Re-acceleration, but for how long?

After the Fed overtightened in 2018, it reversed course abruptly. And risk assets have cheered the Fed’s volte face with a V-shaped surge to new highs. And, coincidentally (since Fed policy acts with a lag), the economic data have turned up at the same time. In the US, it is the best of times right now. But for how long?

I think I will actually leave that question dangling as I go through some of the stories that are headlining today’s market action because I don’t have an answer to that question.

The Fed’s dovish tilt

I spoke to Charlie McElligott of Nomura two weeks ago. And he told me that he thinks the Fed is about to “move the goalposts” towards what he calls an asymmetric inflation approach – allowing the economy to run hot because inflation is so muted. Now this is something Yellen muted but never acted upon. Powell seems ready to act on it.

And the way I would interpret it is – contra Charlie – as symmetric, meaning the Fed is going to look at 2% inflation as a target, not a ceiling. And they will be willing to allow inflation to run above 2% before resuming tightening.

The hope there is that this forward guidance signal will outweigh the previous overtightening of 2018 and prevent the US economy from lapsing into recession as credit tightens. The big question for markets and businesses is whether this gambit will work. It has certainly fuelled a rally in risk assets. But will it keep recession at bay without creating more bubble conditions that turn an end of cycle unwind into a financial crisis? That’s the test.

The strong US dollar

My interview with Marc Chandler is out at Real Vision now. And he’s talking about the broader dollar index DXY hitting 100 and rolling over into the end of this business cycle. And that’s not a 2019 phenomenon per se, but something that takes form over the next year.

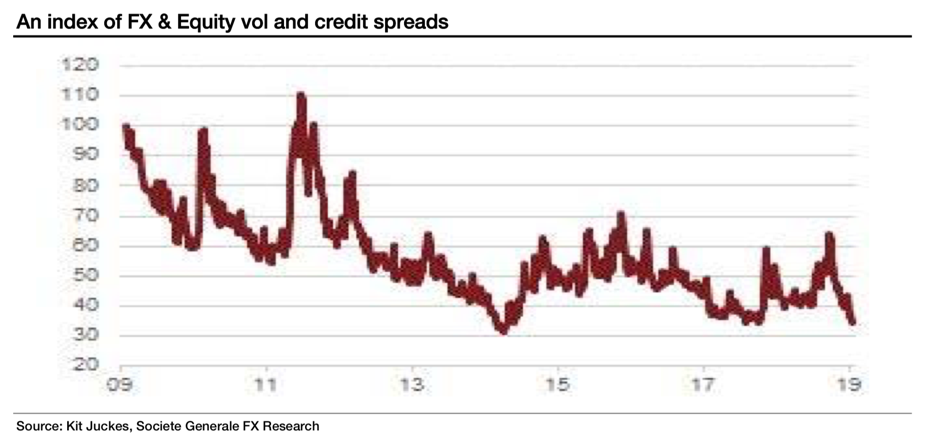

The interesting bit for me was Marc’s belief in the Great Moderation. And by that, he means the tamping down on volatility across the economy, and consequently across all asset classes. His view is that a lot of this owes to the decreasing dependence on manufacturing in advanced economies like the US as well as the advent of just-in-time inventory practices. Both of these effects act to smooth out economic volatility relative to what we were used to seeing 30 or 40 years ago.

And we can see that decline in vol passing through into the FX markets. Here’s a chart from SocGen’s Kit Juckes via Albert Edwards on FX and Equity vol.

For me, the question is whether this decline in volatility is a contrarian indicator. It goes back to the title of this post “Re-acceleration, but for how long?”. With the Fed now having already stopped its tightening, perhaps it has already so overtightened that we are on the precipice of a credit event. There are no signs of a general credit deterioration yet. But, this lack of volatility is a bit disturbing.

