How to front-run market reaction to the US government’s 2018 $1 trillion bond issuance

Yesterday, the Washington Post highlighted the fact the US government is anticipated to issue $1 trillion in new bonds just as the desire to hold safe assets is declining due to synchronized global growth. The question is what this means for inflation and for interest rates, and therefore, for bond markets. A lot of this depends on how the Fed reacts and whether the US economy is operating at full employment. My analysis follows below.

Getting off zero is unprecedented

In a lot of ways, these are still unprecedented times. The Federal Reserve is the first major central bank to implement a zero interest rate policy and be able to reverse that policy without a recession breathing down its neck. The Bank of Japan has never really left zero. It tried in 2006 and 2007, but the global credit crisis stopped them cold.

Source: St. Louis Fed

The major central banks in Europe are all still running negative interest rate policy regimes. But the Fed started to raise interest rates in 2015 and we have not had a recession since they began this normalization process.

In many ways, that’s the legacy that former Fed Chair Janet Yellen is leaving, by the way. But that also means that the role for her successor, Jerome Powell, is that much harder.

Uncertainty about inflation

As with the move to zero and quantitative easing, there is a lot of uncertainty about the economics behind normalization and its impact on the economy. If you recall, there were lots of predictions of inflation when we went to zero and the Fed started buying government bonds and mortgage-backed securities. Some people even talked about hyperinflation. Yet, here we are 10 years later, with inflation below the Fed’s 2% inflation target for six years on the trot.

Basically, a lot of people have got it horribly wrong over the past decade, causing many a macro hedge fund to blow up in the process. The risk now that we are heading toward higher rates is that the same thing occurs, that money managers misunderstand the economics and get the fundamental macro call wrong. Given the recent uptick in interest rates across the curve in the United States and recent predictions that a bond bear market is upon us, this is an important issue for bond investors. So I thought I would write this post to outline what I believe the big issues are as one contemplates how to play the massive increase in stimulus being offered by the Trump administration.

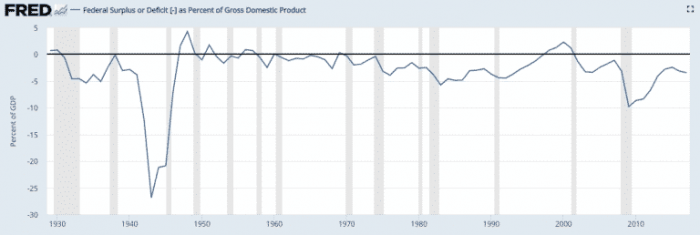

Over the shorter term, most economists agree that governments have very few constraints on how much deficit spending they do in the currencies they create. After all, they are creating liabilities in a currency they create and the central bank controls short-term interest rates. Moreover, even during the Gold Standard years, countries were able to deficit spend at tremendous levels in order to pay for war materiel by going off the gold standard or devaluing their currency. This was certainly the case in the United States during World War 2, as it was elsewhere.

The question on deficits is what happens over the longer-term due to inflation and so-called bond market vigilantes.

On inflation, the latest jobs report showed a modest uptick in wages that some believe is a portent of higher inflation. Moreover, there is some evidence from the regions with the tightest labor markets that wages might rise further still. And on the producer side, price pressures are rife, with inflation as an outlier to the upside in the most recent monthly manufacturing survey.

So there is rightly concern that inflation could tick up and that this could induce the Federal Reserve to raise interest rates more quickly. Moreover, quite a number of Fed officials have indicated that the Fed must act against inflation before it rises in order to prevent its becoming entrenched —so-called pre-emptive tightening. This gives more reason to fear the Fed’s reaction to inflation data.

Understanding the bond market vigilantes

And by the way, this is the right way to look at so-called bond market vigilantes. When the central bank sets its target for overnight rates, it isn’t forcing the banks to buy or sell reserves at that rate. Instead the central bank is promising to transact at that rate. And as the monopoly supplier of reserves, the central bank has so much credibility that the market moves to this rate.

