Expect a dovish hold from the Fed despite the jobs report

I know it’s pure folly to predict what the Fed is likely to do on a FOMC meeting by meeting basis. But hear me out. Despite the fact that I see the Fed looking to remain as tight as they can reasonably be in order to save up firepower for when the economy really nosedives, I expect the Fed to offer up a dovish tilt today when all is said and done. I know the last jobs report was really good. But the repo mess is too problematic heading into year end for the Fed to take a different position. And so the potential for an ugly repeat of last December has to be top of mind. Comments below

The Repo Disaster Trade

Let’s start with Repo here because the market positioning has become extreme as we had into year end. Here’s a little from Nomura’s Charlie McElligott on this from yesterday morning. He is a Managing Director of Cross-Asset Strategy in Global Equity Derivatives at Nomura. So, he has a good feel for institutional flow.

As VVIX & Skew went “bid” BIGTIME yday, this indicates that the market is now once-again beginning to price-in “tail” scenarios—and offers attractive risk-reversal opportunities to play for an upside S&P breakout following 1) a potential “hedge puke” (market has so much protection which will get sold) in the case of 2) a “tariff rollback / delay” later this week / weekend

Said another way, downside protection in S&P is extremely rich, while upside sees little-to no-interest (i.e. yesterday you could sell a 1m 4% OTM S&P Put to buy a 2% OTM Call “costless”)

Translation: Institutional investors are worried about a year-end market ‘crisis’ and are taking out protection to hedge against that outcome. While they are doing so, they are also showing almost no interest in taking a flyer on the more extreme upside scenarios.

What that tells you is that fear of event risk is high. And this risk is likely centered around the repo markets given that has been the locus of most discussion regarding the breakdown in financial plumbing.

Toppy Equity Market

On the tail-risk hedge, Charlie says:

And all of this downside protection makes sense in-light of the overall Equities positioning remaining extremely “LONG” (…and thus susceptible for an “easy” pullback—i.e. Spooz -30 handles this morning from Friday’s highs and -40 handles from last Monday’s highs at one point)

Fund Flows into Global Equities have pivoted sharply +++ in recent weeks, with the 1w inflow to Global Equities Funds at 87th %Ile, the 2w inflow at 94th %ile and the 1m inflow at 92nd %ile

Asset Manager $positioning in S&P futures remains a still-absurd 98th %Ile since 2006 despite beginning to profit-take last week—selling ~$14.7B in futs (worth noting that we actually saw Leveraged Funds forced to cover / capitulate a large portion of their “short” / hedge, buying ~$12.4B S&P futures last week)

Even after yesterday’s pullback, SPX / SPY options consolidated $Delta sits at $466B and 98th %ile since late 2013 off the back of last week’s rally impulse, while QQQ $Delta too stays “very long” at 90th%ile

Per the Nomura QIS CTA model, we estimate the Systematic Trend community’s “Gross Exposure” to the major US Equities futures (SPX, NDX, RTY) now sits back at 22 month highs, with CTA 20d adjusted“Beta to SPX” at ~84%

Translation: the equity market is extremely overbought right now. And that makes it vulnerable to event risk. We have the UK elections, US-China trade and year-end repo positioning all coming up, not to mention the Fed’s presser at 2PM today.

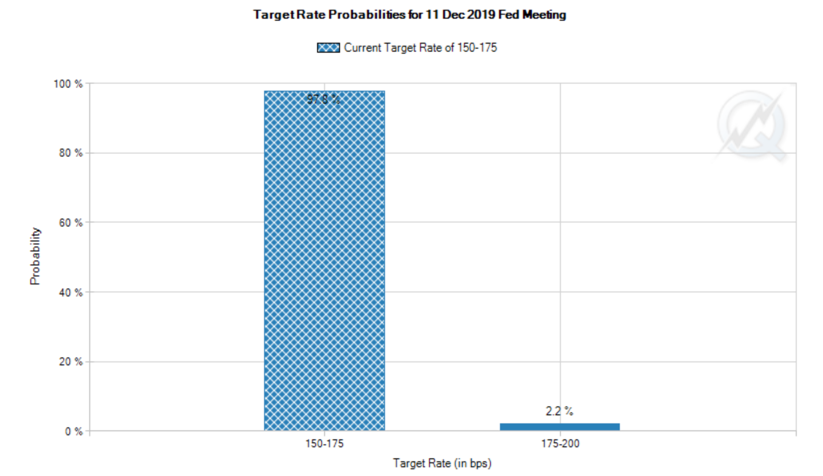

My read then is that the Fed has to tread lightly. Markets expect the Fed to hold as it has already said it is on hold indefinitely. We’re talking about an almost 98% probability here.

Source: CME Group

So the question now goes to how it ‘sells’ that hold. Does the Fed stress downside risk or does it continue to tout the robustness of this economic expansion. The former stance would be a dovish hold. And that’s on balance what I expect. The latter – what the Fed has done until now – would be a policy error. And that error would not only lead to downside equity market volatility but also have an impact beyond equities, in repo and high yield in particular.

CCC credit showing incipient distress signals

We already know about the repo stresses because of the hundreds of billions of dollars of Treasuries the Fed has been buying to stabilize that market. What is less well appreciated, however, is that the high yield market is also showing incipient signs of distress as measured by the option-adjusted spread divergence between BB and CCC credits.

Source: St. Louis Fed

As a former high yield guy, I look to that market for early signs of debt stress that precedes economic downturns. And what we’re seeing now is stress in the CCC space that has yet to ‘infect’ the BB space. What that means to me is that the junkiest credits are seeing stress. But the less junky high yield credits are still showing investor appetite to reach for yield.

We are not at a point of generalized anxiety regarding potential defaults. The question on CCC is about the breakdown of credits in that space. We know the oil patch has had a tough go of it. So, is this an energy credit issue as in 2015-2016? Or is the CCC credit issue a broader issue of investors pulling back from the riskiest credits? I will be talking to Danielle DiMartino Booth and Tracy Shuchart for Real Vision later today to get a read on this.

In the meantime, let me send this note off as the FOMC presser is coming up fast. Let’s see how they position their hold and the US economy and how markets react.

Comments are closed.