Non-US vulnerability

Charlie McElligott sees vulnerability here outside the US as the US dollar tears through the 97 level on the DXY. His view:

- Inherently high-beta / high-yield ARS is breaking-down to new lows on default concerns as 5Y CDS breaks 1240—the highest cost of protection seen during the Macri administration

- TRY melting down again as the CB removed their pledge for further tightening if needed; Lira at lows vs USD since Oct18

- EM safe-haven Korea is too struggling, with Q1 GDP contracting -0.3% QoQ vs +0.3% expectations—the Won is now at 27 month lows vs the US Dollar

- Following the big inflation “miss” earlier in the week, Aussie has dropped below 70 to a new 3 month low vs USD as the same ol’ “Slow-flation” concerns persist

- The Dollar strength too sees USDCNH at 2m highs ( Offshore Yuan weakness vs USD)

Remember, all of this is happening as the US dollar continues to rise, despite being significantly overvalued on a purchasing power parity basis against other G-10 countries. If the Fed is successful in unwinding its 2018 over-tightening, it may be a catalyst for the dollar weakness Marc sees later in 2019 and 2020. And that could give big relief to emerging markets.

Tesla as a signpost

One thesis I have played with in the past is that the demise Tesla could be a catalyst for risk-off in credit markets. We saw that in August when Tesla shares took a nose dive as Elon Musk’s behavior became erratic. But Tesla turned in two good quarters and the scepticism about Tesla became more muted.

With the release of Tesla’s latest quarterly results, showing a loss of just over $700 million and a massive cash bleed, that scepticism has returned. Tesla is a field of dreams play that requires a huge amount of faith, especially at the price. It is most reminiscent of the tech companies of the 1990s dotcom bubble. Other field of dream companies are now coming to market with IPOs.

And for me, Tesla represents a threat to that whole cohort of companies because it is now cash-stricken, talking about the need to raise funds. Last August I talked about the $920 million convertible Tesla had coming due for repayment.

Given Tesla’s cash flow situation, that puts huge pressure on Tesla to get the stock price above $360 or it has to fork over $920 million in February.

What’s more, Tesla has another convertible bond for $1.38 billion at 1.25% that matures 25 February 2021. This issue converts at the exact same price.

Now remember, if these bonds do not convert, Tesla is highly unlikely to get another convertible deal off the ground. It will have to pay the full coupon of a junk bond rated company, if it is able to sell any bonds at all. For example, Tesla’s straight non-convertible notes due 2025, issued at 5.30%, are trading at a yield to maturity of 6.77%.

What’s happened is that Tesla has been forced to pony up for those converts. They now have $2.2 billion, $1.5 billion less than at the end of the last quarter. I think the need for more capital is a question of when, not if. But if Tesla is successful in raising money well before the next convertible is due, then it is a good signpost regarding risk. However, if Tesla fails, its shares could go to zero as it defaults. And that would be a signpost for credit deterioration.

Jobs and the consumer as a signpost

On the other side of this are the bullish signals that continued consumer spending and low initial jobless claims are sending about the resilience of the US economy. The latest report from the US Department of Labor says that “The advance number of actual initial claims under state programs, unadjusted, totaled 211,361 in the week ending April 20, an increase of 14,964 (or 7.6 percent) from the previous week.”

A bit of an uptick, but not worrying yet. I worry when the uptick is many weeks and the year-over-year comparisons show a rise in claims. The year-over-year numbers show a decrease of 17,750 average initial claims. That’s bullish.

And when you add in the massive uptick to the nowcasts that retail sales gave us last week, it tells you that all is well on the consumer front, in terms of jobs, wages and spending. I don’t see any weaknesses on the consumer side leading the US economy down.

I should also point out that the curve inversion recession indicator has mostly unwound.

My view

I started my morning reading Albert Edwards’ latest missive. And, he was – as you could expect – cautious about getting too amped up about equities here. He still favours fixed income. His question: “What happens if, as the savvy David Rosenberg believes, the Fed has overdone the tightening cycle and the economy is already headed into recession?”

The answer is very bad things for equities – and very good things for government bonds.

But, equally, what happens if the Fed is able to claw back its tightening by promising policy symmetry, preventing the economy from heading into recession? I think we get a (dangerous multi-year) melt-up in risk assets similar to what we saw at the end of the dotcom boom.

So, we have two very divergent outcomes ahead. And there is still no firm indication which side is winning the battle.

Comments are closed.