Repeat after me: sectoral balances must sum to zero

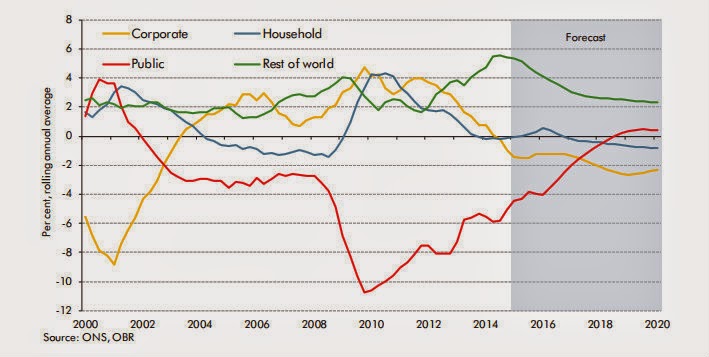

I do like sectoral net lending charts. This one is from the OBR’s latest Economic Forecast:

The thing to remember about sectoral balances is they must sum to zero. It is not possible to have a negative external balance, as the UK does, with concurrent surpluses in the public, household and corporate sectors. If the UK is a net borrower from the rest of the world because of its current account deficit, then somewhere in the domestic economy must be a balancing deficit.

It is pretty obvious where this deficit has been. In 2010, the external sector was in deficit (green line on chart) and corporates (yellow line) were net saving. The external balance had been in deficit for a long time, but corporate net saving commenced at the same time as the public sector (red line) switched from surplus to deficit. This may have been a traumatic response to the dot-com crash, but to me this looks more like a policy change around 2001 that encouraged corporate saving. I wonder what it was. Any suggestions?

The net saving of corporates and foreigners during the pre-crisis years was balanced both by a public sector deficit and by a growing deficit in the household sector (blue line). We now know that the household deficit was associated with unsustainable credit growth. When the crash came, households switched abruptly from deficit to surplus. Foreigners, corporates and households were all net saving at the same time. As I said, the sectoral balances have to sum to zero: so the increase in the government deficit balanced the desire of all three private sectors to save at the same time. When no-one wants to spend, someone must, and that someone is inevitably government. Government is the “spender of last resort”.

The trouble is that when everyone is saving like crazy (including paying down debt, which economically is equivalent to saving) people get very worried indeed at the sight of apparently out-of-control government deficit spending, failing to see the relationship of that spending to their own saving behaviour. So governments then embark on austerity programmes to shrink the deficit. The result of this (assuming no fall in GDP) is that deficit spending moves around. The public sector deficit is shifted back to the private sector.

If you are Germany, deficit spending moves abroad, and you run an ever-larger trade surplus. But if you are the UK, with a deeply entrenched external deficit in part because of a still-dominant financial sector, deficit spending moves to domestic households and corporations. George Osborne’s claim that he wants to build an economy “based upon savings and investment” is economic gibberish, since his plans aim only to eliminate the fiscal deficit, not the trade deficit. As the chart above shows, the OBR forecasts – based upon the Treasury’s spending plans as outlined in the Budget last week – that for the foreseeable future the only people doing any significant saving will be foreigners.

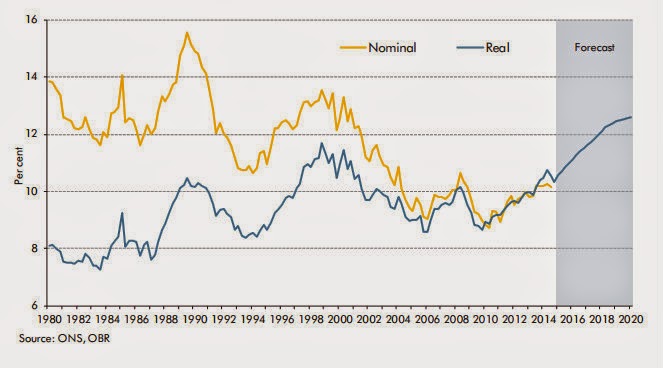

Saving is not necessarily a good thing. Generally, we expect households to save (for their old age, for rainy days) but corporations to invest. The problem prior to the financial crisis was that corporations were saving and households were investing (in property). Now, despite everything we have heard about corporations hoarding cash, corporate saving is falling and the corporate sector has switched from surplus to deficit. This is a welcome development, since it suggests that corporations are investing. And indeed they are:

