Recapping Powell and reasons why the Fed might pause as oil falls below $50 a barrel

Data from the EIA yesterday showed US crude-oil inventories rose for a 10th straight week on the back of surging shale oil production. And prices for WTI dipped below $50 a barrel on the news. While the surging supply is undoubtedly a key driver here, it is demand concerns that have the market worried.

This is one of several reasons the Fed might pause next year, rather than sticking to its three hike timetable. Housing is another that I will get to here as well. And so, there was considerable speculation about a pause on the back of comments by Fed Chairman Jerome Powell as the US equity markets soared on that sentiment.

How to think about the Fed here

Before we get into what the Fed might and might not do, let’s construct a model for how to think about it. IThe first thing we need to remember is that the Fed has a specific way of thinking about monetary policy. I don’t happen to agree with this paradigm. But it’s the one they use. And if you’re going to predict what the Fed is likely to do, you need to know how the Fed thinks.

There are two parts to their model. The first is that there is a neutral level of interest rates that balances savings and investment, both over the long-term and the short term. This is called the Wicksellian natural rate of interest after Swedish economist Knut Wicksell. I don’t think of credit this way and see the natural rate of interest as economic fiction. If you are into economic esoterics, see here for my discussion about it from 2014. That doesn’t matter because Wicksellian natural rates are how the Fed thinks. The key is that, for adherents, like Fed officials, the natural rate is an non-observable measure that can’t be measured. And so it is a moving target that they are constantly looking for ways to hit.

The second part of the model is the concept that there is a trade-off between unemployment and inflation. And here again, we run into this whole stylized economic model thingy again. The non-accelerating interest rate of unemployment – or NAIRU – for short is another unobservable moving target too. The Fed used to say unemployment below 5.5% meant inflation would accelerate. But that didn’t happen in this cycle. Unemployment hit 5.5% under Yellen and went below that level without any impact on inflation whatsoever. The Fed didn’t throw the model out. The Fed simply moved the target down to 4.5%, even as the actual rate of unemployment has dipped far below that level.

Bringing natural rates and NAIRU together

The way these concepts come together to inform monetary policy is that the Fed has short- and long-run targets for both the (neutral or natural) rate of interest and NAIRU. And it’s the short-term neutral rate that is its bogey for rate policy. When the Fed is says it’s being ‘accommodative’ – as it say’s it’s being now – it’s holding the rate of interest below what it judges the short-term neutral rate to be. Policy normalization is basically just the Fed moving the interest rate target toward what it guesses the (unobservable short-term) neutral rate to be.

NAIRU comes in here by impacting the difference between the short- and long-run neutral rate targets. According to this thinking, when unemployment is low – like it is now – it puts upward pressure on inflation, and, thus, on the short-term neutral rate. It could even get to the point where the short-term neutral rate exceeds the longer-term one.

And that would mean the Fed would have to jack interest rates up much higher in the short term to get things under control. They don’t want to go there because it means they could suffocate the economy and stamp out an expansion. So they raise rates in anticipation of this, to prevent having to mash on the brakes later. If you ever listened to Yellen at her press conferences, you would remember her saying that the Fed needed to raise rates now to prevent having to raise them more aggressively later. This is where that statement comes from.

I hope this all makes sense.

And you’ll have noticed the perverse impact of this way of thinking has by creating higher levels of unemployment and lower labor bargaining power as a result. I call it Fed-engineered unemployment because the Fed is engineering it so that rates are at just the right level to keep enough people unemployed in order to prevent inflation from accelerating. They want that buffer of unemployed people to prevent inflation. And, of course, that reduces labor’s bargaining power and puts downward pressure on the growth in wage rates.

What people think Powell said

So that’s the background to yesterday’s rally regarding the models driving Fed policy. What happened yesterday is that Jerome Powell gave a speech to the Economic Club of New York in which he said interest rates were “just below the broad range of estimates of the level that would be neutral for the economy”. And people interpreted that as Powell saying that we were bumping up against the short-term neutral rate that drives Fed policy actions. Basically, people saw Powell saying we’re close to done with hikes.

If Powell were actually saying this, that would be big news. Literally, last month Powell told PBS’ Judy Woodruff that the Fed was “a long way” from neutral. So, yesterday, Fed watchers said, “wait a minute, on October 3rd (before the market volatility), Powell said we were a long way from neutral. Now, he’s saying we’re ‘just below’ neutral. That’s a policy shift. Buy stocks”.

But, of course, the devil is in the details. Powell didn’t say what people think he said. All he said – which is undeniable – is that we’re within shouting distance of the Fed’s broad range of estimates for the short-term neutral rate. So what? We’re not close to the top of that range. And we’re not even close to the middle of that range yet. We’re within shouting distance of the bottom of that range.

Fed Vice Chair Clarida told us the exact same thing on Tuesday, by the way:

Clarida on future hikes: “the real federal funds rate today… is much closer to the vicinity of r* than… in December 2015. How close is a matter of judgment, and there is a range of views on the FOMC. This… supports the case for gradual policy normalization” /5

— Edward Harrison (@edwardnh)

So forgive me for yawning. This is not a big deal.

