Recession watch, Fed policy, wealth taxes and the 2020 US election

I want to tie a number of economic and political topics together today as a way of thinking about what the next 18 months in the US will mean. And a lot of it starts with the US domestic economy.

Recession watch

Over the past several years, I have been pretty bullish on the US economy. And I have consistently said that I have never seen any data patterns pointing to recession in the near-term – not in the macroeconomic data and not in market-based indicators like yield curve inversion.

Instead, what I have seen are signs of over-tightening by the Fed as the US economy dealt with two mid-cycle slowdowns. In the first instance, the Yellen Fed paused and the economy recovered. We are living through the second instance. And the Powell Fed is fully reversing its double-barreled tightening by both cutting rates and expanding the balance sheet. But it’s still unclear if this will be enough.

I am on recession watch, so to speak. The data aren’t saying recession but it is my base case for 2020. And anecdotally, the case for concern is building. For example, there’s this from Axios today:

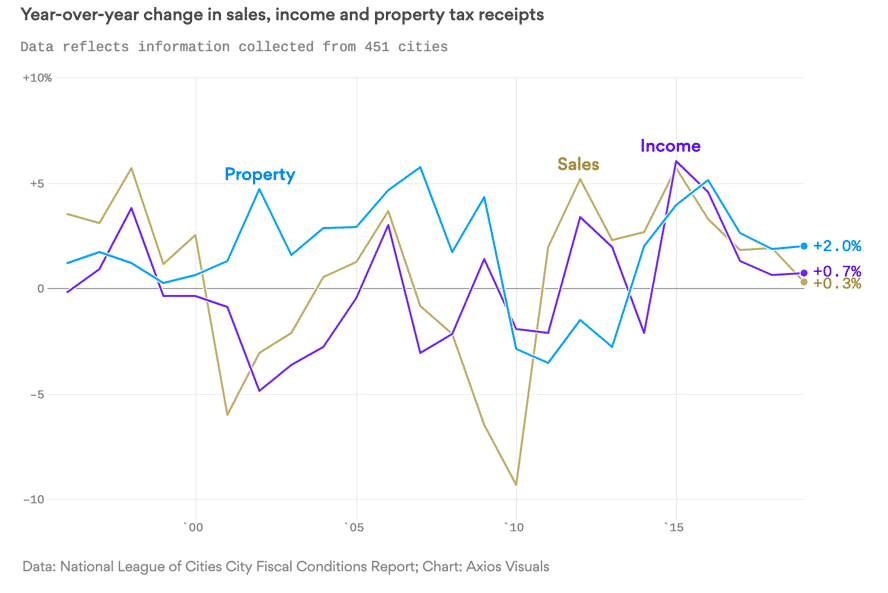

Almost two in three finance officers in large cities are predicting a recession as soon as 2020, according to a new report from the National League of Cities, as weakening major economic indicators and shrinking revenue sources put pressure on municipal budgets.

Why it matters: One of the first signs of changing economic conditions can be seen in city revenue collections. For the first time in 7 years — generally seen as the recovery phase since the Great Recession — cities expect revenues to decline as they close the books on the 2019 fiscal year.

My base case here is that neither fiscal nor monetary policy will be accommodative enough to reverse the present slackening of growth in the US. High deficits and political gridlock prevent the will for fiscal expansion. And resistance to more accommodation within the Fed will prevent a full-blown retreat. And then, in 2020, we will have to see whether or not the trend develops into a full-blown recession.

Trump’s Presidency

The question, then, is how does this affect the Trump Presidency. For example, the recent impeachment hearings have been damaging. But Trump retains a solid base of support. Here’s are some data points from the Quinnipiac poll released today:

- Nearly half of registered voters, 48 percent, say President Trump should be impeached and removed from office, while 46 percent say he should not. Last week, 46 percent supported impeachment while 48 percent were opposed.

- In his dealings with Ukraine, 59 percent of voters say President Trump was pursuing his own personal interest, while 33 percent say he was pursuing the national interest.

- “Republicans remain rock solid in opposing both the impeachment of President Trump and the House impeachment inquiry. But when it comes to the president’s motives in Ukraine, Republicans aren’t all on the same page. Roughly 7 in 10 Republicans say the president was pursuing the national interest in his dealings with Ukraine. The rest say he was pursuing his own personal interest or they don’t know,” said Quinnipiac University Polling Analyst Mary Snow.

- President Trump’s job approval rating has dipped below 40 percent for the first time since the impeachment inquiry began as 38 percent say they approve of the job he is doing, and 58 percent disapprove. Last week, 41 percent approved of the president’s job performance, while 54 percent disapproved.

Except on the President’s motives on Ukraine and his move in Syria, Trump retains not just a solid base of support among Republicans but an overwhelming majority. I don’t see that changing between now and the election.

The worry for the President is three-fold though:

- His base of support in battleground states is weakening. For example, recent polls in Minnesota show Trump losing by a wide margin against all Democratic contenders despite a close election there in 2016. You only need a few percentage points’ shift in Michigan, Pennsylvania and Ohio for Trump to lose the election.