Business investment is now back to its 2000 level. This is no doubt what has generated the UK’s recovery. Perhaps the malaise that has affected corporations ever since the dot-com crisis is over? The OBR seems to think so. It forecasts corporate investment continuing to rise to historically unprecedented levels. Is this credible? I confess that I am unconvinced. The path of business investment has never been smooth. Not only the level of investment projected for 2020 but also the rate of change looks unsustainable to me. I reckon it would level off or dip sooner than that. Indeed there was a dip at the end of 2014 which the forecasters chose to ignore. Hockey-stick projections always worry me.

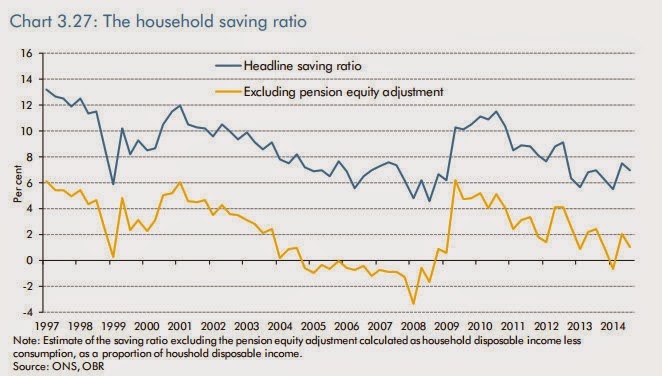

Sadly, the picture for households is not so encouraging. The household saving ratio has already fallen considerably from its 2010 high:

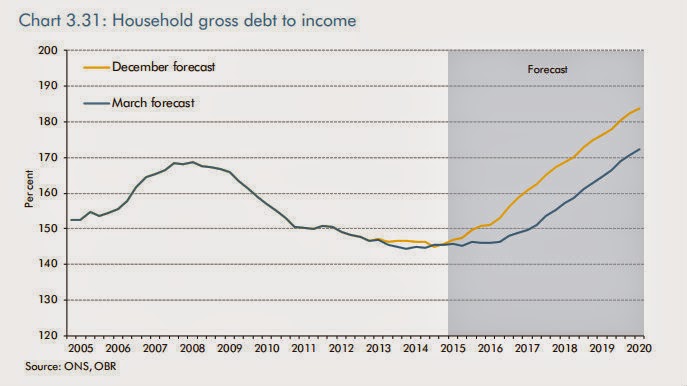

Perhaps more worryingly, there is an evident downwards trend in this chart. Household saving has been diminishing since the late 1990s. The OBR projects that the household sector will be in deficit by 2018, no doubt as a result of the planned sharp fiscal squeeze in 2016-18. As older and richer households would still be net savers, the growing deficit of the household sector would be due to sharply rising debt, particularly among younger and poorer people. Here is the OBR’s projection for household debt to income:

The OBR expresses some concern about this:

Strong growth of residential investment and ongoing growth in house prices and property transactions leave households’ gross debt to income ratio rising back towards its pre-crisis peak by the forecast horizon. That seems consistent with supportive monetary policy and other interventions (such as Help to Buy and further support for first-time buyers announced in this Budget), but it could pose risks to the sustainability of the recovery over the medium term.

This concern is well-founded. Despite all his rhetoric about encouraging saving, the Chancellor’s fiscal plans actually depend on blowing up a household debt bubble of larger proportions than that which burst disastrously in 2008, and using various forms of government support to delay its inevitable implosion. Why do we have to repeat the errors of the past?

Perhaps more importantly, it is by no means clear that such an increase in debt is actually possible. Productivity is on the floor and nominal wage growth remains poor. The OBR identifies this as a key risk to the recovery:

Domestically, productivity and real wages remain weak and the pick-up we forecast from 2015 is a key judgment. If productivity fails to pick up as predicted, consumer spending and housing investment could falter as the resources to sustain them would be lacking

If productivity and wage growth do not pick up, then the fiscal squeeze planned for 2016-18 would have serious consequences for the recovery. The OBR points out that deep spending cuts to unprotected government departments and the welfare budget would have a direct impact on GDP, and expresses concern about the scale and pace of the cuts:

We expect some significant changes in the composition of expenditure associated with the fiscal consolidation and, in particular, with the fact that on current policy so much of that consolidation is delivered through cuts to day-to-day spending on public services that will directly reduce GDP. The scale and speed of the adjustments this switch in spending implies may also represent a risk to the economy evolving in line with our central forecast.

