Competitive currency devaluation and the currency war

The US is the cleanest shirt

Last week, I was talking to Megan Greene, the former chief economist at John Hancock for an interview on the US and European economies. And she said something that resonated with me about the global growth slowdown. She quipped: “The US is the cleanest shirt in the dirty laundry basket”.

I know what she meant too. The US, despite its recent growth deceleration and constant angst about recession, is doing much better than almost any advanced economy out there. You look at Germany, where industrial production has fallen off a cliff and Q2 GDP growth may well be negative and you think the US looks pretty good.

But, there was a second meaning to Megan’s comment that also makes sense but is sinister in some regards. What she was also saying was that US dollar assets look really attractive right now relative to other assets. And she said this explicitly, pointing at the yield differentials, which are an outgrowth of the Fed’s tightening interest rate policy over the past view years.

That might sounds good. But, in a world in which the US dollar is the world’s reserve currency, it’s downright sinister.

Competitive Currency Devaluation

You may have seen this overnight. But three separate central banks lowered interest rates last night. The Reserve Bank of New Zealand cut rates 50 basis points, outdoing expectations for 25. And the central banks of India and Thailand surprised the market with lower rates too.

What we’re seeing here is a competitive currency devaluation. As the global growth slowdown gains steam, with bond yields across the globe falling to record lows, central banks are cutting rates. Now, certainly the cuts are designed to boost the domestic economy by lowering borrowing costs. But, the reality is a lot of any boost will come from making the currency cheaper, allowing countries to ‘steal growth’ from abroad via exports.

The problem, of course, is the US dollar. International borrowers are short dollars because they have been using it as a funding currency. And so, as the dollar appreciates in value relative to other currencies, these debtors find the local currency value of their debt increasing.

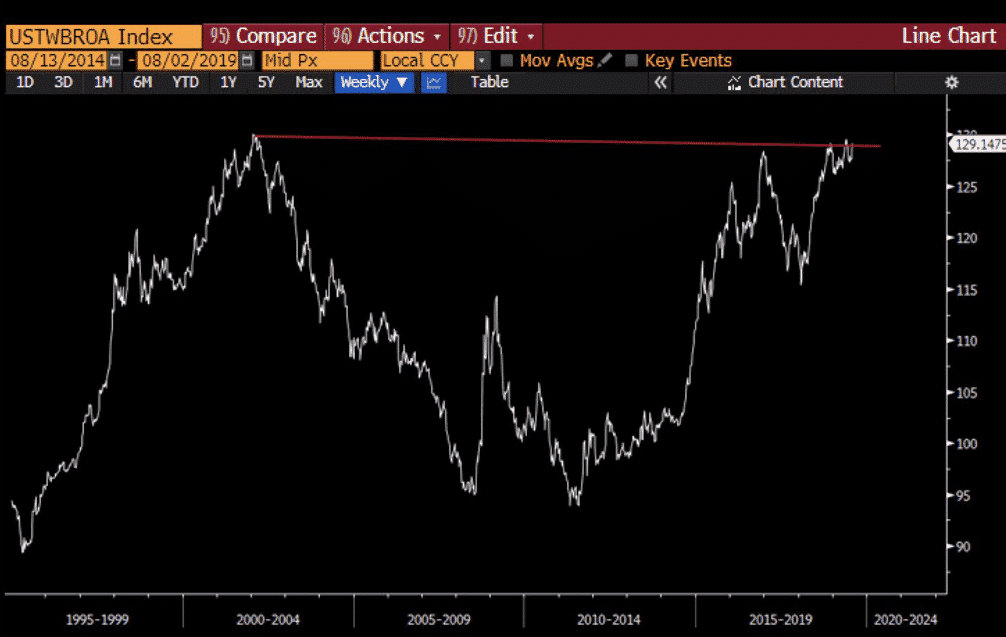

Raoul Pal pointed out this morning that

The Fed Broad Trade Weighted Dollar Index is incredibly close to breaking the ENORMOUS cup and handle pattern at 130. Barely a half a percent away… pic.twitter.com/XCZaSPRQdU

— Raoul Pal (@RaoulGMI) August 7, 2019

Look at the long-term chart.

