GDP growth surprise, jobless claims and the second referendum debate

I have a number of threads to address here. The first is that we got two big pieces of economic data out of the US this morning, one backward looking and the other coincident or forward looking. And I want to break down. My overall take is that the data confirm my view that the US is decelerating, not precipitously per se, but into stall speed.

Let’s look at the GDP growth numbers first.

Fade the December retail sales report

The numbers for GDP growth show 2.6% annualized growth in Q4 versus the prior quarter. And 2.9% growth through all of 2018. These figures were above expectations as the consensus was looking for 2.4% annualized growth in the quarter. So, forget about that weak December retail sales report. It’s not indicative of how the quarter actually went.

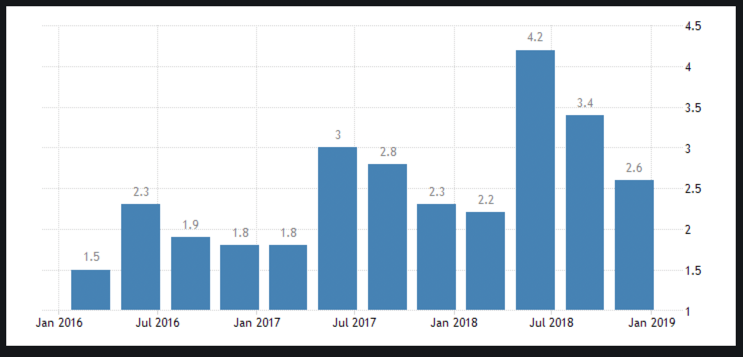

We had 2.2% growth in Q1 followed by 4.2%, 3.4% and 2.6% in the subsequent quarters. The standout stat to describe 2018 is that it was the first year since 2004 in which every quarter’s annualized growth rate exceeded 2.0%.

The way I look at the figures is through the lens of the tax cut’s fiscal stimulus. Overall, the 2018 numbers show stimulus adding to growth most acutely in the middle of the year, with its impact fading by Q4.

The non-residential investment number was solid in Q4 at a 7.2% increase. If the Trump tax cuts are going to have a meaningful long-term impact, you would expect those numbers to be higher. For me, that’s the tell that much of the mid-year GDP growth was a one-off, with Q4 showing a reversion to a trend closer to a 2.0% stall speed number.

The caveat here is that there may be some residual seasonality in the figures, with growth rates declining every quarter from the April-June quarter in each of the last three years.

Source: Trading Economics

So we may see a weak Q1, followed by a better Q2. And I know Goldman Sachs’ economics group is talking about Q1 as a low point, with the economy rebounding from there.

Jobless claims uptick

Now, the GDP report is clearly backward-looking, especially as its release was delayed by the shutdown. Jobless claims data are more coincident or forward looking. And those numbers have been showing softness. This week, the number for initial claims came in at 225,000, pushing up the 4-week average to 229,000. That’s 6,000 more than the year-ago level, putting initial claims above year-ago levels for the third week on the trot. That’s not good.

In fairness though, if you look at continuing claims, the data show a fairly substantial drop from 1.907 million to 1.761 million in the last year. And so, I don’t think we can say with any conviction whether the employment market has deteriorated meaningfully. Jobless claims data bear watching though, because it is a good real-time gauge of where household consumption growth is headed.

Overall, my expectation is for Q1 GDP growth to decelerate from the Q4 2.6% figure toward a 2% stall speed level or lower. And then, we’ll have to see where we are.

Jay Powell’s about-face

It’s meaningful to note that as this deceleration is ongoing, the Fed has paused. Fed Chair Jay Powell, in remarks to Congress on Tuesday in Wednesday, said that the Fed is not just going to pause rate hikes, it is also thinking about pausing its quantitative tightening campaign. And his signal that we would get a double-barrelled pause made me think of this post I wrote two years ago:

And so, as I put it last week, “[a]t some point, either the yield curve flattening will stop or the Fed will stop. During the energy capex bust, the Fed already showed us it is responsive to data. And so to the degree the yield curve continued to flatten, I believe it would show up as poor economic data and the Fed would be forced to yield. Alternatively the flattening could end due to a re-acceleration of growth, ending the whole speculation about secular stagnation, at least temporarily.”

My bet is on the Fed’s pausing. Why? Policy choices.

See, monetary policy is the only game in town. It has been for as long as most of us can remember. This is an outgrowth of stagflation in the 1970s when activist fiscal policy was seen as a primary cause of inflation. And we are still fighting that battle from the 1970s, with the Fed hiking rates now even as it has undershot its target inflation rate for what Fed Governor Lael Brainard recently acknowledged is 58 straight months. And the Fed will soon add double-barrelled tightening to boot, when it starts shrinking its balance sheet.

My bet proved wrong but this framing has proved right. Growth did re-accelerate and the curve flattening stopped as a result. The Fed continued to hike. But in 2018, curve flattening came back with a vengeance. And as we approached inversion late in the year, the Fed paused.

And policy choices matter. St. Louis Fed President Bullard warned back in 2017 that double-barrelled tightening was a mistake. His concern was curve flattening. But not only did the Fed eventually move in that direction, it accelerated its tightening timetable last year. It’s not reversing yet. But it could be pausing on both fronts very soon. And so, to the degree the economy continues to slow, that will be a cushion.

A hanging thread on Brexit

Let me make a detour into the political economy here. I am a bit late to this and I had wanted to mention it yesterday. But I see that some of the biggest Brexiteers are contradicting themselves regarding how Brexit should be conducted.

Andrew Adonis reminded John Redwood on Victoria Derbyshire’s show two weeks ago that he had ben saying that having two Brexit refernda was the right way to do it. You’d have a first referendum on whether to leave the EU. And if the voters opted to leave, after the negotiation terms were clear, voters would vote whether those terms were acceptable. This makes a lot of sense.

But Redwood, caught out by the confrontation, claimed that the second vote had already taken place via the general election in 2017. His claim: voters voted to leave by sending Theresa May back to No. 10. And he said that even though the general election took place before the terms of Brexit were revealed and the Conservatives lost their absolute majority. That’s very dodgy logic to say the least. Here’s the video.

Interestingly, ERG leader Jacob Rees-Mogg made the same point way back in 2011 when discussing a potential Brexit referendum in parliament. Here’s the video.

Clearly, these guys just want to leave the EU and, out of political expediency, are willing to say whatever suits them to further that aim. I just thought I would point out what’s going on here.

I do have some thoughts on the North Korea and China negotiations. But I’ve run out of time, so I’m going to leave it there for now.

Comments are closed.