Moreover, because long-term rates are really just a series of expected future short-term interest rates with some deviation due to uncertainty, basically long-term interest rates are the market’s collective wisdom about where a central bank is headed. The Fed futures market even gives us probabilities of all future target Fed Funds levels.

So the concept that more Treasury supply necessarily means higher rates doesn’t hold any more than mutual fund flows determine equity prices. When economists have tested equity relationships and fund flows, what they found was that flows drive volatility and reverse causality on price — i.e. that price determines flow, not the other way around. Forget about flows; over the longer-term fundamentals matter, both in bond markets and in equity markets.

In short, the central bank is a central planner. It determines the overnight interest rate for banks, and through this it exerts a dominant influence on rates across the yield curve. That curve is all about inflation expectations and the outlook for real short-term interest rates plus a ‘time premium’ for the risk of holding an asset with a fixed payout.The question, therefore, is whether inflation forces the central bank into action now and in the future.

Framing the rise in rates thus far

Gavyn Davies looked at this in a column he just published for the Financial Times. And what he found was this:

Since the overall bear market in US bonds started in mid 2016, the 10 year yield has risen by 130 basis points, from 1.5 per cent to 2.8 per cent. Most of this increase has been due to a rise in the nominal risk premium, and by far the majority of the increase in the nominal risk premium has come from the inflation component, with the real component rising only slightly.

What has happened, therefore, is that the tail risk of deflation that was being priced into bonds in early 2016 has gradually disappeared, and the inflation risk premium has returned to a fairly normal level around zero. All this has happened while the core inflation rate, and the expected path for future inflation, has barely increased at all. The recovery in real output growth (and commodity prices) seems to have reduced the market’s fear of future deflation, and that is what has driven the bear market in bonds.

Basically, the ‘time premium’ for the risk of holding an asset with a fixed payout has returned to normal — as we should expect it would during synchronized global growth. It’s an indication that the preference for long-lived safe assets has diminished and that investors feel more comfortable holding risk assets.

Stocks are selling off and credit spreads are tightening.

Investment-grade spreads reached a new post-crisis low last week. pic.twitter.com/rsygnudpJL

— Tracy Alloway (@tracyalloway)

Front-running the Fed and the market

Ultimately, then, the fact that the US government is set to issue $1 trillion of government paper this year, an 84% jump from last year, is — like our experience with quantitative easing — a perfect economic experiment. First, we may find out for sure if we are at full employment. Remember that the broadest measure of unemployment is above 8% right now. It even ticked up a notch last month.

Furthermore, countries like Switzerland and Japan have even lower headline unemployment than the United States does. And inflation in those countries has remained anchored despite their central banks’ continuing to hold overnight rates below zero, while their balance sheets expand as they buy financial assets.

Second, the concept that consumer price inflation becomes unanchored because of wage growth is a contentious issue. We had much higher real wage growth in the last two economic cycles and inflation barely budged. And as I noted on Friday, this cycle the rise in average hourly earnings trails the 1990s and the 2000s.

If inflation doesn’t rise in the face of Trump’s huge deficits, this will be a good opportunity to see if deficits alone have any impact on long-term interest rates. Everyone acts as if they do. But it’s the inflation at full employment and the Fed’s response that matters.

My view: The rise in interest rates so far is mostly about the term premium normalizing due to systemic risk receding after the endless succession of mini-crises has finally faded and global growth has returned. But, now that term premia have normalized, I don’t think we have to worry about a vicious bond bear market because of deficit spending. It’s inflation and the Fed’s response to perceived inflationary signs that will matter.

I believe the Fed will maintain its forward guidance unless the economy slows considerably. In fact, signs of inflation or wages rising more quickly or unemployment falling more quickly than the Fed has anticipated will accelerate the Fed’s timetable. There’s money to be made there in the short-term.

But the real question is “how late are we in this business cycle?” When it does become apparent that the credit cycle has shifted and spreads begin to climb in corporate bond markets, defaults begin to rise and the economy begins to slow, that’s when one should take the real bet. That’s when we will find out whether deficits really drive rates higher or cause inflation to rise and remain high. I don’t think either of those things is true. But that’s the big question for investors. And we will find out the answer in due course.

Comments are closed.