- Independents are moving against Trump. For example, Quinnipiac says: “In today’s poll, support for impeachment is 86 – 9 percent among Democrats, and 49 – 41 percent among independents, while Republicans oppose impeachment 91 – 6 percent. In last week’s poll, Democrats supported impeachment 85 – 10 percent, independents were divided with 48 percent opposed and 42 percent in support, and Republicans opposed impeachment 93 – 6 percent.” And this is before the Bill Taylor revelations. Independents are where this election is won or lost.

- The economy is shifting down, with the Atlanta Fed’s GDPNow metric for Q3 now at 1.8%. The President’s job approval rating will go even lower if that trend holds.

So, the economy is a big deal.

The economy’s impact on 2020 elections

A few days ago, I saw that the Financial Times wrote a blistering editorial against Trump that all but called for his removal from office. My immediate thought on the politics was that Trump’s move on Syria and the decision to hold the G7 at his own resort were ill-timed and would cost him allies. But that’s not fatal. It’s a poor economy that makes the difference.

I tweeted that “In 1974, the economy was cratering as the smoking gun was revealed for Watergate. I think that was a significant reason support for Nixon crumbled.” and that “By contrast, when Clinton was impeached, the economy was reaching its zenith. Again that mattered in terms of public opinion and the 98 midterms”.

The question is not just about Trump but also about the House of Representatives and the Senate. It’s likely that the Democrats will retain the House in 2020. But in the Senate, let’s remember that the Republicans picked up two seats in 2018.

But, in a bad economy, the Democratic Party taking over the Senate is not as difficult as one might think. The National Journal notes that “New polls and fundraising reports show key GOP senators in political trouble, giving Democrats a solid shot to win back control of the upper chamber.”

The Washington Examiner writes:

In Colorado, Republican Senator Cory Gardner trails Democrat John Hickenlooper by eleven points. In Iowa, Senator Joni Ernst, a veteran and one of the party’s six female senators, also trails her opponent by a sizable spread.

The electoral map favours the Democrats because there are only 12 Democrat incumbents while there are 20 Republicans fighting for re-election. And there are an increasing number of Republican Senators in trouble like Martha McSally, Cory Gardner, Joni Ernst, and even Susan Collins, who on fundraising in Q3 “was outpaced by over $1 million, with Democrat Sara Gideon, the speaker of the Maine House, raising $3.2 million.”

This is all happening before the economy visibly weakens. If the economy does weaken, I continue to believe that it would be an electoral catastrophe for the Republicans given the damaging evidence piling up in the impeachment proceedings. It would make Trump difficult for down ballot contests where independent voters are increasingly turning against him.

Wealth taxes, MMT and all that

I spoke to David Rosenberg about the economy a few weeks ago in Toronto. The video is up now. Here’s a link. His view was very representative of Wall Street in general regarding fears that an Elizabeth Warren presidency would crush equities. Ostensibly, a Warren or Sanders presidency backed by Democratic chambers of Congress would frighten Wall Street even more.

I don’t have a view here. There are too many moving parts right now. But I do believe we are seeing a sea change in how we think about monetary vs fiscal policy, both in North America and in Western Europe.

In the past, mainstream policy thinking was that fiscal policy was largely on auto-pilot with minor tweaks here and there around differing priorities. But fiscal wasn’t ‘activist’ in that it was not a legitimate tool for steering the economy, lest inflation spiral out of control.

Instead, monetary policy was to be used both at cycle troughs by adding accommodation at troughs through rate cuts and raising rates at cycle peaks creating what I have called “Fed-engineered unemployment” to prevent inflation.

This whole framework is being called into question. Why? Monetary policy has become extreme in the past decade, with zero or negative base rates and quantitative easing during a record-long expansion. Rate policy was exhausted after the Great Financial Crisis, forcing central banks to push the envelope. And while they can go further still, the central banks are now running up against political resistance. And so, people are questioning this approach, and looking for others.

People like Bernie Sanders and Elizabeth Warren have different approaches: wealth taxes, greater emphasis on fiscal policy, and more regulation, for example. And Modern Monetary Theory tells us that inflation is the only real constraint to fiscal expansion, whether through tax cuts or spending increases. That’s very different from the mainstream.

I think the next economic downturn makes these ideas politically viable – both in North America and Western Europe – just as economic crisis and a lack of prosecution of banks and bankers made right-wing populism politically viable.

Basically, the West is still in crisis, but this time it’s a political crisis. The political repercussions of the Great Financial Crisis have yet to be fully digested. I think it will take a generation.

But, for now, the best way to think about it revolves around Donald Trump and the fragility of his hold on power. With his focus on tax cuts for the wealthy and corporations and his cut of regulations, he more represents the ‘old order’ than a new order. Only on protectionism do I see a major departure in Trump on economic policy. If he falls from power though, I believe it is very likely we see a wholesale dismemberment of that old order. And the US economy will be the key.

Comments are closed.