Risk-off selling continues as Uber slides

I have some thoughts on economic headlines below. This one is outside the paywall. If you like what you read, please subscribe.

Uber as a signpost

I am just catching up to where I left off at the end of last week regarding the risk-off move in shares. That move continues into today. As I write this Uber is down 6.9% in the pre-market after a decline of nearly 8% Friday. This is after it went to market at the bottom of its trading range. Its smaller rival Lyft is also still hurting, with shares down 30% from its IPO price.

A number of things come to mind here. First, this is a near-term bad sign for the market. That Uber and Lyft were able to IPO at all tells you there is risk-on appetite. I am not talking about retail investors here. The fear of missing out is palpable among money managers. But, at the same time, these stocks have floundered, and it points to a market that is overextended.

Will the likes of WeWork get their IPO off after this drubbing? I wonder. On the one hand, you have Beyond Meat, which I mentioned last week. They IPO’ed on May 2nd, raising $240 million. Some people are acting like its a bubble stock (like Uber and Lyft), indicative of the times. But, compared to Uber and Lyft, their shares are holding up better. And it has long had some deep-pocketed investors like Bill Gates. Their business model looks more sustainable than Uber or Lyft’s.

For me the test will be the IPO of Impossible Foods, which is in the same space. They just raised $300 million in another private funding round, and are backed by the likes of Serena Williams and Katy Perry. That brings total funding to $750 million. And this is pre-IPO. Their implied market valuation from that round is over $4 billion.

They have no plans to IPO though. And we can see why. The private market is flush with cash. Why subject yourself to what Uber and Lyft are dealing with unless you need the money because of cash burn? To me, it points to the possibility that the only companies we will see IPO are the ones that are hemorrhaging cash and need the money. Those are the riskiest bets. And it’s far from clear investors will continue to have a FOMO-based mentality on these names.

Differing views on the medium-term

The FAANG stocks are all sliding 2 or 3% this morning as sentiment has turned cautious because of the tariff battle between the US and China. But, again, as I mentioned on Thursday, “[d]espite the near-term risks that trade and currency wars present, I don’t see these factors knocking the US and global economy off course enough to change the overall direction of the economy or markets. We are still in a period in the US of tough comps that mean a slowing of year-on-year growth.” But I think the lack of Fed tightening and a US economy that is still growing puts a floor under how far this selling pressure will go.

Note that China has hit back at the US and has announced $60 billion of tariffs of its own. So, it’s clear the trade war will escalate as all signs are that China will not back down. They say they will ‘never surrender’. That is severely dampening sentiment. But, again, I don’t think it will have a material impact on the course of the global economy. And, therefore, its impact will fade on shares too.