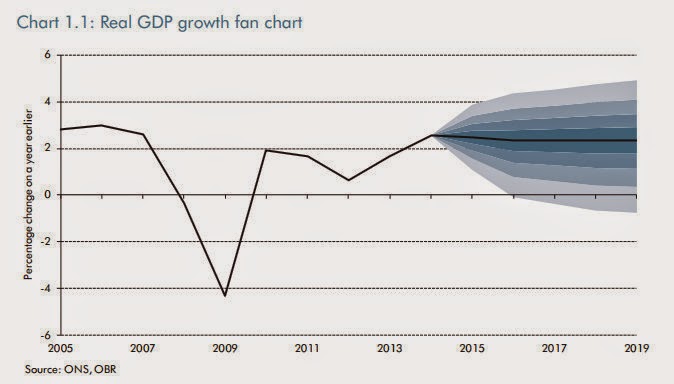

The OBR’s central forecast for the path of GDP shows real GDP growth over the next 5 years of around 2% per annum. But there is a considerable amount of uncertainty around this forecast:

Note that the worst-case scenario here is for the UK to fall into recession from 2016 onwards. This would be likely to be the case if productivity and wage growth disappointed and the fiscal squeeze hurt household incomes sufficiently to eliminate debt-fuelled consumption and investment spending.

And this brings me back to my sectoral net lending. Remember that sectoral balances must sum to zero. If household income falls so much that spending and borrowing cannot be sustained, as the OBR suggests, then there are two possibilities. The first is that there is a sharp correction to the trade balance. This would be due to collapse in imports as domestic demand falls, and rising exports as corporations seek markets elsewhere. We have seen this in many EU (not just Eurozone) countries in the last few years. It is always accompanied by recession, which may be severe.

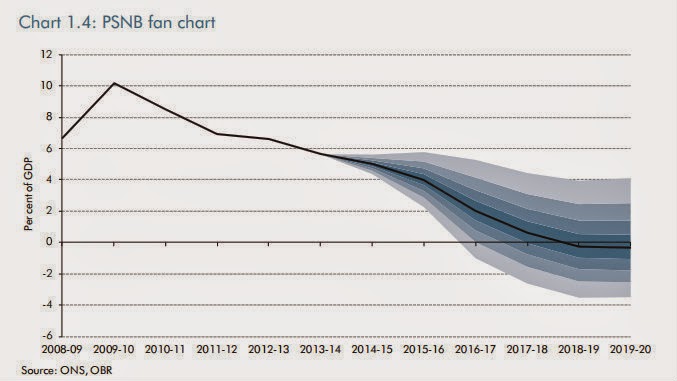

But if the trade balance does not correct – and remember that the UK’s trade deficit is deeply entrenched – then fiscal consolidation becomes all but impossible. Deficit reduction slows to a crawl, as this chart from the OBR shows:

The worst-case scenario here (deficit of 4% of GDP in 2020) would be associated with the worst case in the GDP fan chart, i.e. the UK in recession. When GDP is falling, public sector borrowing as a proportion of GDP naturally rises. This chart therefore assumes that fiscal consolidation efforts would continue despite recession, no doubt because of disappointing deficit reduction. But continued attempts to eliminate the deficit and reduce the deficit would drive the economy ever deeper into recession. Although the deficit itself may reduce further, debt/GDP actually rises in this scenario. As Irving Fisher put it, “the more the borrowers pay, the more they owe”. For Greece, this nightmare was probably inevitable. But the UK has no reason whatsoever to go down that path. If it does, it will be because of political stupidity on a simply mammoth scale.

Unfortunately the simple fact that sectoral balances must sum to zero is currently being ignored by all of the main parties. I do wish politicians would pay more attention to national accounting. It would save a lot of grief.

Comments are closed.