The Eurozone, Germany and the ECB’s interest rates

This comment from Mysjkin on my previous post about Germany has made me think about the effect of free movement of capital and harmonised interest rates in a currency union:

“Imagine a German company going to a German bank, asking for a loan. The German bank answers: no we are not going to lend money to you because we can lend it for a higher interest rate to a company in Spain, but we will lend the money to you if you will also pay this higher rate. If the investment, at that interest rate, is still profitable for the company, it will borrow the money at the higher rate, problem solved. If the company (read: German corporations) does not want to borrow at this higher interest rate, it seems to me that monetary policy is not too loose, but too tight for German domestic conditions.”

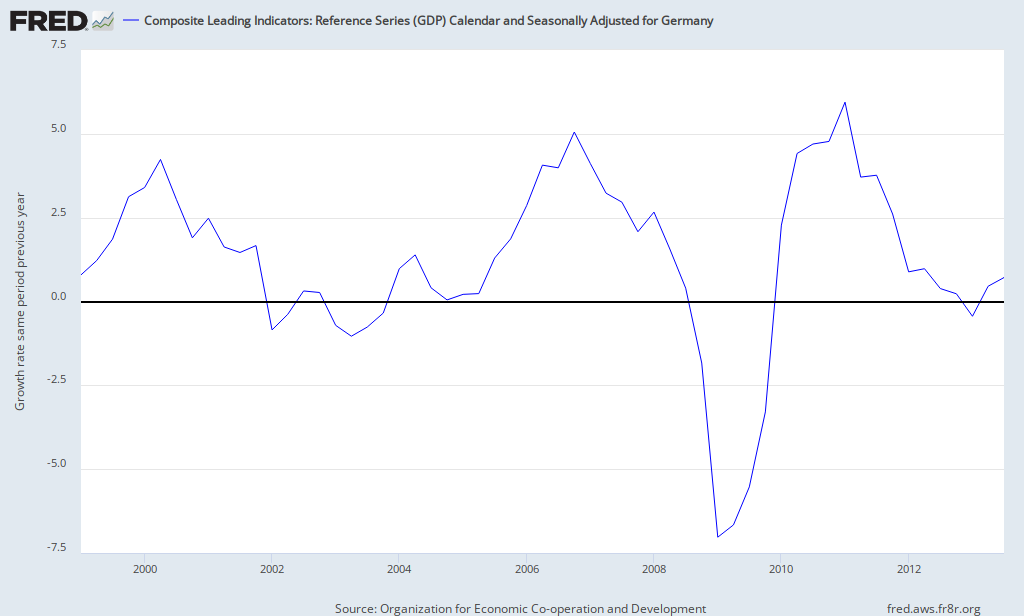

The argument is that ECB interest rate policy prior to the Eurozone crisis resulted in interest rates that were too high for Germany and too low for the periphery. And indeed, a look at Germany’s economic performance during that time suggests that this is indeed the case. Germany was “bumping along the bottom” from 2000-2005. Even its pre-crisis boom barely reached 5% and was very short-lived:

This is certainly not a shining economic performance. And it suggests that ECB interest rate policy has been persistently too tight for Germany.

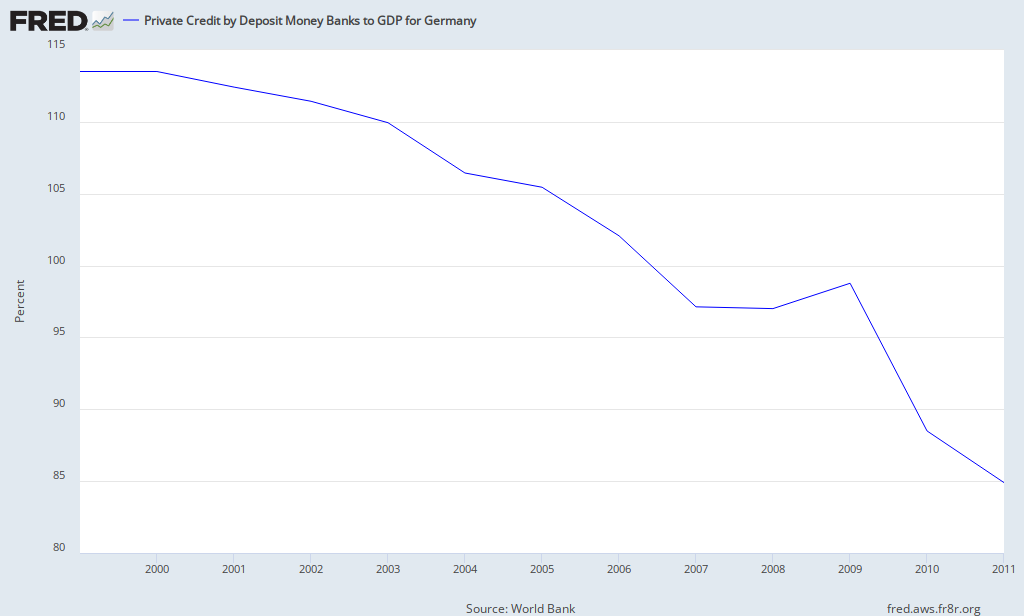

What would be the effects of policy that is persistently too tight, remembering that Germany is part of a currency union? As Mysjkin points out, bank credit would be too expensive. Banks might of course reduce margins in order to maintain lending volumes as funding costs rose. And there is some evidence that they did exactly that:

But in a currency union with free movement of capital, banks can simply lend to households, firms and governments in other countries where the returns are better. Indeed they were encouraged to do so. And the result was a horrible collapse in domestic bank lending to the private sector – a collapse which it seems is still continuing:

Of course, this chart is in relation to GDP. But a quick look at the GDP growth chart above doesn’t suggest that the reason is a massive rise in the denominator. No, it genuinely seems to be a fall in domestic bank credit.

So interest rates prior to the crisis were too high for Germany. Banks were not able to earn enough by lending to the domestic private sector, so they looked elsewhere. And in a currency union, they didn’t have far to look. Commercial property lending in Ireland, Spain and Portugal. Greek and Italian sovereign debt. Not that they stayed within the currency union, though – they also invested heavily in US subprime mortgage assets. The result was a series of frightful crashes, as one after another these more lucrative lending markets collapsed and cross-border deposits fled back to Germany. But that doesn’t mean that banks are lending any more domestically. The charts above show that they are not.

So if German banks still aren’t lending domestically, and investment is continuing to fall, what on earth is the justification for arguing, as this paper does, that ECB interest rates are now too low for Germany? How exactly would raising interest rates encourage cash-rich NFCs to borrow? Raising interest rates to borrowers discourages demand for loans, and raising funding costs for banks discourages their supply. Even if Germany were not in a currency union, raising interest rates at present would be idiotic. Fortunately it is in the Euro area, and the ECB is not going to raise rates simply because German savers would like it to.

Solving Germany’s investment problem requires both low interest rates and increased government investment. The ECB is at least attempting to address the first of these. But when is the German government going to accept its responsibility for the second?

Related reading

Germany’s investment problem

Cross-border banking transactions in the Euro area – BIS (pdf)

Cross-border banking and financial stability – vox (pdf)

Financial crises and cross-border banking – Cass business school (pdf)

Banking across borders – NY Fed (pdf)

Why Germany’s exports are so strong – World Review

Germany’s recovery is faltering – Michael Burke

Comments are closed.