This is trouble. Every emerging market crisis in living memory started because of trends like this. Unless the Fed finds a way to cut aggressively and depreciate the US dollar, it’s only a matter of time before this leads to defaults.

Remember, a dollar funding squeeze is already underway.

The China problem

For me, the biggest risk to the global economy right now is the budding currency war between the US and China. Put simply, a strong US dollar is a problem without the Chinese currency involved. But to the degree China’s currency also depreciates, we have the makings of a serious economic and financial crisis.

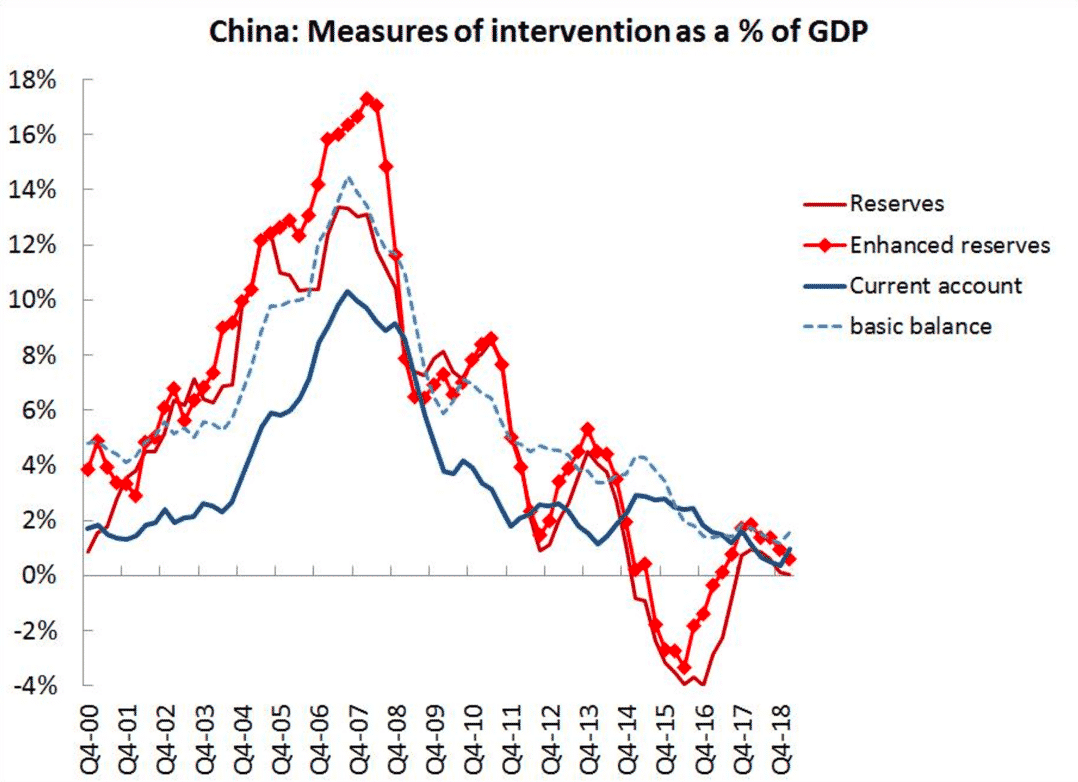

Look at this chart.

Brad Setser says

The U.S. Treasury it seems has decided to name China a currency manipulator roughly 12-13 years after it should have first named China, and roughly 5 years after China stopped manipulating …

(1/x) pic.twitter.com/H3OMjJTnce

— Brad Setser (@Brad_Setser) August 6, 2019

If anything, the Chinese are propping their currency up. All of the pressure is on the downside. There are even rumors about the PBoC borrowing from HSBC to prop up their currency.

So, we are very close to the Yuan depreciating here. The only thing preventing that outcome is the People’s Bank of China defending the currency. All we need is a trigger from US President Trump and the PBoC will let the currency go. How far? We don’t know.

But if the Chinese fully enter this war of competitive currency devaluations, all bets are off. Global recession would be a lock. And a financial crisis would not be far behind.

My advice: watch what the Fed does about rate policy. But more importantly, watch if Trump escalates his trade war. If he does, China may enter the currency war in full. And then, we are headed for trouble.

Comments are closed.