The Bond Bear Market, Greenspan Edition

Everyone is bond bearish these days. You’ve got bond fund managers like Jeff Gundlach and Bill Gross. And recently we’ve heard money managers Ray Dalio and Jeremy Grantham express bond bearish views as well. We can add Alan Greenspan to that list now.

I was watching the former Fed Chairman on Bloomberg yesterday. And even though he refrained from taking a view on how the Fed should be conducting monetary policy right now, I heard him say a number of things that were rather controversial. One was that we risk ‘stagflation’ in the future. The second was that one driving force for the stagflation would be high government deficits. In the end, I got the impression that Greenspan was a bond bear. However, I found his arguments unconvincing and I remain sceptical of the secular bear market thesis.

It occurs to me as I write this that I should look for the video so you can view his comments too. Here it is.

At about the 1:14 mark in the video, Greenspan says, “we’re dealing with a fiscally unstable long-term outlook in which inflation will take hold…we’ve been through almost a decade now of stagnation and we’re working our way toward stagflation.”

Now immediately after he made these remarks, I questioned them on Twitter. Here’s the first comment in a thread of tweets.

Greenspan on Bloomberg right now talking about ‘a fiscally unstable outlook in which inflation will take hold’. Has he seen Japan? This is ludicrous. Why is no one pointing this out?

— Edward Harrison (@edwardnh)

It wasn’t entirely clear what Greenspan meant when he said a fiscally unstable outlook would lead to stagflation. But I assume, given the term ‘stagflation’, that he was talking about longer-term consequences and a secular bear market for bonds. In the end though, whatever model he’s using to get there, his reasoning doesn’t sound right to me.

Before I give you my reasoning here, let’s look at Greenspan for a second. I went back and looked at some stuff Greenspan was saying about inflation and deficits in the past and came across a 2004 New York Times article. From what I can discern, this is his problem with deficits:

Like many economists, Mr. Greenspan has described the deficit as unsustainably high and said it would have to come down. The most common way for that to happen is for the dollar to drop in value, which would make imports more expensive and exports cheaper.

In essence, then, Greenspan is saying that high US deficits will eventually diminish at the expense of the US dollar, which will import inflation into the US. The problem with this, as Lars Christensen pointed out on Twitter this morning is that it’s contrary to basic economics.

Easy fiscal policy and tighter monetary policy seldom is negative for a currency #JustSayingDollar $$$$

— Lars Christensen (@MaMoMVPY)

If Donald Trump turns on the fiscal taps and Congress allows him to do so without enforcing a ‘revenue-neutral’ policy, then the Fed will offset that. And if the Fed tightens policy more quickly, that means US interest rates will be higher than rates abroad, which is supportive of the US dollar over the longer-term.

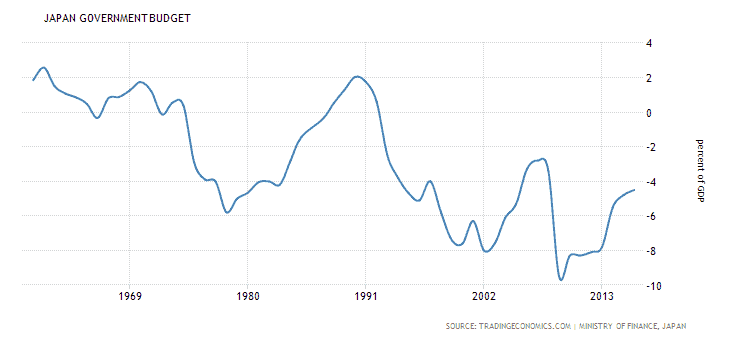

Moreover, if one looks at Japan’s experience with deficit spending, neither the inflation rate nor the bond yields have ticked up. In fact, it has been just the opposite.

Greenspan would need to explain why the US experience would be any different than Japan’s. The impression I get is that his views on deficits are just economic cover for cutting Federal spending on Social Security and Medicare, which is a political issue. The economics don’t add up though.

On the other hand, Gary Shilling’s bond market view makes sense to me because, like Dalio, he is saying that monetary tightening will eventually cause economic upheaval. But, Shilling believes that economic upheaval will be deflationary and supportive of bonds. That’s my view as well.

Albert Edwards had a note out today saying essentially the same thing, if in starker terms:

With the US 10y yield breaking above its long-term downtrend, equity prices have begun to wobble. Although I agree with the bond bears that US yields will continue to rise, causing more problems for equities, I do not believe bond yields have yet seen a secular bottom. I repeat my forecast that US 10y yields will fall below zero.

His view: stop listening to technical analysis about trendlines for long-term US government bonds. The breakout of yields to the upside is a head fake. He thinks increased inflation could rear its head this year already. And the Fed would have to respond. He says the 10-year could go to 3%. But then the Dalio-Shilling scenario would play out and the economy would lapse into recession. The result: negative rates in the US.

Conclusion: that’s the debate in bonds right now. Everyone is bullish on the real economy. And many recognize that a US economy with 3%ish growth and 4%ish headline unemployment is one that practically demands tightening from the Fed. And markets expect tightening. But they expect less than the Fed says. People like Ray Dalio think the Fed will not just tighten more than the market expects, but also more than the Fed expects. And cyclical inflation is one reason why.

My view: We should expect higher rates to potentially add a measure of accelerant to the US economy as debtors pull forward their borrowing and the private sector becomes flush with interest income. Inflation could even surprise to the upside as this cycle reaches its end. This in turn will mean a tightening cycle that is more aggressive than anticipated and risks derailing the US economy in 2019 and beyond. If the US economy enters a recession, I take the other side of Greenspan’s prediction —that downturn will be deflationary, not inflationary.

Comments are closed.