowing where those clusters are. And so, in the absence of an infection count, hospitalization rate is the only thing Cuomo can go by to know staffing levels. New York literally has to wait until someone is so sick they need to be hospitalized to know where the outbreak is most severe.

What to expect

This is a disaster.

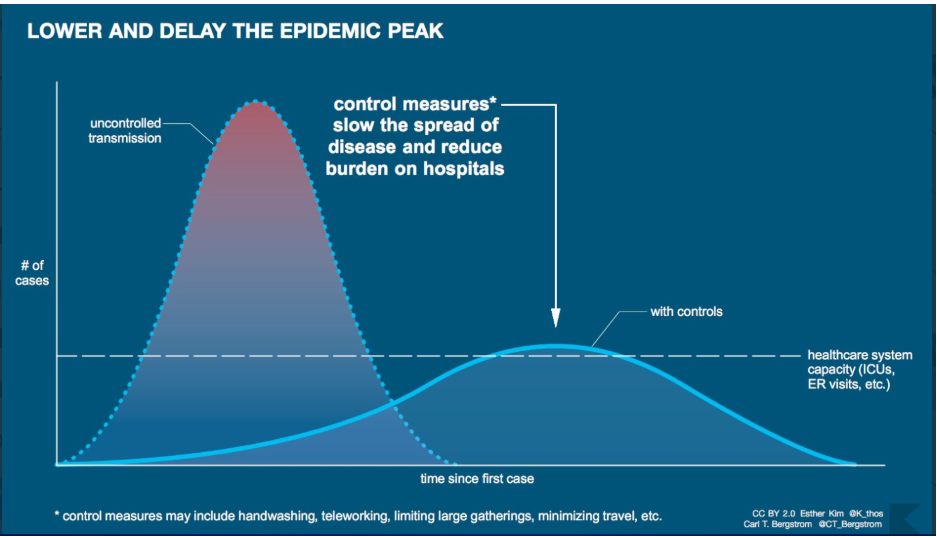

You’ve seen the chart on how people are thinking about social distancing and lockdowns.

The goal is to prevent uncontrolled community transmission so as to diminish the initial exponential increase in infections. While taking measures to diminish the initial exponential explosion may lengthen the cycle of transmission, it helps to prevent resource saturation.

Now, I know the US is finally moving into action, shutting down schools and closing offices. But, it’s abundantly clear, even without testing to confirm the hypothesis, that community transmission is rampant, And so, given the United States’ poor crisis response effort, we should assume our transmission curve looks more like the uncontrolled one than the one with controls.

That means we should lean toward expecting worst case outcomes for the US instead of best case outcomes. Recession should be a foregone conclusion. It has to be your base case now.

Policy errors

I feel almost irresponsible for having turned cautiously optimistic in January on the US economic upturn; I told you exactly what was going to happen in August:

So, by the end of 2020, I expect the accumulation of policy errors by the Fed, the eurozone, the Trump administration and others to combine with an already slowing global economy to push even the US into recession.

But, the data did show a rebound. In fact, the rebound was enough in Q4 to take Germany and the UK, countries I saw likely in recession already in 2019, out of the recession zone. And I couldn’t have anticipated a coronavirus pandemic as a trigger for a relapse.

Still, the framing from August is the right one: when bad things happen, policy makers are called on to act. And policy errors can be fatal for an economic expansion.

In the US, the biggest error has been in the slow movement to lockdown and quarantine. For Europe, it has been the rigid structure of the eurozone’s makeup and the absence of fiscal policy. That point was brought home yesterday when the ECB unveiled its measures to help contain the financial destruction from the coronavirus. ECB chief Lagarde was clearly trying to stress that rate policy is almost useless – even counterproductive – at this point. And so, she was telling Europe’s policy makers that they had to develop a fiscal response to this crisis. She erred in doing so though. It was this exchange that mattered most:

You’ve mentioned that there will probably be a lot of debt issuance in the future. At the moment certain countries are hit especially hard, like Italy. What can the ECB do if the spread for government bonds increase? Would it be an option to activate, for example, the OMT programme, or could there be other possibilities to help certain countries?

President Lagarde: On the guarantee scheme, I think I was very explicit in the introductory statement on that, but I’m happy to restate it. We are making available to all enterprises, with a focus on SMEs, massive refinancing means at very preferential rates, and in significant amounts. To encourage banks to actually use that facility we believe, and we have put in the introductory statement, that guarantee schemes would very much be in order. So in other words, it’s a guarantee that is put together by the state, or an agency of the state, or a European agency in order to support all a part of the risk that is actually taken by the bank in extending lending facility to an enterprise, notably, in a sector which is particularly exposed. I mean, that is how we believe that the financing we’re putting in place will be most efficient. Now, whether that is conducted at the national level or at the European level is for the policymakers to decide. What matters to us is that it is in place as rapidly as is possible. Some countries have already taken steps or are exploring steps in that direction. I would certainly, for the efforts that we are undertaking, I would certainly hope that they do that promptly in order to make sure that credit continues to flow to the economy, particularly the SMEs that are vulnerable in the present circumstances. So that was my point number one.

My point number two has to do with more debt issuance coming down the road depending on the fiscal expansion that will be determined by policymakers. Well, we will be there, as I said earlier on, using full flexibility, but we are not here to close spreads[1]. This is not the function or the mission of the ECB. There are other tools for that, and there are other actors to actually deal with those issues.

It’s that last bit about not being there to keep spreads in Italy and Greece from gapping out that mattered. Immediately, spreads in Italy and Greece gapped out, as traders feared that redenomination risk – where Greece or Italy are ejected from the euro – has become real.

It’s this type of error I pointed to in August. And we’re seeing these errors made in real time now.

My view

We are headed for a global recession now. The US economy will also be in recession. As I write this equity futures for the US are limit up for the day, Friday the 13th. And that’s good to see on one level.

But, let’s be clear, the equity bear markets associated with recessions are a lot more severe than those associated with mid-cycling slowing or brief crashes like 1987. We should expect at least 40% losses from the peak.

But my real worry is the credit market.

HY spreads wider by 176bps so far this week. In the Q4 18 selloff we had a move of a little more than 200bps… over 3 months.

Still haven't taken out the 2016 wides but this move has been brutally fast. pic.twitter.com/xXccbbccqT

— Jonathan Ferro (@FerroTV) March 13, 2020

We have seen spreads gap out. But it’s not a wholesale panic. It’s not a sudden stop like it was in 2008. It’s not even as bad yet as it was in 2016. So there’s still hope that fiscal responses and central bank liquidity will prevent worst case outcomes from becoming realized.

Comments are closed.