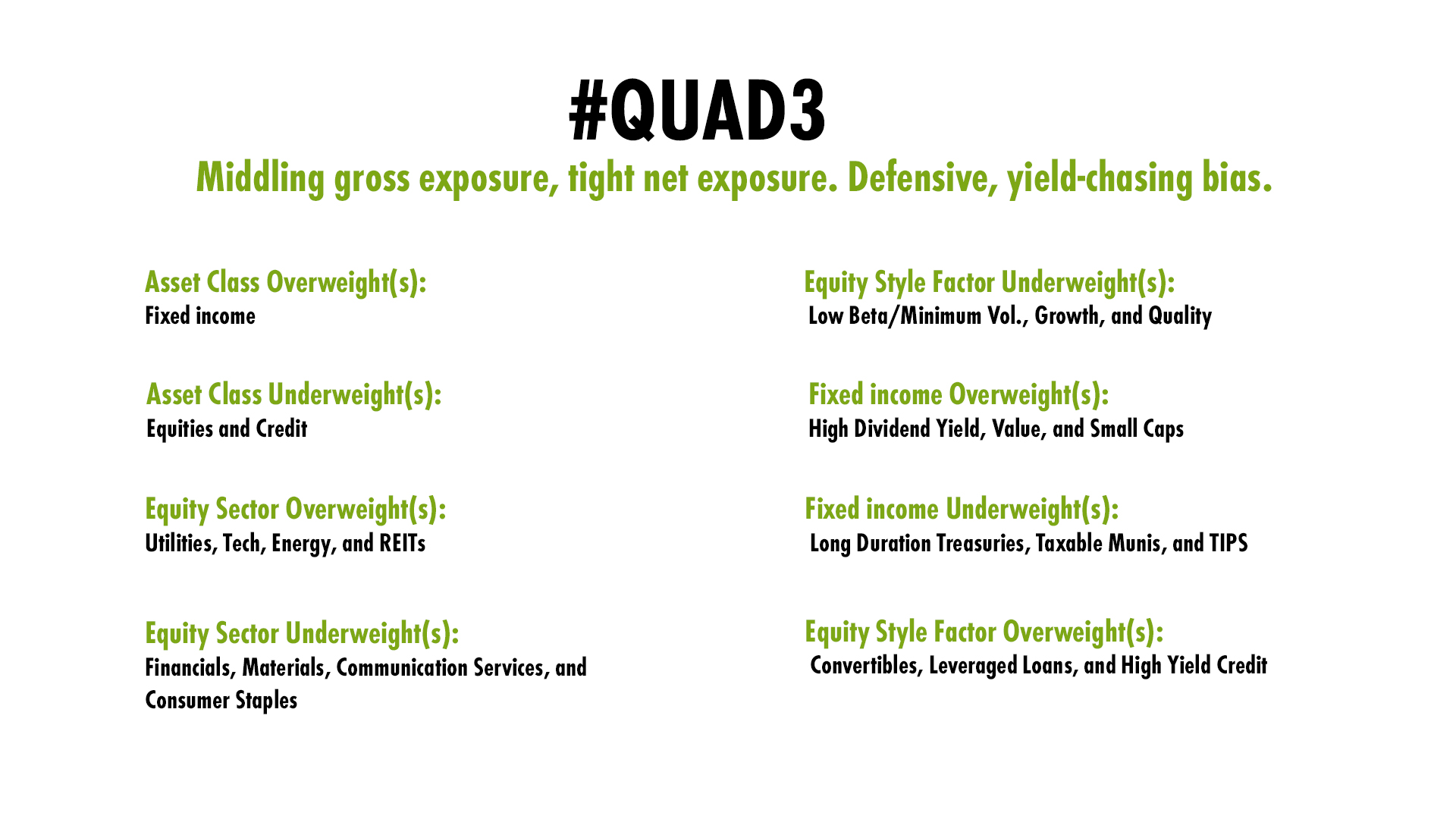

This middling path of growth on the back of renewed record highs in share prices has created a divergence in views regarding risk assets. I spoke to Darius Dale of Hedgeye last week on Real Vision. And the economic model his company uses anticipates near end-of-cycle slowing growth but rising inflation — what they call Quad 3. And they’re saying fixed income will outperform equities, but that within the equities universe the FAANG stocks will do well relative to cyclicals.

That’s not what we’re seeing today, of course. And Morgan Stanley is out saying that the rest of 2019 could be negative for risk assets. Here’s Bloomberg on their note to investors:

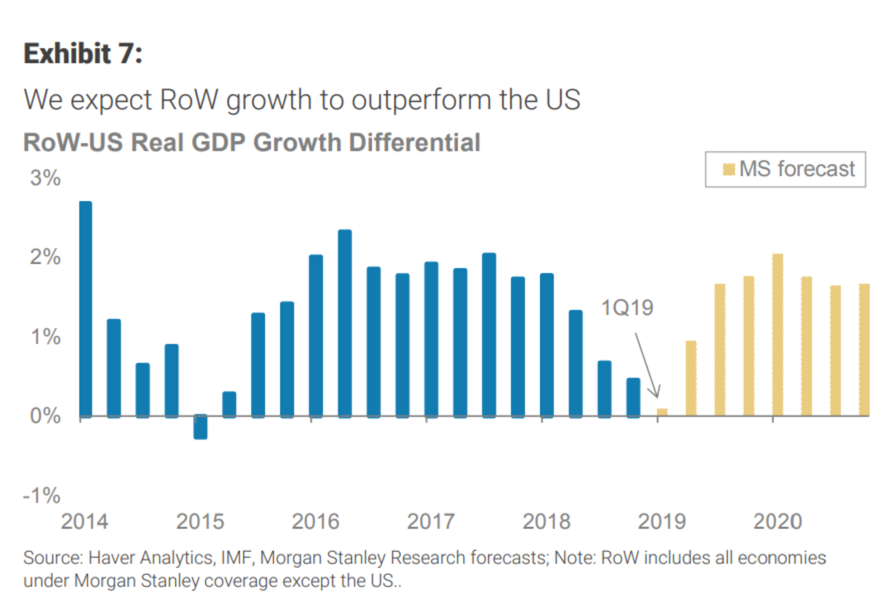

Markets are currently priced for a “Goldilocks” scenario of solid but non-inflationary growth, and America has outperformed — but that’s all set to reverse, strategists including Andrew Sheets wrote in a May 12 note. Their skepticism rests on three factors playing out over the remainder of the year:

- The Goldilocks conditions finally coming to an end

- The divergence between growth in the U.S. and the rest of the world narrowing

- The gap between prices and fundamentals closing

“Investors should hold a defensive tilt and a preference for ex-U.S. risk exposure,” the strategists wrote. “This is supported by where valuations sit versus fundamentals, forecasts that U.S. versus rest-of-world growth reverses and excessive investor confidence that there is little risk of the output gap closing.”