My view on the Fed

I think what’s happened is this: before the October volatility, the Fed was talking up the parts of their forward guidance that showed huge bullishness. In September, Fed governor Lael Brainard even mused aloud about the Fed jacking rates up to above the neutral rate. Yes, the Fed had guidance for 4 hikes this year and 3 next year. But that could change. Their timetable could accelerate. that was the message they were sending.

October changed all of this. They realized they may have made a mistake with the “above neutral” talk. The data were poor. And so, maybe they had got too far ahead of the data, making them appear less data dependent, and more set on a fixed hike path. That’s why we see backpedaling.

It’s not that the official guidance has changed or will change. It’s more in the tone and emphasis. That shift in tone is where the market is reacting. My read is that it isn’t saying the Fed will pause just yet. Rather, it is telling us that accelerations like the guidance change from three to four hikes in 2018 are now unlikely for 2019.

So, what they’re saying is: “we’ve always supported our guidance and will continue to do so. Before October, we were leaning toward guiding u – toward an accelerated hike timetable. The data smacked us in the face on that. So we’re backpedaling. If we get too many more negative surprises, we may just have to guide down – toward a deceleration in our hike timetable. The question is when would they do that. I am guessing the earliest is January. And the data would have to be really bad for that to happen.

The data

So that brings us to the data.

Remember this, the Fed is boxed in by its summary of economic projections and dot plots. These are very firm guidance metrics. And if you look at the macro numbers from the NAIRU-natural rate model they are using, the numbers say full steam ahead. The last two quarters of GDP growth were 4.2% and 3.5% respectively. The unemployment rate of 3.7% is a full 0.8% below their stated NAIRU. Inflation is now running above their 2% target for both core and non-core measures. And, of course, wage growth is now above 3% too. Every time you hear a Fed speech, they point all of this out.

But if the Fed is fearful of getting it wrong, they need an excuse beyond the headline data figures to pause. And so they are building the intellectual case to look at a broader range of outcomes as helping to inform policy decisions.

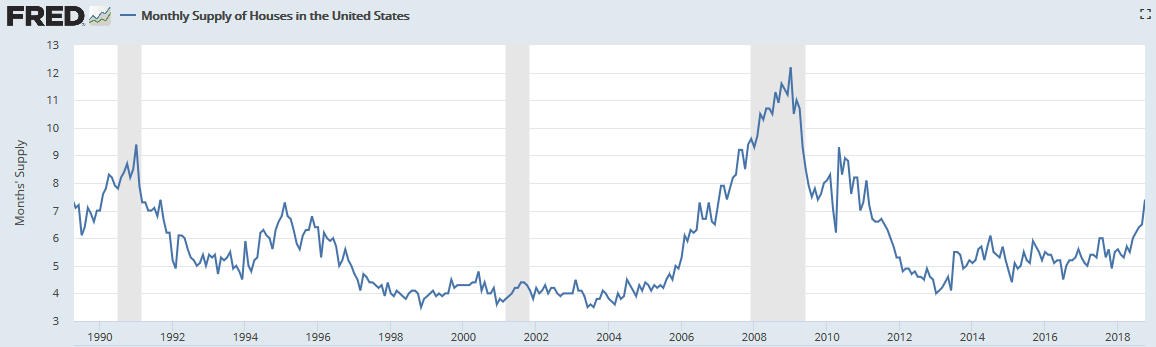

This is where oil prices come in since it affects capital investment and disposable income. This is also where housing comes into play because the deceleration is advancing. It’s worst with new home sales. For example, home builders are now sitting on 74,000 completed spec houses versus just 63,000 in January. And this is happening just as new home sales are drying up. That’s led to a huge spike in new home supply.

Source: St Louis Fed

This isn’t nearly as bad as during the housing bust. But, if you look at the last thirty years’ of data it’s definitely among the highest levels we have seen outside of recession.

These are the kind of data points that could blindside the Fed as it tries to finesse its policy rate normalization process – because these are the things that are revealing the credit cycle has turned down.

Conclusion

So, I think the market is right to be worried about the robustness of the US economy despite the encouraging headline macro numbers. The cracks are beginning to show and the Fed needs to be atuned to this. Nevertheless, I think we need to be cautious about what the Fed is really saying here.

Yesterday, Powell did not say the Fed was near done. The Fed is not saying it is going to stop raising rates after March. What Powell did say is that we are closer to neutral, that we are closer to the end – whatever that means.

For me, it’s about the tone, the stress. He is stressing as are all Fed officials – that the rate hikes will end eventually. Before, Fed officials had been stressing the fact that more rate hikes were to come. So there’s been a clear change in tone from the Fed. But, there hasn’t been a change in policy. That may come. But it will come based on the data. And I think we will have to wait until the holiday shopping data come in before we can say definitively whether the Fed is likely to pause.

Comments are closed.