They are saying the same thing that Hedgeye is regarding slowing growth and outperformance for the rest of the world vis-a-vis the US. But, their conclusion seems to be more bearish to me. Maybe I’m just reading into that though. Hedgeye sees stocks underperforming but thinks there will still be relative value on a sector-specific basis. Morgan Stanley is emphasizing the whole risk-off nature for this climate for the US.

Here’s their view:

In December, when expectations of U.S. versus RoW growth appeared to be reversing, the dollar weakened, stocks outside America outperformed and duration in the U.S. beat Europe, they wrote. “Over the next 12 months, we expect all those performance trends to apply.”

The investment ideas the strategists propose include:

- Stocks and government bonds over credit

- International equities versus U.S., with Japan a favorite

- U.S. Treasuries over Bunds

“The question remains: is the performance pattern year-to-date a template for the rest of the year, or an aberration?” the strategists said. “We think the latter.”

Watch out for Emerging Markets more than Junk

Meanwhile, notice that, even though the US is sen underperforming, it hasn’t fed through into the US dollar yet. And some EM countries are taking it on the chin. Pakistan is the latest to go to the IMF cap in hand for a bailout.

I think the China-US trade war will have a more meaningful impact in EM. And so I would look to those markets as having the volatility that comes from the standoff, rather than looking for something in developed economy markets.

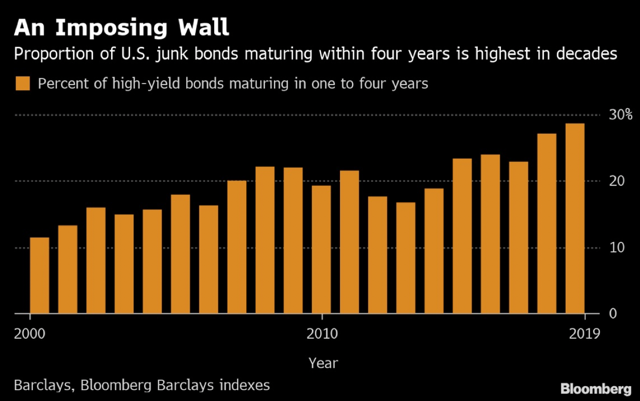

In the developed economy, when we talk about risk assets, high yield is an interesting place to look. And that’s because we are about to see a lot of rollover risk there in the coming years. the proportion of bond maturation is the highest over the next four years we have seen in decades.

Source: Bloomberg

And this is in a market that has swelled in growth.

Now, this isn’t a near-term event. But over the medium-term, I think the high yield market will have a really tough time digesting the flood of issues needed to roll over maturities. And we are going to see defaults rise. This quote from a major investor in a Bloomberg article has risk written all over it:

“Companies are extending maturities out, and that’s healthy,” said Scott Roberts, head of high-yield debt at Invesco Ltd. Refinancing is a better use of debt than buying back shares, he added. “I’ve seen frothy before and this is not it.”

Autonomous Vehicles and the Green New Deal

One last thing. I saw this piece on Bloomberg about a new electrified truck lane on the A5 in Germany just south of Frankfurt.

Germany has opened the first stretch of a so-called electric highway that will connect hybrid trucks to overhead wires, allowing them to recharge while traveling on the country’s main transportation arteries.

The 10-kilometer (6-mile) stretch south of Frankfurt on Germany’s A5 autobahn was opened last week, the German state of Hesse said in a statement. One truck is using it now, with four more planned by 2020.

The system was built by Munich-based engineering firm Siemens AG, while Volkswagen AG’s Scania trucks unit provided the vehicles. It uses technology similar to trains or trams, allowing to trucks to link on while driving at up to 90 kilometers an hour, drawing power from the wires above. The electricity charges up the trucks’s battery, allowing it to drive electrically for a while afterward, with a diesel motor kicking in once the battery is depleted.

Siemens started the project in 2010 with a test track outside Berlin. The first complete track opened in 2016 outside of Stockholm, and the company is working on another in California.

I think it’s a big deal. This is where the future of autonomous and electric vehicles lies – with trucks. Everyone is talking about passenger vehicles as if that’s where the real innovation is coming. Tesla is the company everyone looks to on that front. Yet, when I think about the emerging technology, I think that business transportation has a greater chance of seeing innovation through technology reduce costs.

Incumbent companies like Siemens and Scania are at the vanguard here because they have the most to gain. And we are going to see this electrification swell, with autonomous truck fleets coming soon as well. That has been in development for years. That will reduce costs for transportation, particularly in Europe and Asia, which are more densely populated than the US. And we are going to see electrification lead to autonomous truck fleets over time. It will also eventually be another source of unemployment for a unionized workforce. That’s coming over the next decade. And it’s a lot more important than driverless cars.

Happy Monday!

Comments are closed.